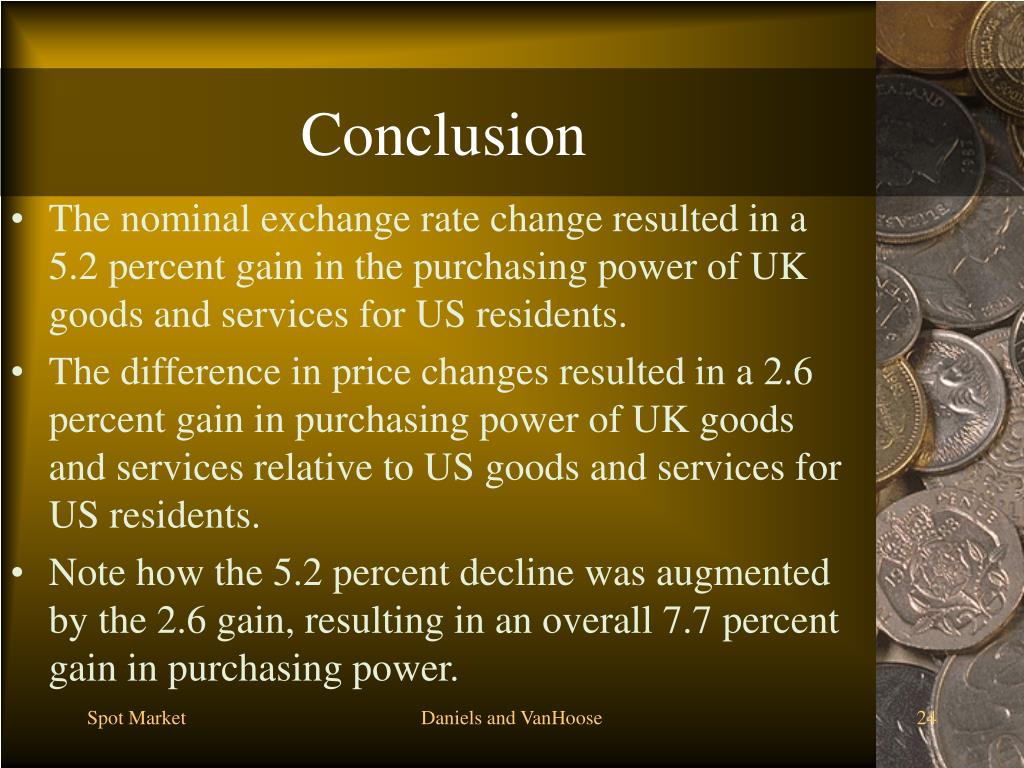

Conclusion for foreign exchange market – The conclusion for the foreign exchange market provides a comprehensive overview of the current state of the market, analyzing key trends, drivers, and economic factors that shape its dynamics. It examines the performance of major currency pairs, the impact of central bank policies, and the role of economic indicators in shaping market sentiment.

By incorporating technical analysis techniques, traders can identify potential trading opportunities and forecast future price movements. Risk management strategies are also discussed, emphasizing the importance of stop-loss orders, position sizing, and risk-reward ratios. Emerging trends and innovations that are shaping the future of the foreign exchange market are also explored.

Market Overview

:max_bytes(150000):strip_icc()/foreign-exchange-markets.asp-final-16abed069d5e4ba0924142476dec4211.png)

The foreign exchange (forex) market, the largest and most liquid financial market globally, witnesses a daily trading volume exceeding $6 trillion. It facilitates the exchange of currencies for various purposes, including international trade, tourism, and investment. The forex market operates 24 hours a day, 5 days a week, across multiple financial centers worldwide, enabling continuous trading.

Key trends shaping the forex market include the rise of algorithmic trading, increasing demand for emerging market currencies, and growing geopolitical uncertainties. Market drivers such as economic data releases, interest rate decisions, and political events significantly influence currency valuations and market dynamics.

Discover the crucial elements that make participants in foreign exchange market pdf the top choice.

Economic Factors

Economic factors play a crucial role in determining currency values. Strong economic growth, low inflation, and a stable political environment generally support a currency’s appreciation. Conversely, weak economic growth, high inflation, and political instability can lead to currency depreciation.

- Gross Domestic Product (GDP): GDP growth indicates the overall health of an economy. Higher GDP growth often leads to currency appreciation.

- Inflation: Inflation measures the rate of price increases. High inflation can erode the value of a currency, leading to depreciation.

- Interest Rates: Central banks set interest rates to manage inflation and economic growth. Higher interest rates tend to attract foreign investment and support currency appreciation.

- Balance of Payments: The balance of payments records a country’s transactions with the rest of the world. A positive balance of payments, indicating more exports than imports, can support currency appreciation.

Currency Pair Analysis

The foreign exchange market witnesses constant fluctuations in the value of different currency pairs, each influenced by a complex interplay of economic, political, and global factors. This section analyzes the performance of major currency pairs, such as EUR/USD, GBP/USD, and USD/JPY, to identify the key drivers behind their movements and forecast potential future trends.

Discover the crucial elements that make foreign exchange market in ethiopia pdf the top choice.

EUR/USD

The EUR/USD pair, representing the value of the euro against the US dollar, is one of the most actively traded currency pairs globally. Its fluctuations are influenced by a range of factors, including interest rate differentials, economic growth prospects, and political developments within the eurozone and the United States.

GBP/USD

The GBP/USD pair, representing the value of the British pound against the US dollar, is another significant currency pair. Its movements are primarily driven by factors such as the UK’s economic outlook, interest rate decisions by the Bank of England, and Brexit-related developments.

