Korelasi pair mata uang forex – In the realm of forex trading, currency pairs exhibit intricate correlations that can significantly impact trading strategies. Understanding these correlations is crucial for traders seeking to navigate market dynamics effectively.

Correlation measures the degree to which the movements of two currency pairs align or diverge. It plays a pivotal role in forex trading, as it can provide insights into potential price movements and help traders make informed decisions.

Introduction

In the realm of foreign exchange (forex) trading, understanding the relationship between currency pairs is crucial for effective decision-making. Currency pairs are essentially the exchange rates between two different currencies, such as EUR/USD (euro versus U.S. dollar) or GBP/JPY (British pound versus Japanese yen). These pairs move in tandem, exhibiting varying degrees of correlation.

Correlation measures the extent to which two variables move in the same or opposite directions. In forex trading, correlation between currency pairs indicates the likelihood of one currency moving in a predictable manner relative to another. A high positive correlation suggests that the pairs tend to move in the same direction, while a high negative correlation indicates they tend to move in opposite directions.

Significance of Correlation

Understanding correlation is vital for forex traders for several reasons. It can help:

- Identify potential trading opportunities: Traders can exploit the correlation between currency pairs to identify potential trades with higher probability of success.

- Manage risk: By diversifying their portfolio with correlated currency pairs, traders can reduce the overall risk of their trades.

li>Make informed trading decisions: Correlation analysis provides valuable insights into the behavior of currency pairs, enabling traders to make more informed trading decisions.

Factors Influencing Correlation

The correlation between currency pairs is influenced by a myriad of factors that can be broadly categorized into three primary groups: economic indicators, political events, and market sentiment.

Economic Indicators

- Interest Rates: Central bank interest rate decisions significantly impact currency values, influencing the correlation between currency pairs.

- Inflation: Differences in inflation rates between countries can lead to changes in the value of their currencies, affecting their correlation.

- Gross Domestic Product (GDP): Economic growth and stability, as measured by GDP, can influence currency values and, consequently, their correlation.

Political Events, Korelasi pair mata uang forex

- Elections: Changes in government or political leadership can trigger market volatility and impact currency values, affecting their correlation.

- Geopolitical Events: International conflicts, trade disputes, and other geopolitical events can have a significant impact on currency markets and their correlations.

Market Sentiment

- Risk Appetite: Investors’ appetite for risk can influence currency demand and supply, impacting their correlation.

- Technical Analysis: Traders often use technical indicators to identify patterns and predict future price movements, which can affect the correlation between currency pairs.

- Speculation: Market speculation can lead to rapid fluctuations in currency values and their correlation.

Types of Correlation

Correlation in forex trading measures the relationship between the price movements of two currency pairs. There are three main types of correlation:

Positive Correlation

Positive correlation occurs when the price movements of two currency pairs move in the same direction. This means that when one currency pair rises, the other currency pair also tends to rise. Examples of currency pairs with a positive correlation include EUR/USD and GBP/USD.

Negative Correlation

Negative correlation occurs when the price movements of two currency pairs move in opposite directions. This means that when one currency pair rises, the other currency pair tends to fall. Examples of currency pairs with a negative correlation include USD/JPY and EUR/JPY.

Zero Correlation

Zero correlation occurs when there is no relationship between the price movements of two currency pairs. This means that the price movements of one currency pair do not have any impact on the price movements of the other currency pair. Examples of currency pairs with a zero correlation are difficult to find, as most currency pairs exhibit some degree of correlation.

Expand your understanding about currency pair standard with the sources we offer.

Identifying Correlated Pairs

Identifying correlated currency pairs is crucial for successful trading. Several methods can be employed to determine the correlation between currency pairs.

