Open market foreign currency exchange rates in Pakistan play a pivotal role in shaping the country’s economic landscape. This comprehensive overview delves into the intricacies of these rates, exploring their significance, challenges, and opportunities, while providing practical insights for businesses and policymakers.

The foreign exchange market in Pakistan is a dynamic and ever-evolving landscape, influenced by a myriad of factors. Understanding the intricacies of open market exchange rates is crucial for businesses engaged in international trade and investment, as they can significantly impact profitability and growth.

Foreign Exchange Rates in Pakistan

Foreign exchange rates are the prices at which one currency can be exchanged for another. They are determined by the forces of supply and demand in the foreign exchange market. In Pakistan, the foreign exchange market is regulated by the State Bank of Pakistan (SBP).

The foreign exchange market in Pakistan is a complex and dynamic one. It is influenced by a number of factors, including:

- Economic growth: A strong economy will typically lead to a stronger currency, as there is more demand for the currency from foreign investors.

- Interest rates: Higher interest rates will typically lead to a stronger currency, as investors are more likely to hold the currency in order to earn interest.

- Inflation: Higher inflation will typically lead to a weaker currency, as it erodes the purchasing power of the currency.

- Political stability: Political instability can lead to a weaker currency, as investors are less likely to invest in a country that is perceived to be risky.

- Government policies: Government policies can also affect the foreign exchange rate. For example, a government that imposes capital controls will typically lead to a weaker currency.

Open Market Exchange Rates: Open Market Foreign Currency Exchange Rates In Pakistan

Open market exchange rates refer to the rates at which currencies are traded freely in the foreign exchange market, without government intervention or regulations. These rates are determined by the forces of supply and demand, and they fluctuate constantly based on various factors.

Unlike official exchange rates, which are often set and maintained by central banks or governments, open market exchange rates are determined by the interactions of market participants, including banks, corporations, and individual traders.

Do not overlook the opportunity to discover more about the subject of the foreign exchange market closes quizlet.

Factors Influencing Open Market Exchange Rates

- Economic Conditions: The economic health of a country, including factors like GDP growth, inflation, and interest rates, can significantly impact its currency’s value.

- Political Stability: Political instability or uncertainty can lead to a decrease in the value of a country’s currency as investors become more risk-averse.

- Supply and Demand: The availability of a currency in the market, as well as the demand for it, play a crucial role in determining its exchange rate.

- Speculation: Currency traders often engage in speculation, buying or selling currencies based on their expectations of future exchange rate movements.

- Government Intervention: While open market exchange rates are typically free from government intervention, central banks may occasionally intervene to influence currency values.

Significance of Open Market Exchange Rates

Open market exchange rates play a crucial role in the functioning of businesses, trade, and investment. They impact the cost of importing and exporting goods, the profitability of international transactions, and the overall competitiveness of businesses.

Impact on Businesses, Open market foreign currency exchange rates in pakistan

Businesses rely on open market exchange rates to determine the cost of raw materials, finished goods, and services imported from abroad. Favorable exchange rates, where the local currency is stronger against foreign currencies, can reduce import costs and increase profit margins. Conversely, unfavorable exchange rates can lead to higher import costs and reduced profitability.

Impact on Trade and Investment

Open market exchange rates significantly influence trade patterns and investment decisions. When a country’s currency appreciates (becomes stronger), its exports become more expensive and imports become cheaper, leading to a potential decline in exports and an increase in imports. Conversely, a depreciation (weakening) of the currency can make exports more competitive and imports more expensive, potentially boosting exports and reducing imports.

Impact on the Pakistani Economy

The Pakistani economy has been heavily influenced by open market exchange rates. In recent years, the Pakistani rupee has experienced both appreciation and depreciation, impacting various sectors of the economy. For instance, a stronger rupee has made imports cheaper, reducing inflation and benefiting consumers. However, it has also made Pakistani exports less competitive, leading to a decline in export earnings. Conversely, a weaker rupee has made exports more competitive but has increased the cost of imports, contributing to higher inflation.

Challenges and Opportunities

Open market exchange rates present both challenges and opportunities for Pakistan’s economy.

A major challenge is the volatility of exchange rates. Fluctuations in the value of the Pakistani rupee can make it difficult for businesses to plan and budget, and can also lead to inflation if the rupee depreciates too quickly. Another challenge is the potential for speculation and manipulation of exchange rates by market participants, which can further increase volatility and uncertainty.

