What time does the foreign exchange market close – When does the foreign exchange market close? This is a critical question for traders who need to know when they can trade and when the market is closed. The foreign exchange market, also known as forex or FX, is the largest financial market in the world, with a daily trading volume of over $5 trillion. It is a decentralized market, meaning that it is not located in a single physical location, but rather operates electronically over a network of computers.

The forex market is open 24 hours a day, 5 days a week, from Sunday evening to Friday evening. However, there are variations in trading hours based on time zones and holidays. The major currency trading centers are located in London, New York, Tokyo, and Sydney. Each of these centers has its own trading hours, which overlap to some extent.

Market Hours

The foreign exchange market, also known as the forex market or FX market, is the largest and most liquid financial market in the world. It operates 24 hours a day, 5 days a week, from Sunday evening to Friday evening.

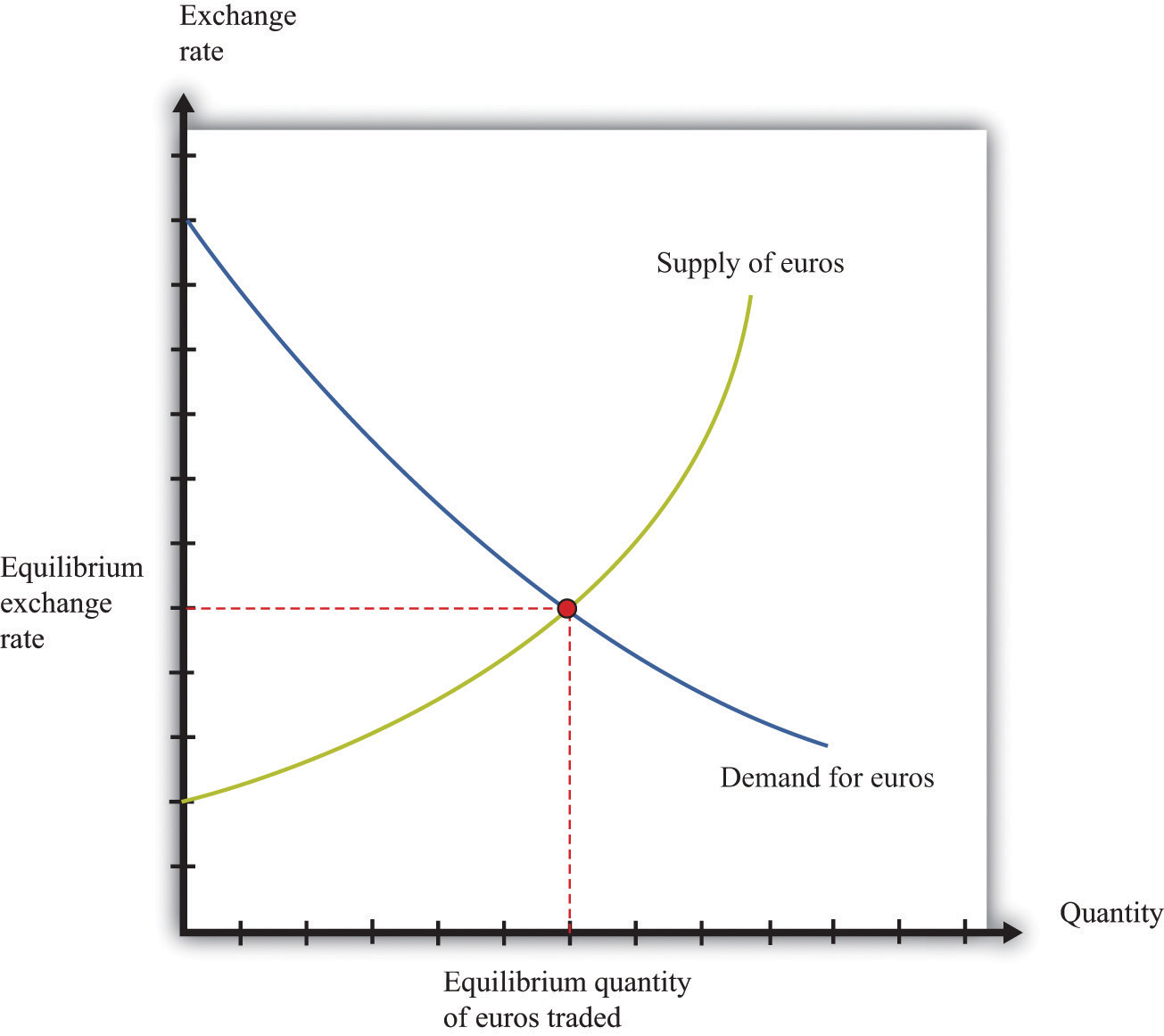

The forex market is a decentralized global market, meaning that it does not have a central exchange like the stock market. Instead, currencies are traded between banks, corporations, and individual traders through a network of electronic brokers.

