As we delve into the intricacies of the foreign exchange market, let us embark on a journey to unravel its significance in global finance. This comprehensive guide will define and explain the foreign exchange market, exploring its participants, factors influencing exchange rates, types of transactions, risks and rewards, and its impact on the global economy.

The foreign exchange market, often abbreviated as forex, serves as a global marketplace where currencies are traded and exchanged. It plays a pivotal role in facilitating international trade, investment, and tourism, fostering economic growth and interconnectedness.

Definition of Foreign Exchange Market

The foreign exchange market, also known as Forex or FX, is a global decentralized market for the trading of currencies. It involves the conversion of one currency into another at an agreed-upon exchange rate. The FX market plays a crucial role in facilitating international trade, investment, and tourism.

Types of Currencies Traded

The FX market trades a wide range of currencies, including major currencies like the US dollar, euro, Japanese yen, and British pound, as well as minor currencies and emerging market currencies. The most commonly traded currency pair is the EUR/USD, followed by USD/JPY and GBP/USD.

Importance for Businesses and Individuals

The FX market is essential for businesses and individuals who engage in international transactions. Businesses need to convert currencies to pay for goods and services from foreign suppliers, while individuals may need to exchange currencies for travel or investments. The FX market provides a platform for these conversions to occur efficiently and at competitive rates.

Participants in the Foreign Exchange Market

The foreign exchange market is a vast and complex global network where currencies are traded. It involves a diverse range of participants, each playing a unique role in the market’s functioning.

Banks

Banks are the largest and most influential participants in the foreign exchange market. They act as intermediaries between buyers and sellers of currencies, facilitating transactions and providing liquidity to the market. Banks hold large amounts of foreign currencies to meet the demands of their clients and engage in speculative trading to profit from currency fluctuations.

Corporations

Corporations are another major participant in the foreign exchange market. They engage in currency transactions to facilitate international trade and investments. Corporations need to convert their currencies into foreign currencies to purchase goods and services from other countries, pay employees, and make investments abroad.

Individual Traders

Individual traders, also known as retail traders, participate in the foreign exchange market on a smaller scale compared to banks and corporations. They trade currencies for speculative purposes, hoping to profit from short-term price movements. Individual traders typically use online platforms to access the market and trade currencies with leverage.

Remember to click foreign exchange converter to understand more comprehensive aspects of the foreign exchange converter topic.

Central Banks

Central banks play a crucial role in the foreign exchange market by implementing monetary policies that influence currency values. They intervene in the market to stabilize currencies, manage inflation, and support economic growth. Central banks hold large reserves of foreign currencies and can buy or sell currencies to influence their exchange rates.

Factors Affecting Foreign Exchange Rates

:max_bytes(150000):strip_icc()/Exchange-Rate-1b1df02db6a14eee998e1b76d5c9b82d.jpg)

The foreign exchange market is a dynamic environment where the value of currencies constantly fluctuates. Numerous factors, ranging from economic to political and social, influence these fluctuations. Understanding these factors is crucial for businesses and individuals involved in international trade and investment.

Economic Factors

Economic factors play a significant role in determining foreign exchange rates. These include:

- Economic Growth: Strong economic growth in a country typically leads to an appreciation of its currency as demand for its goods and services increases.

- Inflation: High inflation can depreciate a currency as it reduces the purchasing power of the domestic economy.

- Interest Rates: Higher interest rates tend to attract foreign investment, leading to an appreciation of the currency.

- Government Debt: High government debt can weaken a currency as it increases the risk of default.

Political Factors

Political stability and events can also impact foreign exchange rates. Factors such as:

- Political Stability: Political instability and uncertainty can depreciate a currency as investors seek safer havens.

- Government Policies: Government policies, such as fiscal and monetary policies, can affect economic growth and inflation, thereby influencing exchange rates.

- International Relations: Tensions between countries can lead to currency fluctuations, particularly if economic sanctions or trade restrictions are imposed.

Social Factors

Social factors, such as:

- Culture and Values: Cultural preferences and values can influence consumer demand for goods and services, thereby affecting exchange rates.

- Demographics: Population growth, age distribution, and education levels can impact economic growth and demand for foreign currencies.

- Technology: Technological advancements can drive economic growth and productivity, leading to currency appreciation.

