Foreign exchange market example in hindi, the global marketplace where currencies are traded, plays a crucial role in international finance. This guide provides an in-depth exploration of the forex market, its participants, mechanics, products, analysis, strategies, regulations, trends, and potential impact of global events.

From the basics of currency trading to advanced analysis techniques, this comprehensive resource empowers individuals to navigate the dynamic world of forex trading with confidence.

Forex Market Basics

The foreign exchange market, also known as the forex market, is a global decentralized market where currencies are traded. It is the largest financial market in the world, with an average daily trading volume of over $5 trillion.

The forex market plays a vital role in global finance by facilitating international trade and investment. It allows businesses to exchange currencies to pay for goods and services, and it provides investors with opportunities to speculate on currency movements.

Types of Forex Market Participants

There are many different types of participants in the forex market, including:

- Commercial banks: Commercial banks are the largest participants in the forex market. They trade currencies on behalf of their customers, who include businesses and individuals.

- Investment banks: Investment banks trade currencies for their own account and for their clients. They also provide research and advisory services to their clients.

- Hedge funds: Hedge funds are investment funds that use sophisticated trading strategies to speculate on currency movements.

- Retail traders: Retail traders are individuals who trade currencies on their own account. They typically trade smaller amounts of currency than institutional traders.

Forex Market Mechanics: Foreign Exchange Market Example In Hindi

The forex market is a global, decentralized market where currencies are traded. The process of currency trading involves buying and selling currencies in pairs, with the exchange rate determining the value of one currency relative to the other.

The exchange rate is determined by the forces of supply and demand, and is constantly fluctuating. When there is more demand for a particular currency than there is supply, the value of that currency will increase. Conversely, when there is more supply of a particular currency than there is demand, the value of that currency will decrease.

Discover the crucial elements that make define foreign exchange market with examples the top choice.