Do not overlook the opportunity to discover more about the subject of nature and functions of foreign exchange market.

Trading Hours by Time Zone

The forex market is open 24 hours a day, but the trading activity is not evenly distributed throughout the day. The most active trading hours are during the overlap of the major financial centers of London, New York, and Tokyo.

- London: 8am – 5pm GMT

- New York: 1pm – 10pm EST

- Tokyo: 9pm – 6am JST

Holidays

The forex market is closed on weekends and on major holidays in the major financial centers. The following are the major holidays when the forex market is closed:

- New Year’s Day

- Good Friday

- Easter Monday

- Memorial Day (US only)

- Independence Day (US only)

- Labor Day (US only)

- Thanksgiving Day (US only)

- Christmas Day

Regional Market Closures: What Time Does The Foreign Exchange Market Close

The foreign exchange market operates 24 hours a day, but different regions have specific closing times for their respective trading sessions.

Further details about foreign exchange market participants is accessible to provide you additional insights.

The following table summarizes the closing times for the major currency trading centers:

Closing Times

| Region | Closing Time (Local Time) |

|---|---|

| London | 5:00 PM |

| New York | 12:00 PM |

| Tokyo | 3:00 PM |

| Sydney | 5:00 PM |

Over-the-Counter Trading

Over-the-counter (OTC) trading is a decentralized market where currencies are traded directly between two parties, without the involvement of an exchange. This type of trading is not subject to the same regulations and trading hours as exchange-traded markets. As a result, OTC trading can continue even after the official market closing times.

Interbank Networks and Electronic Trading Platforms, What time does the foreign exchange market close

Interbank networks and electronic trading platforms have played a significant role in extending the trading hours for OTC markets. These platforms facilitate direct communication and transaction processing between banks and other financial institutions, allowing for continuous trading throughout the day. As a result, OTC traders can access liquidity and execute trades outside of traditional market hours, effectively extending the trading day for foreign exchange.

Impact on Market Volatility

The closure of foreign exchange markets has a significant impact on currency volatility. During closed hours, there is a reduction in liquidity, which can lead to increased price fluctuations.

Obtain direct knowledge about the efficiency of foreign direct investment pdf through case studies.

When the market is open, there are numerous participants actively trading currencies, which provides liquidity and helps to stabilize prices. However, when the market closes, the number of active participants decreases, resulting in reduced liquidity.

Reduced Liquidity and Increased Volatility

The reduced liquidity during closed hours can lead to increased price fluctuations because there are fewer buyers and sellers to absorb market orders. This can result in larger price movements for a given volume of trades.

For example, if a large order is placed during closed hours, it may have a greater impact on the price of a currency than it would if the market were open. This is because there are fewer participants available to offset the impact of the order.

Strategies for Market Closures

Traders can employ various strategies to manage risk during market closures. These strategies include:

Stop-Loss Orders

Stop-loss orders are essential risk management tools that can help traders limit potential losses. A stop-loss order instructs the broker to sell a currency pair automatically when it reaches a predetermined price level. This helps prevent traders from incurring excessive losses in the event of an adverse price movement during the market closure.

Historical Changes

The foreign exchange market has undergone significant changes in its closing times throughout history. In the early days of the forex market, trading was conducted during specific hours at physical trading centers. These trading hours were typically set by the local regulations and customs of each financial center.

With the advent of electronic trading and globalization, the forex market became more accessible and interconnected. This led to a gradual extension of trading hours, as traders from different time zones could now participate in the market.

Technological Advancements

Technological advancements have played a major role in the evolution of forex market closing times. The introduction of electronic trading platforms in the 1990s allowed traders to access the market 24 hours a day, 5 days a week. This extended trading hours beyond the traditional 9-to-5 timeframe, making it possible for traders from different time zones to participate in the market.

Globalization

Globalization has also influenced the changes in forex market closing times. As the world economy became more interconnected, the need for a globalized forex market grew. This led to the establishment of trading centers in different time zones, allowing traders to participate in the market during their local business hours.

The combination of technological advancements and globalization has resulted in the forex market becoming a truly 24/7 market, with trading taking place continuously around the world.

Conclusive Thoughts

In conclusion, the foreign exchange market is a global, 24-hour market. However, there are variations in trading hours based on time zones and holidays. Traders need to be aware of these variations in order to plan their trading activities accordingly.