Welcome to our comprehensive introduction to foreign exchange market ppt, a guide designed to provide a thorough understanding of the dynamic world of forex trading. Dive into the intricacies of currency exchange, unravel the history and evolution of the market, and discover the key players shaping its landscape.

Throughout this presentation, we’ll delve into the complexities of exchange rates, explore the factors influencing their fluctuations, and unravel the structure of the foreign exchange market. We’ll shed light on the diverse range of instruments used in forex trading and equip you with the knowledge to navigate this ever-evolving market.

Introduction to Foreign Exchange Market: Introduction To Foreign Exchange Market Ppt

The foreign exchange market, also known as the forex market or currency market, is a global decentralized market where currencies are traded. It is the largest and most liquid financial market in the world, with a daily trading volume exceeding $5 trillion.

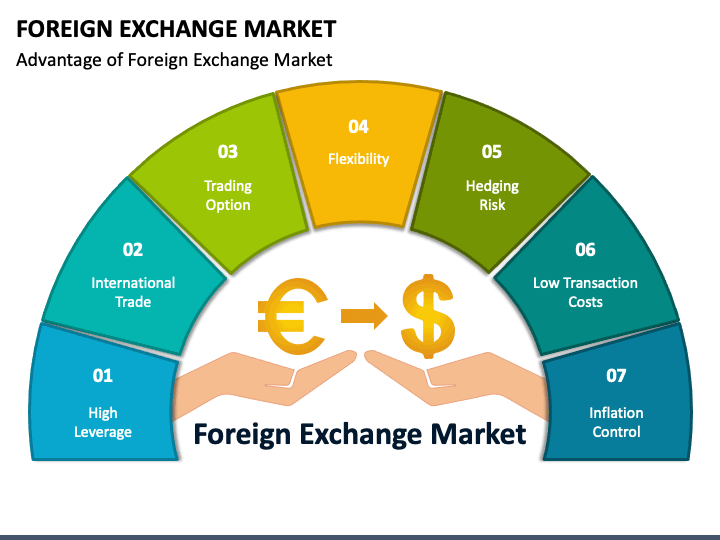

Foreign exchange is essential for global trade and finance. It allows businesses to conduct international transactions and investors to diversify their portfolios. The foreign exchange market also plays a crucial role in stabilizing exchange rates and facilitating international capital flows.

History and Evolution of the Foreign Exchange Market

The foreign exchange market has a long and rich history. The earliest forms of currency exchange date back to ancient times, when merchants and traders would exchange different currencies to facilitate trade. The modern foreign exchange market emerged in the 19th century, with the advent of the gold standard and the development of international trade and investment.

The foreign exchange market has undergone significant changes over the years. The most notable change was the abandonment of the gold standard in the 1970s, which led to the adoption of floating exchange rates. This change made the foreign exchange market more volatile, but it also gave central banks more flexibility to manage their economies.

Participants in the Foreign Exchange Market

The foreign exchange market is a diverse market with a wide range of participants. The largest participants are banks, which account for over 90% of all foreign exchange trading. Other participants include hedge funds, asset managers, corporations, and retail traders.

Each participant in the foreign exchange market has different motivations and trading strategies. Banks, for example, trade foreign exchange to facilitate international payments and to hedge against currency risk. Hedge funds and asset managers trade foreign exchange to speculate on currency movements and to diversify their portfolios. Corporations trade foreign exchange to manage their international operations and to hedge against currency risk. Retail traders trade foreign exchange to speculate on currency movements and to make a profit.

Key Concepts in Foreign Exchange

The foreign exchange market is a global marketplace where currencies are traded. It is the largest and most liquid financial market in the world, with an average daily trading volume of over $5 trillion.

Key concepts in foreign exchange include exchange rates, types of exchange rates, and factors that influence exchange rate fluctuations.

Exchange Rates

An exchange rate is the price of one currency in terms of another. It is determined by the forces of supply and demand in the foreign exchange market.

There are two main types of exchange rates:

- Spot exchange rate: The spot exchange rate is the price of a currency for immediate delivery.

