In the dynamic world of international trade, the foreign exchange market serves as a vital conduit, facilitating the exchange of currencies and shaping global economic landscapes. Foreign exchange market definition in english unveils the intricacies of this financial hub, exploring its participants, influencing factors, and applications in business and investment.

The foreign exchange market, also known as forex, is a decentralized global marketplace where currencies are bought, sold, and exchanged. Its participants include banks, corporations, investment funds, and individual traders, each with distinct roles and motivations.

Definition of Foreign Exchange Market: Foreign Exchange Market Definition In English

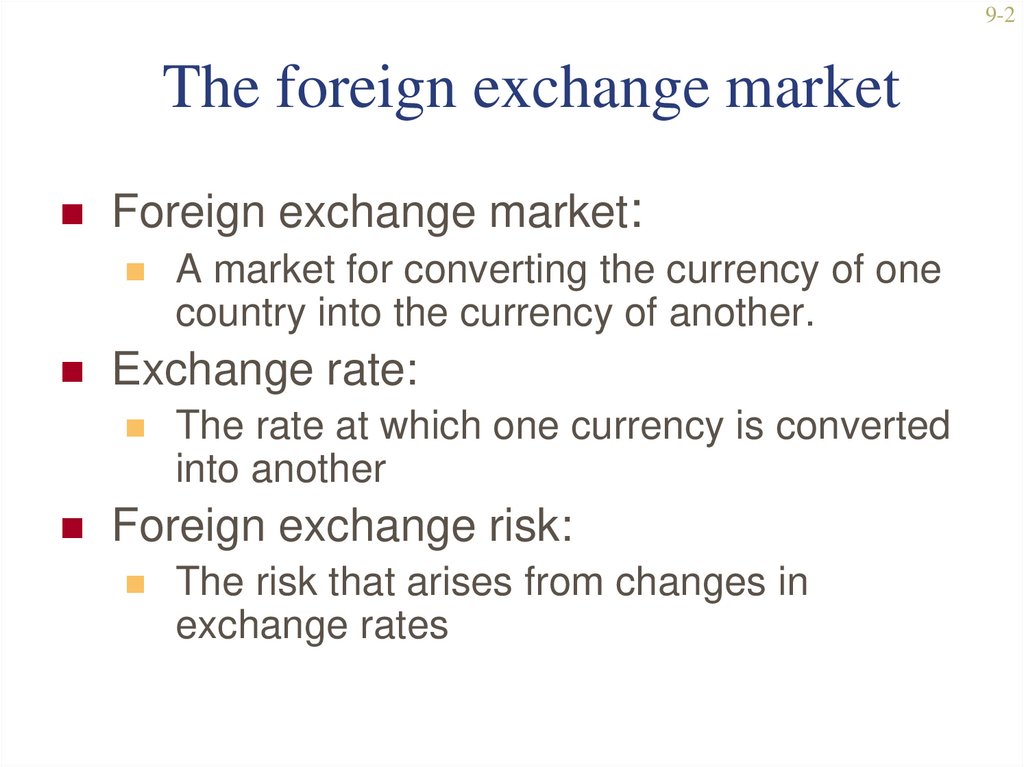

The foreign exchange market, often known as Forex or FX, is a global, decentralized market for the trading of currencies. It is the largest financial market in the world, with a daily trading volume exceeding $5 trillion. The foreign exchange market plays a crucial role in facilitating international trade and investment by enabling the conversion of one currency into another.

Foreign Exchange Transactions

Foreign exchange transactions involve the exchange of one currency for another. These transactions can occur for various reasons, including:

- International trade: When businesses import or export goods or services, they need to exchange their domestic currency for the currency of the country they are trading with.

- Tourism: When individuals travel abroad, they need to exchange their domestic currency for the currency of the country they are visiting.

- Investment: Investors often invest in foreign stocks, bonds, or real estate, which requires them to exchange their domestic currency for the currency of the country where the investment is made.

