Bot exchange rate, a pivotal concept in the financial realm, invites us to delve into the intriguing world of automated trading and its impact on market dynamics. With bots playing an increasingly significant role in financial transactions, understanding their exchange rates is crucial for navigating the complexities of modern markets.

As we explore the factors influencing bot exchange rates, we uncover the interplay between technology, market conditions, and regulatory frameworks. By examining different types of bot exchange rates, we gain insights into their advantages and disadvantages, enabling us to make informed decisions in the ever-evolving financial landscape.

Definition of Bot Exchange Rate

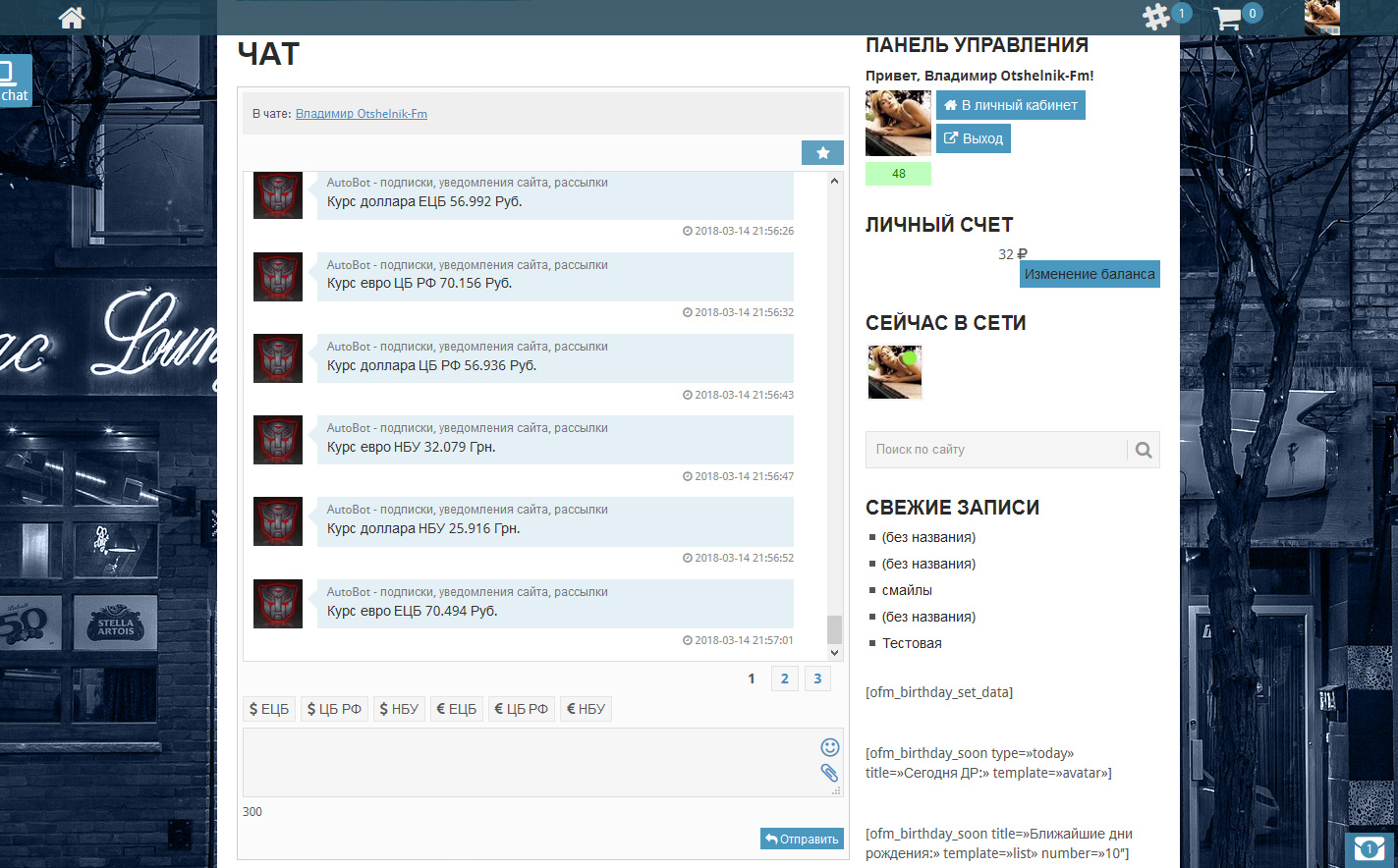

A bot exchange rate is the price of a cryptocurrency determined by trading bots rather than human traders. Trading bots are automated programs that execute trades based on predefined rules and algorithms. They are designed to make decisions quickly and efficiently, and they can trade 24/7 without the need for human intervention.

How Bots are Used in Financial Markets

Bots are used in financial markets for a variety of purposes, including:

- Trading: Bots can be used to execute trades automatically, based on predefined rules and algorithms. This can help traders to take advantage of market opportunities quickly and efficiently.

- Market making: Bots can be used to create liquidity in markets by providing buy and sell orders at specific prices. This can help to reduce volatility and make it easier for traders to execute trades.

- Arbitrage: Bots can be used to exploit price differences between different exchanges. This can help traders to make a profit by buying and selling the same asset on different exchanges.