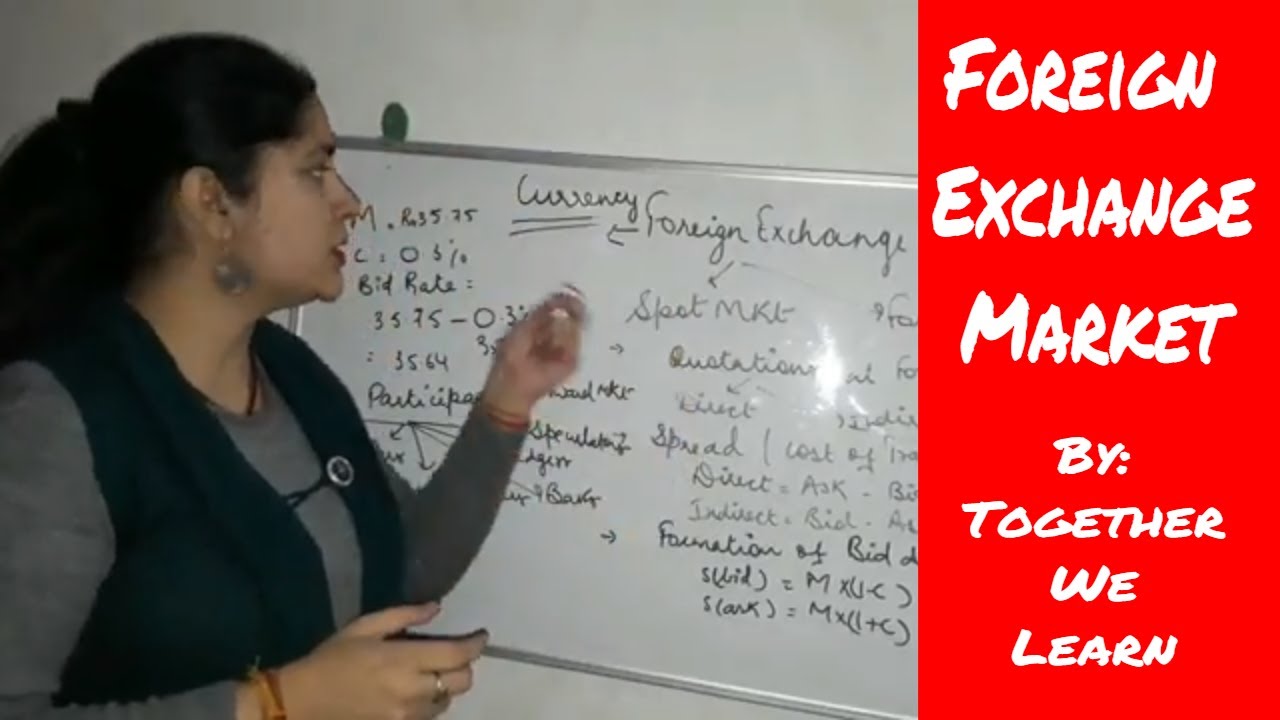

Bid-Ask Spread

When you trade currencies, you will be quoted two prices: the bid price and the ask price. The bid price is the price at which you can sell a currency, while the ask price is the price at which you can buy a currency. The difference between the bid price and the ask price is called the bid-ask spread.

The bid-ask spread is the market maker’s profit, and it is typically expressed in pips. A pip is the smallest unit of change in a currency pair, and it is typically equal to 0.0001. For example, if the bid price for EUR/USD is 1.1234 and the ask price is 1.1236, the bid-ask spread is 2 pips.

Finish your research with information from foreign exchange market full definition.

Factors that Affect Forex Rates

There are a number of factors that can affect forex rates, including:

- Economic data: Economic data, such as GDP growth, inflation, and unemployment rates, can have a significant impact on forex rates. Strong economic data can lead to an increase in demand for a currency, while weak economic data can lead to a decrease in demand.

- Political events: Political events, such as elections, wars, and terrorist attacks, can also have a significant impact on forex rates. Political uncertainty can lead to a decrease in demand for a currency, while political stability can lead to an increase in demand.

- Central bank policy: Central banks play a major role in managing forex rates. Central banks can use monetary policy tools, such as interest rates and quantitative easing, to influence the value of their currency.

- Market sentiment: Market sentiment can also have a significant impact on forex rates. If traders are optimistic about the future of a particular currency, they will be more likely to buy that currency, which will lead to an increase in demand and a higher exchange rate.

Forex Market Products

Forex market offers a wide range of products that cater to the diverse needs of traders and investors. These products vary in terms of their underlying assets, risk profiles, and potential rewards. Understanding the different types of forex products is crucial for making informed trading decisions.

The most common forex product is the spot market, where currencies are traded for immediate delivery. Spot market transactions are typically settled within two business days. Other forex products include forwards, futures, options, and swaps, each with its own unique characteristics and applications.

Spot Market

The spot market is the largest and most liquid segment of the forex market, accounting for the majority of daily trading volume. In the spot market, currencies are traded at their current market price, and transactions are settled promptly. Spot market trading is ideal for short-term traders who seek to capitalize on short-term price movements.

Forward Market

Forward contracts are agreements to buy or sell a specific amount of currency at a predetermined price on a future date. Forward contracts are typically used to hedge against currency risk or to lock in a favorable exchange rate for future transactions.

Futures Market

Futures contracts are standardized contracts traded on exchanges, obligating the buyer to purchase and the seller to deliver a specific amount of currency at a set price on a specified future date. Futures contracts are similar to forward contracts but are more standardized and offer greater liquidity.

Options Market

Options contracts give the buyer the right, but not the obligation, to buy or sell a specific amount of currency at a specified price on or before a certain date. Options contracts are often used for speculation or hedging purposes.

Swap Market

Swap contracts involve the exchange of two different currencies for a specific period, with the exchange rate fixed at the inception of the contract. Swap contracts are commonly used for managing currency risk and hedging against interest rate fluctuations.

The choice of forex product depends on the trader’s risk tolerance, investment objectives, and trading strategy. Each product offers its own set of risks and rewards, and it is important for traders to carefully consider these factors before making any trading decisions.

Forex Market Analysis

Forex market analysis is a crucial aspect of trading in the foreign exchange market. It involves studying and interpreting various factors to make informed trading decisions. There are two main types of forex market analysis: technical analysis and fundamental analysis.

Technical Analysis

Technical analysis focuses on historical price data to identify patterns and trends that may indicate future price movements. It uses various technical indicators, such as moving averages, Bollinger Bands, and Relative Strength Index (RSI), to identify potential trading opportunities.

Fundamental Analysis, Foreign exchange market example in hindi

Fundamental analysis examines economic and political factors that affect currency values. It considers factors such as interest rates, inflation, economic growth, and political stability to determine the intrinsic value of a currency. Fundamental analysts believe that currencies will eventually trade at their fair value based on these fundamental factors.