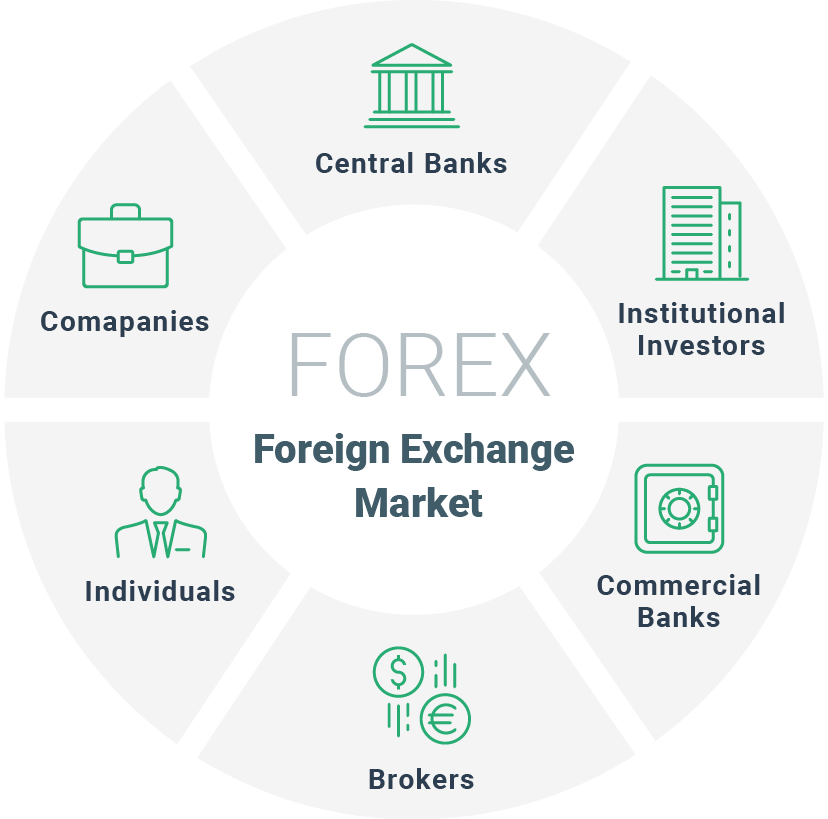

Participants in the Foreign Exchange Market

The foreign exchange market is a vast and complex global marketplace where currencies are traded. A diverse range of participants engage in foreign exchange transactions for various reasons.

Commercial and Non-Commercial Customers

Commercial customers are businesses or individuals who engage in foreign exchange transactions to facilitate international trade or other commercial activities. They may need to convert their domestic currency into a foreign currency to purchase goods or services from abroad, or vice versa.

Non-commercial customers include individuals who exchange currencies for personal reasons, such as travel or investment. They may need to convert their domestic currency into a foreign currency to pay for expenses while traveling abroad or to invest in foreign assets.

Central Banks and Sovereign Wealth Funds

Central banks are government institutions responsible for managing a country’s monetary policy and foreign exchange reserves. They participate in the foreign exchange market to influence the value of their domestic currency, manage inflation, and stabilize the financial system.

Sovereign wealth funds are government-owned investment funds that invest in foreign assets. They participate in the foreign exchange market to manage their foreign currency exposure and generate returns on their investments.

Investment Banks and Financial Institutions

Investment banks and financial institutions act as intermediaries in the foreign exchange market, facilitating transactions between other participants. They provide liquidity, execute orders, and offer financial advice to their clients.

Hedge funds and other investment firms also participate in the foreign exchange market to speculate on currency movements and generate profits.

Retail Foreign Exchange Brokers

Retail foreign exchange brokers provide online platforms for individuals to trade currencies. They offer leverage and other trading tools, enabling retail investors to participate in the foreign exchange market with smaller amounts of capital.

Enhance your insight with the methods and methods of foreign exchange market meaning in forex.

