Delving into the realm of global finance, the BIS foreign exchange market turnover stands as a colossal tapestry woven with intricate threads of currency exchange, shaping the very fabric of international trade and investment. This comprehensive analysis unravels the complexities of this dynamic market, exploring its size, distribution, key players, trading mechanisms, risk management strategies, and profound impact on the global economy.

As the BIS foreign exchange market turnover continues to expand, its influence on global economic growth and stability becomes increasingly evident. This in-depth examination sheds light on the intricate workings of this financial behemoth, providing valuable insights for market participants, policymakers, and anyone seeking to navigate the ever-evolving landscape of international finance.

Market Size and Distribution

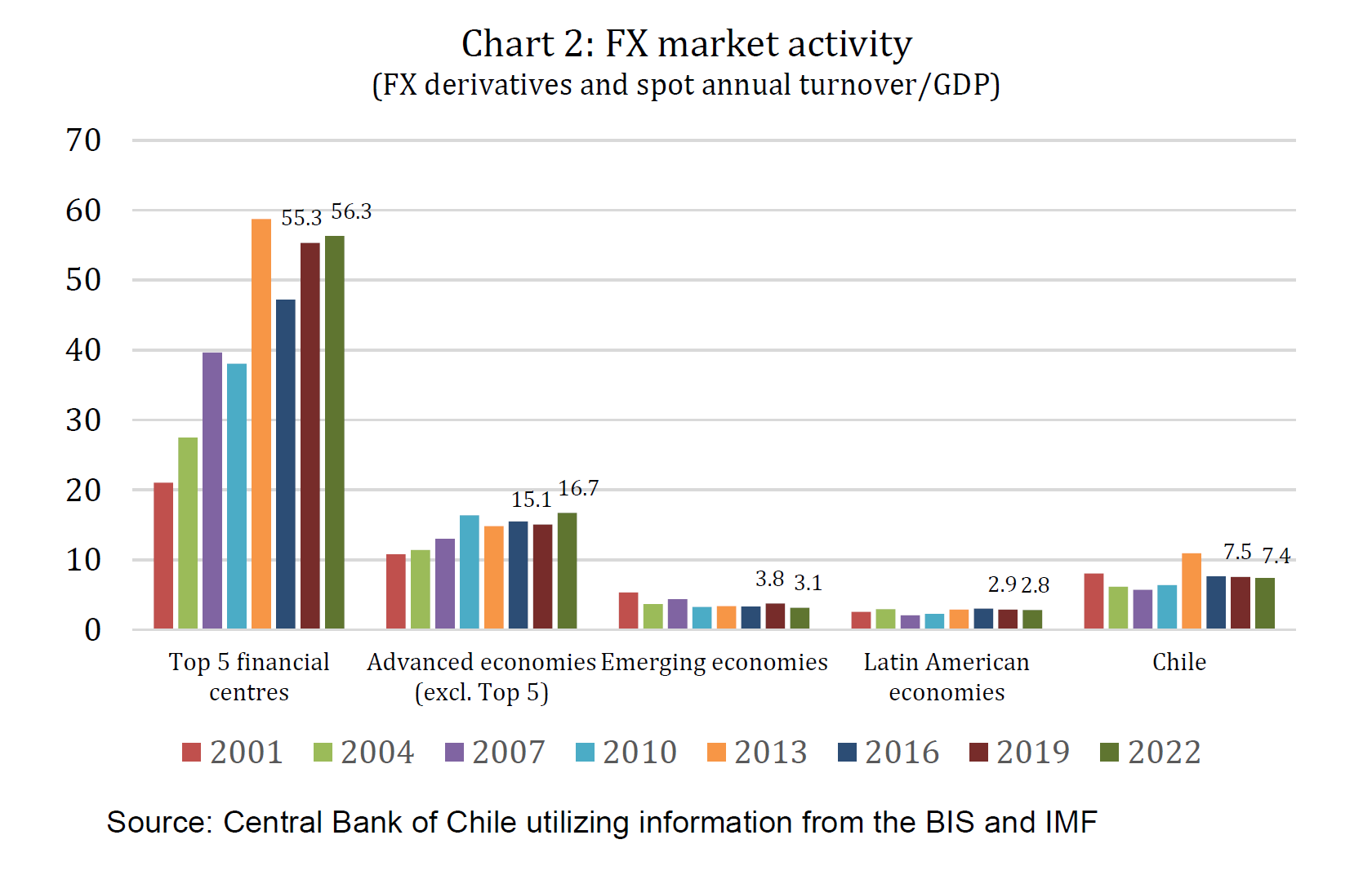

The BIS foreign exchange market turnover is a colossal market, facilitating a staggering amount of currency transactions each day. According to the latest Triennial Central Bank Survey conducted by the Bank for International Settlements (BIS), the global foreign exchange market turnover reached an astounding $6.6 trillion per day in April 2019, marking a substantial increase from $5.1 trillion in 2016.