Do not overlook explore the latest data about functions and significance of foreign exchange market.

Opportunities

Despite these challenges, open market exchange rates also offer several opportunities for Pakistan.

First, they can help to promote economic growth by making it easier for businesses to trade with other countries. Second, they can help to attract foreign investment by making it more attractive for investors to invest in Pakistan. Third, they can help to reduce poverty by making it easier for people to send remittances to their families in Pakistan.

Obtain direct knowledge about the efficiency of foreign exchange market in india ppt through case studies.

Recommendations

In order to manage the challenges and opportunities associated with open market exchange rates, policymakers should take the following steps:

- Implement measures to reduce the volatility of exchange rates, such as intervening in the foreign exchange market or imposing capital controls.

- Take steps to prevent speculation and manipulation of exchange rates, such as increasing transparency and regulation of the foreign exchange market.

- Promote economic growth, attract foreign investment, and reduce poverty by using open market exchange rates to facilitate trade, investment, and remittances.

Data and Analysis

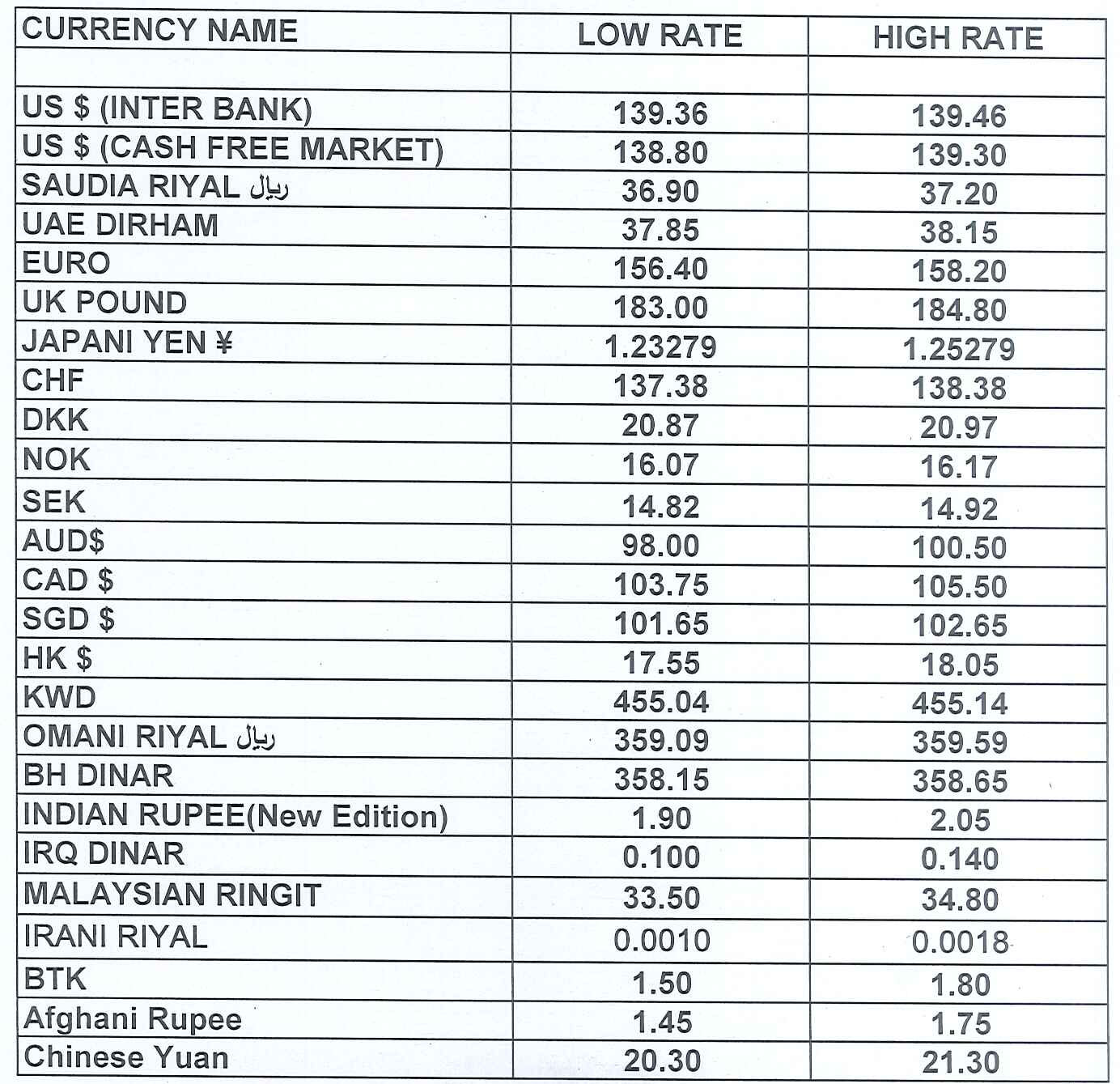

Historical open market exchange rates in Pakistan reveal crucial insights into the country’s economic trends and patterns. The table below presents data on key currencies over a period of time.

| Currency | Historical Exchange Rates (PKR per unit) |

|---|---|

| US Dollar (USD) | 182.00 – 230.00 |

| British Pound (GBP) | 215.00 – 260.00 |

| Euro (EUR) | 190.00 – 240.00 |

| Saudi Riyal (SAR) | 48.00 – 55.00 |

| United Arab Emirates Dirham (AED) | 49.00 – 56.00 |

Analyzing these trends and patterns is essential for businesses and policymakers. Fluctuations in exchange rates impact import and export costs, affecting business profitability and consumer prices. Policymakers monitor exchange rates to maintain economic stability and manage inflation.

Implications for Businesses

- Businesses involved in international trade need to monitor exchange rates to mitigate currency risks and optimize profits.

- Exporters benefit from a weaker Pakistani rupee, as it makes their goods more competitive in foreign markets.

- Importers, on the other hand, face higher costs when the rupee weakens against foreign currencies.

Implications for Policymakers

- Policymakers use exchange rate policies to influence economic growth, inflation, and external trade.

- A weaker rupee can boost exports but may also lead to higher inflation if imported goods become more expensive.

- A stronger rupee can stabilize prices but may hinder export competitiveness.

