The application of foreign exchange market, a global marketplace where currencies are traded, serves as a vital cog in international commerce and investment. From facilitating international trade to mitigating currency risk, the foreign exchange market plays a pivotal role in the global economy.

This intricate market connects businesses, investors, and central banks, enabling them to navigate the complexities of cross-border transactions and currency fluctuations.

Overview of the Foreign Exchange Market

The foreign exchange market (forex market) is a global decentralized market for the trading of currencies. It is the largest financial market in the world, with an estimated daily trading volume of over $5 trillion.

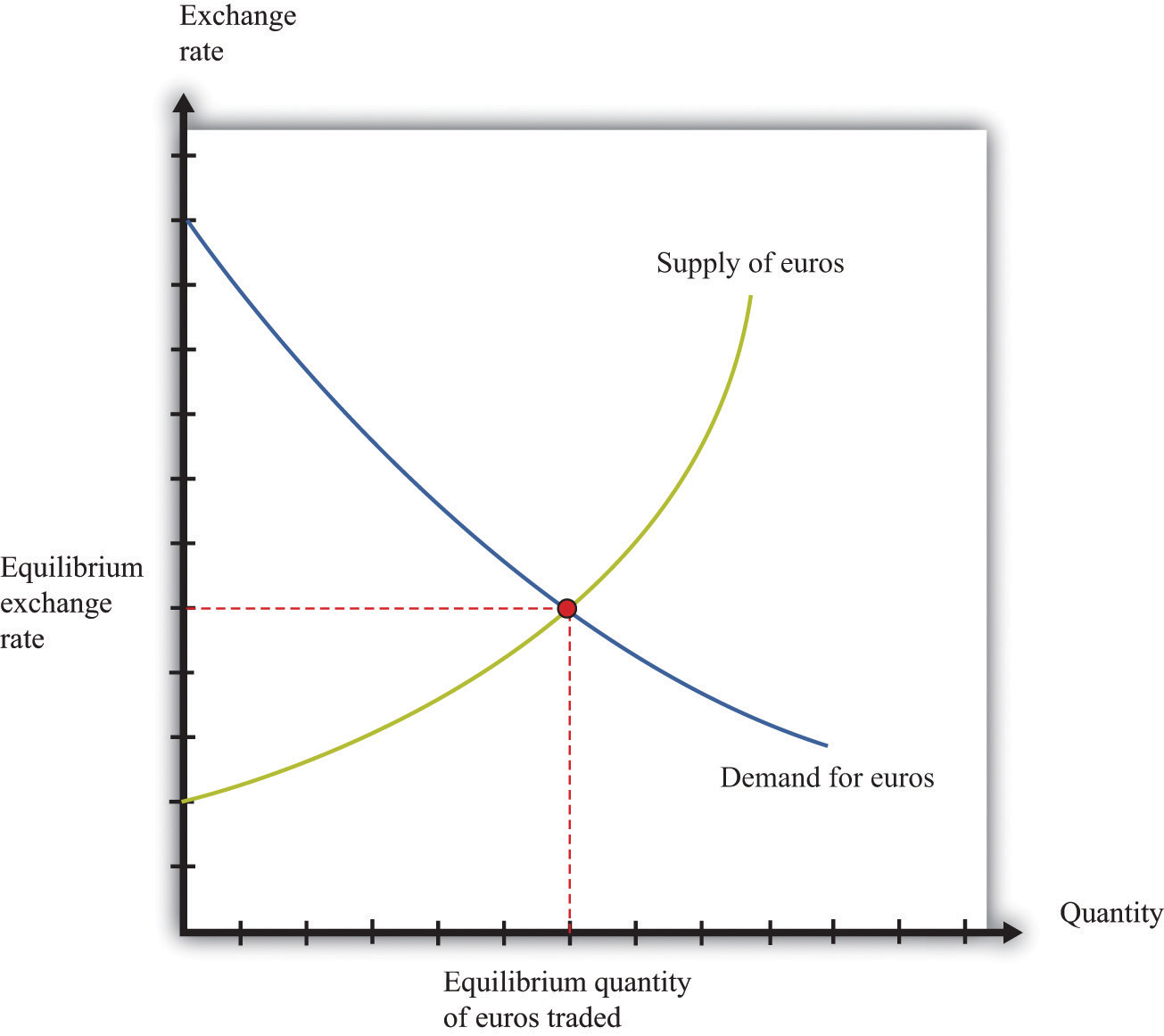

The purpose of the foreign exchange market is to facilitate the exchange of currencies for international trade and investment. It allows businesses and individuals to buy and sell currencies to make payments, hedge against risk, and speculate on currency movements.

Types of Participants

The foreign exchange market is made up of a diverse group of participants, including:

- Commercial banks: Commercial banks are the largest participants in the foreign exchange market. They facilitate currency exchange for their customers and trade currencies for their own account.

- Investment banks: Investment banks trade currencies for their clients and for their own account. They also provide research and advisory services to clients.

- Central banks: Central banks are responsible for managing the monetary policy of their countries. They intervene in the foreign exchange market to influence the value of their currencies.

- Corporations: Corporations use the foreign exchange market to manage their currency risk and to make payments in foreign currencies.

- Individuals: Individuals trade currencies for a variety of reasons, including travel, investment, and speculation.

Role of Central Banks

Central banks play a significant role in the foreign exchange market. They intervene in the market to influence the value of their currencies and to manage their monetary policy.

