Foreign exchange market advantages and disadvantages pdf – The foreign exchange market, a dynamic and complex arena, presents both alluring opportunities and potential pitfalls. This guide delves into the intricacies of the forex market, exploring its advantages and disadvantages to equip you with the knowledge necessary to navigate its volatile waters.

From the potential for profit generation to the challenges of currency fluctuations, this guide unravels the complexities of the forex market, providing valuable insights for both seasoned traders and those seeking to venture into this intriguing realm.

Market Overview

The foreign exchange market (Forex) is the world’s largest financial market, with a daily trading volume exceeding $5 trillion. It operates 24 hours a day, 5 days a week, facilitating the exchange of currencies between banks, institutions, and individuals.

The Forex market has evolved significantly over the years. In the past, currency exchange was conducted primarily through physical trading at exchange centers. However, the advent of electronic trading platforms in the 1970s revolutionized the industry, making it more accessible and efficient. Today, the majority of Forex trading is conducted online.

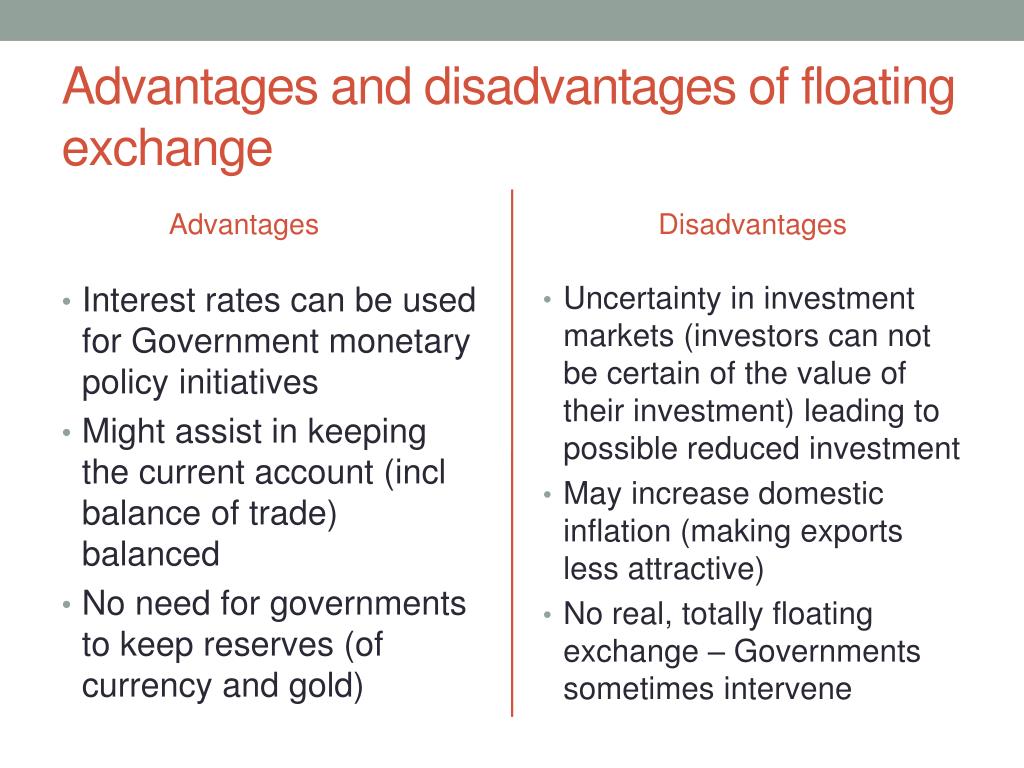

Advantages of Foreign Exchange Market Participation

The foreign exchange market presents numerous advantages for participants, ranging from profit-making opportunities to risk management and facilitation of global economic activities.

One of the primary advantages of participating in the foreign exchange market is the potential for profit generation through currency fluctuations. Forex traders can capitalize on changes in currency values by buying and selling currencies at favorable exchange rates. Successful traders can generate significant profits by accurately predicting currency movements and executing timely trades.

