Delving into the realm of correlation forex, this comprehensive guide unveils the intricacies of this crucial concept, empowering traders with the knowledge to identify and capitalize on correlated currency pairs for enhanced trading strategies. Correlation in forex trading measures the degree of interdependence between currency pairs, providing valuable insights into market behavior and potential trading opportunities.

Understanding correlation is paramount for forex traders seeking to navigate the complexities of the market. By identifying highly correlated and negatively correlated currency pairs, traders can develop informed trading strategies that align with market trends and mitigate risks. This guide explores the methods for identifying correlation, including technical indicators and correlation matrices, as well as the limitations of using correlation in forex trading.

Understanding Correlation in Forex

Correlation in forex trading refers to the relationship between the price movements of two or more currency pairs. Understanding correlation is crucial for traders as it can help them identify potential trading opportunities and manage risk.

Correlated currency pairs tend to move in the same direction, while negatively correlated pairs move in opposite directions. Identifying correlated currency pairs is essential for diversifying a trading portfolio and reducing overall risk.

Examples of Highly Correlated Currency Pairs

– EUR/USD and GBP/USD: Both pairs are influenced by the economic health of the Eurozone and the United Kingdom, and they tend to move in the same direction.

– AUD/USD and NZD/USD: These pairs are known as the “Aussie and Kiwi” and are highly correlated due to their exposure to the Australian and New Zealand economies.

Examples of Negatively Correlated Currency Pairs, Correlation forex

– USD/JPY and EUR/USD: The US dollar and the Japanese yen are often negatively correlated, as traders tend to buy one currency while selling the other during periods of risk aversion.

– USD/CHF and EUR/CHF: The Swiss franc is considered a safe-haven currency, and its pairs with the US dollar and euro tend to move in opposite directions during periods of market uncertainty.

Understanding correlation in forex is a valuable skill for traders as it can help them make informed trading decisions and mitigate risk. By identifying correlated and negatively correlated currency pairs, traders can optimize their portfolios and increase their chances of success.

Methods for Identifying Correlation

Identifying correlation in forex trading is crucial for understanding the relationships between currency pairs and making informed trading decisions. Several methods can be employed to measure and analyze correlation.

Technical Indicators

- Correlation Coefficient: A statistical measure that quantifies the strength and direction of the linear relationship between two variables. Values range from -1 to 1, where -1 indicates a perfect negative correlation, 0 indicates no correlation, and 1 indicates a perfect positive correlation.

- Moving Averages: A technical analysis tool that smooths out price data by calculating the average price over a specified period. Moving averages can be used to identify trends and potential trading opportunities. By comparing the moving averages of two currency pairs, traders can assess their correlation.