Factors Influencing Foreign Exchange Rates

The foreign exchange market is constantly fluctuating due to a complex interplay of economic and political factors. These factors influence the supply and demand for currencies, ultimately affecting their exchange rates.

Obtain a comprehensive document about the application of foreign exchange market ap macro that is effective.

Understanding these factors is crucial for traders, investors, and businesses that engage in international transactions.

Economic Factors

- Interest Rates: Higher interest rates in a country make its currency more attractive to foreign investors seeking higher returns. This increased demand for the currency leads to its appreciation.

- Inflation: High inflation erodes the purchasing power of a currency, making it less valuable in comparison to currencies with lower inflation. This can lead to currency depreciation.

- Economic Growth: A strong and growing economy attracts foreign investment and increases demand for its currency, resulting in appreciation.

- Balance of Trade: A trade surplus (exports exceed imports) increases demand for a country’s currency, while a trade deficit (imports exceed exports) decreases demand, affecting its exchange rate.

- Government Debt: High government debt levels can raise concerns about a country’s financial stability and lead to currency depreciation.

Political Factors

- Political Stability: Political instability, such as war or civil unrest, can erode confidence in a currency and lead to its depreciation.

- Government Policies: Changes in government policies, such as tax laws or trade regulations, can impact foreign investment and the demand for a currency.

- International Relations: Positive or negative diplomatic relations between countries can influence currency exchange rates.

li>Central Bank Intervention: Central banks can intervene in the foreign exchange market to stabilize currency rates or achieve specific economic goals.

Types of Foreign Exchange Transactions

Foreign exchange transactions are classified into three main types: spot, forward, and swap contracts. Each type has its own unique characteristics, advantages, and disadvantages.

Spot Contracts

Spot contracts involve the immediate exchange of currencies at the current market rate. They are typically used for small transactions and require immediate settlement, usually within two business days.

Investigate the pros of accepting currency market vs foreign exchange markets in your business strategies.

Advantages:

- Immediate execution and settlement

- Simple and straightforward

Disadvantages:

- May not be suitable for large transactions

- Exposed to currency fluctuations during the settlement period

Forward Contracts, Foreign exchange market definition in english

Forward contracts are agreements to exchange currencies at a predetermined rate on a future date. They are used to hedge against currency fluctuations and lock in exchange rates for future transactions.

Advantages:

- Protect against currency risk

- Allow for planning and budgeting

Disadvantages:

- Less flexibility than spot contracts

- May incur additional costs, such as interest charges

Swap Contracts

Swap contracts involve the simultaneous exchange of two different currencies at a specific rate and then a reverse exchange at a later date. They are typically used for large transactions and can be customized to meet specific needs.

Advantages:

- Greater flexibility and customization options

- Can be used for both hedging and speculation

Disadvantages:

- Complex and may require specialized expertise

- May incur significant transaction costs

Foreign Exchange Market Regulation

Foreign exchange market regulation is crucial for ensuring the stability and integrity of the global financial system. Regulatory bodies play a vital role in preventing market manipulation, promoting fair competition, and protecting investors.

Role of Regulatory Bodies

- Market Surveillance: Regulators monitor the market for unusual activities, such as excessive volatility or suspicious trading patterns, to prevent manipulation and protect market participants.

- Enforcement of Regulations: Regulatory bodies enforce rules and regulations to ensure compliance and deter misconduct. They impose penalties and sanctions on individuals or institutions that violate regulations.

- Transparency and Disclosure: Regulators require market participants to disclose relevant information, such as trading volumes and positions, to enhance transparency and prevent information asymmetry.

- Investor Protection: Regulations aim to protect investors by ensuring that markets are fair and transparent, reducing the risk of fraud or abuse.

Foreign Exchange Market Trends and Developments

The foreign exchange market is constantly evolving, with new trends and developments emerging all the time. In recent years, some of the most significant trends include the increasing use of electronic trading platforms, the rise of algorithmic trading, and the growing popularity of cryptocurrencies.

