Sell-side participants in the foreign exchange market are most likely to include – In the bustling world of foreign exchange, sell-side participants play a pivotal role, facilitating trades and shaping market dynamics. Let’s delve into their functions, characteristics, and the impact they have on the global currency landscape.

From investment banks and brokers to market makers and hedge funds, the sell-side comprises a diverse array of players who provide liquidity, execute orders, and offer advisory services to clients seeking to buy or sell currencies.

Overview of Sell-Side Participants

Sell-side participants in the foreign exchange market play a crucial role in facilitating currency transactions. They act as intermediaries between buyers and sellers of foreign currencies, providing liquidity and helping to determine exchange rates. Typical sell-side participants include banks, currency brokers, and other financial institutions that offer foreign exchange services.

Banks, Sell-side participants in the foreign exchange market are most likely to include

Banks are the primary sell-side participants in the foreign exchange market, accounting for a significant share of currency transactions. They provide a wide range of foreign exchange services to their clients, including currency trading, hedging, and risk management. Banks have access to large pools of capital and can offer competitive exchange rates, making them a popular choice for both retail and institutional clients.

Currency Brokers

Currency brokers are specialized intermediaries that facilitate currency transactions between buyers and sellers. They typically offer narrower spreads (the difference between the bid and ask prices) than banks, making them attractive for smaller-volume transactions. Currency brokers often have access to a network of liquidity providers, which allows them to offer competitive rates and quick execution of trades.

Other Financial Institutions

Other financial institutions, such as investment banks and hedge funds, also participate in the sell-side of the foreign exchange market. These institutions may engage in foreign exchange trading for their own account or on behalf of their clients. They can provide specialized services, such as structured products and tailored risk management solutions, to meet the specific needs of institutional investors.

Functions of Sell-Side Participants

Sell-side participants play crucial roles in the foreign exchange market, enabling the smooth execution of transactions between buyers and sellers. Their primary functions involve providing liquidity, facilitating price discovery, and offering various services to market participants.

Facilitating Transactions

Sell-side participants act as intermediaries, connecting buyers and sellers in the forex market. They provide liquidity by quoting bid and ask prices, allowing traders to execute their orders efficiently. By constantly updating their quotes, sell-side participants help ensure that there is always a market for currency pairs, even in volatile conditions.

Key Characteristics of Sell-Side Participants

Sell-side participants, including market makers, investment banks, and proprietary trading firms, possess distinct characteristics that set them apart from other market participants. They play a crucial role in providing liquidity, facilitating transactions, and managing risk within the foreign exchange market.

You also can investigate more thoroughly about volume of foreign exchange market to enhance your awareness in the field of volume of foreign exchange market.

The primary motivation of sell-side participants is to generate profits by capitalizing on market inefficiencies, providing services to clients, and executing trades on their behalf. They typically have a deep understanding of the market, access to advanced trading technologies, and a global network of clients and counterparties.

Key Characteristics

- Market Making: Sell-side participants act as market makers, quoting bid and ask prices for currencies, providing liquidity to the market and facilitating transactions between buyers and sellers.

- Client Services: They offer a range of services to clients, including execution of trades, advisory services, and research, catering to the specific needs of institutional investors, hedge funds, and retail traders.

- Proprietary Trading: Some sell-side participants engage in proprietary trading, using their own capital to speculate on currency movements and generate profits.

- Risk Management: Sell-side participants employ sophisticated risk management strategies to mitigate potential losses and ensure the stability of their operations.

- Access to Information: They have access to real-time market data, news, and analysis, enabling them to make informed trading decisions and provide valuable insights to clients.

- Global Presence: Sell-side participants typically operate in multiple financial centers worldwide, allowing them to serve clients across different time zones and regions.

Impact on Market Dynamics: Sell-side Participants In The Foreign Exchange Market Are Most Likely To Include

Sell-side participants play a crucial role in shaping the dynamics of the foreign exchange market. They serve as intermediaries between buyers and sellers, facilitating transactions and providing liquidity. Their activities have a significant impact on price discovery and the overall functioning of the market.

One of the primary ways sell-side participants influence market dynamics is through their role in price discovery. They continuously quote bid and ask prices, which reflect their assessment of the market value of a currency pair. These quotes provide a reference point for market participants, helping them make informed trading decisions.

