Advantage and disadvantages of foreign exchange market – In the globalized world, the foreign exchange market plays a pivotal role, offering both opportunities and risks to investors. This article delves into the advantages and disadvantages of the foreign exchange market, exploring its impact on investments, currency fluctuations, and the global economy.

Understanding the dynamics of the foreign exchange market is crucial for investors seeking diversification, managing currency risk, and navigating the complexities of international trade and investment.

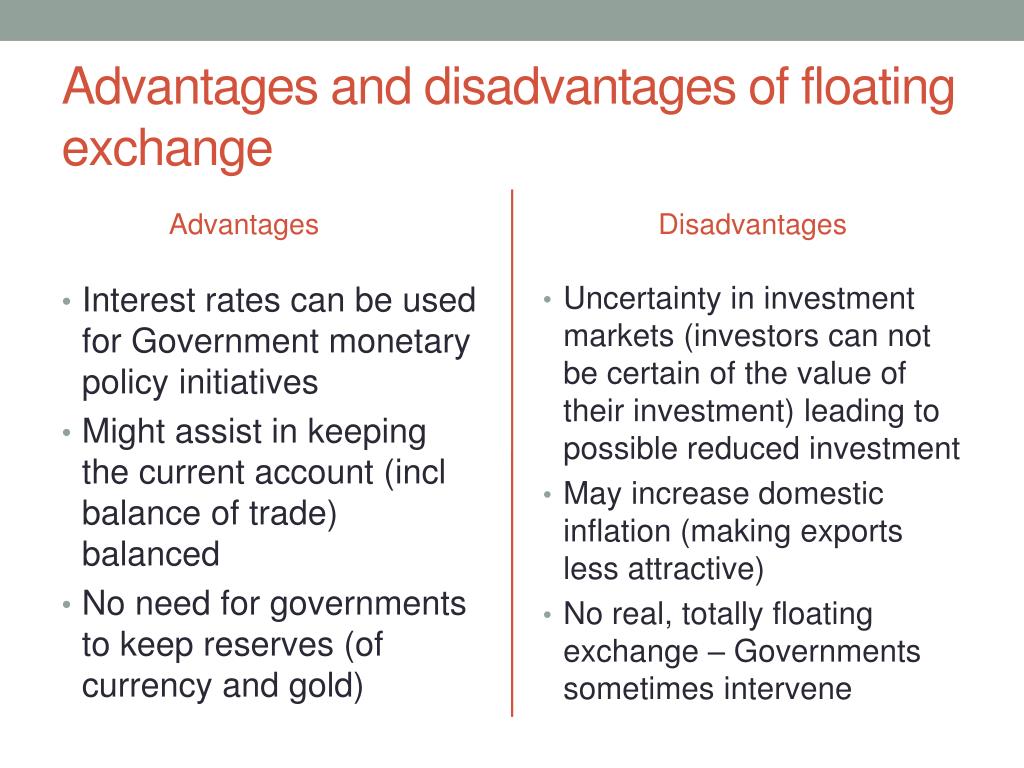

Benefits of Foreign Exchange Market

The foreign exchange market offers several advantages that make it attractive to investors and businesses.

One of the primary benefits of the foreign exchange market is the ability to diversify investments across multiple currencies. By investing in different currencies, investors can reduce the overall risk of their portfolio. This is because currency fluctuations can offset losses in other currencies, resulting in a more stable overall return.

Discover more by delving into what is concept of foreign exchange market further.

Example of Currency Fluctuations Leading to Profits

For example, if an investor has invested in the US dollar and the euro, a decline in the value of the US dollar relative to the euro would lead to a gain in the value of the investor’s euro investment. This gain would help offset any losses incurred due to the decline in the value of the US dollar.

Strategies for Managing Currency Risk

While currency diversification can help reduce risk, it is important to note that currency fluctuations can still lead to losses. To manage this risk, investors can employ various strategies, such as hedging, forward contracts, and options.

Hedging involves entering into a contract that offsets the risk of currency fluctuations. Forward contracts allow investors to lock in an exchange rate for a future date, while options give investors the right, but not the obligation, to buy or sell a currency at a specified price.

Drawbacks of Foreign Exchange Market

Despite the benefits of the foreign exchange market, it also carries certain drawbacks that can affect investors and businesses.

Risks Associated with Currency Volatility

Currency volatility, or the fluctuation in exchange rates, poses a significant risk in the foreign exchange market. Unpredictable economic and political events can cause currency values to rise or fall rapidly, potentially leading to losses for investors who hold foreign currency.

Potential for Losses Due to Exchange Rate Fluctuations

Exchange rate fluctuations can result in significant financial losses for businesses that engage in international trade or have operations in multiple currencies. When the value of a currency depreciates, the value of assets and investments denominated in that currency also decreases. This can lead to losses for businesses that hold assets in depreciating currencies.

