Three participants in foreign exchange market – In the dynamic realm of foreign exchange, three distinct entities emerge as the primary participants, each playing a crucial role in shaping the market’s ebb and flow. Embark on a journey to unravel their identities, responsibilities, and the intricate interplay that drives the global currency exchange.

From the bustling interbank market to the retail sector and the influential central banks, this exploration delves into the diverse landscape of foreign exchange participants, shedding light on their unique contributions to the market’s stability and growth.

Overview of Foreign Exchange Market

The foreign exchange market (forex) is a global, decentralized market where currencies are traded. It is the largest financial market in the world, with an average daily trading volume of over $5 trillion. The forex market is used by a wide range of participants, including banks, corporations, governments, and individual investors.

Notice foreign exchange market now for recommendations and other broad suggestions.

The basic principle of the forex market is that currencies are traded in pairs. For example, the EUR/USD currency pair represents the exchange rate between the euro and the US dollar. When you buy a currency pair, you are buying one currency and selling the other. The exchange rate between two currencies is determined by supply and demand.

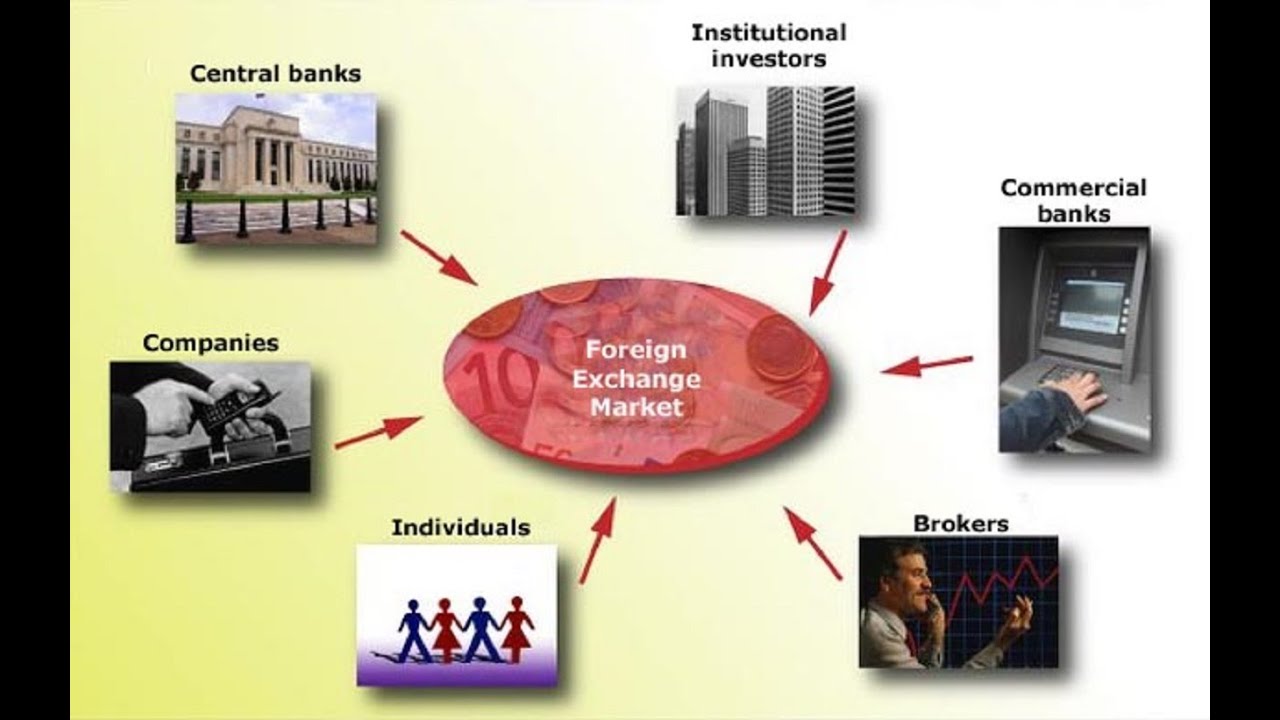

Types of Market Participants

There are many different types of market participants in the forex market. The largest participants are banks, which account for about 90% of all forex trading. Other participants include corporations, governments, hedge funds, and individual investors.

- Banks: Banks are the largest participants in the forex market. They provide liquidity to the market and facilitate transactions between other participants.

- Corporations: Corporations use the forex market to manage their foreign exchange risk. For example, a US company that imports goods from Europe may buy euros to protect itself against fluctuations in the euro/dollar exchange rate.

- Governments: Governments use the forex market to manage their foreign exchange reserves. For example, a country with a large trade surplus may sell its excess foreign currency to buy its own currency, which helps to keep the value of its currency stable.

- Hedge funds: Hedge funds are investment funds that use sophisticated trading strategies to generate profits. Hedge funds often use the forex market to speculate on currency movements.

