Foreign exchange market definition with example, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable. The foreign exchange market, also known as forex, is a global marketplace where currencies are traded. It is the largest and most liquid financial market in the world, with an average daily trading volume of over $5 trillion.

The foreign exchange market plays a vital role in facilitating international trade and investment. It allows businesses and individuals to exchange currencies so that they can buy and sell goods and services from other countries. The market also helps to manage currency risk, which is the risk that the value of a currency will fluctuate against another currency.

Definition of Foreign Exchange Market

The foreign exchange market, also known as forex or FX, is a global marketplace where currencies are traded. It is the largest financial market in the world, with a daily trading volume exceeding $5 trillion. The purpose of the foreign exchange market is to facilitate the exchange of currencies for international trade, investment, and other financial transactions.

There are many different types of participants in the foreign exchange market, including banks, investment firms, hedge funds, corporations, and individuals. Banks play a major role in the market, as they provide liquidity and facilitate transactions between other participants. Investment firms and hedge funds trade currencies for profit, while corporations use the market to exchange currencies for international trade and investment purposes.

Factors that Influence Exchange Rates

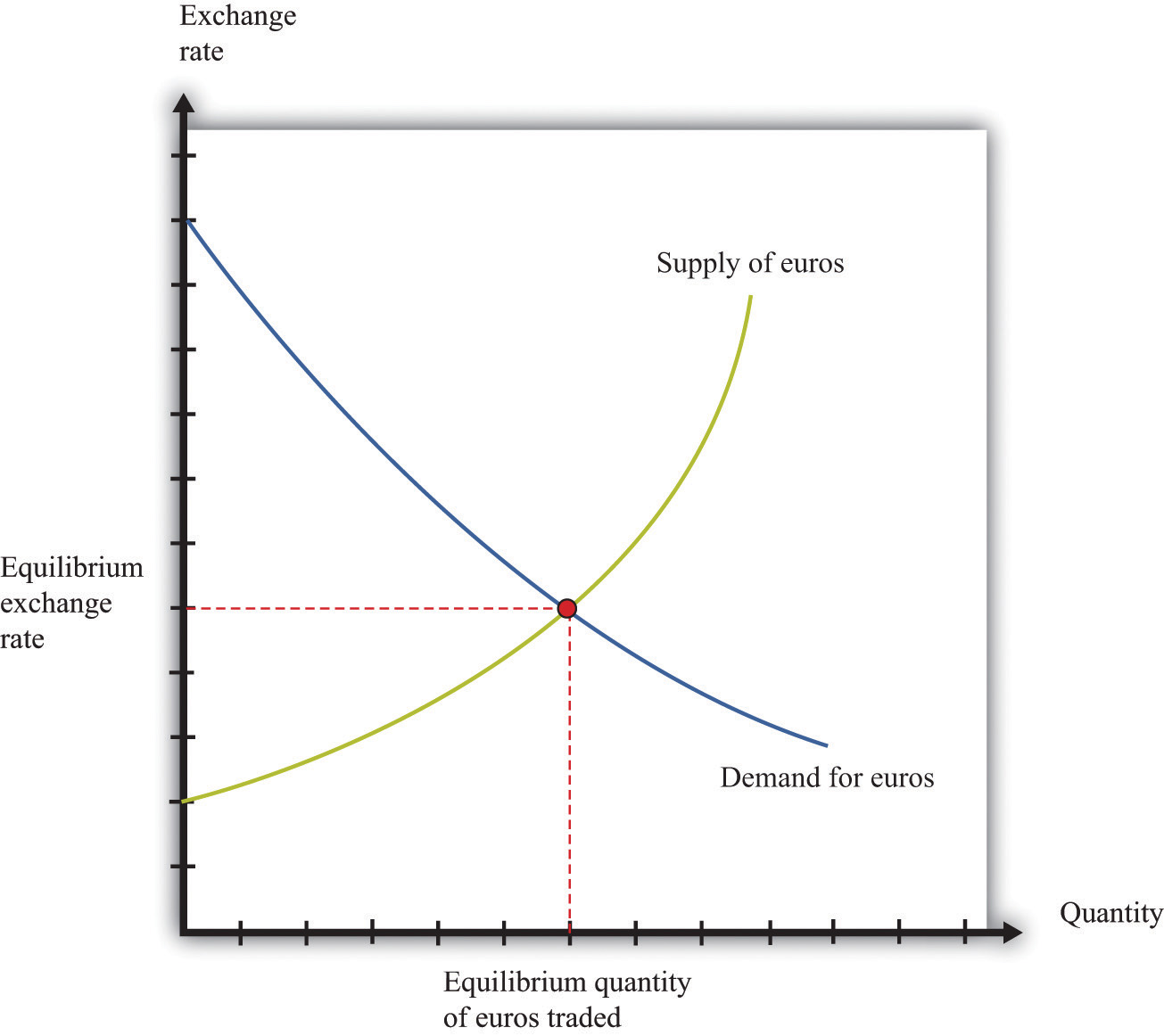

The exchange rate between two currencies is determined by a number of factors, including:

