Although foreign exchange market trades are said to involve the buying and selling of currencies, there is much more to these transactions than meets the eye. This dynamic and ever-evolving market offers a fascinating blend of financial intricacies and global economic influences, making it a compelling subject for exploration.

At its core, the foreign exchange market facilitates the exchange of currencies between countries, enabling international trade, tourism, and investments. However, beneath this seemingly straightforward premise lies a complex network of factors that shape currency values and drive market movements.

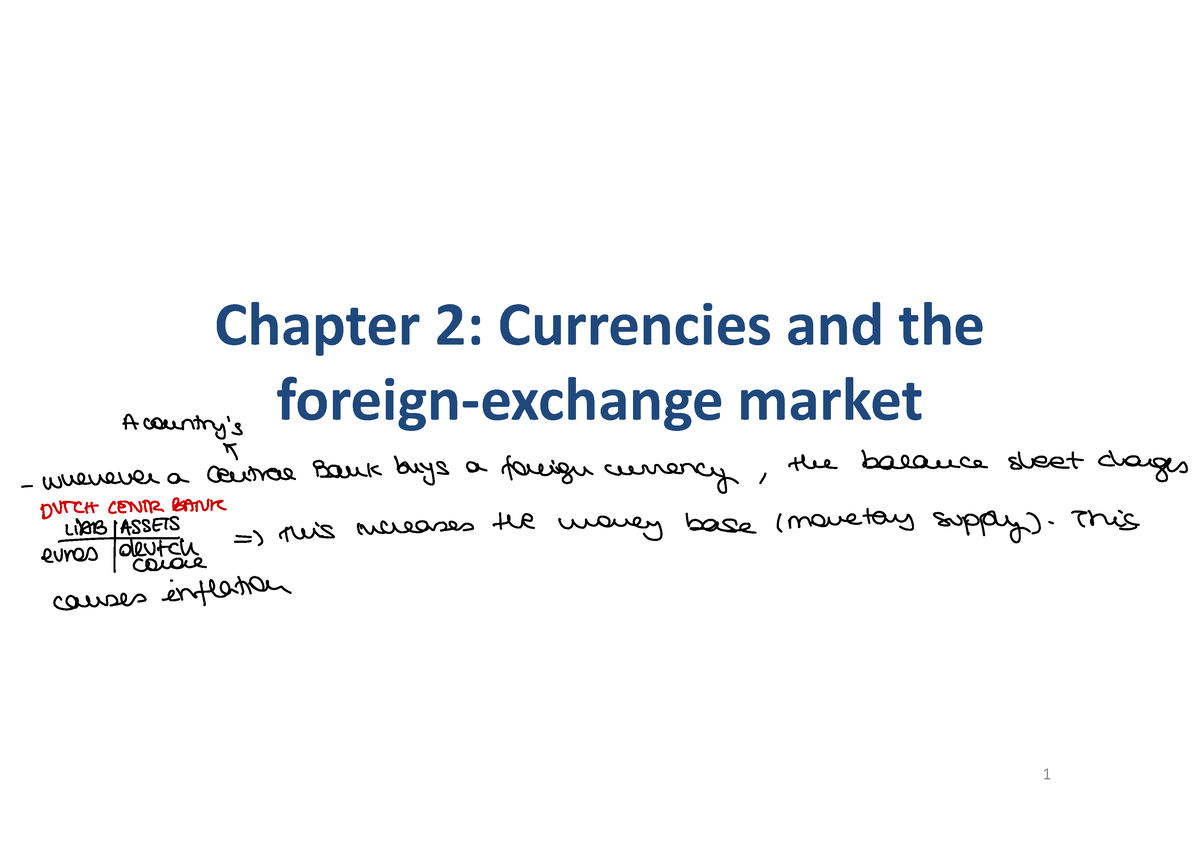

The Nature of Foreign Exchange Market Trades

The foreign exchange market (forex market) is a global decentralized market where currencies are traded. It is the largest and most liquid market in the world, with a daily trading volume exceeding $5 trillion.

In a foreign exchange market trade, one currency is exchanged for another. The exchange rate is the price of one currency in terms of another. For example, if the euro is trading at 1.10 against the US dollar, it means that it costs 1.10 US dollars to buy one euro.

Types of Currencies Traded

The most commonly traded currencies in the forex market are the US dollar, the euro, the Japanese yen, the British pound, and the Swiss franc. These currencies are known as the “major currencies”.

In addition to the major currencies, there are also a number of “minor currencies” that are traded in the forex market. These currencies include the Australian dollar, the Canadian dollar, the New Zealand dollar, and the Mexican peso.

Common Currency Pairs

The most common currency pairs traded in the forex market are the EUR/USD, the USD/JPY, the GBP/USD, and the USD/CHF. These currency pairs are known as the “major currency pairs”.

