Delving into the world of finance, we turn our attention to the German stock exchange, a cornerstone of the European economic landscape. Its rich history, diverse market structure, and vibrant trading activity make it a fascinating subject for exploration.

Established in the heart of Europe, the German stock exchange has played a pivotal role in shaping the financial landscape of the continent. Its origins date back to the 16th century, and over the centuries, it has evolved into a modern and sophisticated marketplace.

Historical Context

The German stock exchange has a rich history that dates back to the 16th century. The first known stock exchange was established in Frankfurt in 1585, and it quickly became a major center for trade in commodities and securities. Over the centuries, the German stock exchange has undergone a number of changes, but it has remained one of the most important financial markets in the world.

One of the key milestones in the development of the German stock exchange was the establishment of the Berlin Stock Exchange in 1840. The Berlin Stock Exchange quickly became the largest and most important stock exchange in Germany, and it played a major role in the development of the German economy. In the late 19th and early 20th centuries, the German stock exchange experienced a period of rapid growth. The number of listed companies increased significantly, and the value of traded securities soared.

Key Events

- 1585: The first known stock exchange is established in Frankfurt.

- 1840: The Berlin Stock Exchange is established.

- 1873: The German Stock Exchange Act is passed.

- 1900: The Berlin Stock Exchange becomes the largest stock exchange in Germany.

- 1914-1918: World War I causes the German stock exchange to collapse.

- 1929: The Great Depression causes the German stock exchange to collapse again.

- 1933-1945: The Nazi regime nationalizes the German stock exchange.

- 1949: The German stock exchange is re-established after World War II.

- 1990: The Berlin Stock Exchange and the Frankfurt Stock Exchange merge to form the Deutsche Börse.

- 2008: The financial crisis causes the German stock exchange to collapse.