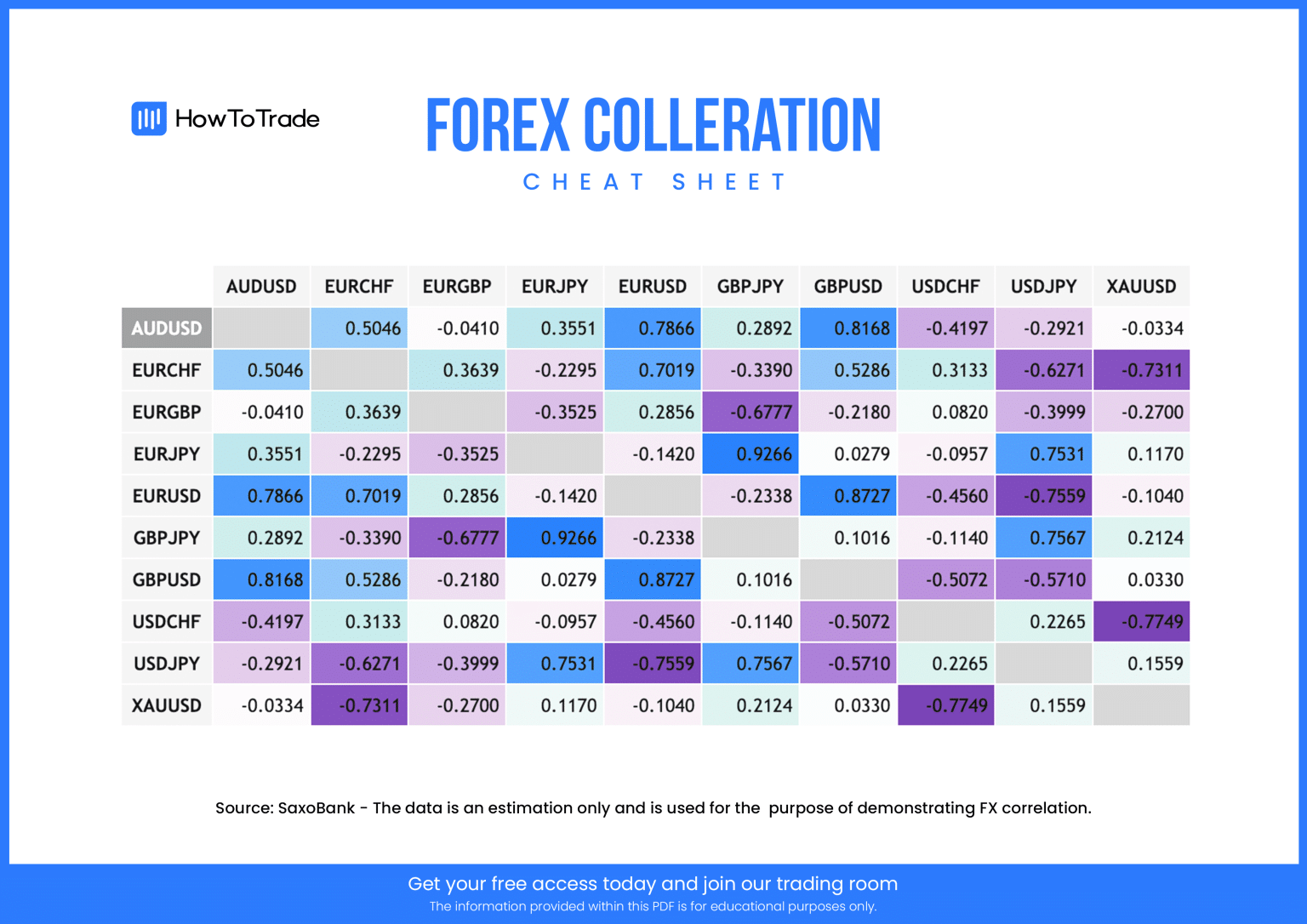

Correlation Matrix

A correlation matrix is a table that displays the correlation coefficients between multiple currency pairs. It provides a comprehensive overview of the relationships within a group of assets.

Notice currency pair format for recommendations and other broad suggestions.

To create a correlation matrix, traders calculate the correlation coefficient for each pair of currency pairs. The resulting matrix shows the strength and direction of the correlation between each pair.

Limitations of Correlation

- Non-linear Relationships: Correlation measures only linear relationships. It may not accurately capture non-linear or complex relationships between currency pairs.

- Time Lag: Correlation does not account for time lag. Currency pairs may exhibit correlation with a time delay, which can affect trading decisions.

- Changing Market Conditions: Correlation can change over time as market conditions fluctuate. Traders need to monitor correlation regularly to adjust their trading strategies accordingly.

Strategies for Trading Correlated Currency Pairs

Trading correlated currency pairs involves leveraging the relationship between two or more currencies to develop trading strategies. By understanding the correlation between currencies, traders can identify opportunities to profit from price movements that move in tandem.

Carry Trade Strategies

Carry trade strategies involve borrowing a currency with a low interest rate and investing it in a currency with a higher interest rate. The difference between the two interest rates is known as the carry. Positive correlation between the two currencies can enhance the carry trade’s profitability as it reduces the risk of currency fluctuations.

Find out about how currency pair forecast today can deliver the best answers for your issues.

Designing Trading Strategies Based on Correlation Analysis

Correlation analysis can provide insights into the historical relationship between currency pairs. By analyzing correlation coefficients and identifying currency pairs with strong positive or negative correlations, traders can design trading strategies that exploit these relationships.

