Ap macro topic 6.3 the foreign exchange market answer key – AP Macro Topic 6.3: The Foreign Exchange Market Answer Key provides a comprehensive overview of the foreign exchange market, its participants, exchange rates, and their impact on businesses and economies. This guide delves into the intricacies of the global currency market, offering valuable insights and practical tips for managing exchange rate risk.

From defining exchange rates and analyzing their determinants to exploring forecasting methods and government intervention, this answer key equips readers with a thorough understanding of the foreign exchange market and its implications for international trade and economic growth.

The Foreign Exchange Market

The foreign exchange market, also known as forex or FX, is a global decentralized market where currencies are traded. It is the largest and most liquid financial market in the world, with a daily trading volume exceeding $5 trillion.

The foreign exchange market serves several important functions. First, it facilitates international trade. When a company imports goods or services from another country, it must exchange its domestic currency for the currency of the exporting country. The foreign exchange market provides the platform for this exchange.

Participants in the Foreign Exchange Market, Ap macro topic 6.3 the foreign exchange market answer key

The foreign exchange market is a diverse market with a wide range of participants. The largest participants are commercial banks, which account for about 50% of all foreign exchange trading. Other major participants include investment banks, hedge funds, and central banks.

Uses of the Foreign Exchange Market

The foreign exchange market is used for a variety of purposes. In addition to facilitating international trade, the foreign exchange market is also used for speculation, hedging, and investment.

Find out further about the benefits of the psychology of the foreign exchange market pdf that can provide significant benefits.

- Speculation: Speculators buy and sell currencies in the hope of making a profit from changes in their exchange rates.

- Hedging: Hedging is a strategy used to reduce the risk of foreign exchange fluctuations. For example, a company that imports goods from another country may buy a forward contract to lock in the exchange rate at a certain level.

- Investment: Some investors buy and sell currencies as a way to diversify their portfolios and earn a return on their investment.

Exchange Rates

Exchange rates are the prices of one currency in terms of another. They are determined by the forces of supply and demand in the foreign exchange market. The supply of a currency is the amount of that currency that is available for sale in the market, while the demand for a currency is the amount of that currency that people want to buy.

There are different types of exchange rates. The most common is the spot exchange rate, which is the price of a currency for immediate delivery. Other types of exchange rates include the forward exchange rate, which is the price of a currency for delivery at a future date, and the cross exchange rate, which is the price of one currency in terms of another currency that is not the US dollar.

For descriptions on additional topics like foreign exchange market short note, please visit the available foreign exchange market short note.

Exchange rates can have a significant impact on businesses and individuals. For example, a business that imports goods from another country will be affected by the exchange rate between the two countries. If the exchange rate rises, the business will have to pay more for the goods. Conversely, if the exchange rate falls, the business will have to pay less for the goods.

Check foreign exchange market functions and participants to inspect complete evaluations and testimonials from users.

Individuals can also be affected by exchange rates. For example, a person who is traveling to another country will need to exchange their currency for the currency of the country they are visiting. If the exchange rate is favorable, the person will get more of the foreign currency for their money. Conversely, if the exchange rate is unfavorable, the person will get less of the foreign currency for their money.

Determinants of Exchange Rates

The following are some of the factors that can affect exchange rates:

- Economic growth: A country with a strong economy will typically have a stronger currency than a country with a weak economy.

- Interest rates: A country with high interest rates will typically have a stronger currency than a country with low interest rates.

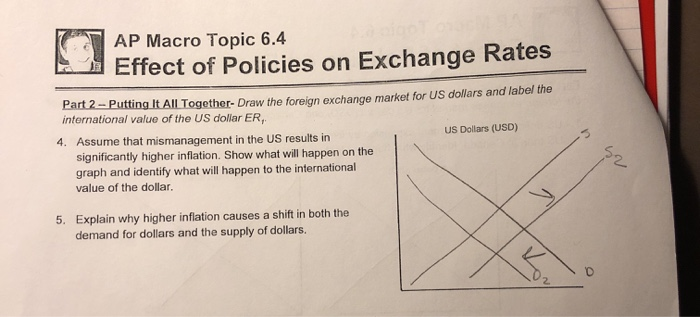

- Inflation: A country with high inflation will typically have a weaker currency than a country with low inflation.

