Business management foreign exchange market definition – The business management foreign exchange market, where the exchange of currencies between countries occurs, plays a pivotal role in facilitating international trade and managing currency risk. Understanding its definition, key functions, market structure, trading mechanisms, and risk management strategies is crucial for businesses operating in the global economy.

Definition of the Business Management Foreign Exchange Market

The foreign exchange market, also known as the forex market, is a global decentralized market for the trading of currencies. It is the largest financial market in the world, with a daily trading volume of over $5 trillion. The foreign exchange market is used by businesses to facilitate international trade and investment, as well as to hedge against currency risk.

Discover how foreign exchange market how it works history and pros and cons (investopedia.com) has transformed methods in RELATED FIELD.

Business management plays a critical role in the foreign exchange market. Businesses need to understand the risks and rewards of foreign exchange trading in order to make informed decisions about how to manage their currency exposure. Businesses also need to be aware of the different types of foreign exchange products and services that are available to them.

Check foreign exchange rate bank indonesia to inspect complete evaluations and testimonials from users.

Types of Business Entities Involved in the Foreign Exchange Market

There are a variety of different types of business entities that are involved in the foreign exchange market, including:

- Banks: Banks are the largest participants in the foreign exchange market. They provide a variety of foreign exchange products and services to their customers, including spot trading, forward contracts, and options.

- Corporations: Corporations use the foreign exchange market to facilitate international trade and investment. They also use the foreign exchange market to hedge against currency risk.

- Investment funds: Investment funds use the foreign exchange market to trade currencies for profit. They also use the foreign exchange market to hedge against currency risk.

- Hedge funds: Hedge funds use the foreign exchange market to trade currencies for profit. They also use the foreign exchange market to hedge against currency risk.

Key Functions of the Business Management Foreign Exchange Market: Business Management Foreign Exchange Market Definition

The business management foreign exchange market plays a crucial role in facilitating international trade and managing currency risk for businesses operating globally.

Facilitation of International Trade

Businesses engaged in international trade rely on the foreign exchange market to convert currencies when buying or selling goods and services across borders. This enables them to pay for imports in foreign currencies and receive payment for exports in their home currency.

Management of Currency Risk, Business management foreign exchange market definition

Currency risk arises when the value of one currency fluctuates against another, potentially affecting the profitability of international transactions. Businesses use the foreign exchange market to hedge against currency risk by entering into forward contracts or options that lock in exchange rates for future transactions.

In this topic, you find that types of foreign exchange market ppt is very useful.

Market Structure and Participants

The business management foreign exchange market is a decentralized global market where currencies are traded. It is the largest and most liquid financial market in the world, with a daily trading volume of over $5 trillion.

The market is structured as an over-the-counter (OTC) market, which means that there is no central exchange where all trades are executed. Instead, trades are conducted directly between two parties, either through a broker or directly on an electronic trading platform.

The participants in the foreign exchange market can be divided into two main categories: commercial participants and financial participants.

Commercial participants are businesses that engage in international trade and need to exchange currencies to settle their transactions. For example, a U.S. company that imports goods from China will need to exchange U.S. dollars for Chinese yuan to pay for the goods.

Financial participants are institutions that trade currencies for profit. These include banks, hedge funds, and other investment firms. Financial participants may also provide liquidity to the market by quoting prices at which they are willing to buy or sell currencies.

Roles and Responsibilities of Market Participants

The different types of participants in the foreign exchange market have different roles and responsibilities.

Commercial participants use the foreign exchange market to exchange currencies for their business transactions. They are typically not interested in making a profit from currency trading, but they do want to get the best possible exchange rate for their transactions.

Financial participants use the foreign exchange market to make a profit from currency trading. They may trade currencies for their own account or on behalf of their clients. Financial participants typically have a deep understanding of the foreign exchange market and use sophisticated trading strategies to make a profit.

Banks play a central role in the foreign exchange market. They provide liquidity to the market by quoting prices at which they are willing to buy or sell currencies. Banks also provide a range of services to their clients, including foreign exchange trading, currency risk management, and international payments.

Hedge funds are investment funds that use sophisticated trading strategies to make a profit from currency trading. Hedge funds typically have a high level of risk tolerance and may use leverage to increase their potential returns.

Other investment firms also participate in the foreign exchange market, including pension funds, insurance companies, and mutual funds. These firms typically have a long-term investment horizon and use currency trading to diversify their portfolios and manage risk.

