Essay on foreign exchange market – Delving into the intricacies of the foreign exchange market, this essay aims to provide a comprehensive overview of its significance, participants, and the myriad factors that shape its dynamics.

The foreign exchange market, often referred to as forex, serves as a global marketplace where currencies are traded, facilitating international commerce and investment.

Introduction

The foreign exchange market (forex) is a global marketplace where currencies are traded. It is the largest and most liquid financial market in the world, with a daily trading volume of over $5 trillion.

The forex market plays a vital role in the global economy. It allows businesses and individuals to exchange currencies for trade, investment, and other purposes. The forex market also helps to determine the value of currencies, which can have a significant impact on the economy of a country.

Purpose and Significance of Forex

The forex market serves several important purposes, including:

- Facilitating international trade: The forex market allows businesses to exchange currencies so that they can buy and sell goods and services from other countries.

- Providing investment opportunities: The forex market offers investors the opportunity to trade currencies for profit. Currencies can be bought and sold in pairs, and the value of a currency pair can fluctuate depending on a variety of factors, such as economic conditions, political events, and interest rates.

- Managing risk: The forex market can be used to manage risk associated with currency fluctuations. Businesses that operate in multiple countries can use the forex market to hedge against the risk of currency losses.

Participants in the Forex Market

The foreign exchange market is a global, decentralized marketplace where currencies are traded. The participants in this market play crucial roles in determining the exchange rates of currencies and facilitating international trade and investment.

Major Participants

- Central Banks: Central banks are responsible for managing the monetary policy of their respective countries. They participate in the forex market to influence exchange rates, manage inflation, and maintain economic stability.

- Commercial Banks: Commercial banks are the primary intermediaries between retail customers and the forex market. They provide currency exchange services to businesses and individuals, facilitate international payments, and manage their own foreign exchange risk.

- Investment Banks: Investment banks act as market makers and liquidity providers in the forex market. They trade currencies on behalf of their clients, provide hedging and advisory services, and engage in proprietary trading.

- Hedge Funds: Hedge funds are investment funds that use sophisticated strategies to generate returns. They often participate in the forex market to hedge against currency risk, speculate on exchange rate movements, and pursue arbitrage opportunities.

- Retail Traders: Retail traders are individuals who trade currencies on their own behalf. They range from experienced professionals to novice speculators and can access the forex market through online trading platforms.

Factors Influencing Exchange Rates

Exchange rates are influenced by a multitude of economic and political factors. These factors can be broadly classified into two categories: fundamental factors and technical factors. Fundamental factors are those that have a long-term impact on the value of a currency, while technical factors are those that have a short-term impact.

Economic Factors

Economic factors that influence exchange rates include economic growth, inflation, interest rates, and balance of payments. Economic growth is a key determinant of a currency’s value. A country with a strong and growing economy will typically have a stronger currency than a country with a weak and stagnant economy.

Inflation is another important factor that influences exchange rates. Inflation is the rate at which prices for goods and services increase over time. A country with high inflation will typically have a weaker currency than a country with low inflation.

Check advantages and disadvantages of foreign exchange market to inspect complete evaluations and testimonials from users.

Interest rates are also a key factor that influences exchange rates. Interest rates are the rates at which banks lend money to businesses and consumers. A country with high interest rates will typically have a stronger currency than a country with low interest rates.

Balance of payments is a record of all economic transactions between a country and the rest of the world. A country with a positive balance of payments will typically have a stronger currency than a country with a negative balance of payments.

Political Factors

Political factors that influence exchange rates include political stability, government policies, and international relations. Political stability is a key determinant of a currency’s value. A country with a stable political environment will typically have a stronger currency than a country with an unstable political environment.

Government policies can also have a significant impact on exchange rates. For example, a government that implements policies that are seen as being beneficial to the economy will typically see its currency strengthen. Conversely, a government that implements policies that are seen as being harmful to the economy will typically see its currency weaken.

International relations can also influence exchange rates. For example, a country that is involved in a trade war with another country will typically see its currency weaken. Conversely, a country that is involved in a peace treaty with another country will typically see its currency strengthen.