- Positive Correlation: When two currencies are positively correlated, a rise in the value of one currency tends to lead to a rise in the value of the other. Traders can buy the stronger currency and sell the weaker currency, expecting them to move in the same direction.

- Negative Correlation: When two currencies are negatively correlated, a rise in the value of one currency tends to lead to a fall in the value of the other. Traders can buy the weaker currency and sell the stronger currency, expecting them to move in opposite directions.

Risk Management Techniques

Trading correlated currency pairs involves managing the risk associated with currency fluctuations. Some common risk management techniques include:

- Diversification: Diversifying across multiple correlated currency pairs can reduce the overall risk of the portfolio.

- Hedging: Using hedging instruments, such as currency forwards or options, can mitigate the risk of adverse currency movements.

- Position Sizing: Managing the size of trading positions based on the correlation between currencies can help control risk.

Correlation and Market Conditions

Correlation in forex trading is not static and can fluctuate depending on the prevailing market conditions. Understanding how correlation behaves in different market environments is crucial for traders to make informed decisions.

Explore the different advantages of currency pairs in zerodha that can change the way you view this issue.

During periods of high market volatility, correlations tend to increase. This is because currencies that are normally positively correlated become even more closely aligned, while negatively correlated currencies move further apart. This is due to the increased risk aversion that characterizes volatile markets, leading traders to seek safety in correlated assets.

Impact of Market Volatility on Correlation

- Increased volatility leads to higher positive correlations.

- Increased volatility leads to stronger negative correlations.

- Correlation can provide insights into market sentiment and risk appetite.

Correlation in Different Market Conditions

- Trending markets: In trending markets, correlation tends to be stronger as currencies move in the same direction for extended periods.

- Range-bound markets: In range-bound markets, correlation is typically weaker as currencies fluctuate within a defined range.

- Volatile markets: In volatile markets, correlation tends to increase as traders seek refuge in correlated assets.

Implications for Traders

Traders need to be aware of the impact of market conditions on correlation and adjust their trading strategies accordingly. In volatile markets, they may consider trading correlated currency pairs to reduce risk. In range-bound markets, they may focus on identifying trading opportunities based on weaker correlations.

Visualizing Correlation: Correlation Forex

Visualizing correlation in forex is crucial for identifying trading opportunities and making informed decisions. Correlation coefficients and charts can help traders understand the relationship between currency pairs and how they move together.

Correlation coefficients range from -1 to 1, where:

- -1 indicates a perfect negative correlation (as one currency pair rises, the other falls)

- 0 indicates no correlation (the movement of one currency pair has no impact on the other)

- 1 indicates a perfect positive correlation (both currency pairs move in the same direction)

Design a Table to Display Correlation Coefficients

Traders can create a table to display correlation coefficients between major currency pairs, providing a quick and easy reference for identifying potential trading opportunities.

| Currency Pair | Correlation Coefficient |

|---|---|

| EUR/USD | 0.85 |

| GBP/USD | 0.75 |

| USD/JPY | -0.55 |

Create a Chart that Demonstrates the Historical Correlation

Traders can also create a chart that demonstrates the historical correlation between two specific currency pairs. This can help visualize how the pairs have moved together over time and identify potential trends or patterns.

For example, a chart showing the historical correlation between EUR/USD and GBP/USD might indicate a strong positive correlation, with both pairs moving in the same direction most of the time.

Explain how to Use Visualization Tools to Identify Trading Opportunities

Visualization tools, such as tables and charts, can help traders identify potential trading opportunities based on correlation. By understanding the correlation between different currency pairs, traders can:

- Identify currency pairs that move together (positive correlation) or in opposite directions (negative correlation)

- Determine the strength of the correlation to assess the potential for profitable trades

- Identify potential trading strategies, such as pairs trading or spread trading, that exploit correlation relationships

Closing Summary

In conclusion, correlation forex plays a pivotal role in forex trading, offering traders a powerful tool to enhance their strategies and navigate market dynamics. By understanding the concept of correlation, employing appropriate identification methods, and implementing effective trading strategies, traders can harness the power of correlation to maximize their trading potential and achieve consistent profitability.