What are foreign exchange market trading? It’s the global marketplace where currencies are traded, allowing businesses and individuals to exchange one currency for another. Join us as we delve into the world of forex trading, exploring its participants, factors affecting exchange rates, instruments used, risks involved, and regulatory landscape.

From the bustling trading floors to the fingertips of individual traders, the foreign exchange market is a dynamic and ever-evolving arena. Its impact on global trade and economies cannot be overstated. Whether you’re a seasoned trader or just curious about the world of currencies, this guide will provide you with a comprehensive understanding of what are foreign exchange market trading.

Foreign Exchange Market Definition

The foreign exchange market, also known as Forex or FX, is a global decentralized marketplace where currencies are traded. It is the largest financial market in the world, with a daily trading volume of over $5 trillion.

For descriptions on additional topics like meaning of foreign exchange market pdf, please visit the available meaning of foreign exchange market pdf.

Foreign exchange transactions involve the exchange of one currency for another. This can be done for a variety of reasons, including international trade, tourism, and investment. For example, a company that imports goods from another country will need to exchange its domestic currency for the foreign currency of the exporting country.

Foreign exchange plays a vital role in global trade. It allows businesses and individuals to exchange currencies so that they can conduct transactions with each other. Without a foreign exchange market, it would be much more difficult to conduct international trade.

Types of Foreign Exchange Transactions

There are two main types of foreign exchange transactions: spot transactions and forward transactions.

Browse the multiple elements of various participants of foreign exchange market to gain a more broad understanding.

- Spot transactions are transactions that are settled immediately. The exchange rate for spot transactions is the current market rate.

- Forward transactions are transactions that are settled at a future date. The exchange rate for forward transactions is agreed upon in advance and is based on the expected future value of the currency.

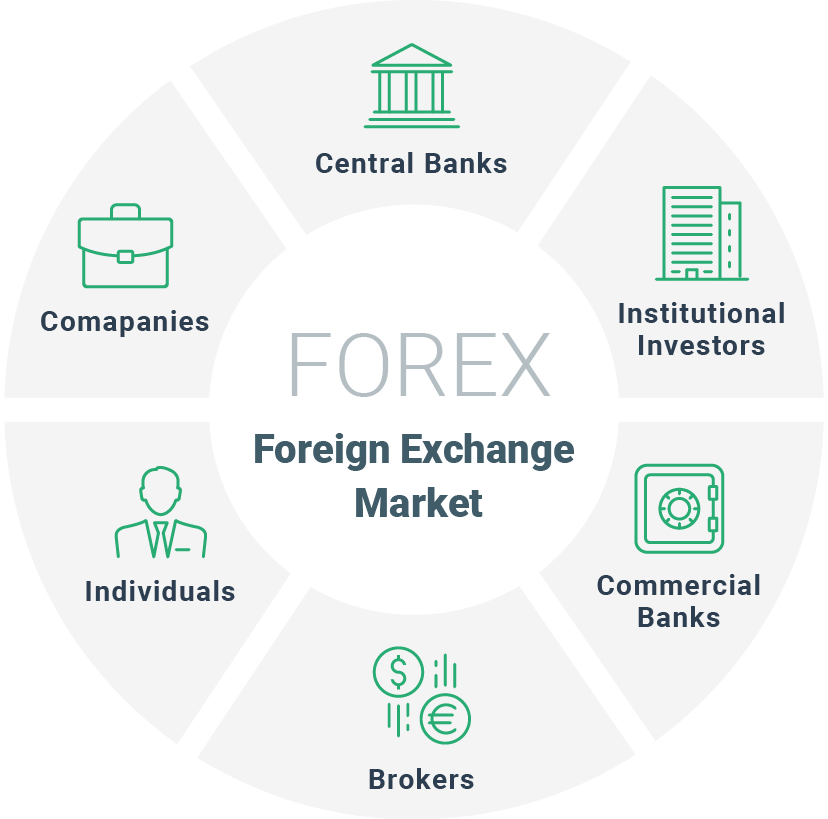

Participants in the Foreign Exchange Market

The foreign exchange market is a global marketplace, and it includes a wide range of participants, including:

- Banks

- Currency traders

- Corporations

- Governments

- Individuals

Importance of the Foreign Exchange Market

The foreign exchange market is important for a number of reasons. It:

- Facilitates international trade

- Provides a way to hedge against currency risk

- Allows for speculation on currency movements

Participants in the Foreign Exchange Market

The foreign exchange market is a vast and complex global network involving a diverse range of participants. These participants play distinct roles in facilitating currency trading and influencing market dynamics.

Banks

Banks are the primary participants in the foreign exchange market, acting as intermediaries between buyers and sellers of currencies. They provide a range of services, including:

- Currency exchange and trading for customers

- Interbank trading to meet their own currency needs

- Providing liquidity and stability to the market

Brokers

Brokers facilitate currency trading by connecting buyers and sellers. They provide a platform for traders to execute orders and offer various tools and resources to assist in decision-making.

Individual Traders

Individual traders, also known as retail traders, participate in the foreign exchange market for various reasons, including speculation, hedging, and income generation. They typically trade smaller volumes of currency compared to banks and brokers.

Central Banks

Central banks play a crucial role in the foreign exchange market by implementing monetary policies that influence currency values. They intervene in the market to manage exchange rates, stabilize the economy, and achieve their monetary policy goals.

