Advantages and disadvantages of foreign exchange market class 12 – In the realm of global finance, the foreign exchange market stands as a pivotal force, shaping international trade and investment. As we delve into the intricacies of this dynamic market, we shall uncover its advantages and disadvantages, providing a comprehensive understanding for students of Class 12.

The foreign exchange market offers a multitude of benefits, enabling businesses and individuals to navigate the complexities of global commerce. By facilitating currency conversions, it removes barriers to international trade, fostering economic growth and interconnectedness. Moreover, the market provides opportunities for speculation and hedging, allowing participants to manage financial risk and potentially generate profits.

Advantages of Foreign Exchange Market: Advantages And Disadvantages Of Foreign Exchange Market Class 12

Benefits of Participating in Foreign Exchange Market

Participating in the foreign exchange market offers numerous advantages to businesses and individuals. The market provides a platform for currency exchange, hedging against foreign exchange risks, and speculation on currency price movements.

Businesses

- Facilitate International Trade: The foreign exchange market enables businesses to conduct international trade by converting their domestic currency into the currency of the country they are importing or exporting from.

- Manage Currency Risk: Businesses can hedge against foreign exchange risks by using the foreign exchange market to lock in exchange rates for future transactions, mitigating the impact of currency fluctuations on their profits.

- Speculate on Currency Movements: Some businesses engage in speculation in the foreign exchange market to potentially profit from currency price fluctuations.

Individuals

- Travel and Tourism: Individuals traveling abroad can use the foreign exchange market to exchange their domestic currency into the currency of the country they are visiting.

- Overseas Investments: Individuals investing in foreign assets or real estate can use the foreign exchange market to convert their domestic currency into the currency of the country where the investment is located.

- Education Abroad: Students studying abroad can use the foreign exchange market to convert their domestic currency into the currency of the country where they are studying.

Role in International Trade and Investment

The foreign exchange market plays a crucial role in facilitating international trade and investment. By providing a platform for currency exchange, the market enables businesses and individuals to engage in cross-border transactions seamlessly. This facilitates the flow of goods, services, and capital across borders, contributing to global economic growth and development.

You also can investigate more thoroughly about foreign exchange market share to enhance your awareness in the field of foreign exchange market share.

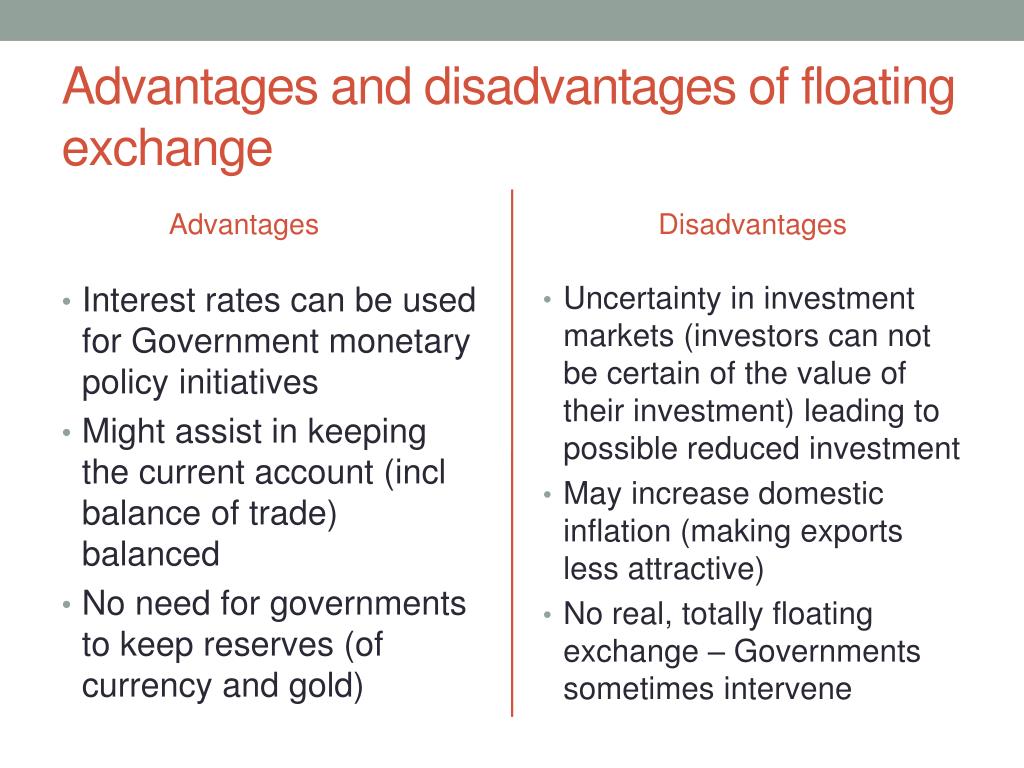

Disadvantages of Foreign Exchange Market

The foreign exchange market, despite its benefits, also presents several risks and challenges that traders and businesses need to be aware of. Currency fluctuations, market manipulation, and the potential for losses can impact both individuals and organizations.

