Foreign exchange market supply and demand shifters – In the dynamic realm of global finance, the foreign exchange market stands as a captivating arena where currencies are traded and exchanged, influenced by a myriad of factors known as supply and demand shifters. This intricate interplay of economic forces, geopolitical events, and market sentiment drives the fluctuations in currency values, shaping the financial landscape for businesses, investors, and individuals alike.

From the interplay of economic data and geopolitical events to the impact of interest rate differentials and technological advancements, the supply and demand shifters in the foreign exchange market present a fascinating tapestry of forces that shape the global economy.

Market Participants

The foreign exchange market is a vast and complex global marketplace where currencies are traded. It involves a wide range of participants, each with their own motivations and strategies.

The major participants in the foreign exchange market can be broadly classified into two categories: institutional traders and retail traders.

Institutional Traders

Institutional traders are large financial institutions that trade foreign exchange on behalf of their clients. These include banks, investment banks, hedge funds, and pension funds. Institutional traders typically have large amounts of capital at their disposal and are responsible for a significant portion of the volume traded in the foreign exchange market.

Retail Traders

Retail traders are individuals who trade foreign exchange on their own behalf. They typically have smaller amounts of capital at their disposal and account for a smaller portion of the volume traded in the foreign exchange market. Retail traders can be further divided into two subcategories:

- Speculators: Speculators are traders who attempt to profit from short-term fluctuations in currency prices.

- Hedgers: Hedgers are traders who use foreign exchange to reduce the risk of currency fluctuations on their international business transactions.

The foreign exchange market is a dynamic and ever-changing environment. The actions of the various market participants can have a significant impact on currency prices.

Economic Data and News: Foreign Exchange Market Supply And Demand Shifters

Economic data releases, such as GDP growth, inflation reports, and unemployment figures, can significantly impact supply and demand in the foreign exchange market. Positive economic data typically increases demand for a currency, while negative data can lead to decreased demand.

Geopolitical events, such as wars, natural disasters, or political instability, can also influence currency values. These events can create uncertainty and risk aversion, leading investors to seek safe-haven currencies like the US dollar or the Japanese yen.

Economic Data Releases

- Strong GDP growth indicates a healthy economy and can increase demand for a currency, as it suggests higher investment opportunities and potential returns.

- Low inflation can be seen as a sign of economic stability and can attract foreign investment, leading to increased demand for the currency.

- High unemployment rates can indicate economic weakness and reduce demand for a currency, as it suggests reduced consumer spending and business investment.

Geopolitical Events

- Wars and conflicts can create uncertainty and risk aversion, leading investors to sell riskier currencies and buy safe-haven currencies like the US dollar.

- Natural disasters can disrupt economic activity and reduce demand for a currency, as they can damage infrastructure, disrupt supply chains, and reduce consumer spending.

- Political instability can create uncertainty and reduce investor confidence, leading to decreased demand for a currency.

Interest Rate Differentials

Interest rate differentials refer to the differences in interest rates between countries. These differences can significantly impact currency values.

When a country’s interest rates are higher than those of other countries, it becomes more attractive for foreign investors to invest in that country’s currency. This increased demand for the currency drives up its value relative to other currencies.

Obtain a comprehensive document about the application of foreign exchange market yesterday that is effective.

Interest Rate Comparison Table

The following table compares the interest rates of different countries:

| Country | Interest Rate |

|---|---|

| United States | 4.25% |

| United Kingdom | 3.50% |

| Japan | 0.10% |

| Eurozone | 2.50% |

| China | 3.65% |

Inflation and Currency Values

Inflation is a crucial factor that significantly impacts currency demand and values. Understanding the relationship between inflation and currency demand is essential for market participants to make informed decisions.

How Inflation Affects Currency Demand

Inflation erodes the purchasing power of a currency over time. As inflation increases, the value of money decreases, leading to a decline in demand for that currency. This is because individuals and businesses are less willing to hold a currency that is losing value.

Historical Examples

- In the 1970s, the United States experienced high inflation, leading to a significant decline in the value of the US dollar.

- In the 1980s, Brazil faced hyperinflation, causing the Brazilian real to lose almost all of its value.

- More recently, in 2022, inflation surged in many countries due to supply chain disruptions and geopolitical events. This resulted in a decline in the value of currencies like the euro and the British pound.

Speculation and Market Sentiment

Speculation and market sentiment play significant roles in shaping supply and demand in the foreign exchange market. Speculation refers to the buying or selling of currencies based on expectations of future price movements, while market sentiment reflects the collective attitude of market participants towards a particular currency or the overall market.

Role of Speculation in Supply and Demand

Speculators can influence supply and demand by taking positions in the market. If they believe a currency will appreciate, they will buy it, increasing demand and pushing up its price. Conversely, if they anticipate a depreciation, they will sell the currency, increasing supply and driving down its price.

Obtain a comprehensive document about the application of foreign exchange market ppt free download that is effective.

Impact of Market Sentiment on Currency Movements

Market sentiment can have a profound impact on currency movements. Positive sentiment, such as optimism about a country’s economic prospects or political stability, can attract buyers and increase demand for its currency. Conversely, negative sentiment, such as concerns about economic weakness or political instability, can lead to selling and reduce demand.

