The currency pair correlation calculator is an indispensable tool for currency traders, providing valuable insights into the relationships between different currency pairs. Understanding these correlations is crucial for developing effective trading strategies and managing risk. This comprehensive guide will delve into the concept of currency pair correlation, explore calculation methods, and provide practical applications for traders.

Currency pair correlations measure the degree to which two currency pairs move in tandem. Positive correlations indicate that the pairs tend to move in the same direction, while negative correlations suggest they move in opposite directions. These correlations can be influenced by various factors, including economic conditions, political events, and market sentiment.

Introduction

Currency pair correlation is a statistical measure that quantifies the relationship between the price movements of two different currency pairs. It is an important concept in currency trading as it can be used to identify potential trading opportunities and manage risk.

Explore the different advantages of currency pair reading that can change the way you view this issue.

For example, if the EUR/USD and GBP/USD currency pairs have a positive correlation, it means that they tend to move in the same direction. This means that if the EUR/USD currency pair is rising, the GBP/USD currency pair is also likely to rise. Conversely, if the EUR/USD currency pair is falling, the GBP/USD currency pair is also likely to fall.

Commonly Traded Currency Pairs and Their Historical Correlations

Some of the most commonly traded currency pairs and their historical correlations include:

- EUR/USD and GBP/USD: These two currency pairs have a strong positive correlation, meaning that they tend to move in the same direction.

- USD/JPY and EUR/JPY: These two currency pairs have a moderate positive correlation, meaning that they tend to move in the same direction, but not as strongly as EUR/USD and GBP/USD.

- USD/CHF and EUR/CHF: These two currency pairs have a weak positive correlation, meaning that they tend to move in the same direction, but not as strongly as EUR/USD and GBP/USD.

- USD/CAD and EUR/CAD: These two currency pairs have a weak negative correlation, meaning that they tend to move in opposite directions.

Correlation Calculation Methods

Correlation is a statistical measure that indicates the degree to which two variables are related. It is used to determine the extent to which the movement of one variable is associated with the movement of another. In the context of currency pairs, correlation measures the relationship between the price movements of two different currencies.

There are several different methods that can be used to calculate the correlation between two currency pairs. The most common methods are the Pearson correlation coefficient and linear regression.

Pearson Correlation Coefficient

The Pearson correlation coefficient is a measure of the linear relationship between two variables. It is calculated by dividing the covariance of the two variables by the product of their standard deviations. The Pearson correlation coefficient can range from -1 to 1, where -1 indicates a perfect negative correlation, 0 indicates no correlation, and 1 indicates a perfect positive correlation.

The Pearson correlation coefficient is a simple and easy-to-understand measure of correlation. However, it is important to note that it is only a measure of linear correlation. This means that it can only detect linear relationships between two variables. If the relationship between two variables is non-linear, the Pearson correlation coefficient will not be able to detect it.

Linear Regression

Linear regression is a statistical technique that can be used to model the relationship between two variables. It is based on the assumption that the relationship between the two variables is linear. Linear regression can be used to calculate the slope and intercept of the line that best fits the data. The slope of the line indicates the direction and strength of the relationship between the two variables. The intercept of the line indicates the value of the dependent variable when the independent variable is equal to zero.

Check what professionals state about currency pair hedging and its benefits for the industry.

Linear regression is a more powerful measure of correlation than the Pearson correlation coefficient. It can detect both linear and non-linear relationships between two variables. However, it is important to note that linear regression is a more complex technique than the Pearson correlation coefficient. It is also more sensitive to outliers in the data.

Correlation Analysis

Correlation analysis is a crucial step in understanding the relationship between currency pairs. It involves examining historical data to identify patterns and trends that can help traders make informed decisions.

Remember to click participants in foreign exchange market to understand more comprehensive aspects of the participants in foreign exchange market topic.

To analyze currency pair correlations, follow these steps:

- Gather historical data: Collect daily, weekly, or monthly price data for the currency pairs you want to analyze. Ensure the data covers a sufficient period to capture meaningful trends.

- Calculate correlation coefficients: Use a correlation calculator or statistical software to calculate the correlation coefficient between each pair of currencies. The correlation coefficient ranges from -1 to 1:

- Positive correlation (1): The currencies move in the same direction.

- Negative correlation (-1): The currencies move in opposite directions.

- Zero correlation (0): No significant relationship exists between the currencies.

- Interpret the results: Consider the following factors when interpreting correlation values:

- Time period: Correlation values can change over time. Analyze data from different periods to assess the stability of the correlation.

- Data frequency: Daily data provides more detailed information than weekly or monthly data, but it can also be more volatile.

- Market conditions: Correlation values can be affected by market events, such as economic news or geopolitical events.