- Interest rates: Interest rates in different countries affect the demand for their currencies. Higher interest rates tend to attract foreign investment, which increases the demand for the currency and leads to an appreciation in its value.

- Inflation: Inflation is the rate at which prices rise. Higher inflation can lead to a depreciation in the value of a currency, as it reduces the purchasing power of the currency.

- Economic growth: Strong economic growth can lead to an appreciation in the value of a currency, as it increases the demand for the currency from foreign investors.

- Political stability: Political stability is another factor that can affect the value of a currency. A stable political environment tends to attract foreign investment, which increases the demand for the currency and leads to an appreciation in its value.

- Speculation: Speculation can also play a role in influencing exchange rates. Traders who believe that a currency will appreciate in value may buy the currency, which can lead to an increase in its value. Conversely, traders who believe that a currency will depreciate in value may sell the currency, which can lead to a decrease in its value.

Functions of Foreign Exchange Market

The foreign exchange market serves several essential functions that facilitate global economic activities.

International Trade

The foreign exchange market enables the exchange of currencies for the settlement of international trade transactions. Importers and exporters use the market to convert their domestic currency into the currency of the country they are trading with. This allows businesses to conduct cross-border transactions seamlessly, promoting global trade and economic growth.

Currency Risk Management

The foreign exchange market provides businesses and investors with tools to manage currency risk. Currency fluctuations can significantly impact the profitability of international transactions. Companies can use hedging strategies, such as forward contracts or currency options, to mitigate the potential losses arising from exchange rate movements.

Investment and Speculation

The foreign exchange market is a vast and liquid market that attracts investors seeking to capitalize on currency fluctuations. Speculators buy and sell currencies with the aim of profiting from short-term price movements. The market’s liquidity and volatility provide opportunities for both retail and institutional investors to trade currencies for speculative purposes.

Structure of Foreign Exchange Market

The foreign exchange market operates through a decentralized network of financial institutions, brokers, and individual traders. It consists of three main segments: the spot market, forward market, and over-the-counter (OTC) market.

Spot Market, Foreign exchange market definition with example

The spot market is where currencies are traded for immediate delivery, typically within two business days. It is the most liquid segment of the foreign exchange market, with high volumes of transactions executed daily.

Forward Market

The forward market is where currencies are traded for future delivery, at a predetermined exchange rate and date. This market allows businesses and investors to hedge against future currency fluctuations.

Over-the-Counter Market

The over-the-counter market is where currencies are traded directly between two parties, without going through an exchange. This market is less regulated than the spot and forward markets, and typically involves larger transactions.

Role of Central Banks

Central banks play a significant role in the foreign exchange market by influencing currency exchange rates through monetary policy and foreign exchange interventions. They can buy or sell currencies to stabilize exchange rates and manage their country’s monetary reserves.

Notice discuss the functions of foreign exchange market for recommendations and other broad suggestions.

Impact of Technology

Technology has revolutionized the foreign exchange market, making it more accessible, efficient, and transparent. Electronic trading platforms and algorithms have increased market liquidity and reduced transaction costs. Mobile trading apps have also made it possible to trade currencies from anywhere at any time.

You also can understand valuable knowledge by exploring foreign exchange market types.

Examples of Foreign Exchange Transactions

Foreign exchange transactions are essential for global trade and finance. They facilitate the exchange of currencies between different countries and enable businesses and individuals to conduct international transactions.

Here are some real-world examples of foreign exchange transactions:

Spot Transactions

Spot transactions involve the immediate exchange of currencies at the current market rate. They are typically used for small-value transactions that need to be settled quickly.

Learn about more about the process of foreign exchange market returns in the field.

- A US importer purchases goods from a Japanese exporter and pays in Japanese yen (JPY). The importer’s bank converts US dollars (USD) into JPY at the current spot rate.