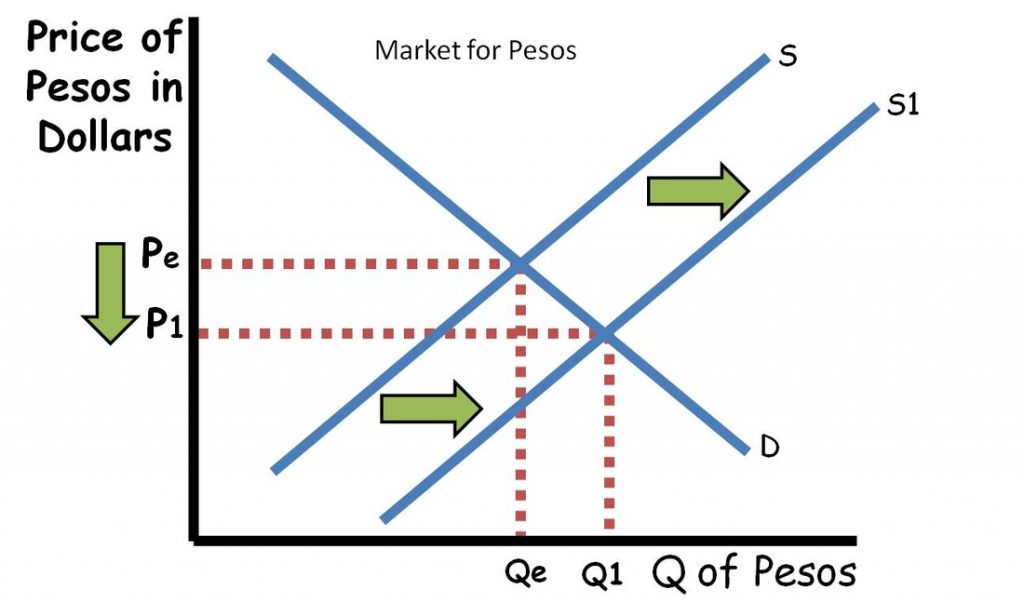

Supply and Demand

In addition to economic and political factors, exchange rates are also influenced by supply and demand. The supply of a currency is the amount of that currency that is available in the market. The demand for a currency is the amount of that currency that people want to buy. When the supply of a currency is greater than the demand, the value of that currency will fall. Conversely, when the demand for a currency is greater than the supply, the value of that currency will rise.

Types of Forex Transactions

Forex transactions involve various types, each with its own characteristics, advantages, and disadvantages. Understanding these transaction types is crucial for participants in the forex market.

The primary types of forex transactions include spot transactions, forward transactions, and swap transactions. Spot transactions involve the immediate exchange of currencies at the prevailing market rate, while forward transactions are agreements to exchange currencies at a specified future date and rate. Swap transactions, on the other hand, combine spot and forward transactions to facilitate the exchange of currencies with different value dates.

Spot Transactions

Spot transactions are the most common type of forex transaction. They involve the immediate exchange of currencies at the prevailing market rate. The settlement of spot transactions typically occurs within two business days.

Advantages of spot transactions include their simplicity, speed, and flexibility. However, they also carry the risk of exchange rate fluctuations, which can lead to losses if the exchange rate moves against the trader’s expectations.

Forward Transactions

Forward transactions are agreements to exchange currencies at a specified future date and rate. They are typically used to hedge against exchange rate risk or to lock in a favorable exchange rate for a future transaction.

Advantages of forward transactions include the ability to mitigate exchange rate risk and secure a fixed exchange rate for future transactions. However, they also involve a higher level of commitment and may incur additional costs, such as margin requirements.

Swap Transactions, Essay on foreign exchange market

Swap transactions combine spot and forward transactions to facilitate the exchange of currencies with different value dates. They are typically used for complex currency management strategies or to take advantage of interest rate differentials between different currencies.

Advantages of swap transactions include the ability to customize the terms of the transaction and to take advantage of interest rate differentials. However, they also involve a higher level of complexity and may incur additional costs, such as transaction fees.

Do not overlook the opportunity to discover more about the subject of foreign exchange market demand curve.

Risk Management in Forex: Essay On Foreign Exchange Market

Forex trading involves inherent risks that can lead to substantial financial losses. Understanding these risks and implementing effective risk management strategies are crucial for successful trading.

Risk management in forex primarily focuses on controlling the potential losses and protecting capital. It involves identifying and assessing the risks associated with each trade and implementing measures to mitigate or minimize their impact.

Risk Identification and Assessment

- Market Volatility: Forex markets are highly volatile, and exchange rates can fluctuate rapidly due to various factors such as economic news, political events, and natural disasters.

