Pair correlation forex, a crucial concept in currency trading, provides insights into the relationships between different currency pairs. By understanding and leveraging these correlations, traders can make informed decisions and potentially enhance their trading strategies.

In this comprehensive guide, we delve into the intricacies of pair correlation forex, exploring its measurement, influencing factors, and practical applications. We also discuss advanced techniques and address the limitations of relying on correlation data.

Pair Correlation

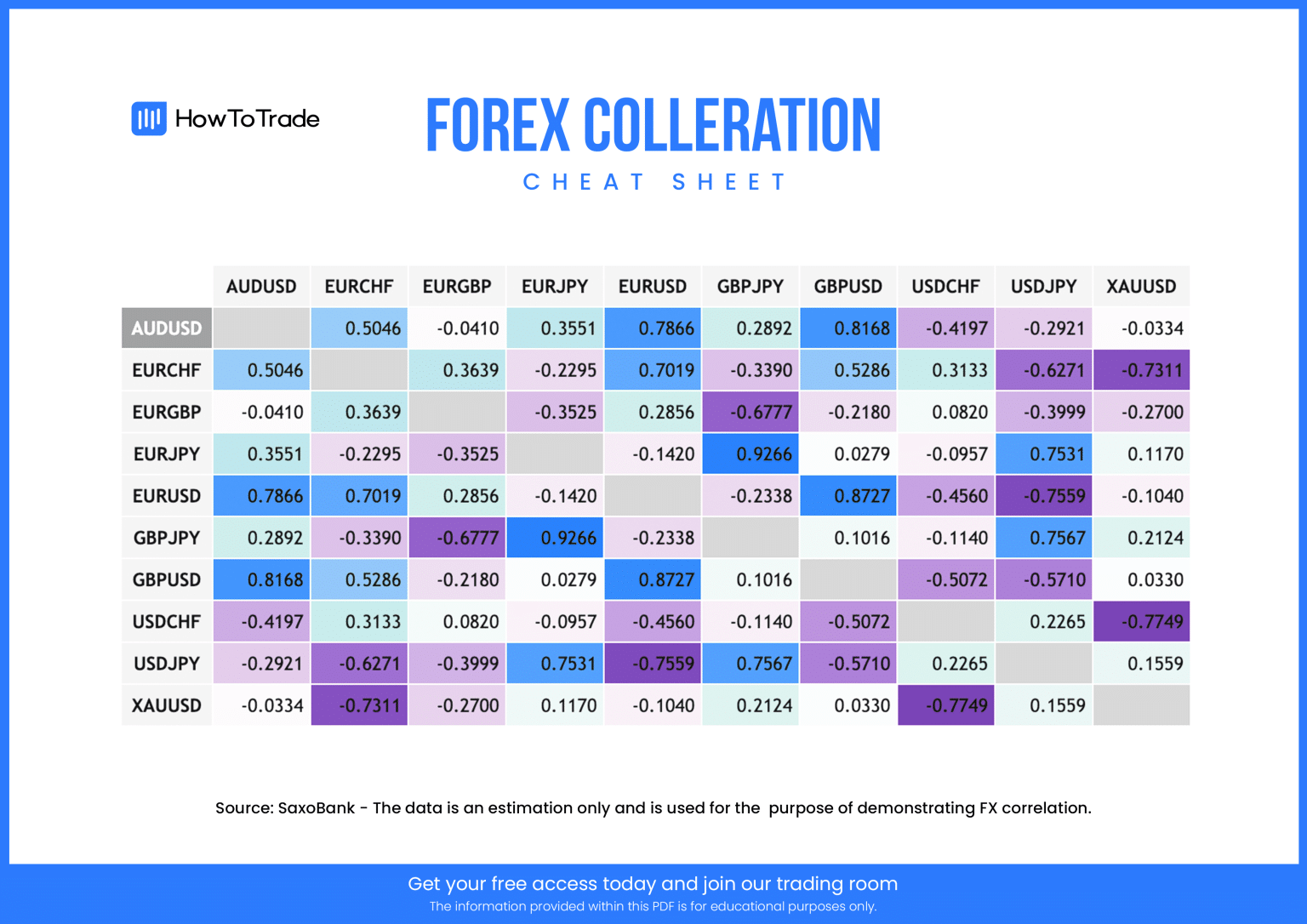

Pair correlation in forex trading is a statistical measure that quantifies the relationship between two currency pairs. It measures the extent to which the price movements of two currency pairs are correlated, meaning they move in the same or opposite directions.

Examples of Pair Correlation in Practice, Pair correlation forex

Pair correlation can be used in various ways in forex trading. Some common examples include:

- Identifying trading opportunities: Traders can use pair correlation to identify potential trading opportunities by looking for currency pairs that are highly correlated and moving in opposite directions. This can provide insights into potential price reversals or trend changes.

- Risk management: By understanding the correlation between different currency pairs, traders can diversify their portfolios and reduce risk. For example, if a trader has a long position in EUR/USD and a short position in USD/JPY, the negative correlation between these pairs can help mitigate overall risk.

- Hedging: Pair correlation can also be used for hedging purposes. By taking positions in two currency pairs with a high positive correlation, traders can effectively reduce the risk associated with one position by offsetting it with the other.

Measuring Pair Correlation

Quantifying the strength of a correlation between two currency pairs is crucial for effective pair correlation trading. Several methods exist to measure this correlation, each with its advantages and limitations.

Find out about how conclusion for foreign exchange market project can deliver the best answers for your issues.

Pearson Correlation Coefficient

The Pearson correlation coefficient is a widely used measure of linear correlation. It ranges from -1 to 1, where:

- -1 indicates a perfect negative correlation.

- 0 indicates no correlation.

- 1 indicates a perfect positive correlation.

