Foreign exchange market usd cad – In the ever-evolving realm of currency exchange, the foreign exchange market between the US dollar (USD) and Canadian dollar (CAD) presents a captivating arena for traders and investors alike. This dynamic market, commonly known as USD/CAD, plays a pivotal role in global trade and investment decisions.

Influenced by a multitude of economic, political, and technical factors, the USD/CAD exchange rate exhibits intricate fluctuations that offer both opportunities and challenges for market participants. This comprehensive guide delves into the intricacies of the USD/CAD market, providing insights into its drivers, trading strategies, and risk management techniques.

Market Overview

The foreign exchange market (forex market) is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. It is a decentralized market where currencies are traded against each other. The participants in the forex market include banks, hedge funds, corporations, and individual traders.

Examine how foreign exchange market grade 12 notes can boost performance in your area.

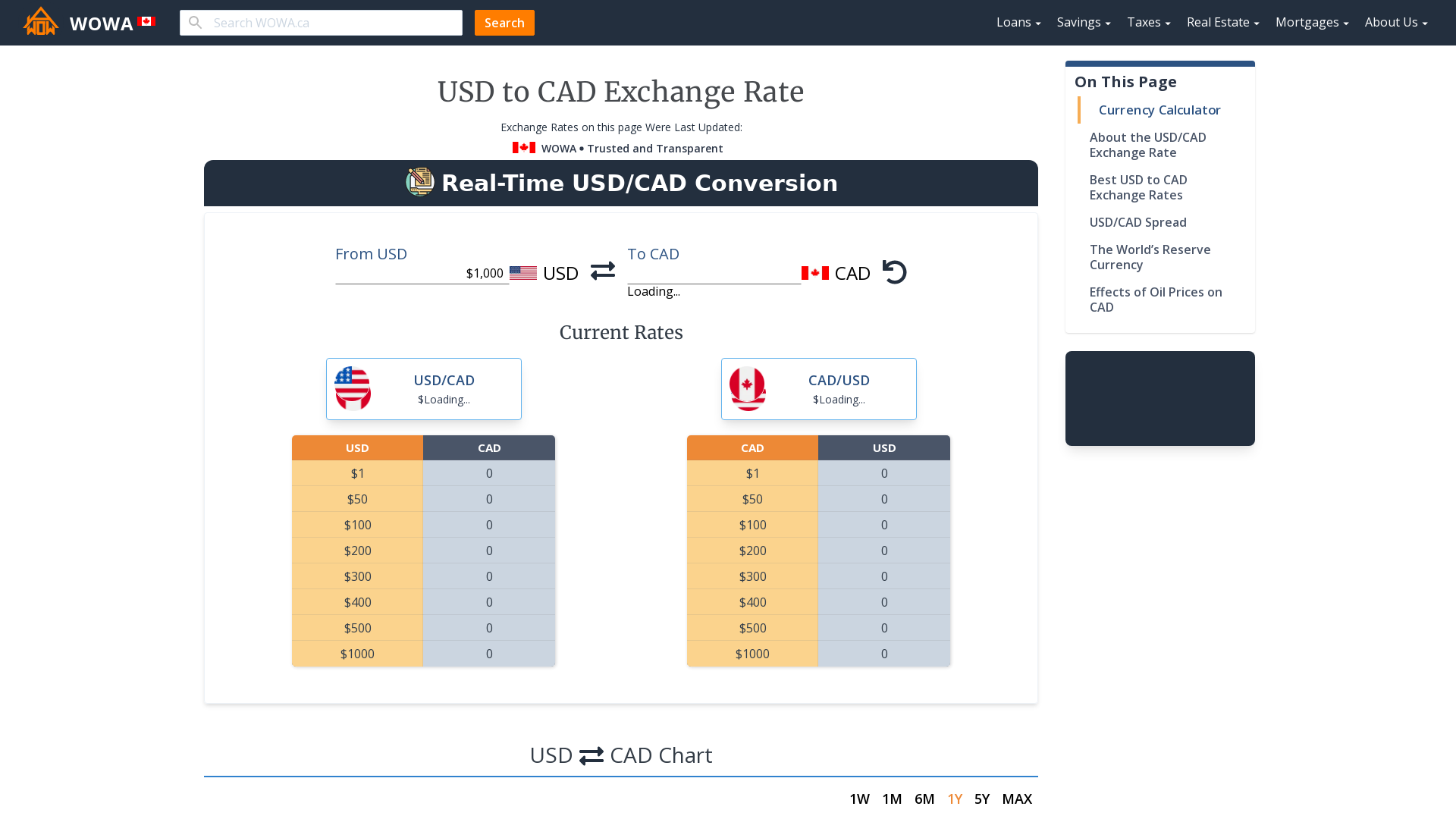

The USD and CAD are two of the most traded currencies in the forex market. The USD is the world’s reserve currency, and it is used in international trade and investment. The CAD is the currency of Canada, and it is a major commodity currency due to Canada’s large natural resource sector.