Market Structure

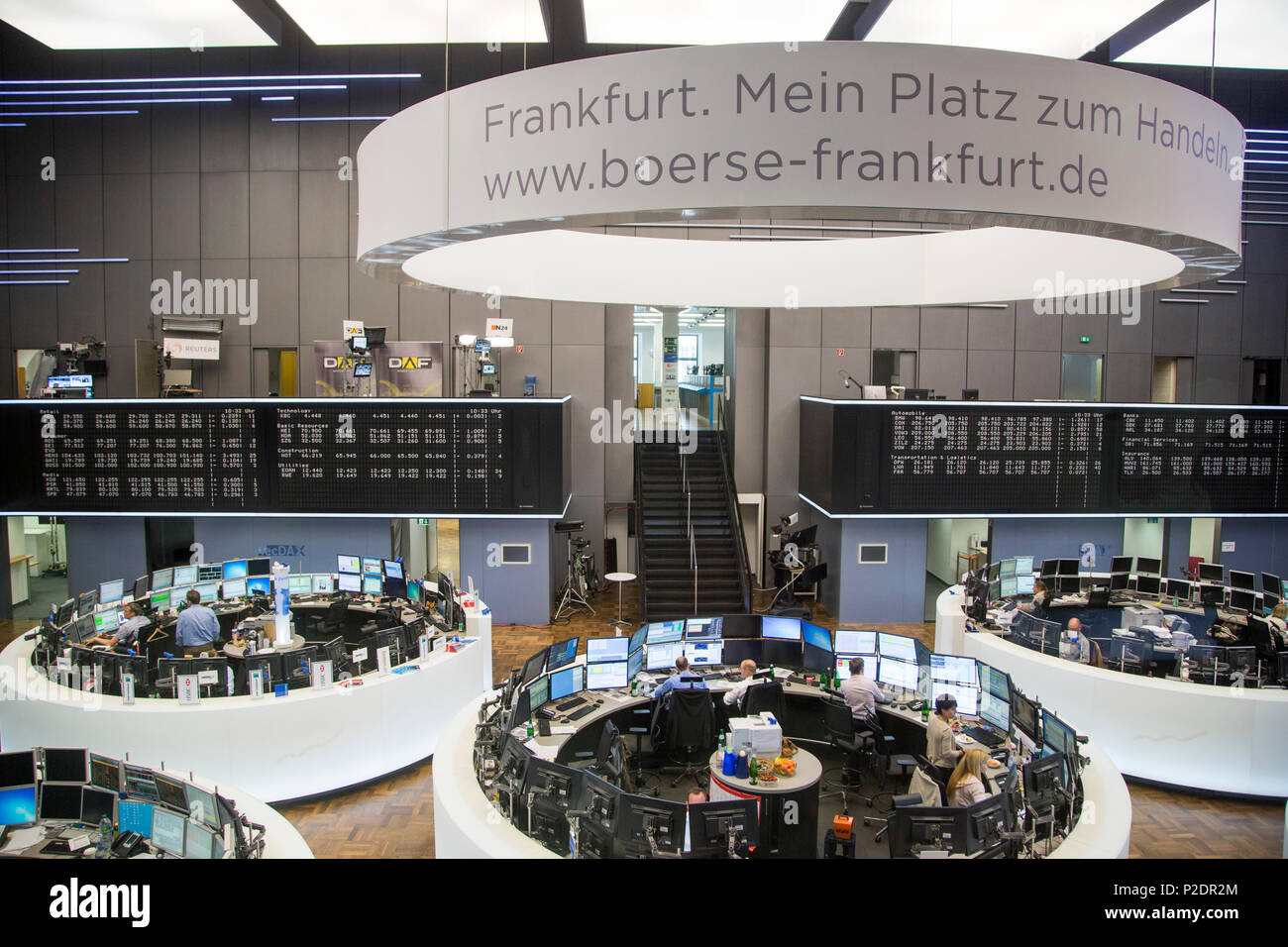

The German stock exchange, also known as the Deutsche Börse, is organized as a holding company with several subsidiaries and affiliates. The core entity, Deutsche Börse AG, is a publicly traded company listed on its own exchange. It owns and operates various exchanges, including the Frankfurt Stock Exchange, which is the largest stock exchange in Germany and one of the largest in Europe.

The Deutsche Börse Group provides a comprehensive range of services to issuers, investors, and other participants in the capital markets. These services include trading, clearing, settlement, and custody of securities, as well as market data and information services.

Regulatory Framework

The German stock exchange is regulated by the German Federal Financial Supervisory Authority (BaFin). BaFin is responsible for overseeing the financial markets in Germany and ensuring that they operate in a fair, transparent, and orderly manner. BaFin has a wide range of powers, including the ability to conduct investigations, impose sanctions, and issue regulations.

Trading Activity

The German stock exchange exhibits a robust trading volume and value, positioning it as one of the most active exchanges globally. Key market participants, including institutional investors, hedge funds, and retail traders, engage in various trading strategies to capitalize on market opportunities.

Trading activity on the German stock exchange is influenced by a multitude of factors, including economic conditions, global events, and regulatory changes. Understanding these factors is crucial for investors seeking to make informed decisions.

Key Market Participants

The German stock exchange is home to a diverse range of market participants, each with unique trading strategies and objectives:

- Institutional Investors: Pension funds, insurance companies, and mutual funds represent significant institutional investors on the German stock exchange. They typically employ long-term investment strategies, focusing on value investing and risk diversification.

- Hedge Funds: Hedge funds actively manage portfolios using advanced trading techniques and often engage in short-term trading strategies. They seek to generate alpha, or excess returns, through various investment approaches.

- Retail Traders: Individual investors participate in the German stock exchange, often focusing on short-term trading and speculative strategies. They may employ technical analysis, fundamental analysis, or a combination of both to make investment decisions.

Listed Companies: German Stock Exchange

The German stock exchange, Deutsche Börse, is home to a diverse range of listed companies, representing various industries and market capitalizations. These companies play a significant role in the German economy and offer investors access to a wide array of investment opportunities.

Industry Distribution

The industry distribution of listed companies on the German stock exchange reflects the strength and diversity of the German economy. Major industries represented include:

- Automotive (e.g., Volkswagen, Daimler, BMW)

- Chemicals (e.g., BASF, Bayer, Henkel)

- Engineering (e.g., Siemens, ThyssenKrupp, Bosch)

- Pharmaceuticals (e.g., Merck, Bayer, Fresenius)

- Finance (e.g., Deutsche Bank, Commerzbank, Allianz)

Market Capitalization

The market capitalization of listed companies on the German stock exchange varies significantly, ranging from large multinational corporations to smaller, niche players. The top 10 companies by market capitalization as of March 2023 include:

- Volkswagen

- Siemens

- SAP

- Deutsche Telekom

- Allianz

- Bayer

- BMW

- Mercedes-Benz Group

- BASF

- Henkel

Performance and Growth Prospects

The performance and growth prospects of listed companies on the German stock exchange are influenced by various factors, including economic conditions, industry trends, and company-specific factors. In recent years, many German companies have performed well, driven by strong domestic demand and export growth.

Looking ahead, the growth prospects for listed companies on the German stock exchange are generally positive. The German economy is expected to continue to grow steadily, and many companies are well-positioned to benefit from global trends such as the rise of electric vehicles and digitalization.