The major currency pairs are traded in large volumes and are highly liquid. This makes them ideal for traders who are looking for a volatile market with a high degree of liquidity.

Mechanics of Foreign Exchange Market Trades

The foreign exchange market, also known as the forex market, facilitates the buying and selling of currencies. This global, decentralized market involves various participants, including banks, brokers, and individual traders. To execute trades, market participants utilize trading platforms and employ different order types, ensuring efficient and timely transactions.

Market Participants

The foreign exchange market involves a diverse range of participants, each playing a specific role in facilitating currency trades. Key participants include:

- Banks: Major banks act as market makers, providing liquidity and facilitating transactions between other market participants.

- Brokers: Brokers serve as intermediaries, connecting traders with the market and executing trades on their behalf.

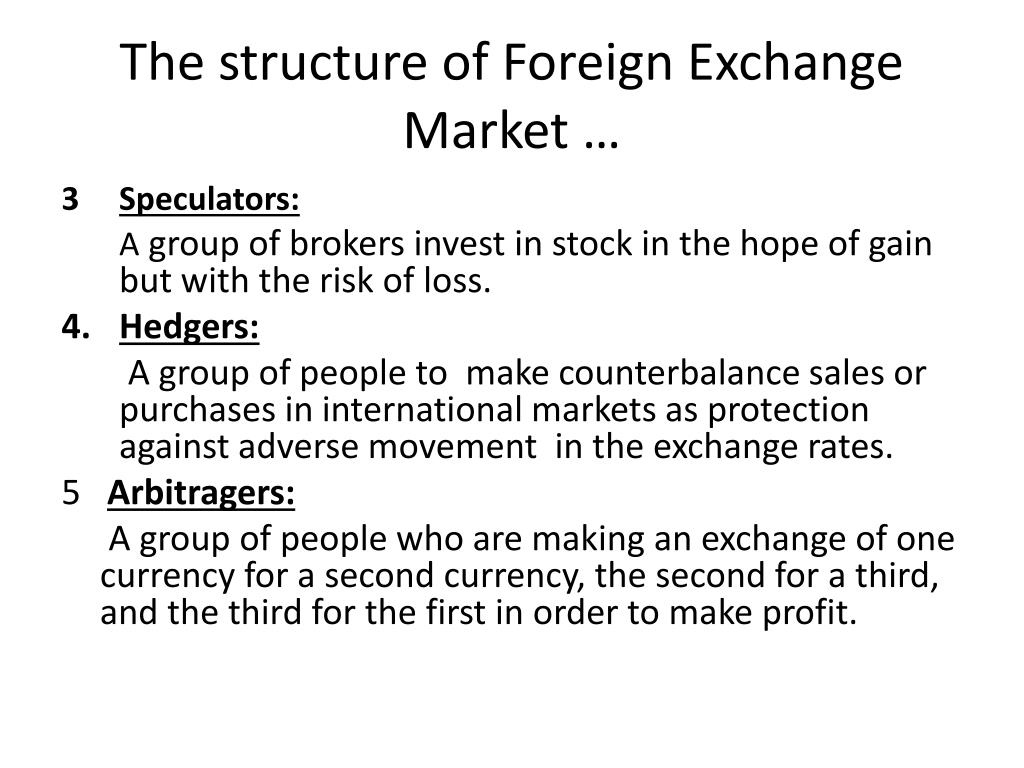

- Traders: Individual traders, ranging from retail investors to hedge funds, engage in currency trading for various reasons, including speculation, hedging, and arbitrage.

Trading Platforms

Foreign exchange trades are executed through electronic trading platforms, which provide a centralized marketplace for market participants to connect and trade currencies. These platforms offer real-time market data, order entry functionality, and risk management tools, enabling traders to make informed decisions and manage their positions effectively.

Learn about more about the process of foreign exchange market exam pdf in the field.

Order Types

Traders employ different order types to execute their trades, each with its own characteristics and advantages. Common order types include:

- Market Order: A market order is executed immediately at the best available market price.

- Limit Order: A limit order is executed only when the market price reaches a specified price level set by the trader.

- Stop Order: A stop order is used to enter or exit a trade when the market price reaches a predetermined level.

Factors Influencing Foreign Exchange Market Trades: Although Foreign Exchange Market Trades Are Said To Involve The Buying And Selling Of Currencies

Foreign exchange market trades are influenced by a myriad of economic and political factors that can significantly impact currency exchange rates. These factors include interest rate differentials, inflation rates, and geopolitical events, among others.

Interest Rate Differentials

Interest rate differentials refer to the difference in interest rates between two countries. When one country has higher interest rates than another, it becomes more attractive for investors to invest in that country’s currency, leading to an increase in its value. Conversely, when interest rates are lower, investors may be less inclined to invest in that currency, leading to a decrease in its value.