Electronic trading platforms have made it much easier for traders to buy and sell currencies, and they have also helped to reduce the cost of trading. Algorithmic trading, which uses computers to execute trades based on pre-defined rules, has also become increasingly popular, as it can help traders to make more efficient use of their time and resources.

Cryptocurrencies are a relatively new asset class, but they have quickly gained popularity due to their potential to provide investors with high returns. However, cryptocurrencies are also highly volatile, and they are not regulated in the same way as traditional currencies. As a result, investors should be aware of the risks involved before investing in cryptocurrencies.

Emerging Technologies and Their Impact on the Market

Emerging technologies are also having a significant impact on the foreign exchange market. For example, the use of artificial intelligence (AI) is helping traders to make more informed decisions, and the use of blockchain technology is helping to make transactions more secure and efficient.

As these technologies continue to develop, they are likely to have an even greater impact on the foreign exchange market in the years to come.

Applications of Foreign Exchange

Foreign exchange serves as a fundamental tool in international business and investment, enabling entities to conduct cross-border transactions, manage risk, and facilitate global operations. Understanding its applications is crucial for businesses seeking to expand internationally.

One of the primary applications of foreign exchange is to facilitate international trade. When businesses import or export goods and services, they need to exchange their domestic currency for the currency of the country they are trading with. Foreign exchange markets provide the platform for this exchange to occur, allowing businesses to make payments and receive funds in different currencies.

Hedging Foreign Exchange Risk

Foreign exchange also plays a vital role in hedging foreign exchange risk. When a business operates in multiple countries, it faces the risk of currency fluctuations. Changes in exchange rates can impact the value of assets, liabilities, and profits. To mitigate this risk, businesses use foreign exchange hedging strategies, such as forward contracts and options, to lock in exchange rates and protect against potential losses.

Facilitating Global Investment

Foreign exchange is essential for facilitating global investment. Investors often seek opportunities in different countries to diversify their portfolios and potentially enhance returns. Foreign exchange markets allow investors to convert their domestic currency into foreign currencies, enabling them to invest in stocks, bonds, real estate, and other assets denominated in different currencies.

Tourism and Travel

Foreign exchange is also widely used in tourism and travel. When individuals travel abroad, they need to exchange their domestic currency for the currency of the country they are visiting. Foreign exchange markets provide convenient and accessible channels for travelers to obtain foreign currency, whether through exchange bureaus, banks, or online platforms.

Careers in Foreign Exchange

The foreign exchange market offers a range of career opportunities for individuals with diverse backgrounds and skills. These opportunities span various roles and responsibilities, providing a dynamic and challenging work environment.

Skills and Qualifications

To succeed in the foreign exchange industry, professionals require a combination of technical knowledge, analytical abilities, and strong communication skills. A deep understanding of financial markets, currency dynamics, and economic principles is essential. Additionally, proficiency in data analysis, quantitative modeling, and risk management is highly sought after. A strong work ethic, attention to detail, and the ability to work effectively under pressure are also key attributes for success in this field.

Types of Roles

The foreign exchange market offers a variety of roles, including:

– Currency Traders: Execute trades on behalf of clients or institutions, managing currency positions and seeking profit opportunities.

– Risk Managers: Assess and mitigate risks associated with foreign exchange transactions, ensuring compliance with regulatory requirements.

– Analysts: Research and analyze currency markets, providing insights and recommendations to clients and traders.

– Sales Traders: Build relationships with clients, offering currency trading services and providing market updates.

– Compliance Officers: Ensure adherence to regulatory guidelines and ethical standards within the foreign exchange industry.

Ending Remarks

Understanding foreign exchange market definition in english empowers individuals and businesses to navigate the complexities of global finance. It provides a framework for managing currency risk, facilitating cross-border transactions, and unlocking opportunities in international markets. As the world continues to become increasingly interconnected, the foreign exchange market will remain a pivotal force in shaping global economic dynamics.