Market Indices

The German stock exchange features a range of market indices that measure the performance of various sectors and the overall market. These indices serve as valuable benchmarks for investors and provide insights into the health and trends of the German economy.

The most prominent market index in Germany is the DAX (Deutscher Aktienindex), which comprises the 40 largest and most liquid companies listed on the Frankfurt Stock Exchange. The DAX is a capitalization-weighted index, meaning that the market capitalization of each company influences its weight in the index. It provides a comprehensive overview of the performance of the German blue-chip companies.

Another important index is the MDAX (Mid-Cap Dax), which tracks the performance of the 50 medium-sized companies listed on the Frankfurt Stock Exchange. The MDAX represents the next tier of companies below the DAX and offers insights into the performance of the mid-cap segment of the German market.

For investors seeking exposure to the broader German market, the TecDAX index offers a comprehensive representation of the technology sector. It comprises 30 technology companies listed on the Frankfurt Stock Exchange and provides insights into the performance of this rapidly growing industry.

Performance of Market Indices

The German market indices have generally exhibited strong performance over time, reflecting the resilience and growth of the German economy. The DAX has consistently reached record highs in recent years, driven by factors such as low interest rates, strong corporate earnings, and investor confidence. The MDAX and TecDAX have also performed well, reflecting the growth of the mid-cap and technology sectors in Germany.

Factors Driving Market Movements

The movements of German market indices are influenced by a range of factors, including:

– Economic growth: The health of the German economy, as measured by GDP growth, inflation, and unemployment, significantly impacts the performance of the stock market.

– Corporate earnings: The profitability of listed companies, as reflected in their earnings reports, is a key driver of stock prices and index movements.

– Interest rates: Changes in interest rates set by the European Central Bank can affect the attractiveness of stocks relative to other investment options.

– Investor sentiment: The overall mood and confidence of investors towards the German market can influence the direction of stock prices and index movements.

– Global economic conditions: The performance of the German stock market can be influenced by global economic events and trends, such as changes in commodity prices or geopolitical events.

Significance as Investment Benchmarks

German market indices serve as important investment benchmarks for a number of reasons:

– Performance measurement: Investors can track the performance of their investments against the market indices to assess their returns and compare them to the broader market.

– Risk management: Market indices can be used as a benchmark for risk management, allowing investors to assess the volatility and risk associated with their investments.

– Index tracking: Exchange-traded funds (ETFs) and other investment products track the performance of market indices, providing investors with a convenient and cost-effective way to gain exposure to the German stock market.

International Comparisons

The German stock exchange, known as the Deutsche Börse, is one of the world’s leading stock exchanges. It is comparable to other major stock exchanges in terms of size, trading activity, and market structure. However, there are some key similarities and differences between the Deutsche Börse and other major exchanges.

In terms of size, the Deutsche Börse is the largest stock exchange in Germany and the third-largest in Europe, with a market capitalization of over €2 trillion. It is comparable to the London Stock Exchange and the Euronext, which are the largest stock exchanges in the United Kingdom and the Eurozone, respectively. However, it is smaller than the New York Stock Exchange and the Nasdaq, which are the largest stock exchanges in the world.

In terms of trading activity, the Deutsche Börse is one of the most active stock exchanges in the world. It has a daily trading volume of over €100 billion, which is comparable to the London Stock Exchange and the Euronext. However, it is less active than the New York Stock Exchange and the Nasdaq, which have daily trading volumes of over $1 trillion.

In terms of market structure, the Deutsche Börse is a regulated market. This means that it is subject to a number of rules and regulations designed to protect investors. These rules and regulations include requirements for companies to disclose information about their financial performance and to comply with certain accounting standards. The Deutsche Börse is also a member of the Federation of European Securities Exchanges (FESE), which is a self-regulatory organization that sets standards for the operation of stock exchanges in Europe.

The Deutsche Börse is a well-developed and efficient stock exchange. It is comparable to other major stock exchanges in terms of size, trading activity, and market structure. However, there are some key similarities and differences between the Deutsche Börse and other major exchanges. These similarities and differences should be taken into account when making investment decisions.

Competitive Landscape

The Deutsche Börse faces competition from a number of other stock exchanges, both in Germany and internationally. In Germany, the Deutsche Börse competes with the Frankfurt Stock Exchange and the Stuttgart Stock Exchange. Internationally, the Deutsche Börse competes with the London Stock Exchange, the Euronext, the New York Stock Exchange, and the Nasdaq.

