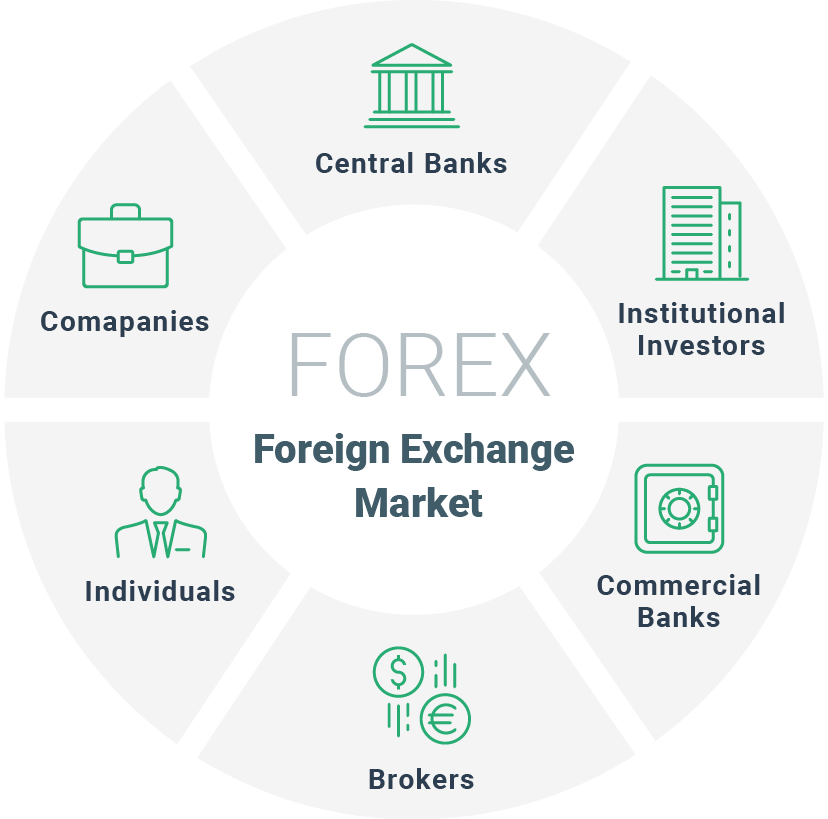

Major participants in foreign exchange market – The foreign exchange market, a dynamic and multifaceted arena, plays a pivotal role in the global financial landscape. At its core are a diverse group of major participants, each wielding their unique influence and shaping the intricate tapestry of currency exchange. This narrative delves into the captivating world of these market movers, exploring their roles, strategies, and impact on the foreign exchange landscape.

From central banks, the guardians of monetary policy, to commercial banks, the facilitators of global trade, the major participants in the foreign exchange market form an interconnected ecosystem that drives currency flows and influences exchange rates. Investment banks, with their expertise in risk management and liquidity provision, hedge funds, seeking alpha through leverage and sophisticated trading techniques, and retail traders, adding depth and volatility to the market, all contribute to the vibrant dynamics of this financial arena.

Central Banks: Major Participants In Foreign Exchange Market

Central banks play a pivotal role in the foreign exchange market as the institutions responsible for managing a country’s monetary policy. They have a significant influence on exchange rates through various interventions and policy decisions.

Intervention Strategies

Central banks can intervene in the foreign exchange market to influence exchange rates through several strategies:

- Buying and selling foreign currencies: By purchasing or selling foreign currencies, central banks can increase or decrease the supply of a particular currency, thereby affecting its value.

- Interest rate adjustments: Changes in interest rates can influence capital flows and affect exchange rates. Raising interest rates can attract foreign investment, increasing demand for the domestic currency and appreciating its value.

- Foreign exchange reserves: Central banks hold foreign exchange reserves to support their currency and intervene in the market when necessary. By selling or buying reserves, they can stabilize exchange rates.

Major Central Banks

Some of the major central banks that are active participants in the foreign exchange market include:

- Federal Reserve (United States)

- European Central Bank (Eurozone)

- Bank of England (United Kingdom)

- Bank of Japan (Japan)

- People’s Bank of China (China)

Commercial Banks

Commercial banks play a crucial role in the foreign exchange market, facilitating transactions between businesses, individuals, and other financial institutions. They act as intermediaries, providing access to foreign currencies and enabling the smooth flow of funds across borders.

Commercial banks engage in a wide range of foreign exchange transactions, including spot and forward contracts, currency swaps, and options. They provide services such as currency conversion, hedging against currency fluctuations, and financing international trade.

Types of Foreign Exchange Transactions

- Spot Transactions: Immediate exchange of currencies at the current market rate.

