Delve into the captivating world of foreign exchange market currency trade, where global economies intertwine and currencies dance to the rhythm of international commerce. This comprehensive guide unveils the intricacies of this dynamic market, empowering you to navigate its complexities with confidence.

Discover the fundamentals of currency trading, from its mechanics and participants to the risks and rewards involved. Explore proven strategies, essential tools, and advanced concepts that shape the success of seasoned traders. As you journey through this guide, you’ll gain a deep understanding of the factors influencing exchange rates, the role of central banks, and the impact of economic events on currency markets.

Foreign Exchange Market Overview

The foreign exchange market, also known as Forex or FX, is the global marketplace where currencies are traded. It is the largest and most liquid financial market in the world, with a daily trading volume exceeding $5 trillion.

The purpose of the foreign exchange market is to facilitate international trade and investment. When a company or individual wants to buy goods or services from another country, they need to exchange their own currency for the currency of the country they are buying from. The foreign exchange market provides the platform for this exchange.

You also can investigate more thoroughly about foreign exchange market pdf to enhance your awareness in the field of foreign exchange market pdf.

Currency Pairs

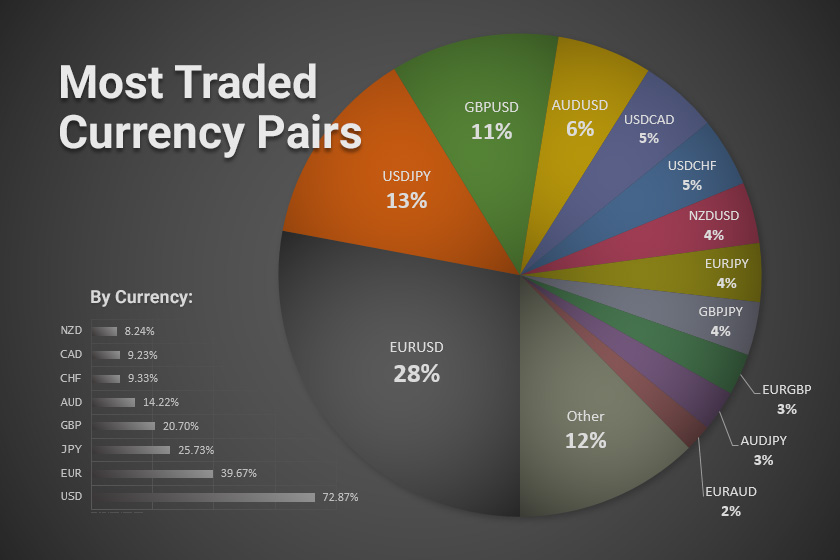

The most commonly traded currency pairs in the foreign exchange market are:

- EUR/USD (Euro/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

- GBP/USD (British Pound/US Dollar)

- USD/CHF (US Dollar/Swiss Franc)

- AUD/USD (Australian Dollar/US Dollar)

Factors Influencing Currency Exchange Rates

The exchange rate between two currencies is determined by a number of factors, including:

- Economic growth

- Interest rates

- Inflation

- Political stability

- Supply and demand

Currency Trading Fundamentals

Currency trading, also known as foreign exchange (forex) trading, involves the buying and selling of different currencies in order to profit from changes in their exchange rates. It is the most traded market in the world, with an average daily trading volume of over $5 trillion.

The mechanics of currency trading are relatively simple. When you buy a currency, you are essentially borrowing it from someone else in the hope that its value will increase against the currency you are selling. If the value of the currency you bought does indeed increase, you can then sell it back to the person you borrowed it from for a profit.

Types of Currency Traders

There are many different types of currency traders, each with their own unique trading strategies and goals. Some of the most common types of currency traders include:

- Retail traders: These are individuals who trade currencies on a small scale, typically with their own money.

- Institutional traders: These are large financial institutions, such as banks and hedge funds, that trade currencies on a much larger scale.

