Speculation and arbitrage in foreign exchange market – Speculation and arbitrage are fundamental pillars of the foreign exchange market, shaping currency prices, volatility, and liquidity. This engaging overview explores the motivations and strategies of speculators and arbitrageurs, delving into the intricate world of currency trading.

Speculation, driven by the anticipation of price movements, and arbitrage, exploiting price discrepancies, play a crucial role in market dynamics, offering both opportunities and risks for savvy traders.

Definition and Overview

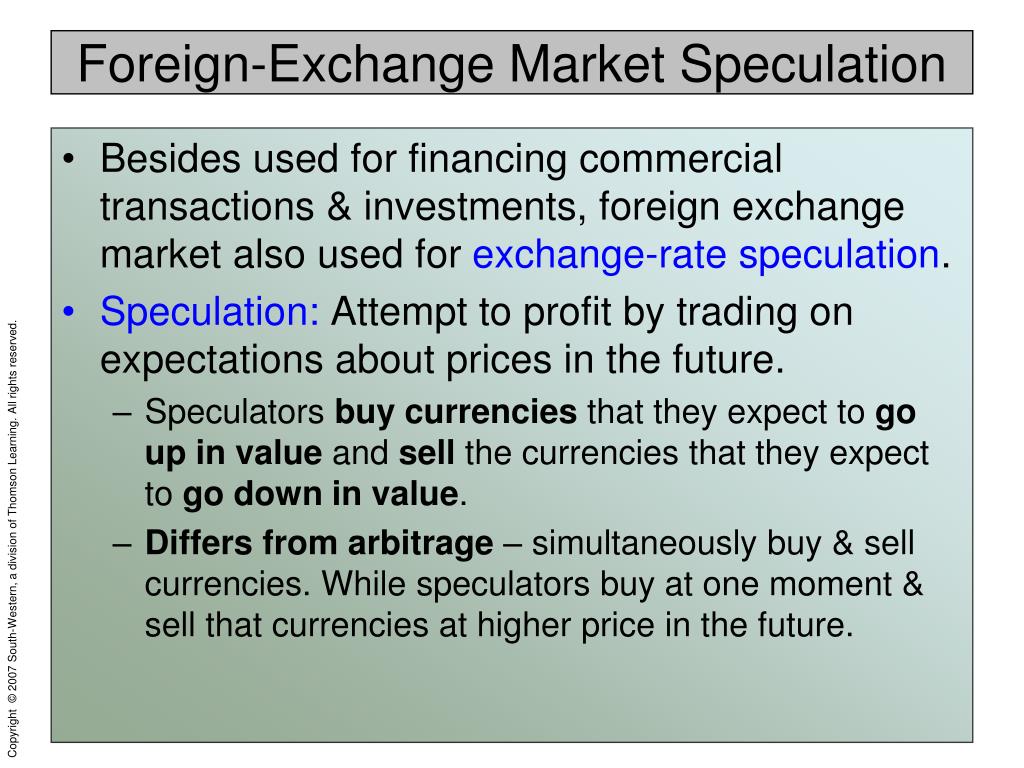

In the realm of foreign exchange, speculation and arbitrage are two fundamental strategies employed by market participants to capitalize on price fluctuations and profit from currency exchange rate movements.

Speculators, driven by the belief that a currency’s value will change in the future, buy or sell currencies with the intention of profiting from the anticipated price difference. Arbitrageurs, on the other hand, seek to exploit price discrepancies between different currency markets or trading platforms, aiming to execute simultaneous transactions that result in a risk-free profit.

Motivations and Objectives

Speculators are motivated by the potential for high returns, often engaging in short-term trading strategies to capitalize on market volatility. They rely on technical analysis, fundamental analysis, or a combination of both to make informed trading decisions. Arbitrageurs, in contrast, focus on identifying and exploiting inefficiencies in the market, typically engaging in low-risk, short-term strategies to capture small but consistent profits.

Types of Speculation and Arbitrage: Speculation And Arbitrage In Foreign Exchange Market

In the foreign exchange market, there are various types of speculation and arbitrage strategies employed by traders to capitalize on market inefficiencies and profit from currency fluctuations.

Types of Speculation

- Carry Trade: This strategy involves borrowing a currency with a low interest rate and investing it in a currency with a higher interest rate. The trader profits from the difference in interest rates, known as the carry, while taking on the risk of currency fluctuations.

- Trend Following: This strategy involves identifying and following established market trends. Traders buy currencies that are trending upwards and sell currencies that are trending downwards, aiming to profit from the continuation of the trend.

- Technical Analysis: This strategy involves analyzing historical price data and using technical indicators to identify potential trading opportunities. Traders use charts and patterns to predict future price movements and make trading decisions.

Types of Arbitrage

- Triangular Arbitrage: This strategy involves buying and selling three different currencies simultaneously to exploit a discrepancy in their exchange rates. The trader buys the undervalued currency, sells the overvalued currency, and uses the proceeds to buy the second undervalued currency.