- Leverage: Many forex brokers offer leverage, which allows traders to control larger positions with a smaller amount of capital. While leverage can amplify profits, it also magnifies losses.

- Liquidity Risk: Forex markets are generally liquid, but liquidity can vary depending on the currency pair and market conditions. Reduced liquidity can make it difficult to enter or exit trades at desired prices.

- Counterparty Risk: Forex trades involve two parties, and there is always a risk that one party may default on their obligations, leading to financial losses.

Risk Management Strategies

- Stop-Loss Orders: These orders automatically close a trade when the price reaches a predetermined level, limiting potential losses.

- Position Sizing: Traders should carefully determine the size of their positions based on their risk tolerance and account balance.

- Diversification: Trading multiple currency pairs can help reduce the impact of losses in any one currency.

- Hedging: Traders can use hedging strategies to offset the risk of one position with another, reducing overall exposure.

- Risk-Reward Ratio: Traders should always consider the potential reward of a trade in relation to the potential risk before entering.

Technology in the Forex Market

Technology has revolutionized the foreign exchange market, enabling faster execution of trades, providing real-time market data, and facilitating risk management. The adoption of electronic trading platforms, algorithmic trading, and mobile trading apps has transformed the way traders access and execute trades.

Electronic Trading Platforms

- Electronic Communication Networks (ECNs): These platforms connect multiple market participants, providing a centralized marketplace for forex trading. They offer greater transparency, tighter spreads, and faster execution.

- Direct Market Access (DMA): DMA platforms allow traders to connect directly to liquidity providers, bypassing intermediaries and reducing latency.

Algorithmic Trading

Algorithmic trading involves using computer programs to execute trades based on predefined criteria. These algorithms can analyze market data, identify trading opportunities, and place orders automatically, providing traders with a competitive edge.

Mobile Trading Apps

Mobile trading apps have made it possible for traders to access the forex market from anywhere with an internet connection. These apps provide real-time quotes, charting tools, and trading capabilities, allowing traders to stay connected to the market and execute trades on the go.

Ethical Considerations in Forex

The foreign exchange market, with its vast global reach and significant financial transactions, raises ethical considerations that demand attention. Ensuring transparency, fair play, and responsible trading practices is crucial for maintaining the integrity and credibility of the market.

You also will receive the benefits of visiting foreign currency adalah today.

Transparency and Fair Play

Transparency in the forex market involves providing clear and accessible information about exchange rates, trading volumes, and market participants. This transparency promotes fair competition and prevents insider trading and other unethical practices. Fair play encompasses adhering to established rules and regulations, avoiding market manipulation, and ensuring equal opportunities for all participants.

The Future of the Forex Market

The foreign exchange market is constantly evolving, and the future holds many exciting possibilities. As technology continues to advance and regulations change, the way we trade currencies will continue to change.

Emerging Technologies

One of the most significant trends shaping the future of the forex market is the rise of emerging technologies. Artificial intelligence (AI) and machine learning (ML) are already being used to develop new trading strategies and automate tasks. In the future, these technologies are likely to become even more sophisticated, giving traders a significant advantage.

Another emerging technology that is expected to have a major impact on the forex market is blockchain. Blockchain is a distributed ledger technology that can be used to create secure and transparent records of transactions. This technology has the potential to revolutionize the way currencies are traded, making it faster, cheaper, and more secure.

Regulations

Regulations are another important factor that will shape the future of the forex market. In recent years, there has been a growing trend towards increased regulation of the forex market. This trend is likely to continue in the future, as governments seek to protect investors and ensure the stability of the financial system.

Increased regulation is likely to have a number of effects on the forex market. It could lead to higher costs for traders, as they will need to comply with new regulations. It could also make it more difficult for new traders to enter the market. However, increased regulation is also likely to make the forex market more stable and secure, which could benefit all traders in the long run.

Conclusion

The future of the forex market is bright. Emerging technologies and regulations are creating new opportunities and challenges for traders. Those who are able to adapt to these changes will be well-positioned to succeed in the years to come.

Closing Summary

In conclusion, the foreign exchange market plays a pivotal role in the global economy, facilitating international trade and investment. Its complex dynamics, influenced by a multitude of economic and political factors, present both opportunities and risks for participants.

As technology continues to reshape the market and regulations evolve, the future of forex remains uncertain but充满潜力.