Forex time zone, a crucial aspect of currency trading, plays a significant role in shaping trading decisions and strategies. This comprehensive guide delves into the intricacies of forex market hours, time zone conversion tools, and their impact on trading.

By understanding the dynamics of forex time zones, traders can optimize their strategies, mitigate risks, and exploit market inefficiencies.

Forex Market Hours

The foreign exchange (forex) market is open 24 hours a day, five days a week, from Sunday evening to Friday evening. This is in contrast to regular market hours, which are typically 9:00 AM to 5:00 PM, Monday through Friday.

The reason for the extended trading hours in the forex market is that it is a global market, with participants from all over the world. This means that there is always someone available to trade, no matter what time of day it is.

Major Currency Pairs Trading Hours, Forex time zone

The following is a list of the trading hours for the major currency pairs:

- EUR/USD: 24 hours a day, 5 days a week

- USD/JPY: 24 hours a day, 5 days a week

- GBP/USD: 24 hours a day, 5 days a week

- USD/CHF: 24 hours a day, 5 days a week

- AUD/USD: 24 hours a day, 5 days a week

- NZD/USD: 24 hours a day, 5 days a week

- USD/CAD: 24 hours a day, 5 days a week

Impact of Time Zones on Forex Trading Strategies

The time zones in which forex traders are located can have a significant impact on their trading strategies. For example, a trader in London will have different trading hours than a trader in New York.

Find out about how foreign exchange market mcq with answers can deliver the best answers for your issues.

Traders need to be aware of the time zones of the currency pairs they are trading, as well as the time zones of their brokers. This will help them to avoid trading during illiquid periods, when there is less liquidity in the market.

Browse the implementation of foreign exchange student in real-world situations to understand its applications.

Time Zone Conversion Tools

Time zone conversion tools are essential for forex traders, as they allow traders to quickly and easily determine the trading hours for specific currency pairs. These tools can be integrated into trading platforms, making it easy for traders to stay on top of the markets.

Obtain recommendations related to kinds of foreign exchange market that can assist you today.

There are a number of different time zone conversion tools available, including:

- Online time zone converters: These websites and apps allow you to convert time between any two time zones. Simply enter the time and date in the first time zone, and the tool will convert it to the second time zone.

- Trading platform time zone converters: Many trading platforms offer built-in time zone converters. These tools allow you to quickly and easily convert time between different time zones, without having to leave the trading platform.

- Mobile time zone converters: There are a number of mobile apps available that allow you to convert time between different time zones. These apps are often free to download and use, and they can be very convenient for traders who are on the go.

Time zone conversion tools can be used to determine the trading hours for specific currency pairs. For example, if you are interested in trading the EUR/USD currency pair, you would need to know the trading hours for both the European and US markets. You can use a time zone conversion tool to determine the overlap between these two markets, and then you can plan your trading accordingly.

Time zone conversion tools are an essential tool for forex traders. They allow traders to quickly and easily determine the trading hours for specific currency pairs, and they can help traders to stay on top of the markets.