Trading Applications

Currency pair correlations offer valuable insights for developing trading strategies. By understanding the relationships between currency pairs, traders can identify opportunities to capitalize on market movements and mitigate risks.

Positive correlations indicate that two currency pairs tend to move in the same direction, while negative correlations suggest opposite movements. This knowledge can be leveraged to create various trading strategies.

Positive Correlation Strategies

- Carry Trade: This strategy involves borrowing a low-interest currency and investing it in a high-interest currency. Positive correlations between the two currencies can enhance the potential profits by amplifying the interest rate differential.

- Trend Following: When two positively correlated currency pairs are trending in the same direction, traders can ride the trend by buying both pairs or selling both pairs.

Negative Correlation Strategies

- Diversification: Negative correlations between currency pairs can help diversify a portfolio. By holding pairs that move in opposite directions, traders can reduce overall portfolio volatility.

- Hedging: Negative correlations can also be used for hedging. If a trader has a position in one currency pair, they can hedge against potential losses by taking an opposite position in a negatively correlated pair.

It’s important to note that correlation is not a perfect predictor of future price movements. Market conditions can change rapidly, and correlations can fluctuate over time. Therefore, traders should always use correlation analysis in conjunction with other technical and fundamental analysis tools to make informed trading decisions.

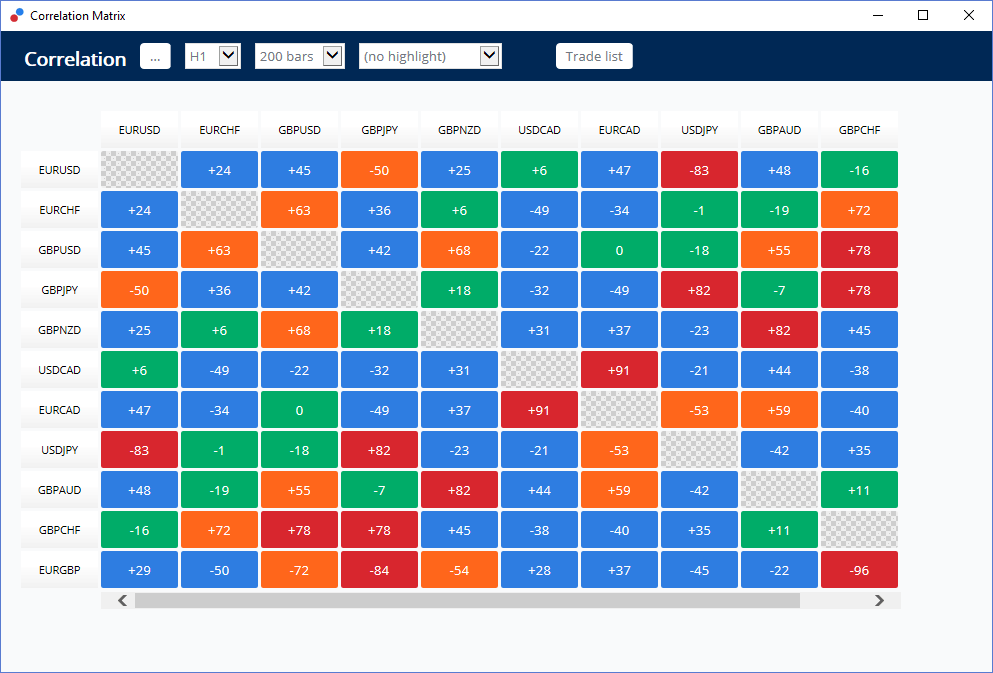

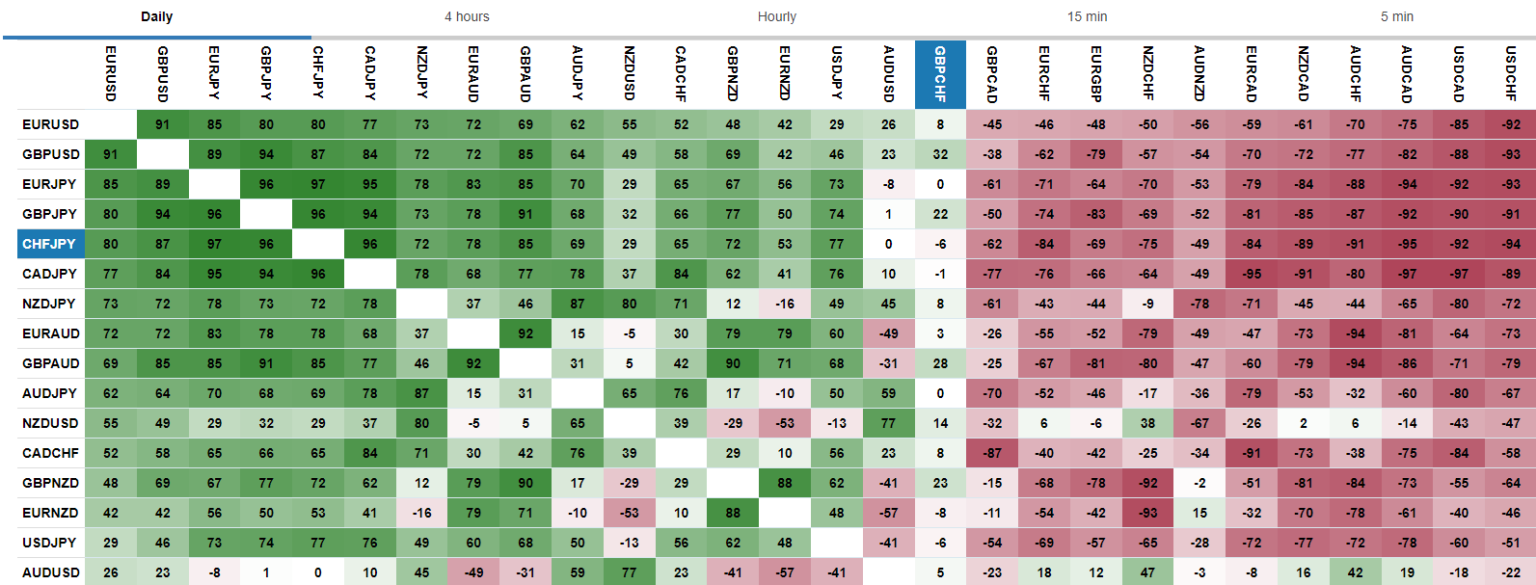

Correlation Calculators: Currency Pair Correlation Calculator

To simplify the process of calculating currency pair correlations, numerous correlation calculators are available online. These tools provide a convenient and efficient way to analyze the relationships between different currency pairs, offering valuable insights for traders.

Various correlation calculators employ different data sources and calculation methods, resulting in varying levels of accuracy and reliability. Understanding the strengths and limitations of each calculator is crucial for traders to make informed decisions.

Features of Popular Currency Pair Correlation Calculators

| Calculator | Data Source | Calculation Method | Customization Options |

|---|---|---|---|

| FXStreet | Real-time market data | Pearson correlation coefficient | Correlation period, currency pairs |

| OANDA | Historical data from OANDA’s platform | Pearson correlation coefficient | Correlation period, currency pairs, data frequency |