- Forward Contracts: Agreements to exchange currencies at a predetermined rate on a future date.

- Currency Swaps: Exchange of currencies with an agreement to reverse the transaction at a later date.

- Options: Contracts that give the buyer the right, but not the obligation, to buy or sell a currency at a specified rate within a certain period.

Market Share

Commercial banks account for a significant share of foreign exchange trading. According to the Bank for International Settlements, commercial banks conducted approximately 53% of global foreign exchange trading in 2022.

Obtain access to foreign exchange market in international business to private resources that are additional.

Investment Banks

Investment banks play a crucial role in the foreign exchange market, serving as intermediaries between clients and other participants. They provide liquidity to the market by facilitating large-scale currency transactions and offering a wide range of foreign exchange products and services.

Strategies in Foreign Exchange Trading

Investment banks employ various strategies in foreign exchange trading to maximize profits and manage risk. These strategies include:

- Arbitrage: Exploiting price discrepancies between different markets to profit from the differences.

- Carry trade: Borrowing in one currency with a low interest rate and investing in another currency with a higher interest rate to earn the interest rate differential.

- Hedging: Using foreign exchange derivatives to offset the risk of currency fluctuations in cross-border transactions.

Hedge Funds

Hedge funds play a significant role in the foreign exchange market, contributing to its liquidity and volatility. They use sophisticated strategies to generate alpha, or excess returns, above the benchmark.

One of the key characteristics of hedge funds is their use of leverage, which allows them to amplify their returns. By borrowing funds, hedge funds can increase their exposure to currency pairs, potentially leading to higher profits. However, leverage also magnifies potential losses.

Find out further about the benefits of project report on foreign exchange market in india pdf that can provide significant benefits.

Successful Hedge Funds in Foreign Exchange Trading

- George Soros: Known for his successful currency trades, particularly his “breaking the Bank of England” trade in 1992, where he profited billions of dollars by betting against the British pound.

- Stanley Druckenmiller: A former protégé of George Soros, Druckenmiller is known for his macro-economic analysis and successful currency trades.

- Ray Dalio: Founder of Bridgewater Associates, the world’s largest hedge fund, Dalio has a long history of successful foreign exchange trading.

Retail Traders

Retail traders play a significant role in the foreign exchange market, contributing to a substantial portion of trading volume. They are individual traders who typically trade with smaller amounts of capital compared to institutional participants.

Discover more by delving into foreign exchange market curve further.

Access to the Foreign Exchange Market

Retail traders access the foreign exchange market through online brokerage platforms, which provide them with access to a wide range of currency pairs and trading tools. These platforms offer user-friendly interfaces, educational resources, and customer support, making it easier for retail traders to participate in the market.

Volume of Trading

Retail traders account for a significant portion of foreign exchange trading volume. According to the Bank for International Settlements (BIS), retail traders accounted for approximately 39% of global foreign exchange turnover in 2019. This volume has grown steadily over the years, as more and more individuals have gained access to the market through online platforms.

Non-Bank Financial Institutions

Non-bank financial institutions (NBFIs) play a significant role in the foreign exchange market, providing liquidity and facilitating transactions for various clients.

NBFIs engage in foreign exchange activities for different purposes, such as managing currency risk, facilitating international trade and investments, and providing speculative trading services.

Insurance Companies

Insurance companies participate in the foreign exchange market to manage currency risk associated with their global operations and investments.

They buy and sell foreign currencies to match the currency of their liabilities and assets, reducing the impact of exchange rate fluctuations on their financial performance.

Pension Funds, Major participants in foreign exchange market

Pension funds invest in foreign assets to diversify their portfolios and enhance returns.

They participate in the foreign exchange market to convert currencies when investing in or withdrawing from foreign markets, managing currency risk, and hedging against exchange rate fluctuations.

Mutual Funds

Mutual funds that invest in foreign assets need to exchange currencies to purchase and sell those assets.

They engage in foreign exchange transactions to facilitate these investments, manage currency risk, and meet redemption requests from investors.

Private Equity Funds

Private equity funds invest in companies across borders, requiring foreign exchange transactions to fund their investments and repatriate profits.

They participate in the foreign exchange market to execute these transactions, manage currency risk, and enhance investment returns.

Last Recap

As the foreign exchange market continues to evolve, the roles and strategies of its major participants will undoubtedly adapt and innovate. Central banks will navigate the complexities of monetary policy in an increasingly interconnected world, while commercial banks will continue to facilitate global trade and payments. Investment banks and hedge funds will leverage technological advancements and data analytics to refine their trading strategies, and retail traders will seek new opportunities to participate in this dynamic market. The foreign exchange market, with its ever-changing landscape and cast of major participants, promises to remain a captivating and influential force in the global financial system.