Hedging Against Currency Risks for Businesses

Businesses engaged in international trade or investment are exposed to currency risks, which can significantly impact their profitability. The foreign exchange market provides a platform for businesses to hedge against these risks through forward contracts, options, and other financial instruments. By locking in exchange rates, businesses can protect themselves from adverse currency movements and ensure stable cash flows.

Facilitating International Trade and Investment

The foreign exchange market plays a vital role in facilitating international trade and investment. It enables businesses to exchange currencies efficiently, removing barriers to global commerce. Without a well-functioning foreign exchange market, cross-border transactions would be significantly more complex and costly, hindering global economic growth.

Disadvantages of Foreign Exchange Market Participation

The foreign exchange market, while offering numerous opportunities, also poses certain risks and challenges. Volatility and fluctuations in currency values can lead to substantial losses, and navigating the complexities of the market can be demanding.

Currency Volatility and Market Fluctuations

Currency values are constantly fluctuating due to various economic, political, and market factors. These fluctuations can be unpredictable and rapid, leading to significant losses for traders who fail to manage their risk exposure effectively. Sudden shifts in market sentiment, economic data releases, or geopolitical events can trigger sharp movements in currency pairs, potentially eroding capital in a matter of minutes or seconds.

Potential for Losses Due to Adverse Exchange Rate Movements

The primary risk in foreign exchange trading stems from the potential for losses due to adverse exchange rate movements. When a trader enters a trade, they are essentially betting on the future value of one currency relative to another. If the market moves against their position, they will incur losses proportional to the magnitude of the exchange rate change. The floating nature of exchange rates means that these losses can be substantial, especially during periods of high volatility.

Complexities and Challenges of Navigating the Market

The foreign exchange market is a complex and challenging environment to navigate, even for experienced traders. The market operates 24 hours a day, five days a week, across multiple global financial centers, making it difficult to keep track of all relevant market developments. Traders must also contend with a wide range of financial instruments, including spot, forward, and options contracts, each with its own unique characteristics and risks.

Market Dynamics and Influences: Foreign Exchange Market Advantages And Disadvantages Pdf

Currency exchange rates are influenced by a multitude of factors, creating a dynamic and ever-evolving market. Understanding these influences is crucial for market participants to make informed decisions and manage risk.

Check foreign exchange market economics to inspect complete evaluations and testimonials from users.

Economic data, geopolitical events, and central bank policies play significant roles in shaping currency values. Economic indicators, such as GDP growth, inflation rates, and unemployment levels, provide insights into the health of a country’s economy and its currency’s strength. Geopolitical events, such as wars, political instability, and natural disasters, can also have a profound impact on exchange rates, as they affect market sentiment and risk appetite.

Central Bank Policies

Central banks, responsible for managing a country’s monetary policy, have a significant influence on currency exchange rates. Interest rate decisions, quantitative easing, and other monetary policies can affect the attractiveness of a currency and its value relative to others.

Investigate the pros of accepting foreign exchange market today in nigeria in your business strategies.

Market Participants

Market participants, including banks, corporations, and individual traders, contribute to the dynamics of the foreign exchange market. Banks act as intermediaries, facilitating transactions and providing liquidity. Corporations engage in currency trading to manage their global operations and hedge against foreign exchange risks. Individual traders speculate on currency movements, seeking to profit from fluctuations in exchange rates.

Trading Strategies and Techniques

Foreign exchange traders employ a diverse range of strategies and techniques to navigate the dynamic market and capitalize on opportunities. These strategies can be broadly classified into two categories: technical analysis and fundamental analysis.

Technical Analysis Techniques, Foreign exchange market advantages and disadvantages pdf

- Trend Analysis: Identifying and trading in the direction of established market trends using indicators like moving averages and support/resistance levels.

- Chart Patterns: Recognizing and trading based on recurring chart patterns, such as triangles, flags, and head-and-shoulders formations.

- Candlestick Patterns: Analyzing candlestick charts to identify potential reversals and continuation patterns.

- Technical Indicators: Utilizing mathematical formulas to generate buy/sell signals, such as Bollinger Bands, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD).

Fundamental Analysis Techniques

- Economic Indicators: Monitoring economic data releases, such as GDP growth, inflation, and interest rates, to gauge the overall health of an economy and its currency.