The formula for calculating the Pearson correlation coefficient is:

ρXY = cov(X, Y) / (σX * σY)

where:

- ρXY is the Pearson correlation coefficient.

- cov(X, Y) is the covariance between the two variables X and Y.

- σX is the standard deviation of X.

- σY is the standard deviation of Y.

Factors Influencing Pair Correlation

The strength and direction of pair correlation are influenced by various factors, including economic events, market conditions, and geopolitical events. These factors can affect the correlation between two currencies in the following ways:

Economic Events

- Economic growth: Strong economic growth in one country can lead to increased demand for its currency, strengthening its value against other currencies. This can result in a positive correlation between the currency of the growing economy and the currencies of countries that trade heavily with it.

- Interest rates: Changes in interest rates can impact currency values. Higher interest rates in one country can make its currency more attractive to investors, leading to increased demand and a stronger currency. This can result in a positive correlation between the currency of the country with higher interest rates and the currencies of countries with lower interest rates.

- Inflation: Inflation can erode the value of a currency, making it less attractive to investors. High inflation in one country can lead to a weaker currency, resulting in a negative correlation between its currency and the currencies of countries with lower inflation.

Market Conditions

- Risk appetite: Investors’ risk appetite can influence currency correlations. During periods of high risk appetite, investors tend to favor riskier assets, such as emerging market currencies. This can lead to a positive correlation between emerging market currencies and the currencies of developed markets.

- Market sentiment: Positive market sentiment can boost demand for a currency, while negative sentiment can lead to selling pressure. This can result in a positive or negative correlation between the currency of a country with strong market sentiment and the currencies of countries with weaker sentiment.

- Liquidity: The liquidity of a currency pair can affect its correlation. More liquid currency pairs tend to have lower correlations because they are more easily traded and less susceptible to price fluctuations.

Geopolitical Events

- Political stability: Political instability in one country can lead to uncertainty and risk aversion, which can weaken its currency. This can result in a negative correlation between the currency of the unstable country and the currencies of stable countries.

- Trade relations: Trade relations between two countries can influence the correlation between their currencies. Strong trade ties can lead to a positive correlation, as the demand for one country’s exports can support the value of its currency.

- Wars and conflicts: Wars and conflicts can have a significant impact on currency correlations. Geopolitical events can create uncertainty and risk aversion, leading to selling pressure on the currencies of the involved countries.

Trading Strategies Based on Pair Correlation

Pair correlation can provide valuable insights for developing trading strategies. By understanding the correlation between currency pairs, traders can make informed decisions about entering and exiting trades.

Positive correlations indicate that the two currency pairs tend to move in the same direction. This can be exploited by trading both pairs in the same direction. For example, if the EUR/USD and GBP/USD pairs have a positive correlation, a trader could buy both pairs simultaneously, expecting them to rise in value together.

Negative correlations, on the other hand, indicate that the two currency pairs tend to move in opposite directions. This can be exploited by trading one pair long and the other short. For example, if the EUR/USD and USD/JPY pairs have a negative correlation, a trader could buy the EUR/USD pair and sell the USD/JPY pair, expecting the EUR/USD to rise while the USD/JPY falls.

Example Strategies

- Carry trade: This strategy involves borrowing a currency with a low interest rate and investing it in a currency with a higher interest rate. The profit comes from the difference in interest rates, which is magnified by the positive correlation between the two currencies.

- Pairs trading: This strategy involves buying and selling two highly correlated currency pairs simultaneously, with the goal of profiting from the spread between the two pairs. The spread is expected to narrow or widen, depending on the direction of the correlation.

- Convergence trading: This strategy involves identifying two currency pairs that have a high correlation but are currently trading at different prices. The trader then buys the cheaper pair and sells the more expensive pair, expecting the prices to converge over time.

Limitations of Pair Correlation: Pair Correlation Forex

While pair correlation can be a valuable tool for traders, it’s important to be aware of its limitations.

Discover how how to add currency pairs on mt4 pc has transformed methods in RELATED FIELD.

One of the main limitations of pair correlation is that it can change over time. Market conditions can change, causing the correlation between two pairs to become stronger or weaker. This can make it difficult to rely on pair correlation for trading decisions over the long term.

Enhance your insight with the methods and methods of foreign exchange market definition simple.

Market Conditions

Market conditions that can affect pair correlation include:

- Economic data releases: Economic data releases can have a significant impact on the correlation between two pairs. For example, if a strong economic report is released for one country, it can cause the currency of that country to strengthen against the currencies of other countries.

- Political events: Political events can also affect pair correlation. For example, if there is a political crisis in one country, it can cause the currency of that country to weaken against the currencies of other countries.

- Natural disasters: Natural disasters can also affect pair correlation. For example, if a natural disaster occurs in one country, it can cause the currency of that country to weaken against the currencies of other countries.

Advanced Techniques in Pair Correlation Analysis

Advanced techniques for analyzing pair correlation have emerged to enhance the accuracy of correlation predictions. These techniques leverage statistical methods and machine learning algorithms to extract deeper insights from historical data.

Time Series Analysis

Time series analysis involves examining the historical values of a time series to identify patterns and trends. By applying statistical techniques like moving averages, exponential smoothing, and ARIMA models, analysts can forecast future values and assess the correlation between different time series.

Machine Learning

Machine learning algorithms, such as neural networks and support vector machines, can be trained on historical pair correlation data to identify complex patterns and make predictions. These algorithms can capture non-linear relationships and handle large datasets, providing more accurate correlation forecasts.

Last Recap

Pair correlation forex offers a valuable tool for traders seeking to navigate the complex currency markets. By incorporating correlation analysis into their strategies, traders can gain a competitive edge, identify potential opportunities, and mitigate risks.