Explain how a foreign exchange market functions and unravel the intricate workings of the global currency exchange system. From understanding the basics to navigating its complexities, this guide will empower you with the knowledge to delve into the fascinating world of forex trading.

The foreign exchange market, or forex market, serves as the backbone of international trade, facilitating the exchange of currencies between nations. It involves a vast network of participants, including banks, corporations, and individual traders, all seeking to capitalize on currency fluctuations.

Foreign Exchange Market Basics

The foreign exchange market, also known as the forex market, is a global decentralized market for the trading of currencies. It is the largest and most liquid financial market in the world, with a daily trading volume of over $5 trillion.

Understand how the union of foreign exchange market demand curve can improve efficiency and productivity.

Foreign exchange plays a crucial role in global trade and investment. It allows businesses to conduct international transactions, facilitate cross-border payments, and hedge against currency risks.

Types of Currencies Traded

The forex market trades a wide range of currencies, including major currencies like the US dollar, euro, Japanese yen, and British pound, as well as minor currencies and emerging market currencies.

Check what professionals state about foreign exchange market meaning define and its benefits for the industry.

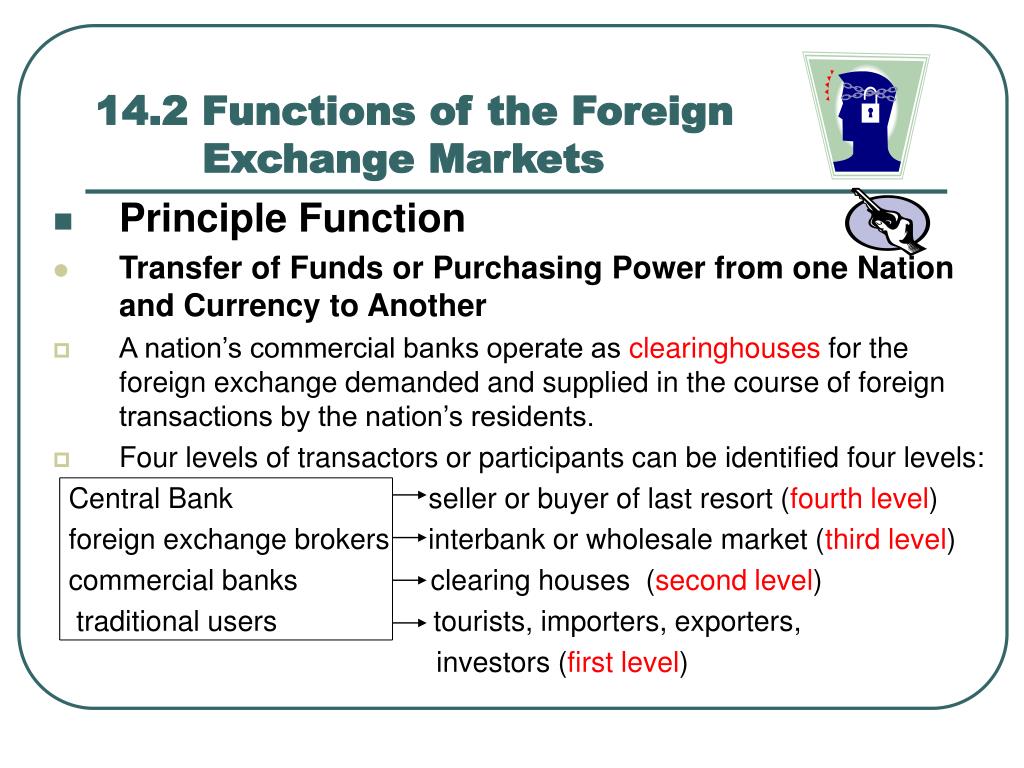

Participants in the Forex Market

The forex market involves a diverse range of participants, including banks, hedge funds, institutional investors, corporations, and retail traders. Banks are the primary market makers, providing liquidity and facilitating transactions.

Mechanics of the Forex Market

The foreign exchange market operates through a vast network of financial institutions, brokers, and individual traders who facilitate the buying and selling of currencies. The process involves several key steps and utilizes various types of orders and trading platforms.

Buying and Selling Currencies

To buy or sell a currency in the forex market, traders first need to establish an account with a forex broker. Brokers act as intermediaries between traders and the market, providing access to trading platforms and executing orders.