- Forward exchange rate: The forward exchange rate is the price of a currency for delivery at a future date.

Factors that Influence Exchange Rate Fluctuations

A number of factors can influence exchange rate fluctuations, including:

- Economic conditions: The economic conditions of a country can have a significant impact on its exchange rate. For example, a country with a strong economy will typically have a stronger currency than a country with a weak economy.

- Interest rates: Interest rates can also affect exchange rates. For example, a country with high interest rates will typically attract more foreign investment, which can lead to a stronger currency.

- Supply and demand: The forces of supply and demand can also affect exchange rates. For example, if there is a high demand for a currency, its price will typically rise.

li>Political stability: Political stability can also affect exchange rates. For example, a country with a stable political environment will typically have a stronger currency than a country with a unstable political environment.

Foreign Exchange Market Structure

The foreign exchange market is a global, decentralized market where currencies are traded. It is the largest and most liquid financial market in the world, with an average daily trading volume of over $5 trillion.

The foreign exchange market is made up of a number of different types of markets, including the spot market, the forward market, and the swap market. The spot market is where currencies are traded for immediate delivery. The forward market is where currencies are traded for delivery at a future date. The swap market is where currencies are exchanged for other currencies for a specified period of time.

Find out about how tamil meaning of foreign exchange market can deliver the best answers for your issues.

Participants in the Foreign Exchange Market

The foreign exchange market is made up of a number of different participants, including banks, corporations, investment funds, and central banks.

- Banks are the largest participants in the foreign exchange market. They provide a range of services to their clients, including currency trading, foreign exchange hedging, and foreign exchange risk management.

- Corporations use the foreign exchange market to hedge their exposure to foreign currency risk. They may also use the foreign exchange market to speculate on currency movements.

- Investment funds use the foreign exchange market to diversify their portfolios and to generate returns.

- Central banks use the foreign exchange market to manage their country’s foreign exchange reserves and to influence the value of their currency.

Role of Central Banks in the Foreign Exchange Market

Central banks play a significant role in the foreign exchange market. They use a variety of tools to influence the value of their currency, including interest rate policy, foreign exchange intervention, and capital controls.

- Interest rate policy is the most important tool that central banks use to influence the value of their currency. By raising or lowering interest rates, central banks can make their currency more or less attractive to investors.

- Foreign exchange intervention is another tool that central banks use to influence the value of their currency. Foreign exchange intervention involves buying or selling foreign currencies in the foreign exchange market.

- Capital controls are measures that restrict the flow of capital into or out of a country. Central banks may use capital controls to prevent their currency from becoming too strong or too weak.

Types of Foreign Exchange Transactions

There are a number of different types of foreign exchange transactions, including spot transactions, forward transactions, and swap transactions.

- Spot transactions are transactions that involve the immediate delivery of currencies. Spot transactions are typically settled within two business days.

- Forward transactions are transactions that involve the delivery of currencies at a future date. Forward transactions are typically used to hedge against foreign currency risk.

- Swap transactions are transactions that involve the exchange of currencies for a specified period of time. Swap transactions are typically used to speculate on currency movements.

Foreign Exchange Market Instruments

The foreign exchange market offers various instruments that enable participants to trade currencies. These instruments serve different purposes and cater to diverse risk appetites and investment strategies.

Spot Contracts

Spot contracts involve the immediate exchange of currencies at the prevailing market rate. These contracts are settled within two business days, typically with no additional fees or charges. Spot contracts are suitable for short-term currency trading or for businesses requiring immediate settlement of foreign currency transactions.

Forward Contracts

Forward contracts are agreements to exchange currencies at a predetermined rate on a future date. These contracts lock in the exchange rate, protecting against potential fluctuations in currency values. Forward contracts are commonly used by businesses and investors seeking to manage currency risk over a longer period. They provide certainty in future currency transactions and can be customized to meet specific requirements.

Examine how foreign exchange market graph macro can boost performance in your area.