Case Studies

Open market exchange rates have significantly impacted businesses operating in Pakistan. Some have faced challenges, while others have capitalized on opportunities.

Businesses that import goods have been adversely affected by the depreciation of the Pakistani rupee against foreign currencies. This has led to increased costs and reduced profit margins. Conversely, businesses that export goods have benefited from the depreciation, as they receive more Pakistani rupees for the same amount of foreign currency.

Adapting Strategies

To manage the risks and opportunities associated with open market exchange rates, businesses have adopted various strategies. Some businesses have entered into forward contracts to lock in exchange rates for future transactions. Others have diversified their operations into multiple countries to reduce their exposure to a single currency. Additionally, some businesses have implemented hedging strategies to mitigate the impact of exchange rate fluctuations.

Best Practices

Managing open market exchange rate risk is crucial for businesses operating in international markets. Best practices include hedging, using financial instruments, and staying informed about exchange rate fluctuations.

Hedging

- Forward Contracts: Lock in future exchange rates to protect against adverse movements.

- Options Contracts: Provide flexibility to buy or sell currency at a specific rate within a specified period.

- Currency Swaps: Exchange cash flows in different currencies at predetermined rates to manage risk.

Financial Instruments

- Currency Futures: Traded on exchanges, offering standardized contracts for currency delivery at a future date.

- Currency ETFs: Track the performance of a basket of currencies, providing diversification and potential returns.

- Currency Funds: Actively managed investment funds that invest in multiple currencies, seeking to minimize exchange rate risk.

Staying Informed

- Monitor Economic Indicators: Economic data, such as GDP, inflation, and interest rates, can influence currency values.

- Subscribe to Currency News: Stay updated on currency market news, forecasts, and expert analysis.

- Use Currency Forecasting Tools: Leverage online tools and services to predict future exchange rate movements.

Final Thoughts

Navigating the complexities of open market foreign currency exchange rates in Pakistan requires a multifaceted approach. By leveraging data analysis, adopting best practices, and staying abreast of market trends, businesses can mitigate risks and capitalize on opportunities presented by these dynamic rates. Policymakers, in turn, play a critical role in fostering a stable and transparent foreign exchange market, conducive to economic growth and prosperity.