- Central banks: These are government agencies that are responsible for managing the monetary policy of their respective countries. They often trade currencies in order to influence the value of their own currency.

Risks and Rewards of Currency Trading

As with any type of trading, there are both risks and rewards involved in currency trading. Some of the potential risks include:

- Currency risk: This is the risk that the value of the currency you are trading will fluctuate against the currency you are selling.

- Counterparty risk: This is the risk that the person or institution you are trading with will not fulfill their obligations.

- Leverage risk: This is the risk that you will lose more money than you invested if the value of the currency you are trading moves against you.

However, there are also a number of potential rewards involved in currency trading, including:

- High potential returns: Currency trading can be a very lucrative business, with some traders making millions of dollars in profits.

- Flexibility: Currency trading can be done from anywhere in the world, at any time of day or night.

- Low barrier to entry: It is relatively easy to get started with currency trading, with many brokers offering low minimum deposits.

Currency Trading Strategies

Currency trading strategies are plans that traders use to make informed decisions about buying and selling currencies. These strategies are based on various factors, including technical analysis, fundamental analysis, and market sentiment.

There are numerous currency trading strategies, each with its own unique characteristics and potential rewards. Some of the most common strategies include:

Technical Analysis Strategies, Foreign exchange market currency trade

Technical analysis strategies involve studying historical price data to identify patterns and trends that may indicate future price movements. Some popular technical analysis strategies include:

- Trend following: This strategy involves identifying the overall trend of a currency pair and trading in the direction of the trend.

- Support and resistance: This strategy involves identifying key price levels that act as support (where the price tends to bounce up) and resistance (where the price tends to bounce down). Traders may buy near support levels and sell near resistance levels.

- Moving averages: This strategy involves calculating the average price of a currency pair over a specified period of time. Traders may use moving averages to identify trends and potential trading opportunities.

- Chart patterns: This strategy involves identifying specific patterns in price charts, such as triangles, flags, and pennants. These patterns can provide clues about future price movements.

Fundamental Analysis Strategies

Fundamental analysis strategies involve studying economic and political factors that may affect currency prices. Some popular fundamental analysis strategies include:

- Economic data: This strategy involves analyzing economic data, such as GDP, inflation, and unemployment rates, to assess the health of a country’s economy and its currency.

- Political events: This strategy involves monitoring political events, such as elections, changes in government, and international conflicts, that may impact currency prices.

- Interest rates: This strategy involves analyzing interest rates set by central banks, as interest rate differentials can affect currency prices.

- Carry trade: This strategy involves borrowing a currency with a low interest rate and investing it in a currency with a higher interest rate, profiting from the difference in interest rates.

Examples of Successful Currency Trading Strategies

There are many successful currency trading strategies, and the best strategy for a particular trader will depend on their individual risk tolerance, time horizon, and trading style. Some examples of successful currency trading strategies include:

- The carry trade: This strategy has been successfully used by many traders to profit from interest rate differentials between currencies.

- Trend following: This strategy has been successfully used by traders to ride long-term trends in currency prices.

- Support and resistance trading: This strategy has been successfully used by traders to identify potential trading opportunities near key price levels.

- Chart pattern trading: This strategy has been successfully used by traders to identify potential trading opportunities based on specific patterns in price charts.

Currency Trading Tools and Resources

Currency traders rely on a variety of tools and resources to make informed decisions and manage their trades effectively.

These include software platforms, market analysis techniques, and reputable sources of news and data.

Essential Tools for Currency Traders

Essential tools for currency traders include:

| Tool | Description |

|---|---|

| Trading Platform | Software that provides access to the currency market and allows traders to place orders, manage positions, and track market data. |

| Charts | Graphical representations of currency price movements, used for technical analysis. |

| Indicators | Mathematical formulas applied to price data to identify trends and trading opportunities. |

| Economic Calendar | Schedule of upcoming economic events that can impact currency prices. |

| News Feed | Real-time updates on news and events that may affect currency markets. |

Market Analysis Techniques

Currency traders use various market analysis techniques to identify trading opportunities and make informed decisions. These techniques include:

- Technical Analysis: Analysis of historical price data to identify patterns and trends.