Factors Affecting Foreign Exchange Rates

Exchange rates, the values of currencies relative to each other, are constantly fluctuating due to a multitude of factors. Understanding these factors is crucial for businesses, investors, and individuals involved in international trade or finance.

Economic Conditions

- Economic Growth: Strong economic growth, characterized by rising GDP and low unemployment, increases demand for a country’s currency, leading to currency appreciation.

- Inflation: High inflation erodes the purchasing power of a currency, reducing its value relative to other currencies.

- Interest Rates: Higher interest rates make a currency more attractive to foreign investors, leading to currency appreciation.

- Balance of Payments: A surplus in the balance of payments indicates that a country is exporting more than it imports, increasing demand for its currency.

Political Events

- Political Stability: Political instability, such as wars or revolutions, can lead to currency depreciation as investors lose confidence in the country’s economic outlook.

- Government Policies: Changes in government policies, such as tax rates or foreign investment regulations, can impact currency values.

- International Relations: Diplomatic tensions or trade disputes between countries can negatively affect currency exchange rates.

Market Sentiment

- Speculation: Currency traders often speculate on future exchange rate movements, which can create self-fulfilling prophecies.

- Market Psychology: Market sentiment, such as fear or optimism, can influence currency values, even in the absence of fundamental economic changes.

- Technical Analysis: Traders use technical analysis, such as chart patterns and moving averages, to predict future currency movements.

Supply and Demand, What are foreign exchange market trading

Ultimately, exchange rates are determined by the forces of supply and demand. When demand for a currency exceeds supply, its value increases. Conversely, when supply exceeds demand, its value decreases.

Foreign Exchange Market Instruments: What Are Foreign Exchange Market Trading

Foreign exchange instruments are financial contracts that allow participants to manage currency risk and facilitate international trade and investment. These instruments include spot contracts, forward contracts, and options.

Spot Contracts

Spot contracts are agreements to exchange currencies at the current market rate. They are typically settled within two business days and are used for immediate currency needs.

Forward Contracts

Forward contracts are agreements to exchange currencies at a specified future date and rate. They are used to lock in exchange rates and manage currency risk over a specific period.

Check what professionals state about foreign exchange market strategies and its benefits for the industry.

Options

Options are contracts that give the buyer the right, but not the obligation, to buy or sell a currency at a specified price on or before a specified date. They are used to speculate on currency movements or hedge against currency risk.

Foreign Exchange Market Risks

Foreign exchange trading involves various risks that traders must be aware of to make informed decisions. These risks include currency fluctuations, counterparty risk, and market volatility.

Currency fluctuations refer to changes in the value of one currency against another. These fluctuations can be influenced by economic factors, political events, and market sentiment. Traders must understand the potential impact of currency fluctuations on their positions and take appropriate measures to mitigate the risks.

Counterparty Risk

Counterparty risk refers to the risk that one party to a foreign exchange transaction will not fulfill its obligations. This risk can arise due to factors such as the financial instability of the counterparty or changes in market conditions. Traders can mitigate counterparty risk by choosing reputable counterparties, using intermediaries, and diversifying their trading partners.

Market Volatility

Market volatility refers to the rapid and unpredictable fluctuations in foreign exchange rates. This volatility can make it difficult for traders to predict market movements and can lead to significant losses. Traders can mitigate market volatility by using risk management techniques such as stop-loss orders, hedging, and diversification.

Foreign Exchange Market Regulation

The foreign exchange market is a global and decentralized market where currencies are traded. Due to its size and complexity, it is essential to have a regulatory framework to ensure its stability and transparency.

Regulation of the foreign exchange market involves various government agencies and international organizations. These entities establish rules and regulations to govern the conduct of participants, prevent market manipulation, and protect investors.

Role of Government Agencies

- Central Banks: Central banks play a crucial role in regulating the foreign exchange market by setting monetary policy, managing foreign exchange reserves, and intervening in the market to stabilize exchange rates.

- Securities and Exchange Commissions: These agencies regulate the activities of foreign exchange brokers and dealers, ensuring compliance with anti-money laundering and know-your-customer (KYC) regulations.

- Financial Conduct Authorities: These authorities oversee the conduct of financial institutions involved in foreign exchange trading, enforcing rules to prevent market abuse and protect investors.

Role of International Organizations

- International Monetary Fund (IMF): The IMF monitors the global financial system and provides financial assistance to countries experiencing balance of payments problems. It also promotes cooperation among member countries on foreign exchange policies.

- Bank for International Settlements (BIS): The BIS is a central bank for central banks. It facilitates cooperation among central banks and promotes financial stability. The BIS also sets standards for foreign exchange trading and risk management.

- International Organization of Securities Commissions (IOSCO): IOSCO is a global organization of securities regulators. It develops and promotes international standards for the regulation of securities markets, including foreign exchange markets.

Importance of Regulation

Regulation of the foreign exchange market is essential for maintaining market stability and protecting investors. It helps to prevent market manipulation, ensure transparency, and promote fair and orderly trading. Regulation also contributes to the overall stability of the global financial system by preventing excessive risk-taking and promoting confidence in the market.

Final Conclusion

As we conclude our exploration of what are foreign exchange market trading, it’s evident that this global marketplace is a complex and fascinating arena. Understanding its intricacies empowers businesses and individuals to navigate currency exchanges effectively, mitigate risks, and capitalize on opportunities. Whether you’re a seasoned trader or just starting to explore the world of forex, we hope this guide has provided you with valuable insights into this dynamic and ever-evolving market.