This colossal market is characterized by its decentralized nature, with trading taking place across multiple centers worldwide. The largest foreign exchange trading centers include London, New York, Tokyo, Singapore, and Hong Kong, collectively accounting for the bulk of global trading activity.

The distribution of trading activity across different currency pairs and regions varies significantly. The US dollar (USD) is the most heavily traded currency, involved in approximately 88% of all transactions. Other major currencies include the euro (EUR), Japanese yen (JPY), British pound (GBP), and Swiss franc (CHF). These currencies constitute the “majors” and are widely traded against each other.

The factors influencing the market’s growth and fluctuations over time are multifaceted. Economic growth, interest rate differentials, political stability, and technological advancements all play a role in shaping the market’s dynamics. Periods of economic expansion and low interest rates tend to boost trading activity, while political uncertainty and market volatility can lead to a decline in trading volumes.

The foreign exchange market is a crucial component of the global financial system, facilitating international trade and investment. Its size and distribution reflect the interconnectedness of the world economy and the importance of currency exchange in facilitating global commerce.

Major Participants and Their Roles

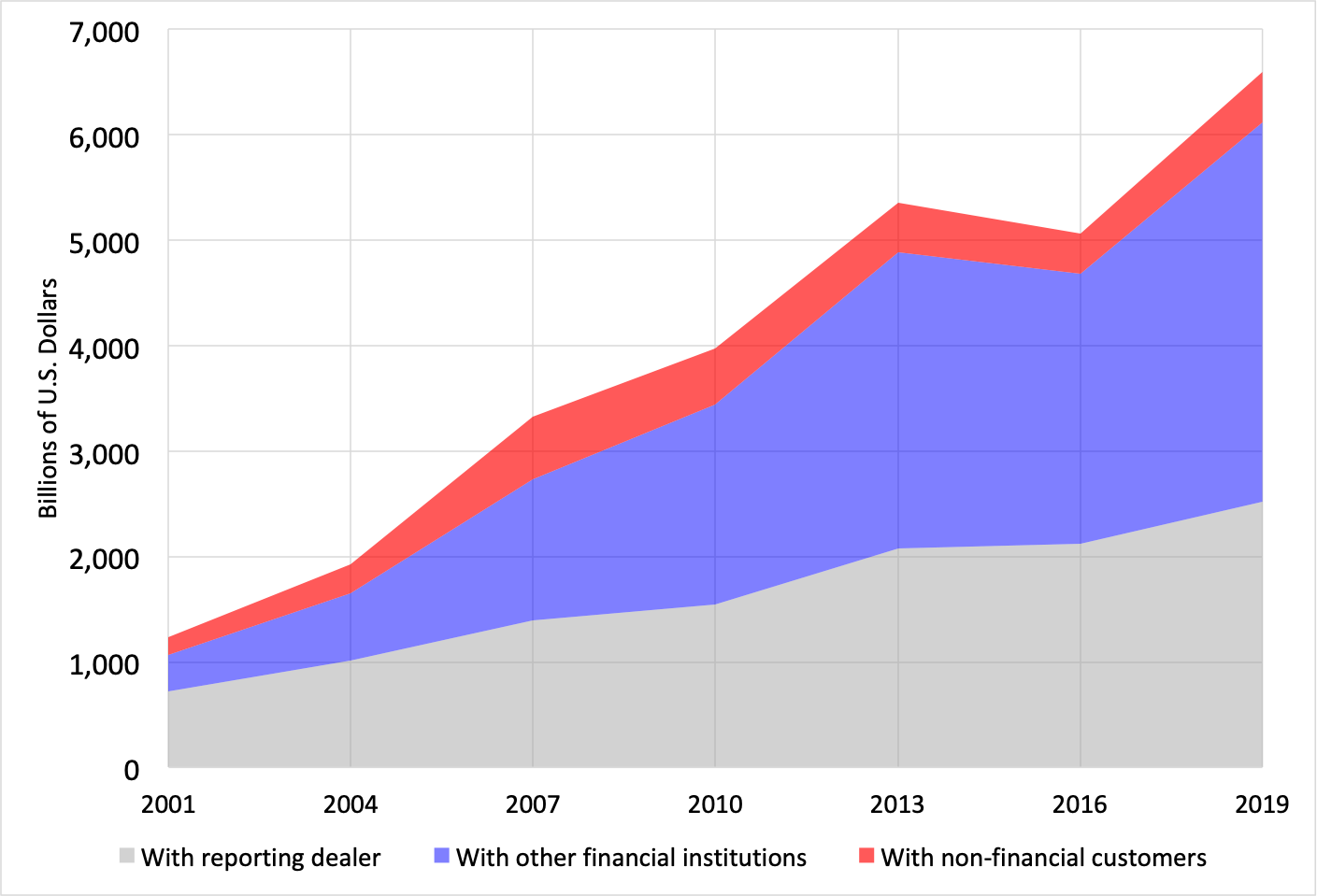

The BIS foreign exchange market is a vast and complex ecosystem involving various entities that play distinct roles in facilitating global currency transactions. Key participants include banks, non-bank financial institutions, and central banks, each contributing to market liquidity and ensuring the smooth functioning of the market.

Banks

- Commercial banks are the primary participants in the foreign exchange market, accounting for the majority of transactions.

- They provide currency exchange services to their clients, including businesses, individuals, and other financial institutions.

- Banks act as market makers by quoting bid and ask prices for different currencies, creating a liquid market.

Non-Bank Financial Institutions

Non-bank financial institutions, such as hedge funds, investment banks, and asset managers, also participate actively in the foreign exchange market.

- Hedge funds engage in speculative trading strategies, seeking to profit from currency fluctuations.

- Investment banks facilitate currency transactions for their clients and may also engage in proprietary trading.