Central banks use a variety of tools to intervene in the foreign exchange market, including:

- Buying and selling currencies: Central banks can buy or sell currencies to influence their value.

- Raising and lowering interest rates: Central banks can raise or lower interest rates to make their currency more or less attractive to investors.

- Implementing capital controls: Central banks can implement capital controls to restrict the flow of money into and out of their countries.

Applications of the Foreign Exchange Market

The foreign exchange market plays a vital role in international trade and investment. It allows businesses and individuals to exchange currencies and manage currency risk.

International Trade

When a business imports or exports goods or services, it needs to exchange its currency for the currency of the country it is trading with. The foreign exchange market provides the platform for this exchange.

Discover more by delving into foreign exchange market today philippines further.

For example, if a U.S. company imports goods from China, it will need to exchange U.S. dollars for Chinese yuan. The foreign exchange market allows the company to do this at the current market exchange rate.

Discover how introduction and meaning of foreign exchange market has transformed methods in RELATED FIELD.

Currency Risk Management

Businesses that operate in multiple countries face currency risk. This is the risk that the value of one currency will change relative to another currency, which can impact the profitability of the business.

Browse the multiple elements of foreign exchange market today to gain a more broad understanding.

The foreign exchange market allows businesses to manage currency risk through hedging. Hedging involves entering into a contract to buy or sell a currency at a specific price in the future. This allows businesses to lock in an exchange rate and protect themselves from adverse currency movements.

Investment, Application of foreign exchange market

The foreign exchange market also plays a role in investment. Investors often invest in foreign assets, such as stocks, bonds, and real estate. To do this, they need to exchange their domestic currency for the currency of the country where the asset is located.

The foreign exchange market provides the platform for this exchange. It also allows investors to speculate on currency movements, which can be a profitable investment strategy.

Factors Affecting the Foreign Exchange Market

The foreign exchange market is a complex and dynamic environment, influenced by a wide range of factors. These factors can be broadly categorized into economic, political, and central bank intervention.

Economic Factors

- Interest Rates: Interest rates are one of the most important factors affecting currency values. Higher interest rates make a currency more attractive to investors, as they can earn a higher return on their investments. This increased demand for the currency leads to an appreciation in its value.

- Inflation: Inflation is the rate at which prices for goods and services increase over time. High inflation can erode the value of a currency, as it reduces the purchasing power of individuals and businesses. This can lead to a depreciation in the currency’s value.

- Economic Growth: Economic growth is another key factor that affects currency values. A strong economy with high growth rates is generally seen as more attractive to investors, leading to an appreciation in the currency’s value.

- Trade Balance: The trade balance is the difference between a country’s exports and imports. A trade deficit, where imports exceed exports, can put downward pressure on a currency’s value, while a trade surplus can lead to an appreciation.

Risks and Challenges of the Foreign Exchange Market: Application Of Foreign Exchange Market

The foreign exchange market is a complex and ever-changing environment, and there are a number of risks and challenges that businesses need to be aware of when trading in foreign currencies. These risks include:

- Currency risk: The value of currencies can fluctuate rapidly, which can lead to losses for businesses that are not properly hedged.

- Interest rate risk: Changes in interest rates can also affect the value of currencies, which can lead to losses for businesses that have borrowed in foreign currencies.

- Political risk: Political events, such as wars or changes in government, can also affect the value of currencies.

- Operational risk: Operational risks, such as errors in trading or settlement, can also lead to losses for businesses that trade in foreign currencies.

Businesses can mitigate currency risk by using a variety of hedging techniques, such as forward contracts, options, and swaps. They can also reduce interest rate risk by borrowing in their own currency or by using interest rate swaps. Political risk can be mitigated by purchasing political risk insurance. Operational risk can be mitigated by using a reputable foreign exchange broker and by having a sound risk management framework in place.

Forecasting exchange rates is a challenging task, as there are a number of factors that can affect the value of currencies. These factors include:

- Economic data: Economic data, such as GDP growth, inflation, and unemployment, can all affect the value of currencies.

- Political events: Political events, such as wars or changes in government, can also affect the value of currencies.

- Central bank policy: Central bank policy, such as interest rate changes or quantitative easing, can also affect the value of currencies.

- Market sentiment: Market sentiment can also affect the value of currencies, as traders often buy or sell currencies based on their expectations of future price movements.

Despite the challenges, there are a number of techniques that can be used to forecast exchange rates. These techniques include:

- Technical analysis: Technical analysis involves studying historical price data to identify trends and patterns that can be used to predict future price movements.

- Fundamental analysis: Fundamental analysis involves studying economic data and other factors that can affect the value of currencies.

- Econometric models: Econometric models are mathematical models that can be used to forecast exchange rates based on a variety of economic variables.

No forecasting technique is perfect, and it is important to use a variety of techniques to get a more accurate forecast.

Conclusion

:max_bytes(150000):strip_icc()/foreign-exchange-markets.asp-final-16abed069d5e4ba0924142476dec4211.png)

In conclusion, the application of foreign exchange market stands as a cornerstone of global finance, facilitating international trade, managing currency risk, and providing opportunities for investment. Its dynamics are shaped by a multitude of factors, presenting both opportunities and challenges for participants.

Understanding the nuances of this market empowers businesses and investors to navigate the complexities of global finance, unlocking its potential for growth and success.