For example, if the United States has higher interest rates than the United Kingdom, investors may choose to sell their British pounds and buy US dollars to take advantage of the higher returns. This increased demand for US dollars would lead to an appreciation of the dollar against the pound.

Inflation Rates

Inflation rates measure the rate at which prices for goods and services increase over time. High inflation can erode the purchasing power of a currency, making it less valuable. Conversely, low inflation can help maintain the value of a currency.

You also can investigate more thoroughly about foreign exchange market easy meaning to enhance your awareness in the field of foreign exchange market easy meaning.

For instance, if the eurozone has higher inflation than the United States, investors may sell their euros and buy US dollars to protect their wealth from the effects of inflation. This increased demand for US dollars would lead to an appreciation of the dollar against the euro.

Geopolitical Events

Geopolitical events, such as wars, political instability, and trade disputes, can also significantly impact currency exchange rates. These events can create uncertainty and risk, which can lead investors to sell currencies that are perceived as risky and buy currencies that are perceived as safe havens.

You also can understand valuable knowledge by exploring role of rbi in foreign exchange market pdf.

For example, during the 2008 financial crisis, investors sold risky currencies like the Icelandic króna and the Hungarian forint and bought safe haven currencies like the US dollar and the Swiss franc. This increased demand for safe haven currencies led to their appreciation against other currencies.

Risks and Rewards of Foreign Exchange Market Trades

Foreign exchange market trading involves the buying and selling of currencies, presenting both potential risks and rewards. Understanding these factors is crucial for successful trading.

Potential Risks

One significant risk in forex trading is currency fluctuations. The value of currencies can change rapidly due to various factors, such as economic data, political events, and central bank policies. These fluctuations can result in losses if the trader’s predictions are incorrect.

Market volatility is another risk associated with forex trading. The market can experience periods of high volatility, leading to rapid and unpredictable price movements. This volatility can amplify potential losses and make it difficult to manage positions effectively.

Potential Rewards

Despite the risks, successful forex trading can offer potential rewards. Traders can generate profits by correctly predicting currency movements and capitalizing on price fluctuations. Trading forex can also provide portfolio diversification, reducing overall risk by adding a non-correlated asset class to an investment portfolio.

Strategies for Managing Risks

To manage risks in forex trading, traders can employ various strategies. These include:

- Stop-loss orders: These orders automatically close positions when the price reaches a predetermined level, limiting potential losses.

- Position sizing: Traders should carefully manage the size of their positions relative to their account balance to avoid excessive risk exposure.

- Risk-reward ratio: Traders should assess the potential reward of a trade compared to the potential risk to ensure a favorable risk-reward profile.

Maximizing Returns

To maximize returns in forex trading, traders can consider the following strategies:

- Technical analysis: Studying price charts and patterns can provide insights into potential market movements.

- Fundamental analysis: Analyzing economic and political factors that influence currency values can help traders make informed decisions.

- News trading: Monitoring news and events that can impact currency markets can provide opportunities for profitable trades.

Applications of Foreign Exchange Market Trades

Foreign exchange market trades facilitate a wide range of international transactions, serving as a cornerstone of global commerce. From facilitating international trade to enabling tourism and supporting foreign investments, foreign exchange markets play a crucial role in the modern economy.

Businesses and International Trade

Foreign exchange markets are essential for businesses engaged in international trade. When a company imports goods from another country, it needs to convert its domestic currency into the currency of the exporting country to pay for the goods. Similarly, when a company exports goods, it receives payment in the currency of the importing country and needs to convert it back into its domestic currency.

Tourism and Foreign Exchange, Although foreign exchange market trades are said to involve the buying and selling of currencies

Foreign exchange markets also support the tourism industry. When individuals travel abroad, they need to exchange their home currency for the currency of the country they are visiting. Foreign exchange markets provide the means for tourists to convert their currency into the local currency, allowing them to make purchases and participate in activities during their travels.

Foreign Investments and Currency Markets

Foreign exchange markets facilitate foreign investments by allowing investors to convert their domestic currency into the currency of the country where they wish to invest. This enables investors to diversify their portfolios and seek investment opportunities in different countries, contributing to the global flow of capital.

Case Study: Facilitating Global Trade

A notable example of the successful application of foreign exchange market trades is the role they play in facilitating global trade. For instance, consider a German company importing machinery from Japan. The German company needs to convert its euros (EUR) into Japanese yen (JPY) to pay for the machinery. The foreign exchange market provides the platform for this currency conversion, ensuring the smooth flow of goods between the two countries.

Ending Remarks

In conclusion, foreign exchange market trades are not merely transactions involving the exchange of currencies. They are a reflection of the interconnectedness of global economies and the constant interplay of economic, political, and social forces. Understanding the nuances of this market not only provides insights into the financial world but also offers a lens through which to observe the dynamics of our ever-changing planet.