Trading Mechanisms and Instruments

The business management foreign exchange market utilizes various trading mechanisms to facilitate the exchange of currencies. These mechanisms include:

- Spot Market: Involves the immediate delivery and payment of currencies at the prevailing exchange rate.

- Forward Market: Allows businesses to lock in exchange rates for future transactions, mitigating currency fluctuations.

- Options Market: Provides businesses with the right, but not the obligation, to buy or sell currencies at a predetermined price within a specified time frame.

- Swaps Market: Enables businesses to exchange cash flows denominated in different currencies, managing currency risk.

The foreign exchange market offers a wide range of instruments to meet the needs of businesses. These instruments include:

- Currency Pairs: Represent the exchange rate between two currencies, such as EUR/USD or GBP/JPY.

- Foreign Exchange Forwards: Contracts that fix the exchange rate for a future delivery date.

- Foreign Exchange Options: Options to buy or sell currencies at a specified price within a defined period.

- Currency Swaps: Agreements to exchange cash flows denominated in different currencies for a specified period.

The pricing of foreign exchange instruments is influenced by various factors, including:

- Supply and Demand: Market forces that determine the exchange rate based on the relative demand for and supply of currencies.

- Interest Rate Differentials: Differences in interest rates between countries, which can impact the value of their currencies.

- Economic and Political Factors: Events or developments that affect the economic outlook or political stability of countries, influencing currency values.

Risk Management and Compliance

Navigating the foreign exchange market requires careful consideration of various risks and adherence to regulatory guidelines. Businesses must implement effective risk management strategies and comply with industry regulations to mitigate potential losses and ensure ethical operations.

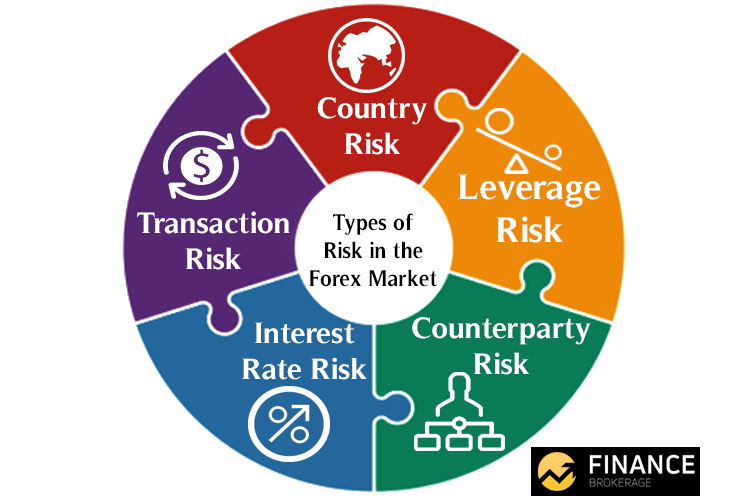

Types of Risks

- Transaction Risk: Loss due to fluctuations in exchange rates during the settlement of a transaction.

- Market Risk: Losses arising from adverse movements in exchange rates over a specific period.

- Credit Risk: Counterparty defaulting on its obligations, resulting in financial losses.

- Operational Risk: Errors or failures in systems, processes, or personnel leading to losses.

- Liquidity Risk: Difficulty in converting foreign currency into the home currency at a reasonable price and within a reasonable time frame.

Risk Management Strategies

Businesses employ various strategies to manage foreign exchange risks:

- Hedging: Using financial instruments like forwards, futures, or options to offset potential losses.

- Diversification: Investing in multiple currencies to reduce the impact of fluctuations in any single currency.

- Natural Hedging: Matching foreign currency receivables with payables to minimize net exposure.

li>Risk Monitoring: Continuously tracking market conditions and risk exposure to make timely adjustments.

Regulatory Compliance

Businesses operating in the foreign exchange market must adhere to regulatory requirements to ensure transparency and prevent financial crimes. Key regulations include:

- Anti-Money Laundering (AML) and Know Your Customer (KYC): Preventing the use of foreign exchange transactions for illicit activities.

- Sanctions and Embargoes: Compliance with restrictions on transactions with certain countries or individuals.

- Market Abuse Regulations: Prohibiting insider trading and other forms of market manipulation.

Closure

In summary, the business management foreign exchange market is a complex and dynamic environment that requires businesses to have a comprehensive understanding of its functions, participants, and risk management strategies. By leveraging the foreign exchange market effectively, businesses can mitigate currency risks, facilitate international trade, and enhance their global competitiveness.