Delving into the intricate world of foreign exchange, the BIS global foreign exchange market turnover presents a fascinating landscape of global financial flows, shaping international trade and investment. This comprehensive guide unravels the complexities of this dynamic market, exploring its major players, influencing factors, and regional distribution, providing a deep understanding of its impact on the global economy.

Global Foreign Exchange Market Overview

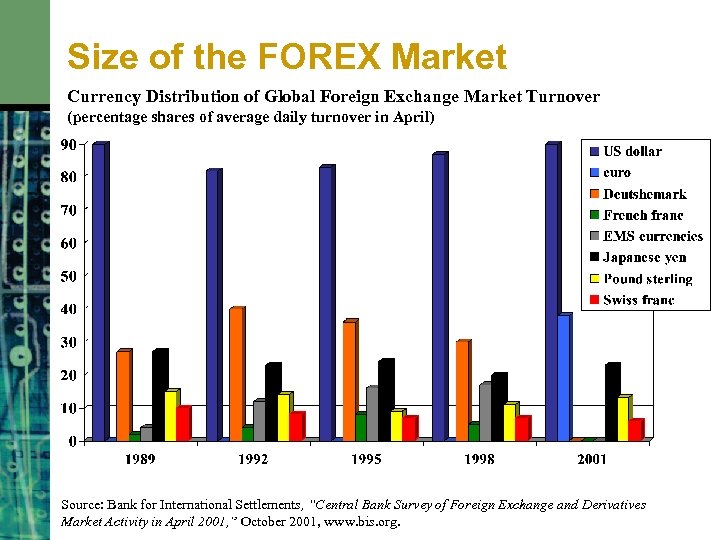

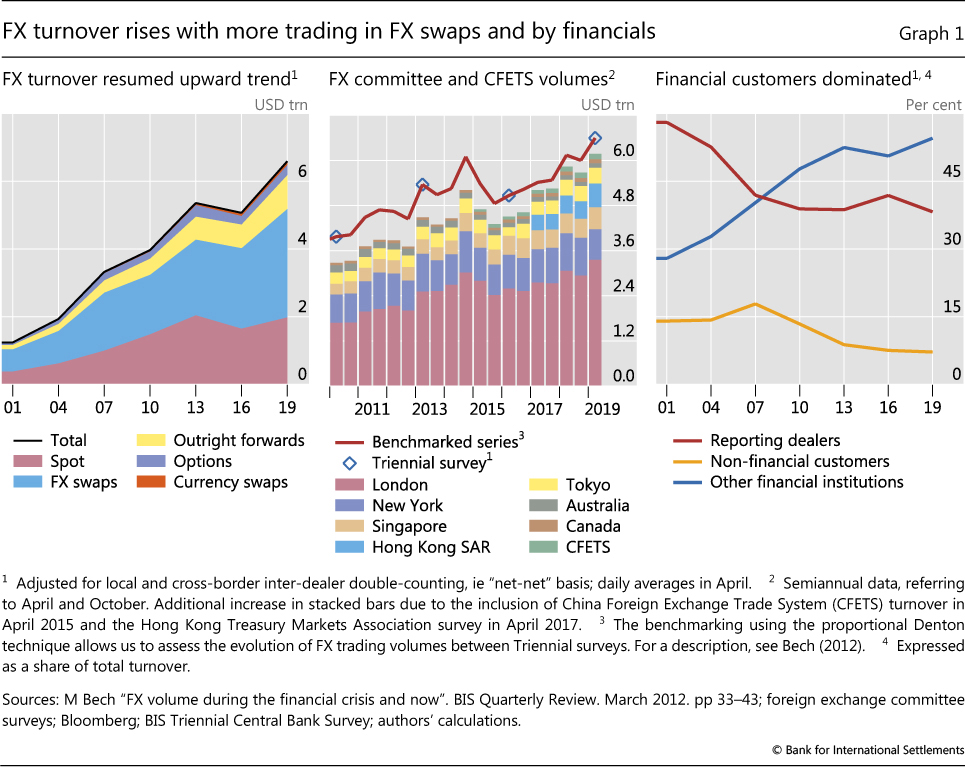

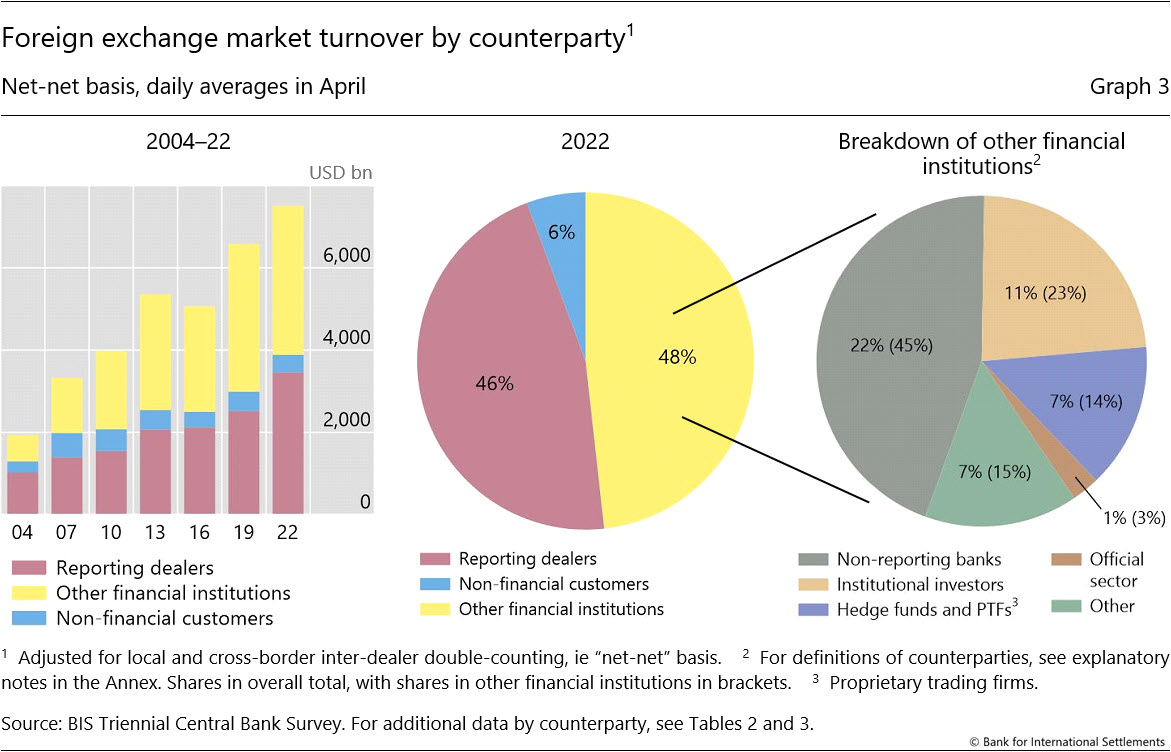

The global foreign exchange (forex) market is a decentralized global market for the trading of currencies. It is the largest financial market in the world, with a daily trading volume of over $5 trillion. The forex market is used by a wide range of participants, including banks, corporations, governments, and individual investors.

The major participants in the forex market are banks, which account for the majority of trading volume. Banks act as intermediaries between buyers and sellers of currencies, and they also provide liquidity to the market. Other major participants in the forex market include corporations, which use the market to hedge their foreign currency exposure, and governments, which use the market to manage their foreign exchange reserves.

The forex market is a 24-hour market, with trading taking place around the world. The market is divided into three main sessions: the Asian session, the European session, and the American session. The Asian session is the most active, with the majority of trading taking place in Tokyo and Hong Kong. The European session is the second most active, with the majority of trading taking place in London. The American session is the least active, with the majority of trading taking place in New York.

The forex market is a highly volatile market, with prices constantly fluctuating. This volatility is caused by a number of factors, including economic news, political events, and natural disasters. The volatility of the forex market can make it a risky market to trade in, but it can also provide opportunities for profit.

Factors Influencing Global Foreign Exchange Market Turnover

The global foreign exchange market is a dynamic and ever-changing landscape, with a multitude of factors influencing its turnover. These factors can be broadly categorized into economic and political factors.