Currency Fluctuations

- Unpredictable currency fluctuations can adversely affect businesses engaged in international trade.

- Companies may face losses if the value of their home currency appreciates against the currency of the country they import from, as it makes imports more expensive.

- Individuals traveling abroad may find their purchasing power reduced if the value of their home currency depreciates against the currency of their destination.

Market Manipulation

- The foreign exchange market is susceptible to manipulation by large financial institutions or individuals with significant capital.

- These entities can artificially inflate or deflate currency values to profit from the resulting fluctuations.

- Market manipulation can lead to false signals and increased volatility, making it difficult for traders to make informed decisions.

Potential for Losses

- Trading in the foreign exchange market involves significant risk, and traders can lose their entire investment.

- Leverage, a common practice in forex trading, can amplify both profits and losses.

- Inexperienced traders may not fully understand the risks involved and may make unwise decisions that result in substantial losses.

Factors Affecting Foreign Exchange Rates

The foreign exchange market is a dynamic environment where currency values are constantly fluctuating. A variety of factors influence these fluctuations, including economic conditions, political events, and market sentiment. Understanding these factors is crucial for businesses and investors who engage in international transactions.

Economic Conditions

Economic conditions play a significant role in determining foreign exchange rates. Strong economic growth, low inflation, and stable interest rates tend to strengthen a country’s currency, as these factors indicate a healthy economy and attract foreign investment. Conversely, weak economic growth, high inflation, and volatile interest rates can weaken a currency, as they signal economic instability and deter foreign investors.

Political Events

Political events can also have a significant impact on foreign exchange rates. Political uncertainty, such as elections, changes in government, or international conflicts, can cause investors to seek safe havens for their assets, leading to increased demand for currencies of politically stable countries. Major political events, such as wars or economic sanctions, can also disrupt trade and investment flows, affecting currency values.

Market Sentiment, Advantages and disadvantages of foreign exchange market class 12

Market sentiment, or the overall perception of market participants, can also influence foreign exchange rates. Positive market sentiment, such as optimism about economic growth or expectations of a rise in interest rates, can lead to increased demand for a currency, while negative sentiment can cause its value to decline. Speculators, who buy and sell currencies based on market sentiment, can also amplify these fluctuations.

Role of Central Banks

Central banks play a crucial role in managing foreign exchange rates. They use monetary policy tools, such as interest rate adjustments and foreign exchange interventions, to influence the value of their currency. By raising interest rates, central banks can make their currency more attractive to foreign investors, leading to an appreciation in its value. Conversely, lowering interest rates can weaken a currency.

Notice foreign exchange market types of transaction for recommendations and other broad suggestions.

Types of Foreign Exchange Market Participants

The foreign exchange market is a vast and complex ecosystem involving a diverse range of participants. These participants play crucial roles in facilitating currency transactions and shaping market dynamics.

Banks

Banks are the most significant participants in the foreign exchange market. They act as intermediaries between buyers and sellers of currencies, providing liquidity and facilitating the smooth functioning of the market. Banks also engage in proprietary trading, using their knowledge and expertise to profit from currency fluctuations.

Obtain a comprehensive document about the application of foreign exchange market interview questions that is effective.

Brokers

Brokers are intermediaries who connect buyers and sellers of currencies. They do not hold positions in currencies themselves but facilitate transactions between their clients. Brokers typically charge a commission for their services, which can vary depending on the volume of transactions and the type of currency pair traded.

Individual Traders

Individual traders, also known as retail traders, participate in the foreign exchange market on a smaller scale compared to banks and brokers. They speculate on currency movements and attempt to profit from short-term fluctuations. Individual traders often use leverage to increase their potential profits but also expose themselves to higher risks.

Impact on Market Dynamics

The different types of participants in the foreign exchange market have a significant impact on market dynamics. Banks provide liquidity and stability, while brokers facilitate transactions and connect buyers and sellers. Individual traders contribute to market volatility and can influence currency movements, especially during periods of high speculation.

Strategies for Managing Foreign Exchange Risk

Businesses and individuals can use various strategies to manage foreign exchange risk, which arises from the fluctuations in exchange rates between different currencies. These strategies aim to reduce the potential financial losses that may result from adverse currency movements.

Hedging Instruments

Hedging instruments are financial tools used to mitigate foreign exchange risk by locking in an exchange rate for future transactions. Two common hedging instruments are forward contracts and options:

– Forward Contracts: A forward contract is an agreement between two parties to exchange a specified amount of currency at a predetermined exchange rate on a future date. This allows businesses to fix the exchange rate for a future transaction, reducing the risk of unfavorable currency movements.

– Options: An option gives the buyer the right, but not the obligation, to buy or sell a specified amount of currency at a predetermined exchange rate within a certain time frame. This flexibility allows businesses to protect against potential losses while maintaining the opportunity to benefit from favorable currency movements.

Summary

In conclusion, the foreign exchange market presents both opportunities and challenges. Its advantages, such as facilitating international trade and providing risk management tools, must be weighed against its disadvantages, including currency fluctuations and the potential for losses. Understanding these factors empowers businesses and individuals to make informed decisions in the global financial arena.