- Fundamental Analysis: Analysis of economic data and geopolitical events to assess the underlying value of currencies.

- Sentiment Analysis: Analysis of market sentiment to gauge the overall mood of traders.

Reputable Sources for Currency Market News and Data

Reliable sources for currency market news and data include:

- Bloomberg

- Reuters

- CNBC

- Federal Reserve

- Bank of International Settlements

Advanced Currency Trading Concepts: Foreign Exchange Market Currency Trade

This section delves into advanced concepts that enhance currency trading knowledge and understanding. These include currency hedging, the role of central banks, and the impact of economic events on exchange rates.

Enhance your insight with the methods and methods of forex today.

Currency Hedging

Currency hedging involves strategies to mitigate the risk of exchange rate fluctuations. It is commonly used by businesses engaged in international trade to protect against potential losses due to currency movements.

Role of Central Banks

Central banks play a pivotal role in currency markets by implementing monetary policies that influence exchange rates. They set interest rates, conduct open market operations, and intervene directly in currency markets to manage inflation, economic growth, and currency stability.

Find out about how three major functions of foreign exchange market can deliver the best answers for your issues.

Impact of Economic Events

Economic events, such as GDP growth, inflation data, and political developments, can significantly impact currency exchange rates. Positive economic indicators tend to strengthen a currency, while negative indicators can weaken it.

Currency Trading Platforms

Currency trading platforms are software applications that provide traders with access to the foreign exchange market. They offer a range of features and tools to help traders analyze market data, place orders, and manage their positions.

There are many different currency trading platforms available, each with its own strengths and weaknesses. Some of the most popular platforms include MetaTrader 4, MetaTrader 5, cTrader, and NinjaTrader.

Platform Comparison

The following table compares some of the key features of these platforms:

| Platform | Features | Benefits |

|---|---|---|

| MetaTrader 4 | – User-friendly interface – Wide range of technical indicators – Automated trading capabilities – Large community of users | – Easy to use, even for beginners – Provides a wide range of tools for technical analysis – Allows traders to automate their trading strategies – Offers a large community of users for support and collaboration |

| MetaTrader 5 | – Improved charting capabilities – More advanced technical indicators – Built-in economic calendar – Mobile trading capabilities | – Provides more advanced charting capabilities than MetaTrader 4 – Offers a wider range of technical indicators – Includes a built-in economic calendar for tracking market events – Allows traders to trade on the go |

| cTrader | – Fast and reliable execution – Intuitive interface – Advanced order types – Social trading features | – Provides fast and reliable execution of orders – Offers an intuitive and easy-to-use interface – Supports a variety of advanced order types – Allows traders to share and follow trading strategies |

| NinjaTrader | – Professional-grade charting – Market replay capabilities – Advanced order management tools – Customizable interface | – Provides professional-grade charting tools for technical analysis – Allows traders to replay market data to test trading strategies – Offers advanced order management tools for managing risk – Allows traders to customize the interface to their preferences |

Choosing a Trading Platform

When choosing a currency trading platform, there are a few key factors to consider:

- Ease of use: The platform should be easy to use, even for beginners.

- Features: The platform should offer a range of features and tools to support your trading needs.

- Reliability: The platform should be reliable and stable, with minimal downtime.

- Cost: The platform should be affordable and offer a pricing model that fits your budget.

Concluding Remarks

Whether you’re a seasoned trader or just starting your foray into the foreign exchange market, this guide provides a comprehensive roadmap to navigate its complexities. Embrace the opportunities and mitigate the risks as you delve into the ever-evolving world of currency trade. Remember, knowledge is the key to unlocking the potential of this dynamic market.