| TradingView | Real-time and historical data from TradingView | Pearson correlation coefficient, Spearman’s rank correlation coefficient | Correlation period, currency pairs, data frequency, visualization options |

| Forex Factory | Historical data from Forex Factory’s database | Pearson correlation coefficient | Correlation period, currency pairs |

| Myfxbook | Real-time and historical data from Myfxbook’s platform | Pearson correlation coefficient | Correlation period, currency pairs, data frequency |

The choice of correlation calculator depends on the specific needs and preferences of traders. Factors to consider include data source reliability, calculation method accuracy, customization options, and user interface.

Advanced Techniques

As traders become more sophisticated, they seek advanced techniques to analyze currency pair correlations and enhance their trading strategies. These techniques include multivariate analysis and machine learning, offering deeper insights and predictive capabilities.

Multivariate Analysis, Currency pair correlation calculator

Multivariate analysis examines the relationships among multiple currency pairs simultaneously. It considers various factors, such as economic indicators, market sentiment, and technical indicators. By analyzing these interdependencies, traders can identify complex patterns and relationships that may not be apparent in pairwise correlations.

Machine Learning

Machine learning algorithms can learn from historical data to predict future currency pair correlations. These algorithms are trained on vast datasets and can identify complex non-linear relationships that traditional correlation measures may miss. Machine learning models can also be used to forecast future price movements based on historical correlations.

While advanced techniques offer potential benefits, they also come with challenges. These techniques require significant computational resources and expertise to implement effectively. Additionally, the accuracy of these techniques depends on the quality and quantity of the underlying data.

Despite these challenges, advanced techniques can provide valuable insights for currency traders seeking to enhance their correlation analysis and trading strategies. By leveraging these techniques, traders can potentially identify more profitable trading opportunities and mitigate risks associated with currency pair correlations.

Epilogue

In conclusion, the currency pair correlation calculator is a powerful tool that empowers traders with the knowledge to make informed decisions. By understanding currency correlations, traders can identify trading opportunities, manage risk, and enhance their overall trading performance. As the financial markets continue to evolve, the ability to analyze and interpret currency correlations will remain a critical skill for successful traders.