The Deutsche Börse has a number of competitive advantages over its rivals. These advantages include its large size, its high trading volume, and its well-developed market structure. However, the Deutsche Börse also faces a number of challenges. These challenges include the increasing competition from other stock exchanges and the growing popularity of electronic trading.

In order to remain competitive, the Deutsche Börse is investing in new technologies and expanding its product offerings. The Deutsche Börse is also working to develop new partnerships with other stock exchanges and financial institutions. By taking these steps, the Deutsche Börse is positioning itself to remain a leading stock exchange in the years to come.

Areas for Improvement

There are a number of areas where the Deutsche Börse could improve its competitiveness. These areas include:

- Increasing its trading volume

- Expanding its product offerings

- Developing new technologies

- Partnering with other stock exchanges and financial institutions

By addressing these areas, the Deutsche Börse can position itself to remain a leading stock exchange in the years to come.

Technological Advancements

The German stock exchange has undergone significant technological advancements that have revolutionized its operations and transformed the trading landscape. These advancements have not only enhanced efficiency and accessibility but have also paved the way for innovative trading strategies and new market opportunities.

Obtain a comprehensive document about the application of foreign exchange market limitations that is effective.

Electronic trading platforms have played a pivotal role in modernizing the exchange. These platforms allow traders to execute orders electronically, eliminating the need for physical trading floors and manual order processing. The introduction of electronic trading has significantly reduced transaction costs, increased market liquidity, and enabled faster order execution.

Finish your research with information from japanese intervention in foreign exchange market.

Data Analytics

Data analytics has emerged as a powerful tool for market participants in the German stock exchange. Advanced analytical techniques and algorithms allow traders to analyze vast amounts of market data, identify trading opportunities, and make informed investment decisions. Data analytics tools provide insights into market trends, company performance, and investor sentiment, enabling traders to gain a competitive edge.

Remember to click foreign exchange market importance to understand more comprehensive aspects of the foreign exchange market importance topic.

Blockchain Technology

Blockchain technology has the potential to revolutionize the German stock exchange by enhancing security, transparency, and efficiency. Blockchain-based systems can create immutable and tamper-proof records of transactions, reducing the risk of fraud and manipulation. Additionally, blockchain technology can facilitate the development of new trading models, such as decentralized exchanges, and enable the tokenization of traditional assets.

Emerging Technologies, German stock exchange

The German stock exchange is actively exploring emerging technologies to further enhance its operations and meet the evolving needs of market participants. Artificial intelligence (AI) and machine learning (ML) algorithms are being utilized to automate tasks, improve risk management, and provide personalized trading recommendations. Quantum computing holds the potential to accelerate complex financial calculations and enable real-time market analysis.

Investment Opportunities

The German stock exchange offers a diverse range of investment opportunities for both domestic and international investors. Identifying undervalued companies or sectors with growth potential can lead to lucrative returns.

Investment strategies should consider the risk tolerance and financial goals of the investor. Effective risk management techniques are crucial to mitigate potential losses and preserve capital.

Undervalued Companies

Thorough research and analysis are essential to identify undervalued companies with strong fundamentals and growth prospects. Factors to consider include:

- Price-to-earnings ratio (P/E) below industry average

- Price-to-book ratio (P/B) below 1

- Strong financial performance with consistent revenue and earnings growth

- Competitive advantage in the market

Growth Sectors

Investing in sectors with high growth potential can yield substantial returns. Some promising sectors in the German economy include:

- Renewable energy

- Technology

- Healthcare

- E-commerce

Investment Strategies

Investors can employ various investment strategies to maximize returns and minimize risk:

- Value investing: Focuses on purchasing undervalued companies with strong fundamentals.

- Growth investing: Targets companies with high growth potential, often in emerging industries.

- Dividend investing: Aims to generate income through regular dividend payments.

- Index investing: Diversifies investments by tracking a market index, such as the DAX.

Risk Management

Effective risk management is crucial to protect investments. Key strategies include:

- Diversification: Investing in a variety of assets and sectors to reduce overall risk.

- Stop-loss orders: Predetermined orders to sell a security if it falls below a certain price.

- Hedging: Using financial instruments to offset potential losses.

- Regular portfolio review: Monitoring investments and adjusting strategies as needed.

Final Review

In conclusion, the German stock exchange stands as a testament to the enduring power of financial markets. Its historical significance, robust market structure, and innovative spirit make it a compelling destination for investors seeking opportunities in the heart of Europe.

As the world of finance continues to evolve, the German stock exchange is poised to maintain its position as a leading player in the global financial arena.