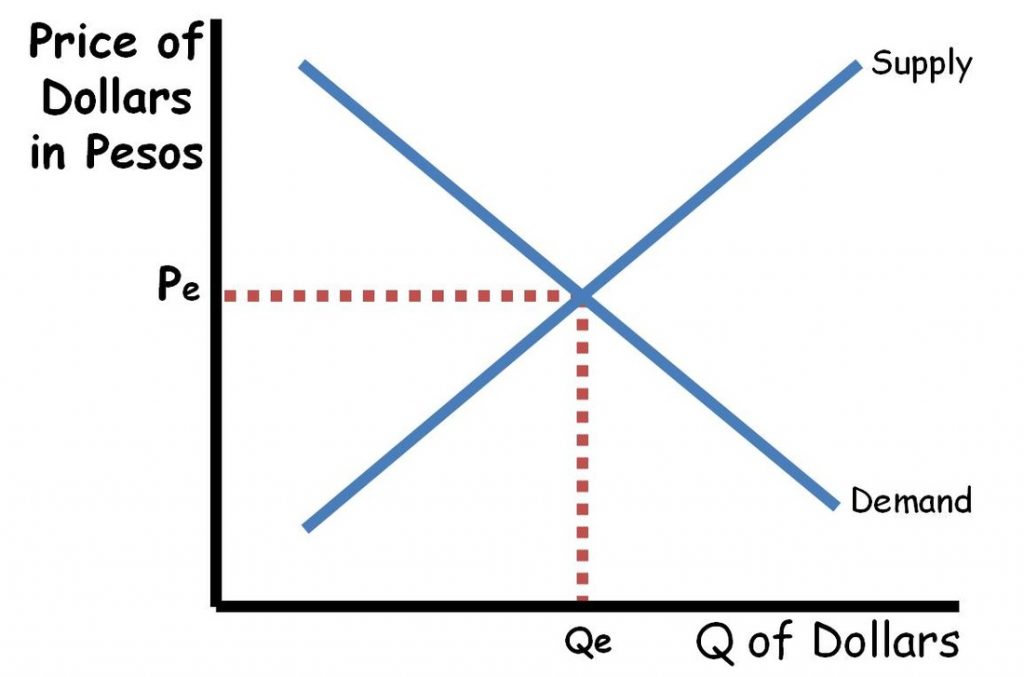

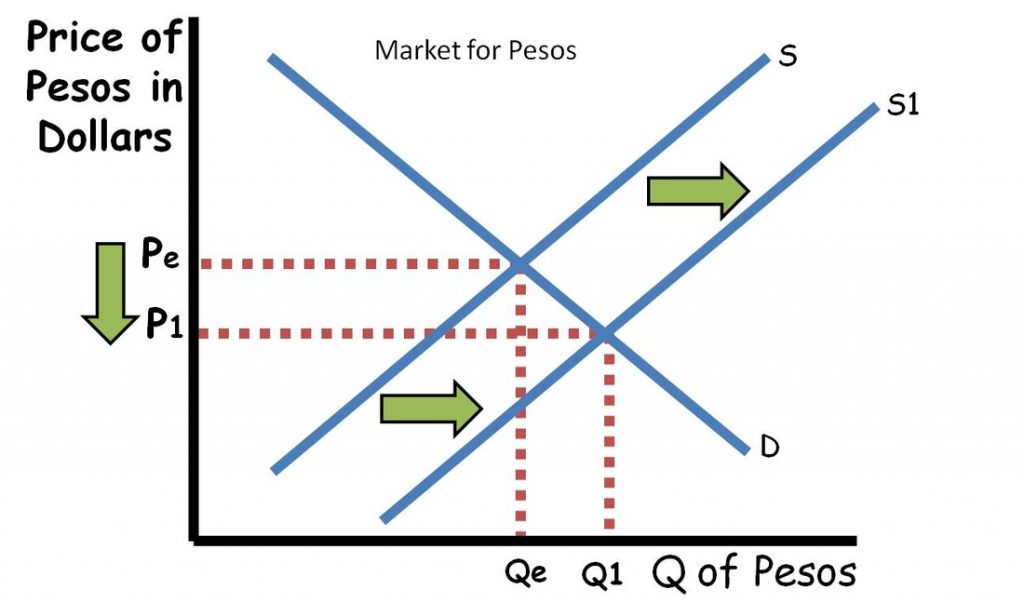

Supply and Demand Dynamics

The foreign exchange market is driven by supply and demand. When there is a high demand for a currency, its value increases. Conversely, when supply exceeds demand, the currency depreciates. Factors such as trade flows, investment decisions, and speculation can influence supply and demand.