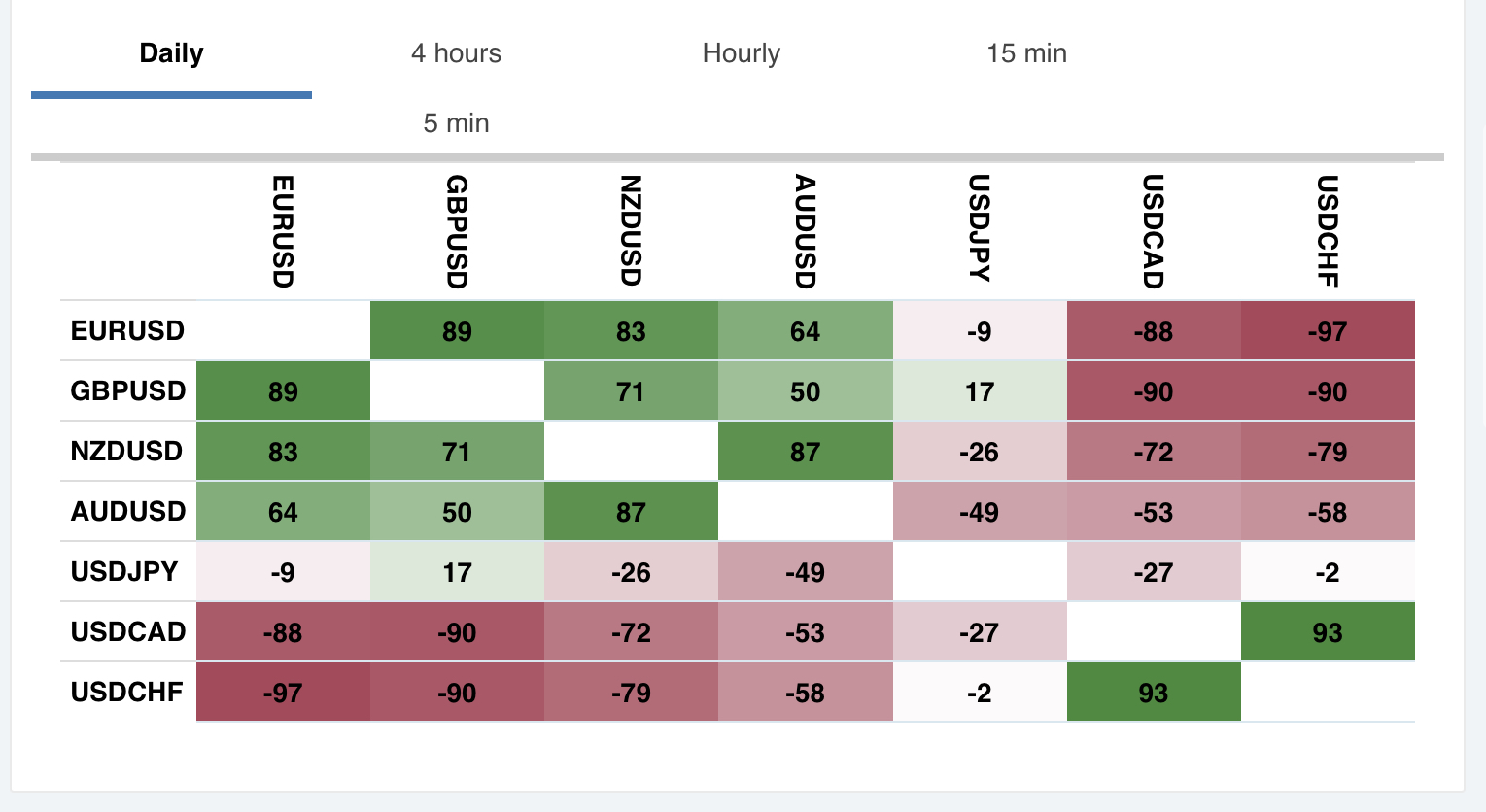

One common approach is using technical indicators like the Correlation Coefficient, which measures the linear relationship between two currency pairs. Values closer to 1 indicate a strong positive correlation, while values closer to -1 indicate a strong negative correlation.

Remember to click currency pair quotes to understand more comprehensive aspects of the currency pair quotes topic.

Statistical Analysis

Statistical analysis techniques, such as regression analysis, can also be used to assess the correlation between currency pairs. Regression analysis helps determine the strength and direction of the relationship between two or more variables, providing a numerical measure of correlation.

Historical Data Analysis

Analyzing historical data can provide valuable insights into the correlation between currency pairs. By examining past price movements, traders can identify pairs that have consistently exhibited strong or weak correlations.

Trading Strategies Based on Correlation

Traders can leverage correlation in their trading strategies to make informed decisions. By understanding the correlation between currency pairs, they can identify potential opportunities and manage risk effectively.

There are two main types of trading strategies based on correlation: positive correlation strategies and negative correlation strategies.

Positive Correlation Strategies

Positive correlation strategies involve trading currency pairs that move in the same direction. When one currency pair rises, the other is likely to rise as well. This allows traders to take advantage of the predictable price movements and profit from both uptrends and downtrends.

Remember to click currency pairs of nasdaq to understand more comprehensive aspects of the currency pairs of nasdaq topic.

- Carry trade: This strategy involves borrowing a currency with a low interest rate and investing it in a currency with a higher interest rate. The trader profits from the difference in interest rates, and the positive correlation between the two currencies helps mitigate the risk of exchange rate fluctuations.

- Trend following: This strategy involves identifying a trend in the price of a currency pair and trading in the direction of the trend. The positive correlation between the two currencies helps confirm the trend and provides additional support for the trade.

Negative Correlation Strategies

Negative correlation strategies involve trading currency pairs that move in opposite directions. When one currency pair rises, the other is likely to fall. This allows traders to profit from both uptrends and downtrends by taking opposite positions in the two currency pairs.

- Pairs trading: This strategy involves identifying two highly correlated currency pairs that are temporarily mispriced. The trader buys one currency pair and sells the other, profiting from the mean reversion of the price difference between the two pairs.

- Divergence trading: This strategy involves identifying a divergence in the price action of two correlated currency pairs. The trader trades in the direction of the divergence, betting that the correlation will eventually break down and the two pairs will move in opposite directions.

Limitations of Correlation: Korelasi Pair Mata Uang Forex

While correlation can be a valuable tool for forex traders, it’s essential to acknowledge its limitations. Correlation is not a perfect predictor of future price movements and can lead to false signals.

One significant limitation is the impact of market volatility. During periods of high volatility, correlations between currency pairs can fluctuate significantly, making it challenging to rely on historical correlations. Additionally, correlation does not consider other factors that may influence currency prices, such as economic data, political events, or central bank policies.

False Signals

Correlation can generate false signals, particularly during periods of market turmoil. When the market is volatile, correlations can become unstable, leading to unreliable signals. Traders may enter or exit trades based on false signals, resulting in losses.

Wrap-Up

In conclusion, forex currency pair correlation is a multifaceted concept that offers valuable insights into market behavior. By understanding the factors that influence correlation, traders can develop effective trading strategies that exploit positive and negative correlations to maximize their returns.

However, it is important to acknowledge the limitations of correlation and consider market volatility and false signals. With careful analysis and a comprehensive understanding of correlation, traders can enhance their trading outcomes and navigate the complexities of the forex market.