- Asset managers invest client funds in foreign exchange instruments, diversifying their portfolios and seeking returns.

Central Banks

Central banks play a crucial role in managing the foreign exchange market and influencing currency values.

Investigate the pros of accepting foreign exchange market graph examples in your business strategies.

- They intervene in the market by buying or selling currencies to stabilize exchange rates or influence monetary policy.

- Central banks also set regulations and policies that impact the participation of different entities in the foreign exchange market.

- Their actions can significantly affect market liquidity and currency valuations.

Impact of Regulations and Policies

Regulations and policies implemented by central banks and other regulatory bodies influence the participation of different entities in the foreign exchange market.

- Capital requirements, reporting obligations, and risk management frameworks impact the participation of banks and non-bank financial institutions.

- Anti-money laundering and counter-terrorism financing regulations aim to prevent illicit activities in the foreign exchange market.

- Policies related to exchange rate management and capital controls can also affect the behavior of participants.

Trading Mechanisms and Instruments: Bis Foreign Exchange Market Turnover

The BIS foreign exchange market facilitates various trading mechanisms and instruments that cater to the diverse needs of market participants. These mechanisms and instruments enable efficient execution of foreign exchange transactions and provide flexibility to manage currency risk.

Trading Mechanisms, Bis foreign exchange market turnover

The primary trading mechanisms in the BIS foreign exchange market include:

- Spot Transactions: Immediate exchange of currencies at the prevailing market rate, with settlement typically occurring within two business days.

- Forward Transactions: Contracts to exchange currencies at a predetermined rate on a future date, providing protection against exchange rate fluctuations.

- Swap Transactions: Simultaneous buying and selling of currencies with different value dates, often used for managing interest rate risk.

Foreign Exchange Instruments

The BIS foreign exchange market trades a wide range of instruments, including:

- Currency Pairs: The exchange rate between two currencies, such as EUR/USD or GBP/JPY.

- Options: Contracts that give the buyer the right, but not the obligation, to buy or sell a currency at a specified price on a future date.

- Futures: Contracts to buy or sell a currency at a predetermined price on a specific future date.

