Foreign exchange options and risk management market dynamics models and human behaviour – Foreign exchange options and risk management market dynamics models and human behavior: this captivating topic delves into the intricacies of currency trading, exploring the models and psychological factors that shape market dynamics and decision-making.

From understanding the principles of foreign exchange options to analyzing market dynamics and mitigating risks, this comprehensive guide provides a holistic perspective on the complex world of currency trading.

Foreign Exchange Options Market Dynamics

Foreign exchange (FX) options are financial instruments that give the buyer the right, but not the obligation, to buy or sell a specific amount of currency at a predetermined exchange rate on or before a certain date. They are used by businesses and investors to hedge against foreign exchange risk and speculate on currency movements.

Obtain direct knowledge about the efficiency of foreign exchange market value meaning through case studies.

Types of Foreign Exchange Options

- Call options give the buyer the right to buy a specific amount of currency at a predetermined exchange rate on or before a certain date.

- Put options give the buyer the right to sell a specific amount of currency at a predetermined exchange rate on or before a certain date.

- European-style options can only be exercised on the expiration date.

- American-style options can be exercised at any time up to and including the expiration date.

Factors Influencing the Pricing of Foreign Exchange Options

- Spot exchange rate: The current exchange rate for the underlying currency pair.

- Strike price: The predetermined exchange rate at which the option can be exercised.

- Time to expiration: The amount of time remaining until the option expires.

- Volatility: The expected volatility of the underlying currency pair.

- Interest rates: The interest rates in the two countries whose currencies are involved in the option.

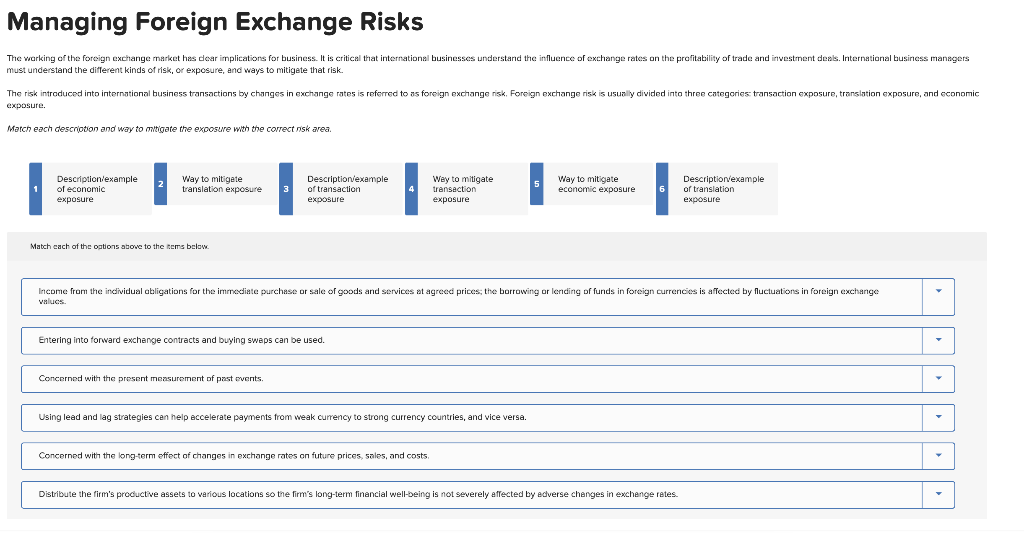

Risk Management in Foreign Exchange Options

Foreign exchange (FX) options trading involves various risks that need to be carefully managed to protect the trader’s capital and ensure profitable outcomes. Understanding and implementing effective risk management strategies is crucial for success in this market.

Do not overlook the opportunity to discover more about the subject of functions and structure of foreign exchange market.

Risks Associated with Foreign Exchange Options

- Currency Risk: Fluctuations in exchange rates can significantly impact the value of FX options, leading to losses if the underlying currency moves against the trader’s position.

- Time Decay Risk: As options have a finite lifespan, their value decays over time, which can result in losses if the option expires worthless.

- Volatility Risk: Changes in implied volatility can affect the option’s value, leading to potential losses if volatility moves in an unfavorable direction.

- Counterparty Risk: When trading FX options, there is a risk of default by the counterparty, which can result in financial losses.