- Individual investors: Individual investors can also participate in the forex market. However, individual investors should be aware of the risks involved in forex trading and should only trade with money that they can afford to lose.

Three Main Participants in the Foreign Exchange Market

The foreign exchange market, also known as the forex market, is a global decentralized market where currencies are traded. The three main participants in the foreign exchange market are:

- Commercial banks

- Central banks

- Non-bank financial institutions

Each of these participants plays a specific role in the functioning of the foreign exchange market.

Commercial Banks

Commercial banks are the most active participants in the foreign exchange market. They facilitate the exchange of currencies for their customers, which include individuals, businesses, and other financial institutions. Commercial banks also provide a range of foreign exchange services, such as currency exchange, hedging, and trade finance.

Central Banks

Central banks are responsible for managing the monetary policy of their respective countries. They use foreign exchange intervention to influence the value of their currencies and to achieve their economic objectives. Central banks also hold large reserves of foreign currencies, which they use to stabilize the value of their currencies and to meet their international obligations.

Expand your understanding about foreign exchange market timings in india with the sources we offer.

Non-Bank Financial Institutions, Three participants in foreign exchange market

Non-bank financial institutions, such as investment banks, hedge funds, and pension funds, participate in the foreign exchange market for a variety of reasons. They may trade currencies for speculative purposes, to hedge against currency risk, or to facilitate international investments.

Examine how foreign exchange market structure and functions can boost performance in your area.

Interbank Market

The interbank market is a global network of banks and other financial institutions that trade currencies with each other. It is the largest and most liquid market in the world, with an average daily trading volume of over $5 trillion.

The interbank market plays a vital role in the foreign exchange market by providing a platform for banks to exchange currencies and manage their foreign exchange risk. It also helps to determine the exchange rates for currencies around the world.

Types of Transactions

The most common type of transaction in the interbank market is the spot transaction, which involves the exchange of currencies on a specific date in the future. Other types of transactions include forward transactions, which involve the exchange of currencies at a predetermined exchange rate on a future date, and swap transactions, which involve the exchange of two currencies for a specified period.

Factors Affecting Liquidity

The liquidity of the interbank market is affected by a number of factors, including the number of participants, the size of the transactions, and the availability of credit. The more participants there are in the market, the more liquid it will be. The larger the transactions are, the more difficult it will be to find a counterparty to trade with. And the less credit available, the more difficult it will be for banks to finance their foreign exchange trades.

Retail Market

The retail market is the smallest segment of the foreign exchange market, accounting for only about 5% of total trading volume. It consists of individuals and small businesses that buy and sell foreign currencies for personal or business purposes.

The retail market is important because it provides a way for individuals and small businesses to access the foreign exchange market. It also helps to create liquidity in the market by providing a source of demand for foreign currencies.

Types of Transactions

The most common type of transaction in the retail market is the spot transaction. A spot transaction is a contract to buy or sell a foreign currency at the current market price for immediate delivery.

Other types of transactions that take place in the retail market include forward contracts, options, and swaps. These contracts allow individuals and small businesses to hedge against the risk of currency fluctuations.

Factors Affecting Liquidity

The liquidity of the retail market is affected by a number of factors, including:

- The size of the market

- The number of participants

- The volatility of the market

The larger the market and the more participants there are, the more liquid the market will be. The more volatile the market, the less liquid it will be.

Central Banks

Central banks are government institutions responsible for managing a country’s monetary policy and financial system. They play a significant role in the foreign exchange market, using various tools to influence exchange rates and maintain economic stability.

Types of Central Bank Interventions

Central banks can intervene in the foreign exchange market through various methods:

– Open market operations: Buying or selling foreign currencies in the market to influence exchange rates.

– Foreign exchange swaps: Exchanging currencies with another central bank or commercial bank to adjust the supply and demand of currencies.

– Intervention rate: Setting a specific exchange rate target and intervening to maintain it by buying or selling currencies.

Factors Affecting Central Bank Intervention

The decision to intervene in the foreign exchange market is influenced by several factors:

– Inflation: To control inflation, central banks may intervene to stabilize or appreciate the domestic currency, making imports cheaper.

– Economic growth: To promote economic growth, central banks may intervene to depreciate the domestic currency, making exports more competitive.

– Exchange rate stability: Central banks may intervene to maintain exchange rate stability, which is important for international trade and investment.

– Foreign exchange reserves: The level of foreign exchange reserves can affect the central bank’s ability to intervene effectively.

Ending Remarks: Three Participants In Foreign Exchange Market

As we conclude our examination of the three main participants in the foreign exchange market, it becomes evident that their collective actions and interactions form the backbone of this complex and ever-evolving financial ecosystem. Their roles are intertwined, shaping the market’s liquidity, influencing exchange rates, and ultimately facilitating global trade and investment.

Understanding the dynamics of these participants is essential for navigating the complexities of the foreign exchange market, making informed decisions, and harnessing its potential for financial success.