Factors Influencing Bot Exchange Rates

The exchange rate of bots is influenced by a complex interplay of factors, including supply and demand, bot functionality, and market sentiment.

Bot Functionality

The functionality of a bot plays a significant role in determining its exchange rate. Bots with advanced capabilities, such as natural language processing, machine learning, and automated task execution, are generally more valuable and command a higher exchange rate.

- For example, a bot that can generate human-like text may be more valuable than a bot that can only perform simple tasks like sending messages.

Types of Bot Exchange Rates

Bot exchange rates can vary based on the type of bot and the platform or marketplace where it is traded. Understanding the different types of bot exchange rates can help you make informed decisions when trading bots.

Examine how articles on foreign exchange market can boost performance in your area.

Flat Rate

A flat rate is a fixed price that is charged for a bot, regardless of its features or complexity. This type of exchange rate is common for simple bots that perform basic tasks. The advantage of a flat rate is that it is easy to understand and budget for. However, it can be disadvantageous if you are looking for a more complex bot, as you may end up paying more than you need.

Expand your understanding about foreign exchange market for yen with the sources we offer.

Tiered Pricing

Tiered pricing is a system where bots are priced based on their features and complexity. This type of exchange rate is common for more complex bots that offer a range of features. The advantage of tiered pricing is that you can pay for the features that you need, without having to pay for features that you do not need. However, it can be more difficult to compare the prices of bots from different providers, as the features and complexity of the bots can vary.

Volume Discounts

Volume discounts are offered by some bot providers to customers who purchase multiple bots. This type of exchange rate can be advantageous if you are planning to purchase a large number of bots. The advantage of volume discounts is that you can save money on the overall cost of the bots. However, it is important to compare the prices of bots from different providers, as the volume discounts may vary.

Regulation of Bot Exchange Rates

The regulation of bot exchange rates is a complex and evolving landscape. Different jurisdictions have taken different approaches to regulating this emerging market, with some implementing specific regulations and others relying on existing laws and guidelines.

Examples of Regulations and Guidelines

- United States: The Securities and Exchange Commission (SEC) has classified bots as “digital asset trading platforms” and has proposed regulations that would require them to register with the agency and comply with anti-money laundering and know-your-customer (KYC) requirements.

- United Kingdom: The Financial Conduct Authority (FCA) has issued a warning to consumers about the risks of investing in bots and has stated that it is considering regulating them.

- Japan: The Financial Services Agency (FSA) has issued guidelines for bot operators that include requirements for transparency, disclosure, and risk management.

Impact of Bot Exchange Rates on Financial Markets

Bot exchange rates can significantly impact the stability and efficiency of financial markets. These automated systems can facilitate faster and more efficient trading, but they can also introduce new risks and challenges.

Browse the implementation of interbank foreign exchange market in kuala lumpur in real-world situations to understand its applications.

One of the key impacts of bot exchange rates is on market volatility. Bots can amplify market movements by quickly reacting to changes in supply and demand. This can lead to increased volatility, making it more difficult for investors to make informed decisions.

Another impact of bot exchange rates is on market liquidity. Bots can provide liquidity by automatically placing orders on exchanges. However, they can also withdraw liquidity if they detect adverse market conditions. This can make it more difficult for investors to buy or sell assets at a fair price.

Case Study – Flash Crash of 2010, Bot exchange rate

One notable example of the impact of bot exchange rates on financial markets is the Flash Crash of 2010. On May 6, 2010, the Dow Jones Industrial Average plunged by over 1,000 points in a matter of minutes. The crash was later attributed to a series of algorithmic trading errors, highlighting the potential risks associated with bot exchange rates.

Future Trends in Bot Exchange Rates

The bot exchange rate market is constantly evolving, and a number of trends are expected to shape its future. These include the increasing use of artificial intelligence (AI) and machine learning (ML) in bot development, the growing popularity of decentralized exchanges, and the increasing regulation of the bot exchange rate market.

AI and ML are already being used to develop more sophisticated bots that can trade more effectively. As these technologies continue to develop, we can expect to see even more efficient and profitable bots enter the market.

Decentralized exchanges are also becoming increasingly popular, as they offer a number of advantages over centralized exchanges. Decentralized exchanges are not controlled by a single entity, which makes them more resistant to hacking and manipulation. They also offer lower fees and greater privacy than centralized exchanges.

The bot exchange rate market is also expected to become more regulated in the future. This is due to the increasing concerns about the potential risks of bot trading, such as market manipulation and fraud. Regulators are likely to implement measures to protect investors and ensure the integrity of the market.

Emerging Technologies

- Artificial intelligence (AI)

- Machine learning (ML)

- Blockchain technology

- Decentralized exchanges

Regulatory Developments

- Increased regulation of bot trading

- Measures to protect investors

- Ensuring the integrity of the market

Final Review

In conclusion, bot exchange rates are a multifaceted phenomenon that continues to shape the trajectory of financial markets. As technology advances and regulatory landscapes evolve, we can expect further developments in this domain. Understanding the intricacies of bot exchange rates empowers investors, traders, and market participants to adapt to the changing market dynamics and make strategic decisions.