Forex Market Trading Strategies

Forex trading strategies are plans that guide traders in making informed decisions about buying and selling currencies. These strategies help traders identify potential trading opportunities, manage risk, and maximize profits.

You also will receive the benefits of visiting function of foreign exchange market ppt today.

Types of Forex Trading Strategies

- Trend Following Strategies: These strategies aim to identify and trade in the direction of prevailing market trends.

- Range Trading Strategies: These strategies focus on trading within a specific price range, capitalizing on market fluctuations within that range.

- Breakout Trading Strategies: These strategies involve identifying and trading breakouts from support and resistance levels.

- Scalping Strategies: These strategies involve taking small, frequent profits from short-term price movements.

- News Trading Strategies: These strategies involve trading based on the release of economic news and events that can impact currency prices.

Risk Management Techniques

Risk management is crucial in forex trading to protect capital and minimize losses. Common risk management techniques include:

- Position Sizing: Determining the appropriate size of each trade based on available capital and risk tolerance.

- Stop-Loss Orders: Orders that automatically close a trade when a predetermined loss level is reached.

- Take-Profit Orders: Orders that automatically close a trade when a predetermined profit level is reached.

- Hedging: Using offsetting positions in different currencies to reduce risk.

Successful Forex Trading Strategies

While there is no single “best” forex trading strategy, some common successful strategies include:

- Moving Average Crossover Strategy: Trading based on the crossover of two moving averages with different periods.

- Bollinger Bands Strategy: Trading based on the Bollinger Bands indicator, which measures volatility and potential trading opportunities.

- Ichimoku Cloud Strategy: Trading based on the Ichimoku Cloud indicator, which provides multiple layers of technical analysis.

Forex Market Regulations

The forex market is the largest and most liquid financial market in the world, with an average daily trading volume of over $5 trillion. Due to its size and complexity, the forex market is subject to a complex regulatory environment.

Regulatory bodies play a crucial role in the forex market by ensuring that it operates in a fair and orderly manner. They do this by setting rules and regulations that govern the conduct of market participants, investigating and enforcing violations, and providing oversight of the market.

Types of Forex Market Scams

Forex market scams are fraudulent schemes that attempt to deceive investors and steal their money. Common types of forex market scams include:

- Ponzi schemes: These schemes promise high returns with little or no risk, but they actually use new investors’ money to pay off old investors.

- Boiler rooms: These are high-pressure sales operations that use aggressive tactics to sell worthless or overpriced investments.

- Pump-and-dump schemes: These schemes involve artificially inflating the price of a stock or currency and then selling it off at a profit.

- Forex robots: These are automated trading systems that promise to make money for investors without any effort. However, these systems are often unreliable and can lead to losses.

Forex Market Trends

The foreign exchange market is constantly evolving, and the trends that shape it are constantly changing. By understanding the current trends and forecasting the future direction of the market, traders can make more informed decisions and improve their chances of success.

Global Economic Outlook

The global economic outlook is a major factor that influences the forex market. When the global economy is growing, demand for currencies from countries with strong economies tends to increase, while demand for currencies from countries with weak economies tends to decrease. Conversely, when the global economy is contracting, demand for currencies from countries with strong economies tends to decrease, while demand for currencies from countries with weak economies tends to increase.

Interest Rates

Interest rates are another important factor that influences the forex market. When interest rates in a country are high, demand for that country’s currency tends to increase, as investors are attracted to the higher returns available on their investments. Conversely, when interest rates in a country are low, demand for that country’s currency tends to decrease, as investors are less attracted to the lower returns available on their investments.

Political Events

Political events can also have a significant impact on the forex market. For example, if there is a political crisis in a country, demand for that country’s currency may decrease as investors become concerned about the stability of the country’s economy and government.

Natural Disasters

Natural disasters can also have a significant impact on the forex market. For example, if there is a natural disaster in a country, demand for that country’s currency may decrease as investors become concerned about the impact of the disaster on the country’s economy.

Technological Advancements

Technological advancements can also have a significant impact on the forex market. For example, the development of new trading platforms has made it easier for traders to access the market and execute trades. This has led to increased participation in the market and has made it more difficult for large traders to manipulate prices.

Closure

In conclusion, the foreign exchange market example in hindi offers a multifaceted landscape of opportunities and challenges. Understanding its intricacies and applying sound strategies can unlock the potential for successful trading outcomes. As the forex market continues to evolve, staying informed about current trends and regulatory developments is essential for informed decision-making.