Factors Contributing to Market Uncertainty and Instability, Advantage and disadvantages of foreign exchange market

Various factors can contribute to uncertainty and instability in the foreign exchange market, including:

- Political and economic events

- Interest rate changes

- Natural disasters

- Speculative trading

These factors can create market volatility and make it challenging for investors to predict exchange rate movements.

Market Structure and Participants: Advantage And Disadvantages Of Foreign Exchange Market

The foreign exchange market is a decentralized global market with a vast network of participants. Each participant plays a unique role in facilitating currency exchange and contributing to the overall functioning of the market.

Browse the implementation of foreign exchange market supply and demand shifters in real-world situations to understand its applications.

Types of Participants

The major participants in the foreign exchange market can be broadly categorized into three groups: central banks, commercial banks, and retail traders.

Central Banks

Central banks are government institutions responsible for managing a country’s monetary policy and financial system. They play a crucial role in the foreign exchange market by intervening to stabilize exchange rates, manage foreign exchange reserves, and influence monetary conditions.

Enhance your insight with the methods and methods of foreign exchange market meaning define.

Commercial Banks

Commercial banks are financial institutions that provide a range of banking services, including foreign exchange trading. They act as intermediaries between customers and the interbank market, facilitating currency exchange transactions for businesses, individuals, and other financial institutions.

Retail Traders

Retail traders are individuals who participate in the foreign exchange market for speculative or investment purposes. They typically trade smaller amounts of currency compared to institutional participants and use online platforms to access the market.

| Participant | Role | Functions |

|---|---|---|

| Central Banks | Monetary policy management | – Stabilize exchange rates – Manage foreign exchange reserves – Influence monetary conditions |

| Commercial Banks | Intermediaries | – Facilitate currency exchange transactions – Provide foreign exchange services to customers |

| Retail Traders | Speculation and investment | – Trade currencies for profit – Use online platforms to access the market |

Trading Strategies and Techniques

The foreign exchange market presents a vast array of trading strategies and techniques that cater to diverse risk tolerances and time horizons. Understanding these strategies and techniques is crucial for navigating the complexities of the market and making informed trading decisions.

Common Trading Strategies

- Scalping: This strategy involves making multiple small profits over a short period, typically within minutes or hours.

- Day Trading: Traders enter and exit positions within the same trading day, aiming to capitalize on intraday price fluctuations.

- Swing Trading: This strategy holds positions for a few days to several weeks, seeking to profit from medium-term market trends.

- Position Trading: Traders hold positions for months or even years, betting on long-term price movements.

Technical Analysis Techniques

Technical analysis involves studying historical price data to identify trading opportunities. Some common techniques include:

- Trendlines: Lines drawn on a chart to identify the overall direction of price movement.

- Support and Resistance Levels: Areas where price has historically struggled to break through, indicating potential reversal points.

- Moving Averages: Lines plotted on a chart to smooth out price fluctuations and identify potential trend changes.

- Oscillators: Indicators that measure the momentum and overbought/oversold conditions of a currency pair.

Comparison of Trading Strategies

| Strategy | Risk Tolerance | Time Horizon |

|---|---|---|

| Scalping | High | Minutes/Hours |

| Day Trading | Moderate | Hours/Days |

| Swing Trading | Low-Moderate | Days/Weeks |

| Position Trading | Low | Months/Years |

Impact on Global Economy

The foreign exchange market plays a pivotal role in facilitating international trade and investment. It allows businesses and individuals to exchange currencies seamlessly, enabling them to transact across borders. By providing a platform for currency conversion, the foreign exchange market facilitates the smooth flow of goods, services, and capital around the world.

Role of Central Banks

Central banks, such as the Federal Reserve in the United States and the European Central Bank in Europe, play a crucial role in stabilizing currency markets and mitigating economic risks. They intervene in the foreign exchange market by buying or selling currencies to influence their value. By doing so, central banks can prevent excessive currency fluctuations, which can harm economic growth and stability.

Currency Fluctuations and Economic Impact

Currency fluctuations can significantly impact economic growth and inflation. When a country’s currency appreciates, its exports become more expensive, which can lead to a decline in exports and economic growth. Conversely, a currency depreciation can boost exports by making them cheaper for foreign buyers, leading to increased economic growth. Currency fluctuations can also affect inflation by influencing the prices of imported goods and services.

Final Conclusion

In conclusion, the foreign exchange market presents a complex and dynamic environment with both advantages and disadvantages. Investors must carefully consider their risk tolerance, investment goals, and market conditions before engaging in foreign exchange trading. By understanding the benefits and drawbacks of this market, investors can make informed decisions and potentially harness its potential for growth and diversification.