Factors Influencing the Exchange Rate

The exchange rate between the USD and CAD is influenced by a number of factors, including:

- Economic growth: A strong economy will typically lead to a stronger currency, as investors are more likely to invest in a country with a growing economy.

- Interest rates: Higher interest rates will typically lead to a stronger currency, as investors are more likely to invest in a country with higher interest rates.

- Inflation: Higher inflation will typically lead to a weaker currency, as it erodes the purchasing power of the currency.

- Political stability: A country with political stability is more likely to have a stable currency, as investors are less likely to invest in a country with political instability.

- Commodity prices: Canada is a major exporter of commodities, so the prices of commodities can have a significant impact on the CAD.

Economic Factors

Economic factors play a significant role in determining the exchange rate between the US dollar (USD) and the Canadian dollar (CAD). These factors include economic growth, inflation, interest rates, trade flows, and balance of payments.

Economic growth in either the US or Canada can affect the demand for their respective currencies. Stronger economic growth in the US, for example, can lead to increased demand for USD as investors and businesses seek to invest in the US economy. Conversely, stronger economic growth in Canada can increase the demand for CAD as foreign investors and businesses look to take advantage of Canada’s economic opportunities.

Discover the crucial elements that make foreign exchange market report the top choice.

Inflation

Inflation is another important economic factor that can impact the exchange rate. Higher inflation in the US relative to Canada can lead to a depreciation of the CAD against the USD. This is because investors may perceive the CAD as less valuable due to its lower purchasing power in the face of inflation. Conversely, higher inflation in Canada relative to the US can lead to an appreciation of the CAD against the USD.

Interest Rates

Interest rates set by central banks can also influence the exchange rate. Higher interest rates in the US relative to Canada can make USD more attractive to investors seeking higher returns, leading to an appreciation of the USD against the CAD. Conversely, higher interest rates in Canada relative to the US can make CAD more attractive, leading to an appreciation of the CAD against the USD.

Trade Flows and Balance of Payments, Foreign exchange market usd cad

Trade flows and the balance of payments can also affect the demand for USD and CAD. A trade surplus, where a country exports more goods and services than it imports, can lead to an appreciation of its currency as there is increased demand for the currency to purchase the country’s exports. Conversely, a trade deficit, where a country imports more goods and services than it exports, can lead to a depreciation of its currency as there is less demand for the currency to purchase the country’s exports.

Central Banks

Central banks play a role in managing the exchange rate through monetary policy tools such as interest rates and foreign exchange interventions. By adjusting interest rates, central banks can influence the demand for their respective currencies and thereby affect the exchange rate. Central banks may also intervene in the foreign exchange market by buying or selling their currencies to influence the exchange rate.

Political and Geopolitical Factors

Political and geopolitical factors play a significant role in shaping the USD/CAD exchange rate. These factors can include changes in government policies, such as fiscal and monetary policy, as well as global economic and political events.

Government Policies

Changes in government policies can have a significant impact on the exchange rate. For example, a change in fiscal policy, such as an increase in government spending or taxes, can affect the demand for the currency and thus its value. Similarly, changes in monetary policy, such as interest rate changes, can affect the attractiveness of the currency to investors and thus its value.

Global Economic and Political Events

Global economic and political events can also have a significant impact on the USD/CAD exchange rate. For example, a global economic crisis can lead to a decrease in demand for the Canadian dollar, as investors seek safe haven assets such as the US dollar. Similarly, geopolitical tensions between the United States and Canada, or between Canada and other countries, can lead to a decrease in demand for the Canadian dollar as investors become more risk-averse.