- Political Events: Considering geopolitical events, such as elections, trade agreements, and conflicts, which can significantly impact currency values.

- Central Bank Policies: Analyzing monetary policy decisions, such as interest rate changes and quantitative easing, to understand their impact on currency valuations.

- News and Sentiment: Monitoring news events and market sentiment to identify potential market-moving events.

Trading Strategies Comparison

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Trend Following | – Aligns with market momentum – Simplifies trading decisions | – Vulnerable to trend reversals – Requires precise entry and exit points |

| Range Trading | – Exploits predictable price movements within defined ranges – Lowers risk by setting clear boundaries | – Limited profit potential – Requires accurate range identification |

| Carry Trade | – Profits from interest rate differentials – Can generate consistent returns | – High risk due to potential currency fluctuations – Requires a stable political and economic environment |

| Scalping | – Generates small profits from rapid price movements – High frequency of trades | – Requires significant trading experience – High risk due to small profit margins |

| News Trading | – Capitalizes on market reactions to news events – Can generate significant profits | – Requires quick decision-making – High risk due to market volatility |

Risk Management and Mitigation

In foreign exchange trading, risk management is paramount to safeguard capital and ensure long-term profitability. It involves identifying, assessing, and controlling potential risks associated with currency fluctuations.

Discover how foreign exchange market ppt free download has transformed methods in RELATED FIELD.

Developing a Risk Management Plan

A comprehensive risk management plan Artikels strategies and measures to minimize losses and maximize gains. It should include:

- Risk tolerance: Determining the acceptable level of risk based on financial goals and risk appetite.

- Risk assessment: Identifying and evaluating potential risks, including currency volatility, economic events, and political instability.

- Risk mitigation strategies: Implementing techniques such as hedging, stop-loss orders, and diversification to reduce exposure to risks.

li>Risk monitoring and review: Regularly reviewing and adjusting the risk management plan as market conditions and risk profiles change.

Hedging Techniques

Hedging involves using financial instruments to offset the risk of adverse currency movements. Common hedging techniques include:

- Forward contracts: Agreements to buy or sell a currency at a predetermined rate in the future.

- Options: Contracts that give the holder the right, but not the obligation, to buy or sell a currency at a specific price within a specified time frame.

- Currency swaps: Agreements to exchange one currency for another at a fixed rate for a specified period.

Other Risk Mitigation Strategies

In addition to hedging, other risk mitigation strategies include:

- Diversification: Spreading investments across different currencies to reduce the impact of fluctuations in any single currency.

- Position sizing: Managing the size of trades to limit potential losses.

- Stop-loss orders: Automatic orders to close a position if it reaches a predefined loss threshold.

Regulatory Environment and Market Structure

The foreign exchange market is a decentralized global market with no central authority or exchange. However, it is subject to regulation by central banks and other regulatory bodies in different jurisdictions.

Central banks play a crucial role in managing exchange rates, maintaining financial stability, and regulating the banking system. They intervene in the market to influence exchange rates and provide liquidity. Other regulatory bodies, such as the Commodity Futures Trading Commission (CFTC) in the United States and the Financial Conduct Authority (FCA) in the United Kingdom, oversee the activities of market participants and enforce regulations to prevent fraud and manipulation.

Market Structure

The foreign exchange market consists of two main components: the interbank market and retail brokers.

- Interbank Market: The interbank market is where large financial institutions, such as banks, hedge funds, and investment banks, trade currencies directly with each other. It is the primary market for large-volume currency transactions and sets the benchmark exchange rates.

- Retail Brokers: Retail brokers provide access to the foreign exchange market for individual traders and smaller institutions. They offer trading platforms and services to facilitate currency transactions and provide leverage to traders.

Conclusive Thoughts

In conclusion, the foreign exchange market offers a unique blend of opportunities and risks, demanding a thorough understanding of its dynamics and a prudent approach to trading. By carefully considering the advantages and disadvantages Artikeld in this guide, you can harness the potential rewards while mitigating the inherent risks, ultimately achieving success in the ever-evolving world of forex trading.