For descriptions on additional topics like foreign exchange market instruments, please visit the available foreign exchange market instruments.

Liquidity Provision

Sell-side participants also contribute to market liquidity by providing a constant stream of orders. They are willing to buy or sell currencies at quoted prices, ensuring that there are always buyers and sellers available to trade. This liquidity is essential for the smooth functioning of the market, as it allows participants to enter or exit positions quickly and efficiently.

Regulatory Considerations

The foreign exchange market operates within a complex regulatory framework designed to ensure its stability, transparency, and fairness. Sell-side participants are subject to a range of regulations and oversight mechanisms aimed at mitigating risks and protecting market integrity.

Compliance with these regulations is crucial for sell-side participants to maintain their licenses and avoid penalties. It also helps to foster trust and confidence in the market among participants and investors.

Risk Management

Effective risk management is a cornerstone of regulatory compliance for sell-side participants. They must implement robust risk management frameworks to identify, assess, and mitigate potential risks associated with their activities. This includes:

- Establishing clear risk appetite and tolerance levels

- Developing comprehensive risk assessment methodologies

- Implementing appropriate risk mitigation strategies

- Regularly monitoring and reviewing risk exposures

By adhering to regulatory requirements and implementing sound risk management practices, sell-side participants contribute to the overall stability and integrity of the foreign exchange market.

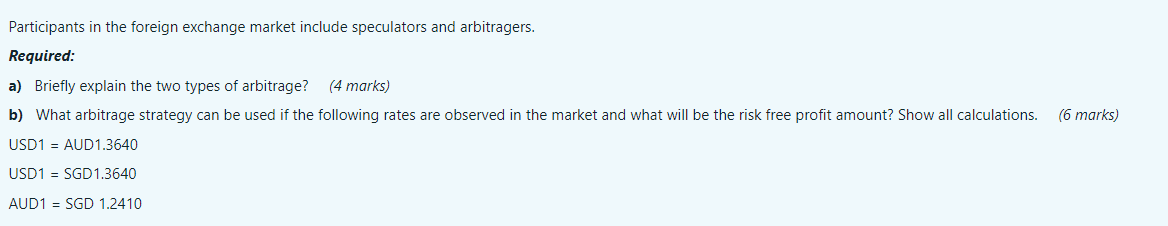

You also can investigate more thoroughly about arbitrage in foreign exchange market pdf to enhance your awareness in the field of arbitrage in foreign exchange market pdf.

Emerging Trends and Future Outlook

The role of sell-side participants in the foreign exchange market is continuously evolving, driven by technological advancements, regulatory changes, and evolving market dynamics. Here are some emerging trends and potential future developments:

Integration of Artificial Intelligence (AI) and Machine Learning (ML)

Sell-side participants are increasingly adopting AI and ML technologies to automate tasks, enhance risk management, and provide personalized trading solutions to clients. AI-powered algorithms can analyze vast amounts of data, identify patterns, and make informed trading decisions, leading to increased efficiency and profitability.

Growth of Electronic Trading Platforms

Electronic trading platforms have become increasingly popular, allowing sell-side participants to access liquidity and execute trades more efficiently. These platforms offer real-time market data, automated order execution, and advanced trading tools, enabling faster and more cost-effective trading.

Increased Focus on Risk Management

Regulatory pressures and market volatility have led to a heightened focus on risk management among sell-side participants. They are implementing robust risk management frameworks, utilizing advanced analytics, and employing stress testing to mitigate potential losses and ensure financial stability.

Expansion into New Markets

Sell-side participants are expanding their operations into emerging markets, seeking growth opportunities and diversifying their revenue streams. These markets offer untapped potential, but also pose challenges due to different regulatory environments and market conditions.

Collaboration and Partnerships

To enhance their offerings and meet client demands, sell-side participants are forming strategic partnerships with other financial institutions, technology providers, and data analytics companies. These collaborations enable them to provide integrated solutions, access specialized expertise, and leverage synergies.

Final Thoughts

In conclusion, sell-side participants in the foreign exchange market are a diverse group of entities that play a critical role in facilitating currency trading, providing liquidity, and influencing market dynamics. Their expertise and access to global networks make them indispensable partners for businesses, investors, and individuals seeking to navigate the complex world of foreign exchange.