Technical Analysis: Foreign Exchange Market Usd Cad

Technical analysis is a method of forecasting the future direction of a financial instrument’s price by studying its historical price movements and other technical indicators. In the context of the USD/CAD exchange rate, technical analysis involves identifying patterns and trends in the price data to make informed trading decisions.

Key Technical Indicators and Patterns

Traders use a variety of technical indicators and patterns to identify potential trading opportunities. Some of the most common include:

- Moving averages: Moving averages smooth out price data to identify trends and support and resistance levels.

- Relative Strength Index (RSI): The RSI measures the strength of a trend and identifies potential overbought or oversold conditions.

- Bollinger Bands: Bollinger Bands provide a visual representation of volatility and can identify potential breakout opportunities.

- Support and resistance levels: Support and resistance levels are horizontal lines that represent areas where the price has historically bounced off.

- Chart patterns: Chart patterns, such as head and shoulders, double tops, and triple bottoms, can indicate potential reversals or continuations in the trend.

Limitations and Risks of Technical Analysis

While technical analysis can be a valuable tool for traders, it is important to be aware of its limitations and risks:

- Historical data: Technical analysis relies on historical data, which may not always be a reliable predictor of future price movements.

- Subjectivity: Technical indicators and patterns are subjective, and different traders may interpret them differently.

- False signals: Technical analysis can sometimes generate false signals, leading to incorrect trading decisions.

- Overfitting: Overfitting occurs when a technical indicator or pattern is too closely aligned with the historical data and does not generalize well to new data.

Trading Strategies

Traders employ various strategies to capitalize on fluctuations in the USD/CAD exchange rate. These strategies differ in their risk-reward profiles and suitability for different market conditions.

Understanding the risks and rewards associated with each strategy is crucial before implementation.

Scalping

Scalping involves executing numerous small trades over a short period, typically within minutes or hours. The aim is to profit from tiny price movements, often exploiting market inefficiencies or imbalances.

Find out about how foreign exchange market is can deliver the best answers for your issues.

While scalping can yield quick profits, it also carries high risk due to the small profit margins and the need for quick execution and precise timing.

Day Trading

Day traders enter and exit trades within a single trading day, holding positions overnight. They analyze intraday price movements and technical indicators to identify potential trading opportunities.

Day trading requires a high level of market knowledge, quick decision-making, and the ability to manage risk effectively.

Swing Trading

Swing traders hold positions for several days or weeks, aiming to capture larger price swings. They identify trends and market momentum to enter and exit trades at favorable points.

Swing trading involves less frequent trading activity than scalping or day trading, allowing for more in-depth market analysis and risk management.

Trend Trading

Trend traders capitalize on established market trends by identifying and following the direction of the prevailing price movement.

This strategy requires patience and discipline, as it involves holding positions for extended periods. Trend trading can be rewarding in strong trending markets but may struggle during periods of consolidation or choppy price action.

Counter-Trend Trading

Counter-trend traders attempt to profit from short-term price reversals or corrections within a larger trend. They identify areas of overbought or oversold conditions and enter trades against the prevailing trend.

Counter-trend trading is inherently riskier than trend trading and requires a deep understanding of market dynamics and timing.

Risk Management

Risk management is crucial in foreign exchange trading, as it involves managing potential losses and preserving capital. Effective risk management strategies help traders minimize the impact of adverse market movements and increase their chances of success.

Traders employ various risk management tools and techniques to mitigate risk. These include:

Stop-Loss Orders

Stop-loss orders are used to limit potential losses by automatically closing a trade when the market price reaches a predetermined level. This prevents traders from incurring excessive losses if the market moves against their position.

Take-Profit Orders

Take-profit orders are used to lock in profits by automatically closing a trade when the market price reaches a predetermined level. This helps traders secure their profits and avoid giving them back due to market fluctuations.

Position Sizing

Position sizing involves determining the appropriate amount of capital to allocate to a particular trade. Proper position sizing ensures that traders do not risk more than they can afford to lose, thereby minimizing their overall risk exposure.

Last Word

In conclusion, the foreign exchange market between USD and CAD presents a complex and dynamic environment that demands a comprehensive understanding of its underlying factors and trading strategies. By carefully navigating the economic, political, and technical intricacies of this market, traders can harness its potential for profit while effectively managing risks.

Stay informed about the latest market developments, employ sound risk management practices, and continuously refine your trading strategies to maximize your success in the ever-evolving USD/CAD foreign exchange market.