Forward Transactions

Forward transactions involve the exchange of currencies at a predetermined rate on a future date. They are used to hedge against exchange rate fluctuations.

- A UK company expects to receive payment in euros (EUR) in three months. It enters into a forward contract to sell EUR for GBP at a fixed rate to protect against potential fluctuations.

Currency Swaps

Currency swaps involve the exchange of two currencies for a specific period, with the currencies being exchanged back at the end of the period. They are used for various purposes, including managing currency risk and optimizing cash flows.

- A US investor wants to invest in a Japanese bond but does not want to bear the currency risk. They enter into a currency swap to exchange USD for JPY and then invest the JPY in the bond.

| Transaction Type | Currency Pair | Amount | Date |

|---|---|---|---|

| Spot | USD/JPY | $100,000 | March 8, 2023 |

| Forward | EUR/GBP | €1,000,000 | June 15, 2023 |

| Currency Swap | USD/JPY | $1,000,000 | January 1, 2023 – December 31, 2023 |

| Spot | GBP/USD | £500,000 | April 12, 2023 |

Methods of Foreign Exchange Trading

The foreign exchange market offers various trading methods to cater to different needs and preferences. These methods include direct trading, brokered trading, and electronic trading.

Direct trading involves transacting directly between two parties, typically large financial institutions, without an intermediary. This method provides greater control over the trade and allows for customized terms. However, it requires establishing relationships with counterparties and can be less accessible for smaller participants.

Brokered trading involves using a foreign exchange broker as an intermediary to facilitate trades between buyers and sellers. Brokers provide a platform for matching orders, executing trades, and offering support services. They charge a commission or spread for their services, making this method suitable for smaller traders who lack direct access to the market.

Electronic trading, also known as online trading, is conducted through electronic platforms that connect buyers and sellers. These platforms offer real-time quotes, automated order execution, and advanced trading tools. Electronic trading is convenient, accessible, and cost-effective, making it popular among retail traders and smaller financial institutions.

The process of placing an order in the foreign exchange market involves specifying the currency pair, the amount to be traded, the desired exchange rate, and the type of order (e.g., market order, limit order). The order is then submitted to a broker or electronic platform, which matches it with a counterparty’s order. Once matched, the trade is executed, and the currencies are exchanged at the agreed-upon rate.

Procedures for Foreign Exchange Settlement: Foreign Exchange Market Definition With Example

Settlement in the foreign exchange market involves the exchange of currencies between two parties. The procedures for settling foreign exchange transactions are crucial to ensure the timely and accurate completion of trades.

The settlement process typically involves several steps:

- Confirmation of the trade: Once a foreign exchange transaction is agreed upon, the parties involved confirm the details of the trade, including the amount, currency pair, exchange rate, and settlement date.

- Payment instruction: The buyer of the foreign currency instructs their bank to transfer the agreed-upon amount to the seller’s bank.

- Settlement through correspondent banks: If the buyer and seller banks do not have a direct relationship, they use correspondent banks to facilitate the settlement process. Correspondent banks act as intermediaries, exchanging currencies and settling payments on behalf of their clients.

- Clearing system: In many countries, foreign exchange transactions are cleared through a central clearing system. The clearing system ensures the orderly settlement of trades, reduces settlement risk, and provides anonymity to the participants.

- Final settlement: Once the payment has been cleared, the currencies are exchanged, and the transaction is complete.

Role of Correspondent Banks

Correspondent banks play a crucial role in foreign exchange settlement, particularly when the buyer and seller banks do not have a direct relationship. They act as intermediaries, facilitating the exchange of currencies and settling payments on behalf of their clients. Correspondent banks maintain accounts with each other, allowing for the smooth transfer of funds between different countries and currencies.

Clearing Systems

Clearing systems are central institutions that facilitate the settlement of foreign exchange transactions. They provide a platform for banks to exchange payment instructions, match buy and sell orders, and ensure the orderly settlement of trades. Clearing systems reduce settlement risk by acting as a central counterparty, guaranteeing the fulfillment of obligations between the buyer and seller.

Settlement Risk

Settlement risk refers to the possibility that one party to a foreign exchange transaction may fail to fulfill its obligations. This risk can arise due to factors such as counterparty default, operational errors, or systemic failures. To manage settlement risk, market participants use techniques such as netting, collateralization, and the use of clearing systems.

Final Conclusion

The foreign exchange market is a complex and ever-changing environment. However, by understanding the basics of the market, you can take advantage of the opportunities it offers and mitigate the risks involved.