- Political stability: A country with a stable political system will typically have a stronger currency than a country with an unstable political system.

- Government intervention: Governments can intervene in the foreign exchange market to influence the value of their currency.

Factors Affecting Exchange Rates

Exchange rates, the prices of one currency in terms of another, are constantly fluctuating due to a multitude of factors. These factors can be broadly categorized into economic, political, and psychological influences, each of which plays a significant role in shaping the value of currencies.

Economic Factors

- Interest Rates: Changes in interest rates can significantly impact exchange rates. Higher interest rates in a country make its currency more attractive to investors seeking higher returns, leading to an appreciation of the currency.

- Inflation: Inflation, a sustained increase in the general price level, can erode the purchasing power of a currency. High inflation can make a currency less valuable, leading to its depreciation.

- Economic Growth: A country with a strong and growing economy is more likely to attract foreign investment, which can increase demand for its currency and lead to appreciation.

- Balance of Payments: The balance of payments measures the difference between a country’s exports and imports. A trade surplus (more exports than imports) can strengthen a currency, while a trade deficit can weaken it.

Exchange Rate Forecasting

Exchange rate forecasting aims to predict future currency exchange rates. Methods used include:

- Technical Analysis: Examines historical price patterns to identify trends and predict future movements.

- Fundamental Analysis: Considers economic data like GDP, inflation, and interest rates to determine a currency’s intrinsic value.

- Econometric Models: Statistical models that use historical data to predict future exchange rates based on economic relationships.

The accuracy of these methods varies depending on market conditions and the time horizon of the forecast. Technical analysis tends to be more effective for short-term predictions, while fundamental analysis is better for long-term forecasts.

Tips for Managing Exchange Rate Risk

Businesses and individuals can manage exchange rate risk through:

- Hedging: Using financial instruments like forward contracts or options to lock in exchange rates for future transactions.

- Diversification: Investing in assets denominated in different currencies to reduce exposure to fluctuations in any one currency.

- Monitoring Market Conditions: Staying informed about economic and political events that may affect exchange rates.

The Impact of Exchange Rates on the Economy

Exchange rates, which determine the value of one currency relative to another, play a crucial role in influencing economic outcomes. Fluctuations in exchange rates can impact inflation, economic growth, and employment levels.

Inflation

Exchange rates can influence inflation through the cost of imported goods. A depreciation in the domestic currency makes imports more expensive, potentially leading to higher inflation. Conversely, an appreciation in the domestic currency reduces the cost of imports, which can help to keep inflation in check.

Economic Growth

Exchange rates can affect economic growth by influencing exports and imports. A depreciation in the domestic currency makes exports cheaper and imports more expensive, which can boost exports and reduce imports, leading to economic growth. Conversely, an appreciation in the domestic currency has the opposite effect, potentially slowing economic growth.

Employment

Exchange rate fluctuations can impact employment levels in export-oriented industries. A depreciation in the domestic currency makes exports more competitive, leading to increased demand for goods produced domestically and potentially creating jobs. Conversely, an appreciation in the domestic currency can lead to job losses in export-oriented industries.

Examples

The impact of exchange rates on economies can be seen in real-world examples. For instance, the depreciation of the Japanese yen in the 1990s led to a surge in Japanese exports and contributed to economic growth. In contrast, the appreciation of the Chinese yuan in recent years has made Chinese exports more expensive, potentially slowing economic growth.

Government Intervention

Governments can intervene in the foreign exchange market to manage exchange rates and mitigate their impact on the economy. They can use monetary policy, such as interest rate adjustments, to influence the value of their currency. Additionally, governments can implement capital controls or intervene directly in the foreign exchange market to stabilize exchange rates.

Closure: Ap Macro Topic 6.3 The Foreign Exchange Market Answer Key

In conclusion, AP Macro Topic 6.3: The Foreign Exchange Market Answer Key serves as an invaluable resource for students, businesses, and anyone seeking to navigate the complexities of the global currency market. Its comprehensive coverage, clear explanations, and practical guidance empower readers to make informed decisions and mitigate exchange rate risks.