- Covered Interest Arbitrage: This strategy involves borrowing a currency in one country and investing it in another country with a higher interest rate, while simultaneously entering into a forward contract to hedge against currency fluctuations.

- Pairs Trading: This strategy involves trading two highly correlated currency pairs simultaneously, exploiting small price discrepancies between the pairs. The trader buys the undervalued pair and sells the overvalued pair, aiming to profit from the convergence of their prices.

Impact on Market Dynamics

Speculation and arbitrage significantly impact currency prices, volatility, and liquidity in the foreign exchange market.

Finish your research with information from foreign exchange market participants.

Speculators’ activities can influence exchange rates by creating excess demand or supply for a particular currency. When speculators anticipate a currency’s appreciation, they buy it, driving up its value. Conversely, if they expect a currency to depreciate, they sell it, leading to a decline in its price.

Volatility

Speculation can increase market volatility. When speculators enter or exit positions en masse, it can create sudden and sharp price fluctuations. This volatility can benefit traders who can profit from price swings, but it also poses risks for those holding long-term positions.

Liquidity

Arbitrage, on the other hand, generally enhances market liquidity. By exploiting price discrepancies between different markets, arbitrageurs bring prices closer to equilibrium. This increased liquidity makes it easier for traders to enter and exit positions, reducing transaction costs and improving market efficiency.

Benefits and Risks

Speculative trading and arbitrage can offer potential benefits and risks:

- Benefits:

- Profit from price fluctuations

- Enhance market liquidity

- Risks:

- Potential losses if market moves against expectations

- Increased market volatility

Traders must carefully weigh these factors before engaging in speculation or arbitrage.

You also will receive the benefits of visiting foreign exchange market short meaning today.

Market Analysis and Strategies

In the foreign exchange market, market analysis and effective strategies are crucial for successful speculation and arbitrage. Analyzing market conditions and developing tailored trading strategies can help traders identify and capitalize on potential opportunities while managing risks.

You also can investigate more thoroughly about foreign exchange market today in nigeria to enhance your awareness in the field of foreign exchange market today in nigeria.

Technical Analysis

- Technical analysis involves studying historical price charts and patterns to identify trends and predict future price movements.

- Traders use indicators like moving averages, support and resistance levels, and candlestick patterns to make informed decisions.

Fundamental Analysis

- Fundamental analysis focuses on economic and political factors that influence currency values, such as interest rates, inflation, GDP growth, and political stability.

- Traders monitor economic data and news to assess the underlying strength or weakness of a currency and make trading decisions accordingly.

Developing Trading Strategies

Once market conditions have been analyzed, traders can develop trading strategies that align with their risk tolerance and profit objectives.

- Strategies may include trend following, range trading, or scalping.

- Traders should consider factors such as entry and exit points, stop-loss orders, and position sizing.

Managing Risk

Risk management is paramount in foreign exchange trading. Traders should:

- Use stop-loss orders to limit potential losses.

- Diversify their portfolio across multiple currency pairs.

- Monitor their trades closely and adjust their strategies as market conditions change.

Examples and Case Studies

Throughout history, there have been numerous examples of successful speculation and arbitrage in the foreign exchange market. These case studies offer valuable insights into the strategies and factors that contribute to success in this dynamic and complex market.

One notable example is the “carry trade” strategy, which involves borrowing in a currency with a low interest rate and investing in a currency with a higher interest rate. This strategy was widely used during the early 2000s, when interest rates in Japan were near zero while rates in the United States were significantly higher. Investors borrowed in Japanese yen and invested in US dollars, profiting from the difference in interest rates.

George Soros and the Black Wednesday Crisis

George Soros is a renowned hedge fund manager who made billions of dollars speculating on currency markets. One of his most famous trades was his bet against the British pound in 1992, which led to the Black Wednesday crisis. Soros borrowed heavily in British pounds and sold them for German marks, betting that the pound would devalue. When the British government was forced to devalue the pound, Soros made a profit of over $1 billion.

Lessons Learned and Key Success Factors, Speculation and arbitrage in foreign exchange market

These case studies highlight several key lessons for successful speculation and arbitrage in the foreign exchange market:

- Thorough Market Analysis: Successful speculators and arbitrageurs conduct extensive research and analysis to identify market trends and potential opportunities.

- Risk Management: Managing risk is crucial in the foreign exchange market. Speculators and arbitrageurs use various strategies to mitigate risk, such as hedging and diversification.

- Discipline and Patience: Speculation and arbitrage require discipline and patience. Successful traders stick to their strategies and avoid making emotional decisions.

- Understanding Market Dynamics: It is essential to understand the factors that drive currency movements, such as economic data, political events, and central bank policies.

Final Conclusion

Understanding speculation and arbitrage empowers traders with the knowledge to navigate the complexities of the foreign exchange market. By analyzing market conditions, developing sound strategies, and managing risk effectively, traders can harness the power of these market forces to achieve success.