Advantages and Disadvantages

The choice of trading mechanism and instrument depends on factors such as the desired settlement date, risk tolerance, and market conditions. Spot transactions offer immediate execution but may expose participants to exchange rate fluctuations. Forward transactions provide protection against currency risk but involve a commitment to exchange currencies at a future date. Swap transactions allow for the management of interest rate risk but can be complex to execute.

Similarly, the selection of foreign exchange instruments depends on the specific trading strategy and risk appetite. Currency pairs are the most basic instrument, while options and futures provide more sophisticated ways to manage currency risk or speculate on exchange rate movements.

You also can investigate more thoroughly about foreign exchange market shifters to enhance your awareness in the field of foreign exchange market shifters.

Market Dynamics and Risk Management

The foreign exchange market is constantly evolving, driven by a complex interplay of economic, political, and technological factors. Understanding these dynamics and managing the associated risks are crucial for market participants to succeed.

Key Drivers of Market Dynamics

Economic data, geopolitical events, and central bank policies are the primary drivers of market dynamics in the foreign exchange market.

- Economic data: Economic indicators such as GDP growth, inflation, unemployment, and trade balance provide insights into the health of economies and influence currency valuations.

- Geopolitical events: Political instability, wars, and natural disasters can create uncertainty and volatility in the market, affecting currency values.

- Central bank policies: Monetary policy decisions, such as interest rate changes and quantitative easing, can significantly impact currency values and market sentiment.

Types of Risks in Foreign Exchange Trading

Foreign exchange trading involves various types of risks, including:

- Exchange rate risk: The risk of losses due to fluctuations in currency values.

- Country risk: The risk of losses due to political or economic instability in the country whose currency is being traded.

- Liquidity risk: The risk of not being able to buy or sell a currency at a desired price due to low market liquidity.

- Operational risk: The risk of losses due to errors or failures in trading systems or processes.

Risk Management Practices

Market participants employ various risk management strategies to mitigate the risks associated with foreign exchange trading.

- Hedging: Using financial instruments, such as forwards and options, to offset the risk of exchange rate fluctuations.

- Diversification: Trading multiple currencies to reduce the impact of losses in any one currency.

- Limit orders: Setting buy or sell orders at specific prices to limit potential losses.

- Stop-loss orders: Setting orders to automatically sell or buy a currency when it reaches a predetermined price level, to prevent further losses.

Role of Technology and Innovation

Technological advancements have significantly enhanced market efficiency and risk management practices in the foreign exchange market.

Notice foreign exchange market overview for recommendations and other broad suggestions.

- Electronic trading platforms: Online platforms allow for faster and more efficient execution of trades, reducing transaction costs and improving liquidity.

- Risk management tools: Software and algorithms help market participants monitor and manage their risk exposure in real-time.

- Big data analytics: Data analysis tools provide insights into market trends and risk factors, enabling better decision-making.

Impact on the Global Economy

The massive turnover in the BIS foreign exchange market significantly influences global economic growth and stability. It underpins international trade and investment, facilitating seamless cross-border transactions and promoting economic interconnectedness.

The foreign exchange market enables businesses to conduct transactions in different currencies, mitigating currency risks and facilitating international commerce. It also allows investors to diversify their portfolios across global markets, contributing to capital flows and economic growth.

Potential Risks

While a large and active foreign exchange market offers benefits, it also carries potential risks:

- Currency volatility: Fluctuations in exchange rates can impact the value of investments and international trade, potentially leading to losses or economic disruptions.

- Financial instability: Excessive speculation and leverage in the foreign exchange market can contribute to financial instability and market crashes.

- Economic imbalances: Large capital flows driven by currency movements can create economic imbalances and distortions, such as asset bubbles or unsustainable trade deficits.

Potential Benefits

Despite the risks, a large and active foreign exchange market also offers benefits:

- Economic growth: Facilitates international trade and investment, which can boost economic growth and prosperity.

- Risk management: Allows businesses and investors to hedge against currency risks, protecting their assets and promoting economic stability.

- Financial innovation: Drives the development of new financial products and instruments, enhancing market efficiency and access to capital.

Ending Remarks

In conclusion, the BIS foreign exchange market turnover serves as a vital artery for global economic activity, facilitating international trade, investment, and risk management. Its size, distribution, participants, trading mechanisms, and risk management practices are constantly evolving, reflecting the dynamic nature of the global economy. Understanding the intricacies of this market is paramount for navigating its complexities and harnessing its potential benefits.