Options, Introduction to foreign exchange market ppt

Options are contracts that give the buyer the right, but not the obligation, to buy or sell a currency at a specified price within a certain period. Options provide flexibility and allow traders to speculate on currency movements without committing to a purchase or sale. They are commonly used for hedging or to gain exposure to currency fluctuations.

Discover more by delving into foreign currency exchange khan market further.

Risks and Rewards

Using foreign exchange instruments involves both risks and rewards. Fluctuations in currency values can lead to potential gains or losses. Spot contracts carry lower risks compared to forward contracts and options, as they involve immediate settlement. Forward contracts and options, while offering opportunities for speculation and risk management, come with higher risks due to the longer time frame involved and the potential for significant currency movements.

Foreign Exchange Market Analysis

Foreign exchange market analysis is a crucial aspect of understanding and predicting currency movements. It involves studying various factors that influence exchange rates, including technical and fundamental factors.

Technical Analysis

Technical analysis focuses on the historical price data of a currency pair to identify patterns and trends. It uses various technical indicators, such as moving averages, support and resistance levels, and candlestick patterns, to predict future price movements.

Fundamental Analysis

Fundamental analysis examines economic, political, and social factors that affect currency values. It considers factors such as interest rates, economic growth, inflation, and political stability to assess the underlying strength of a currency.

Foreign Exchange Market Risk Management

The foreign exchange market, also known as forex or FX, involves the trading of currencies and is one of the largest and most liquid financial markets in the world. However, like any financial market, forex trading carries inherent risks that must be carefully managed to mitigate potential losses.

There are several types of risks associated with foreign exchange trading, including:

- Currency risk: This refers to the risk that the value of one currency may fluctuate relative to another, resulting in losses for traders who hold positions in those currencies.

- Interest rate risk: This refers to the risk that changes in interest rates may affect the value of currencies, as traders may adjust their positions based on interest rate differentials.

- Liquidity risk: This refers to the risk that a trader may not be able to enter or exit a position in a timely manner due to a lack of liquidity in the market.

- Political risk: This refers to the risk that political events or changes in government policies may affect the value of currencies.

To manage these risks, traders employ various strategies, including:

- Hedging: This involves using financial instruments to offset the risk of currency fluctuations. For example, a trader may buy a currency forward contract to lock in a future exchange rate.

- Diversification: This involves spreading investments across different currencies to reduce the impact of fluctuations in any single currency.

- Risk management tools: Traders may use stop-loss orders or limit orders to automatically close positions when certain price levels are reached, limiting potential losses.

Risk management is crucial in foreign exchange trading, as it helps traders protect their capital and mitigate potential losses. By understanding the different types of risks involved and employing appropriate risk management strategies, traders can increase their chances of success in the foreign exchange market.

Case Studies

The foreign exchange market is a complex and dynamic environment, and it is important to understand how the concepts and strategies discussed in this presentation have been applied in real-world situations. This section will provide several case studies that illustrate the successes and failures of different approaches to the foreign exchange market.

By examining these case studies, we can draw valuable lessons that can help us become more successful foreign exchange market participants.

Case Study: The 1992 Black Wednesday Crisis

The 1992 Black Wednesday Crisis was a major event in the history of the foreign exchange market. On September 16, 1992, the British pound sterling was forced to withdraw from the European Exchange Rate Mechanism (ERM) after a series of speculative attacks by hedge funds. The crisis led to a loss of billions of pounds for the British government and caused a major loss of confidence in the ERM.

One of the key lessons that can be learned from the Black Wednesday Crisis is the importance of understanding the risks involved in currency speculation. The hedge funds that attacked the pound sterling were able to profit from the crisis because they had a deep understanding of the market and were able to identify the weaknesses in the ERM. Individual investors should be aware of the risks involved in currency speculation and should only trade with money that they can afford to lose.

Last Recap

As we conclude our exploration of the foreign exchange market, we hope you have gained a deeper understanding of its intricacies. Remember, the forex market is a constantly evolving landscape, presenting both opportunities and challenges. By embracing continuous learning and staying abreast of market dynamics, you can navigate this dynamic realm with confidence and potentially reap its rewards.