When buying a currency, traders exchange their base currency for the desired currency. Conversely, when selling a currency, they exchange the desired currency for their base currency. The exchange rate determines the amount of the base currency required to purchase a unit of the desired currency.

Types of Orders

Forex traders use different types of orders to execute their trades:

- Market order: Executes a trade at the prevailing market price.

- Limit order: Specifies a price at which a trade should be executed. The order is filled only when the market price reaches the specified level.

- Stop order: Triggers a trade when the market price reaches a predefined level. It is often used to limit losses or secure profits.

Trading Platforms

Forex traders can access the market through various trading platforms provided by brokers:

- Web-based platforms: Accessed through a web browser, offering a user-friendly interface and basic trading tools.

- Desktop platforms: Downloaded and installed on a computer, providing advanced charting and analysis features.

- Mobile platforms: Allow traders to trade on the go using their smartphones or tablets.

Factors Influencing Currency Exchange Rates

The exchange rate between two currencies is determined by a complex interplay of economic, political, and psychological factors. These factors can influence the supply and demand for a particular currency, thereby affecting its value relative to other currencies.

Economic Data

Economic data provides insights into the health of a country’s economy and its future prospects. Strong economic growth, low inflation, and a stable financial system can increase the demand for a country’s currency, leading to its appreciation. Conversely, weak economic data, high inflation, and financial instability can erode confidence in a currency, causing it to depreciate.

- GDP growth: A country with a growing economy typically has a stronger currency as investors seek to participate in its growth potential.

- Inflation: High inflation can erode the purchasing power of a currency, reducing its value relative to other currencies.

- Interest rates: Central banks adjust interest rates to manage inflation and economic growth. Higher interest rates can attract foreign capital and strengthen a currency.

Political Events

Political events can have a significant impact on currency exchange rates. Political stability, transparency, and sound governance foster confidence in a currency. Conversely, political instability, corruption, and economic sanctions can weaken a currency.

- Elections: Changes in government can lead to shifts in economic policies, which can affect the value of a currency.

- Wars and conflicts: Political instability and military conflicts can create uncertainty and reduce confidence in a currency.

li>Trade agreements: Bilateral or multilateral trade agreements can affect the demand for a currency and its exchange rate.

Central Bank Policies

Central banks play a crucial role in managing exchange rates through monetary policy. They can adjust interest rates, intervene in the foreign exchange market, and implement quantitative easing or tightening measures to influence the supply and demand for a currency.

- Interest rate adjustments: Central banks raise or lower interest rates to control inflation and economic growth, which can impact currency values.

- Foreign exchange intervention: Central banks can buy or sell foreign currencies to stabilize the exchange rate or prevent excessive volatility.

- Quantitative easing: Central banks can purchase government bonds or other assets to increase the money supply, which can weaken a currency.

Risk Management in Forex Trading: Explain How A Foreign Exchange Market Functions

Forex trading involves inherent risks, and managing these risks effectively is crucial for successful trading. This section delves into the risks involved in forex trading and provides strategies for managing them, including stop-loss orders, position sizing, and emotional control.

Understanding Forex Trading Risks

- Currency Fluctuations: The primary risk in forex trading stems from currency price fluctuations. Currency values constantly fluctuate due to economic, political, and market factors, which can lead to significant losses if not managed properly.

- Leverage: Forex trading often involves the use of leverage, which amplifies both profits and losses. While leverage can increase potential returns, it also magnifies risks and can lead to substantial losses if not used judiciously.

- Market Volatility: The forex market is known for its high volatility, with currency prices experiencing sudden and unpredictable movements. This volatility can lead to large fluctuations in trading positions, resulting in losses if not anticipated.

- Trading Errors: Human errors, such as misjudging market conditions or entering incorrect trade orders, can lead to significant losses. Emotional trading and a lack of discipline can also contribute to trading errors.

Risk Management Strategies

Stop-Loss Orders

Stop-loss orders are essential risk management tools that automatically close a trade when the market price reaches a predetermined level. They help limit potential losses by exiting a trade when the market moves against the trader’s position.

Position Sizing

Position sizing involves determining the appropriate trade size based on the trader’s risk tolerance and account balance. It ensures that the potential loss on any given trade does not exceed a predetermined percentage of the trader’s capital.

Emotional Control

Managing emotions is crucial in forex trading. Traders should avoid impulsive decisions and stick to their trading plan. Greed, fear, and overconfidence can lead to poor trading decisions and increased risks.