USD/JPY

The USD/JPY pair, representing the value of the US dollar against the Japanese yen, is influenced by factors such as the relative strength of the US and Japanese economies, interest rate policies of the Federal Reserve and the Bank of Japan, and geopolitical events in the Asia-Pacific region.

Central Bank Policies

Central bank policies exert a significant influence on foreign exchange rates. Monetary policies implemented by central banks, such as interest rate decisions and quantitative easing, have far-reaching implications for currency valuations.

Interest rate decisions directly affect the attractiveness of a country’s currency. Higher interest rates make a currency more appealing to foreign investors, leading to increased demand and appreciation in its value. Conversely, lower interest rates reduce the incentive for foreign investment, causing a depreciation of the currency.

Quantitative Easing

Quantitative easing (QE) is a monetary policy tool used by central banks to increase the money supply. By purchasing government bonds or other assets, central banks inject liquidity into the financial system. QE can lead to a depreciation of the currency as the increased money supply reduces its value relative to other currencies.

Economic Indicators

Economic indicators play a pivotal role in shaping foreign exchange market sentiment by providing insights into the economic health of a country. These indicators influence currency valuations, as they reflect the underlying strength or weakness of an economy and its potential for growth.

Key economic indicators that impact foreign exchange rates include GDP growth, inflation, unemployment rates, and trade balances.

GDP Growth

GDP growth measures the overall size and growth rate of an economy. Higher GDP growth rates indicate a strong economy with increased production and consumption, leading to increased demand for the country’s currency.

Inflation

Inflation measures the rate of price increases for goods and services. High inflation can erode the value of a currency, making it less attractive to investors and leading to depreciation.

Unemployment Rates

Unemployment rates reflect the availability of labor in an economy. Low unemployment rates indicate a strong economy with high employment and increased consumer spending, which can boost the value of a currency.

You also can investigate more thoroughly about foreign exchange market meaning and examples to enhance your awareness in the field of foreign exchange market meaning and examples.

Trade Balances

Trade balances measure the difference between a country’s exports and imports. A positive trade balance (exports exceeding imports) can strengthen a currency, while a negative trade balance (imports exceeding exports) can weaken it.

Technical Analysis

Technical analysis is a method of evaluating securities by analyzing statistics generated from market activity, such as past prices and volume. Technical analysts believe that past price movements can be used to predict future price movements.

Technical analysis can be used to identify potential trading opportunities by analyzing chart patterns, indicators, and support/resistance levels.

Chart Patterns

Chart patterns are specific formations that appear on price charts and are believed to indicate future price movements. Some common chart patterns include:

- Head and shoulders

- Double top

- Double bottom

- Triangle

- Wedge

Indicators

Indicators are mathematical calculations that are used to analyze price data. Some common indicators include:

- Moving averages

- Relative strength index (RSI)

- Bollinger Bands

- Stochastic oscillator

- MACD

Support and Resistance Levels

Support and resistance levels are price levels that have been tested multiple times and have acted as a barrier to price movement. Support levels are prices at which a security has found buyers, while resistance levels are prices at which a security has found sellers.

Risk Management: Conclusion For Foreign Exchange Market

In foreign exchange trading, effective risk management is paramount to protect capital and ensure long-term success. A comprehensive risk management strategy involves employing various techniques to minimize potential losses while maximizing profit opportunities.

One crucial aspect of risk management is setting appropriate stop-loss orders. A stop-loss order automatically exits a trade when the market price reaches a predefined level, thereby limiting potential losses. Traders should carefully determine the optimal stop-loss level based on their risk tolerance and the market conditions.

Position Sizing, Conclusion for foreign exchange market

Position sizing refers to the amount of capital allocated to a particular trade. It is essential to avoid overleveraging and risking more capital than one can afford to lose. Proper position sizing ensures that potential losses do not exceed a predetermined percentage of the trader’s account balance.

Risk-Reward Ratios

Risk-reward ratios compare the potential profit to the potential loss of a trade. A favorable risk-reward ratio implies that the potential profit significantly outweighs the potential loss. Traders should aim for trades with risk-reward ratios of at least 2:1 or 3:1 to minimize risk and maximize profit potential.

Emerging Trends

The foreign exchange market is constantly evolving, shaped by technological advancements, fintech innovations, and the forces of globalization. These emerging trends are transforming market dynamics and creating new opportunities for participants.

One of the most significant trends is the rise of fintech companies that are offering innovative solutions to traditional foreign exchange services. These companies are leveraging technology to streamline processes, reduce costs, and improve transparency. For example, some fintech companies are offering mobile apps that allow users to easily exchange currencies at competitive rates.

Technology and Automation

Technology is playing a major role in shaping the future of the foreign exchange market. Artificial intelligence (AI) and machine learning (ML) are being used to automate tasks, improve risk management, and provide real-time market insights. For example, AI-powered trading platforms can analyze vast amounts of data to identify trading opportunities and execute trades automatically.

Globalization and Interconnectedness

Globalization is leading to increased interconnectedness between economies, which is having a significant impact on the foreign exchange market. The rise of global supply chains and the growth of cross-border trade are creating new demand for foreign exchange services. Additionally, the increasing popularity of e-commerce is making it easier for individuals and businesses to purchase goods and services from around the world, further driving demand for foreign exchange.

Conclusive Thoughts

In conclusion, the foreign exchange market is a complex and ever-evolving landscape. By understanding the key factors that influence market dynamics, traders can make informed decisions and navigate the challenges and opportunities it presents.