Economic Factors

Economic factors play a significant role in shaping forex market turnover. Interest rate differentials, inflation, and economic growth are key economic indicators that impact the demand for currencies and, consequently, the volume of forex transactions.

Interest Rate Differentials

Interest rate differentials refer to the difference in interest rates between two countries. When interest rates are higher in one country compared to another, it can lead to increased demand for the currency of the country with higher interest rates. This is because investors are attracted to higher returns, leading to increased currency inflows and higher forex market turnover.

Finish your research with information from participants in foreign exchange market pdf.

Inflation

Inflation, or the rate at which prices increase, can also impact forex market turnover. High inflation can erode the value of a currency, making it less attractive to investors. As a result, currencies with higher inflation rates tend to experience lower demand, leading to reduced forex market turnover.

Economic Growth

Economic growth is another important economic factor that influences forex market turnover. Strong economic growth can lead to increased demand for a country’s currency, as investors seek to capitalize on opportunities in growing economies. This increased demand can result in higher forex market turnover.

Political Factors

Political factors can also have a significant impact on forex market turnover. Political stability, government policies, and geopolitical events can influence the demand for currencies and the volume of forex transactions.

Political Stability

Political stability is essential for a healthy forex market. Political instability, such as coups, wars, or civil unrest, can create uncertainty and risk aversion among investors. This can lead to decreased demand for currencies associated with politically unstable countries, resulting in lower forex market turnover.

Government Policies

Government policies, such as monetary policy and fiscal policy, can also influence forex market turnover. Changes in monetary policy, such as interest rate adjustments, can impact the attractiveness of a currency and affect forex market turnover.

Geopolitical Events

Geopolitical events, such as international conflicts, trade disputes, or natural disasters, can have a significant impact on forex market turnover. These events can create uncertainty and volatility in the markets, leading to increased demand for safe-haven currencies and reduced demand for riskier currencies.

Regional Distribution of Global Foreign Exchange Market Turnover: Bis Global Foreign Exchange Market Turnover

The global foreign exchange (forex) market is geographically dispersed, with different regions contributing varying proportions to the overall market turnover. The regional distribution of forex trading is influenced by several factors, including economic growth, financial market development, and regulatory frameworks.

The following table presents the regional distribution of global forex market turnover, based on data from the Bank for International Settlements (BIS):

| Region | Turnover (USD billions) | Percentage of Total |

|---|---|---|

| Americas | 19.3 | 39.9% |

| Europe | 15.5 | 31.8% |

| Asia-Pacific | 11.9 | 24.5% |

| Other | 1.8 | 3.8% |

The Americas region dominates the global forex market, accounting for nearly 40% of the total turnover. This dominance is largely due to the presence of major financial centers such as New York, Chicago, and Toronto. These centers are home to a large number of banks, investment firms, and other financial institutions that engage in foreign exchange trading.

Europe is the second-largest region in terms of forex market turnover, accounting for about 32% of the total. The region is home to major financial centers such as London, Frankfurt, and Paris. These centers are known for their deep and liquid foreign exchange markets, which attract a wide range of participants.

The Asia-Pacific region is the third-largest region in terms of forex market turnover, accounting for about 25% of the total. The region has experienced strong economic growth in recent years, which has led to increased demand for foreign exchange services. The region is also home to a number of major financial centers, such as Tokyo, Hong Kong, and Singapore.

The remaining regions, including the Middle East, Africa, and Eastern Europe, account for a relatively small share of global forex market turnover. However, these regions are expected to see increased activity in the coming years as their economies continue to grow and their financial markets develop.

Currency Pairs and Trading Patterns

The global foreign exchange market is characterized by a vast array of currency pairs, each with its unique trading patterns and characteristics. Understanding the most actively traded currency pairs and the factors influencing their popularity is crucial for traders seeking to navigate the complexities of the forex market.

You also can understand valuable knowledge by exploring foreign exchange market with examples.