Interest Rates and Inflation

Interest rates and inflation are closely intertwined with foreign exchange rates. Higher interest rates attract foreign investment, leading to an appreciation of the currency. Conversely, higher inflation reduces the purchasing power of a currency, leading to depreciation.

Notice foreign exchange market background for recommendations and other broad suggestions.

Types of Foreign Exchange Transactions

Foreign exchange transactions involve the exchange of currencies between parties for various purposes. These transactions can be classified into different types based on their characteristics and the underlying objectives of the parties involved. The most common types of foreign exchange transactions include spot, forward, and swap contracts.

Spot Transactions

Spot transactions are the most basic type of foreign exchange transaction, involving the immediate exchange of currencies at the current market rate. In a spot transaction, the buyer and seller agree on an exchange rate and settle the transaction within two business days. Spot transactions are typically used for small-scale currency exchanges or for meeting immediate payment obligations.

Forward Transactions

Forward transactions are contracts that lock in an exchange rate for a future date, allowing parties to hedge against potential fluctuations in currency values. In a forward transaction, the buyer and seller agree on an exchange rate and a future settlement date. The exchange rate is fixed at the time of the contract and does not change, regardless of market fluctuations. Forward transactions are used by businesses and investors to manage currency risk and protect against potential losses due to exchange rate changes.

Obtain direct knowledge about the efficiency of how does a foreign exchange market functions through case studies.

Swap Contracts

Swap contracts are agreements between two parties to exchange currencies at different points in time and at predetermined exchange rates. In a swap contract, the parties agree to exchange a specific amount of one currency for another currency at a future date and then exchange the currencies back at a later date. Swap contracts are often used for managing currency risk, speculating on exchange rate movements, and hedging against interest rate fluctuations.

Risks and Rewards of Foreign Exchange Trading

Foreign exchange trading, also known as forex trading, involves the buying and selling of currencies. It is the largest and most liquid financial market in the world, with an average daily trading volume of over $5 trillion. While forex trading can be a lucrative endeavor, it also comes with a number of risks.

Potential Risks, Define and explain the foreign exchange market

- Currency Volatility: Currency prices can fluctuate rapidly and unpredictably, making it difficult to predict the direction of the market. This volatility can lead to significant losses if trades are not managed properly.

- Leverage: Forex traders often use leverage to increase their potential profits. However, leverage can also magnify losses, making it important to use it wisely.

- Counterparty Risk: Forex trades are typically conducted through brokers, who act as intermediaries between buyers and sellers. If a broker becomes insolvent, traders may lose their funds.

Potential Rewards

Despite the risks, forex trading can also offer a number of potential rewards.

- High Liquidity: The forex market is the most liquid financial market in the world, meaning that there is always a buyer or seller for any currency pair.

- 24-Hour Trading: The forex market is open 24 hours a day, 5 days a week, making it possible to trade at any time.

- Profit Potential: Forex trading can be a profitable endeavor, especially for those who are able to manage risk effectively.

Managing Risk

To manage risk in the forex market, traders can use a number of strategies, including:

- Stop-Loss Orders: Stop-loss orders are used to limit losses by automatically closing a trade when the price of a currency pair reaches a predetermined level.

- Position Sizing: Position sizing refers to the amount of money that a trader is willing to risk on a single trade. By carefully managing position size, traders can reduce the potential impact of losses.

- Hedging: Hedging involves using a combination of trades to reduce the risk of losses. For example, a trader might buy one currency pair while simultaneously selling another currency pair that is correlated to the first.

Impact of Foreign Exchange Market on Global Economy: Define And Explain The Foreign Exchange Market

The foreign exchange market plays a crucial role in facilitating international trade and investment, enabling seamless cross-border transactions. It provides a platform for businesses to exchange currencies and facilitate trade, promoting economic growth and interdependence among nations.

Impact of Currency Fluctuations on Economic Growth and Stability

Currency fluctuations can significantly impact economic growth and stability. When a country’s currency appreciates, it becomes more expensive for domestic businesses to export goods and services, potentially leading to a decrease in exports and a slowdown in economic growth. Conversely, a depreciation in the currency can make exports cheaper, boosting exports and stimulating economic growth.

Last Word

In conclusion, the foreign exchange market is a dynamic and ever-evolving landscape that underpins the global economy. Understanding its mechanisms and complexities is essential for businesses, investors, and individuals alike. By mastering the concepts Artikeld in this guide, you will gain a solid foundation in the world of foreign exchange, empowering you to make informed decisions and navigate the challenges and opportunities it presents.