Remember to click structure of foreign exchange market pdf to understand more comprehensive aspects of the structure of foreign exchange market pdf topic.

Common Trading Mistakes

- Overtrading: Trading more than the trader’s risk tolerance or account balance allows.

- Revenge Trading: Trading emotionally to recover losses, often leading to further losses.

- Ignoring Stop-Loss Orders: Failing to use stop-loss orders or overriding them can result in substantial losses.

- Lack of Discipline: Deviating from the trading plan and making impulsive decisions.

- Chasing Losses: Attempting to recover losses by increasing trade size or taking on excessive risk.

Advanced Forex Trading Strategies

Advanced forex trading strategies involve complex techniques and in-depth market analysis to maximize profits and minimize risks. These strategies combine technical and fundamental analysis, algorithmic trading, and risk management to enhance trading decisions.

Technical Analysis

Technical analysis examines historical price data to identify patterns and trends that can predict future price movements. Traders use charts, indicators, and mathematical formulas to analyze price movements, volume, and momentum. By recognizing patterns like support and resistance levels, moving averages, and candlestick patterns, traders can anticipate price changes and make informed trading decisions.

Fundamental Analysis

Fundamental analysis evaluates economic and geopolitical factors that influence currency exchange rates. Traders consider interest rates, inflation, GDP growth, political stability, and global events to assess the intrinsic value of a currency. By understanding the underlying economic fundamentals, traders can make informed decisions about the long-term direction of currency pairs.

Algorithmic Trading, Explain how a foreign exchange market functions

Algorithmic trading, also known as automated trading, uses computer programs to execute trades based on predefined rules and strategies. Algorithms monitor market conditions and execute trades automatically, eliminating emotional bias and allowing for faster execution. By using complex algorithms that analyze vast amounts of data, traders can identify trading opportunities and execute trades with precision.

Successful Trading Strategies

Successful forex trading strategies combine technical and fundamental analysis with risk management techniques. Some common strategies include:

– Trend following: Identifying and trading in the direction of the prevailing trend using technical analysis.

– Range trading: Trading within a defined price range, buying near support levels and selling near resistance levels.

– Carry trade: Borrowing in a low-interest currency and investing in a high-interest currency to profit from the interest rate differential.

– Scalping: Executing numerous small trades within a short period, aiming for small profits from each trade.

Implementation

Implementing forex trading strategies requires discipline, patience, and risk management. Traders should backtest strategies on historical data, optimize parameters, and define entry and exit points clearly. Risk management techniques, such as stop-loss orders and position sizing, are crucial to protect capital and limit losses. By following a structured approach and adhering to trading rules, traders can enhance their chances of success in the forex market.

Forex Market Regulation

The forex market, being a global and decentralized market, is subject to regulations in different jurisdictions. These regulations aim to ensure market integrity, protect investors, and prevent illegal activities.

Regulatory bodies play a crucial role in overseeing the forex market. They establish rules and guidelines that govern the conduct of forex brokers, dealers, and other market participants. These regulations cover aspects such as capital requirements, risk management practices, and reporting obligations.

Types of Forex Market Regulations

- National Regulations: Individual countries have their own regulations governing the forex market within their borders. These regulations may vary depending on the country’s financial system and economic policies.

- International Regulations: There are also international organizations that set standards and guidelines for the forex market. These organizations include the Bank for International Settlements (BIS) and the International Organization of Securities Commissions (IOSCO).

Role of Regulatory Bodies

- Market Oversight: Regulatory bodies monitor the forex market to ensure compliance with regulations and identify any potential risks or irregularities.

- Investor Protection: They protect investors by ensuring that forex brokers and dealers operate in a fair and transparent manner.

- Dispute Resolution: Regulatory bodies provide a mechanism for resolving disputes between market participants.

Forex Trading Licenses and Certifications

In many jurisdictions, forex traders are required to obtain licenses or certifications to operate legally. These licenses and certifications demonstrate that the trader has the necessary knowledge and skills to trade in the forex market.

The requirements for obtaining a forex trading license or certification vary depending on the jurisdiction. Typically, traders must pass an exam and meet certain experience and educational requirements.

Final Wrap-Up

Understanding how a foreign exchange market functions is essential for anyone involved in global commerce or seeking to navigate the ever-changing currency landscape. By grasping the mechanics, influences, and strategies that govern forex trading, you can make informed decisions and potentially reap the benefits of this dynamic market.