Obtain direct knowledge about the efficiency of foreign exchange market economics definition through case studies.

Technological Advancements

Technology has revolutionized the foreign exchange market, making it more accessible, efficient, and transparent. It has led to significant improvements in trading speed, execution, and liquidity, benefiting both retail and institutional traders.

Electronic Trading Platforms

- Electronic trading platforms have replaced traditional open outcry systems, enabling traders to execute orders instantly and anonymously.

- These platforms provide real-time market data, news, and analysis, empowering traders with the information they need to make informed decisions.

- The increased efficiency of electronic trading has reduced transaction costs and improved market liquidity.

Automated Trading

- Automated trading systems, such as algorithmic trading, allow traders to set specific trading parameters and execute trades automatically.

- These systems can monitor market conditions 24/7, reacting to price movements and executing trades faster than manual trading.

- Automated trading has increased market efficiency and liquidity, but it also poses risks if not used properly.

Mobile Trading, Foreign exchange market supply and demand shifters

- Mobile trading apps have made it possible for traders to access the foreign exchange market from anywhere with an internet connection.

- These apps provide similar features to desktop trading platforms, including real-time market data and charting tools.

- Mobile trading has increased accessibility and convenience, allowing traders to manage their positions on the go.

Central Bank Intervention

Central banks, such as the Federal Reserve in the United States or the European Central Bank, play a significant role in managing currency values. They do this through various mechanisms, including buying and selling foreign currencies in the open market, setting interest rates, and intervening directly in the foreign exchange market.

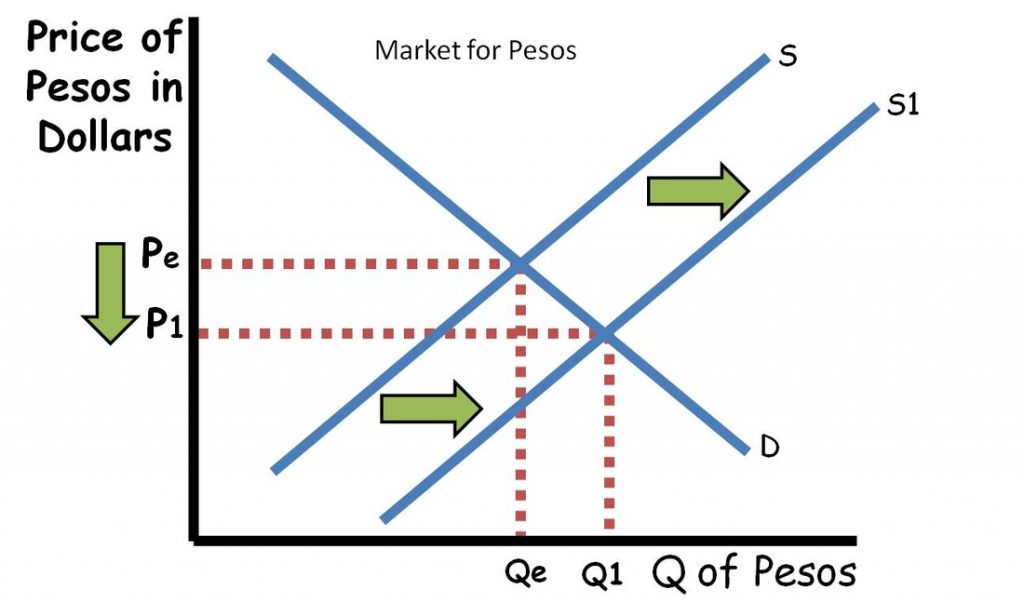

One of the most common ways that central banks intervene in the foreign exchange market is by buying or selling their own currency. When a central bank buys its own currency, it reduces the supply of that currency in the market, which can lead to an appreciation in its value. Conversely, when a central bank sells its own currency, it increases the supply of that currency in the market, which can lead to a depreciation in its value.

Central banks also use interest rates to influence currency values. When a central bank raises interest rates, it makes its currency more attractive to investors, which can lead to an appreciation in its value. Conversely, when a central bank lowers interest rates, it makes its currency less attractive to investors, which can lead to a depreciation in its value.

In addition to buying and selling currencies and setting interest rates, central banks can also intervene in the foreign exchange market directly. This can involve taking actions such as setting limits on the amount of currency that can be traded or imposing taxes on currency transactions.

Historical Examples of Central Bank Intervention

There are many historical examples of central bank intervention in the foreign exchange market. One notable example is the Plaza Accord of 1985, in which the central banks of the United States, Japan, France, Germany, and the United Kingdom agreed to intervene in the foreign exchange market to depreciate the US dollar. This intervention was successful in bringing down the value of the US dollar, which had been rising steadily against other currencies.

Another example of central bank intervention is the Swiss National Bank’s decision to peg the Swiss franc to the euro in 2011. This intervention was successful in keeping the Swiss franc from appreciating too much against the euro, which would have hurt the Swiss economy.

Last Recap

As we delve into the complexities of foreign exchange market supply and demand shifters, we gain a deeper understanding of the intricate forces that shape currency values and drive global financial markets. By unraveling the dynamics of this ever-evolving landscape, we empower ourselves to navigate the complexities of international trade, investment, and financial planning.