Most Actively Traded Currency Pairs

The most actively traded currency pairs, often referred to as “majors,” include the following:

- EUR/USD (Euro/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

- GBP/USD (British Pound/US Dollar)

- USD/CHF (US Dollar/Swiss Franc)

- AUD/USD (Australian Dollar/US Dollar)

- USD/CAD (US Dollar/Canadian Dollar)

These currency pairs account for a significant portion of global forex market turnover, reflecting their importance in international trade and investment.

Factors Influencing Currency Pair Popularity

Several factors contribute to the popularity of specific currency pairs:

- Economic Strength: The economic strength and stability of the underlying countries play a significant role in determining the popularity of a currency pair. Currencies of countries with strong economies tend to be more actively traded.

- Interest Rate Differentials: Differences in interest rates between countries can influence the demand for a particular currency pair. Traders often seek out currency pairs with attractive carry trade opportunities, where they can borrow in one currency with a low interest rate and invest in another currency with a higher interest rate.

- Political Stability: Political stability and economic uncertainty can also affect currency pair popularity. Currencies of countries with political instability or economic turmoil tend to be less desirable for trading.

- Liquidity: Liquidity refers to the ease with which a currency can be bought or sold in the market. Currency pairs with high liquidity are more attractive to traders, as they can execute trades quickly and efficiently.

Trading Patterns and Trends

Trading patterns and trends in major currency pairs can provide valuable insights for traders. Technical analysis techniques, such as charting and trendlines, can help identify potential trading opportunities. Additionally, economic data releases, such as GDP reports and interest rate decisions, can significantly impact currency pair movements.

Impact of Technology on Global Foreign Exchange Market Turnover

Technology has revolutionized the global foreign exchange market, facilitating trading, increasing accessibility, and transforming market dynamics.

Discover the crucial elements that make what are foreign exchange market trading the top choice.

Electronic trading platforms have emerged as the primary venues for forex transactions, enabling traders to execute trades directly with each other or through intermediaries. These platforms provide real-time market data, liquidity, and execution capabilities, significantly reducing transaction costs and increasing efficiency.

Algorithmic Trading

Algorithmic trading, also known as algo trading, has further automated the forex market. Algorithms are computer programs that execute trades based on predefined rules and strategies. Algo trading allows traders to automate their trading decisions, respond quickly to market movements, and optimize their execution strategies.

Mobile Trading and Social Media

Mobile trading apps and social media platforms have made forex trading more accessible to retail traders. Mobile apps allow traders to monitor markets and execute trades from their smartphones, while social media platforms provide a forum for traders to share information, strategies, and market insights.

Future Trends in Global Foreign Exchange Market Turnover

The global foreign exchange (forex) market is constantly evolving, and several emerging trends are expected to shape its future. These trends include the increasing use of blockchain technology, artificial intelligence (AI), and regulatory changes.

Impact of Blockchain Technology, Bis global foreign exchange market turnover

Blockchain technology has the potential to revolutionize the forex market by providing a secure and transparent way to process transactions. Blockchain is a distributed ledger system that records transactions in a way that makes them immutable and tamper-proof. This could help to reduce the risk of fraud and increase the efficiency of the forex market.

Impact of Artificial Intelligence

AI is another emerging trend that is expected to have a significant impact on the forex market. AI can be used to automate tasks, such as data analysis and trade execution. This could help to improve the efficiency and profitability of forex trading.

Impact of Regulatory Changes

Regulatory changes are another factor that could affect the future of the global forex market. In recent years, there has been a trend towards increased regulation of the forex market. This could lead to increased costs for forex brokers and traders, and it could also make it more difficult to access the market.

Forecast of Future Growth and Evolution

Despite the challenges posed by emerging trends and regulatory changes, the global forex market is expected to continue to grow in the coming years. The market is expected to be driven by increasing global trade and investment, as well as the growing popularity of online forex trading.

Last Recap

In conclusion, the BIS global foreign exchange market turnover serves as a barometer of global economic activity, reflecting the interplay of economic, political, and technological forces. As the market continues to evolve, driven by innovation and regulatory changes, its future trajectory holds immense significance for businesses, investors, and policymakers alike, shaping the contours of international finance in the years to come.