- Operational Risk: Errors in order execution, system failures, or human mistakes can lead to losses in FX options trading.

Risk Management Techniques

To mitigate these risks, traders can employ various risk management techniques, including:

- Hedging: Using offsetting positions in the underlying currency or other financial instruments to reduce the impact of adverse price movements.

- Diversification: Trading options on different currencies and underlying assets to spread risk across various markets.

- Position Sizing: Carefully managing the size of each trade relative to the trader’s capital and risk tolerance.

- Stop-Loss Orders: Setting pre-defined price levels at which positions are automatically closed to limit potential losses.

- Risk-Reward Analysis: Assessing the potential reward of an option trade against the associated risk before entering a position.

Importance of Risk Management

Effective risk management is essential in FX options trading for several reasons:

- Preserves Capital: By implementing sound risk management strategies, traders can protect their capital from potential losses and ensure the longevity of their trading activities.

- Enhances Profitability: Risk management helps traders make informed decisions and avoid excessive risk-taking, which can lead to increased profitability over the long term.

- Promotes Discipline: Risk management imposes discipline on traders, encouraging them to adhere to pre-defined rules and avoid emotional decision-making.

Models for Analyzing Foreign Exchange Options: Foreign Exchange Options And Risk Management Market Dynamics Models And Human Behaviour

Various models are employed to analyze foreign exchange options, each offering distinct advantages and drawbacks. The selection of an appropriate model depends on the specific requirements and characteristics of the option being analyzed.

Obtain recommendations related to foreign exchange market of functions that can assist you today.

Binomial Model

- Divides the option’s life into discrete time intervals.

- Assumes the underlying asset’s price follows a binomial distribution.

- Provides a relatively simple and intuitive approach.

- May not be accurate for options with long maturities or complex features.

Black-Scholes Model

- Assumes the underlying asset’s price follows a lognormal distribution.

- Considers factors such as volatility, interest rates, and time to maturity.

- Widely used for pricing and hedging foreign exchange options.

- May not be suitable for options with non-linear payoffs or exotic features.

Monte Carlo Simulation

- Generates random paths for the underlying asset’s price.

- Simulates the option’s value under each path.

- Provides a more flexible and versatile approach.

- Can be computationally intensive, especially for complex options.

Finite Difference Methods

- Discretizes the partial differential equation governing the option’s value.

- Solves the resulting system of equations to obtain the option’s price.

- Provides high accuracy, especially for long-term options.

- Can be computationally demanding and may not be suitable for complex options.

Importance of Model Selection

Choosing the appropriate model for analyzing foreign exchange options is crucial. The model should:

- Capture the key characteristics of the option.

- Provide accurate and reliable results.

- Be computationally efficient and feasible for the available resources.

By carefully considering these factors, traders and analysts can select the most suitable model to effectively analyze foreign exchange options and make informed decisions.

Human Behavior in Foreign Exchange Options

Human behavior plays a significant role in foreign exchange options trading, as it can influence traders’ decision-making and market dynamics.

Traders are susceptible to various psychological biases that can affect their judgment, such as:

Confirmation Bias

Traders tend to seek information that confirms their existing beliefs and ignore evidence that contradicts them. This can lead to overconfidence and poor decision-making.

Overconfidence

Traders may overestimate their abilities and knowledge, leading them to take excessive risks and make poor trades.

Fear of Missing Out (FOMO)

Traders may feel pressure to enter or exit trades based on market movements, even when it is not in line with their trading plan.

Herd Mentality

Traders may follow the crowd and make trades based on what others are doing, rather than their own analysis.

Strategies for Overcoming Biases, Foreign exchange options and risk management market dynamics models and human behaviour

To overcome these biases, traders can:

- Be aware of their own biases and take steps to mitigate them.

- Seek objective information and consider multiple perspectives before making decisions.

- Stick to a trading plan and avoid making impulsive trades based on emotions.

- Learn from their mistakes and use them to improve their trading strategies.

Conclusion

In the realm of foreign exchange options, market dynamics are intricately intertwined with risk management strategies and human behavior. By comprehending the interplay of these elements, traders can navigate the complexities of currency markets with greater confidence and effectiveness.