Impact of Time Zones on Trading Strategies

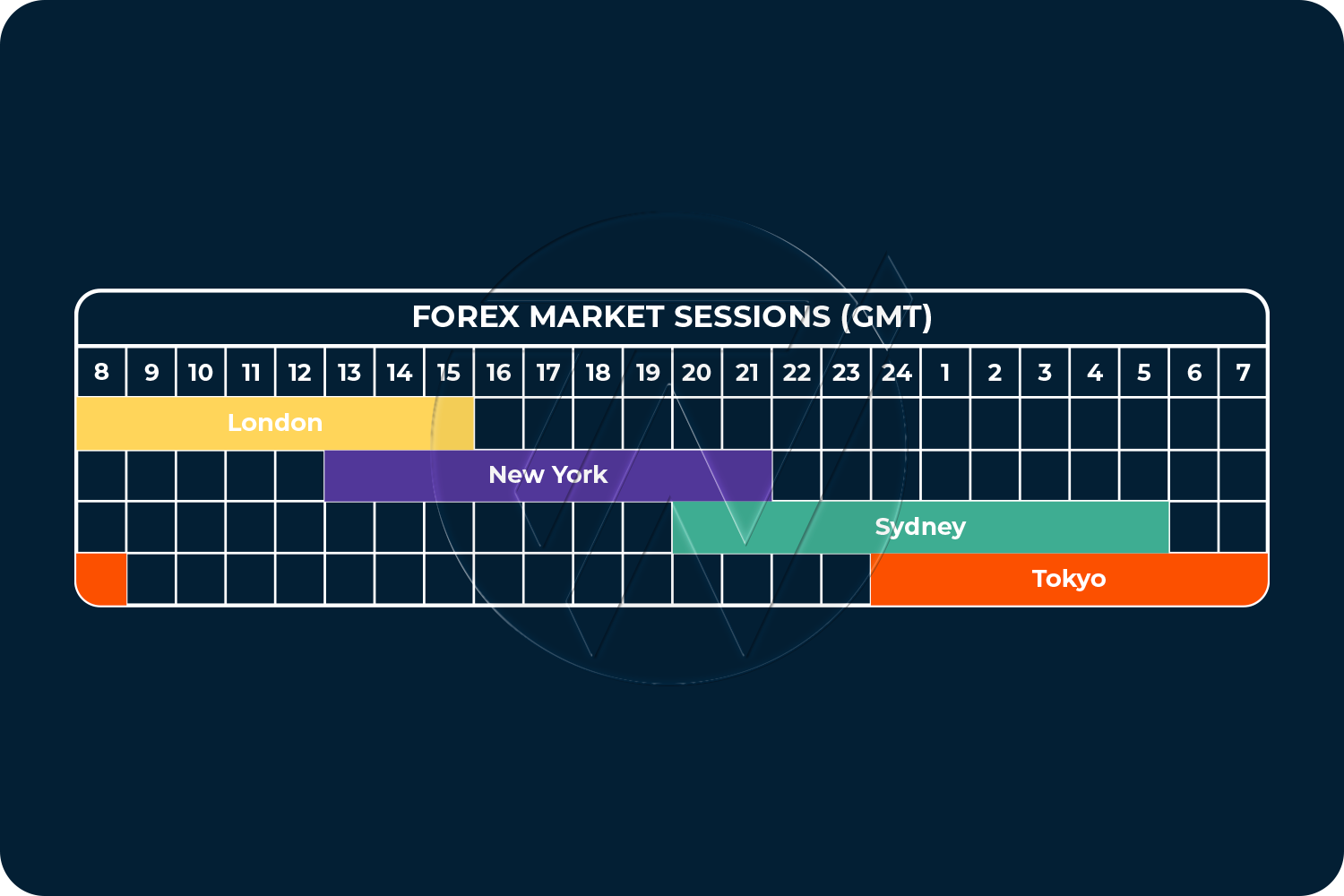

Time zones play a crucial role in Forex trading as they determine the opening and closing hours of different markets around the world. Understanding the impact of time zones is essential for traders to make informed decisions, manage risk effectively, and exploit market inefficiencies.

Impact on Trading Decisions and Risk Management

Time zones can influence trading decisions by affecting market liquidity and volatility. During overlapping trading sessions, when multiple markets are open, liquidity tends to be higher, providing more opportunities for traders to enter and exit positions. However, during non-overlapping sessions, liquidity may be lower, leading to wider spreads and increased risk.

Traders should also consider the time zone of their own location when making trading decisions. For example, a trader in London may prefer to trade during the European session (8 am to 5 pm GMT), as it aligns with their regular business hours and provides access to higher liquidity.

Time Zone Arbitrage

Time zone arbitrage is a trading strategy that exploits price inefficiencies between markets in different time zones. It involves buying or selling a currency pair in one market and simultaneously selling or buying the same pair in another market at a different time zone. The profit is generated from the difference in prices between the two markets.

For example, if the EUR/USD currency pair is trading at 1.1000 in the London market (4 pm GMT) and 1.1005 in the New York market (9 am EST), a trader can buy EUR/USD in London and sell it in New York to profit from the 5-pip difference.

Trading Strategies Considering Time Zones

Traders can incorporate time zones into their trading strategies in various ways:

- Scalping during Overlapping Sessions: Scalping involves making numerous small trades within a short period. Traders can take advantage of higher liquidity during overlapping sessions to scalp for quick profits.

- Range Trading during Non-Overlapping Sessions: During non-overlapping sessions, markets tend to move within a range. Traders can use range trading strategies to profit from these sideways movements.

- Time Zone Arbitrage: As discussed earlier, traders can employ time zone arbitrage to exploit price inefficiencies between markets in different time zones.

Time Zone Synchronization in Trading Platforms

Time zone synchronization is crucial in forex trading platforms to ensure accurate trade execution and market analysis. By synchronizing the platform’s time zone with the server’s time zone, traders can avoid discrepancies in trade orders and market data.

Methods for Synchronizing Time Zones

There are several methods for synchronizing time zones in trading platforms:

- Manual Synchronization: Traders can manually adjust the platform’s time zone settings to match the server’s time zone.

- Automatic Synchronization: Some platforms offer automatic time zone synchronization, which updates the platform’s time zone based on the server’s time zone.

- NTP Synchronization: Platforms can use the Network Time Protocol (NTP) to synchronize their time zone with an external time server.

Benefits of Synchronized Time Zones

Synchronized time zones provide several benefits for traders:

- Accurate Trade Execution: Time zone synchronization ensures that trade orders are executed at the correct time, minimizing slippage and execution delays.

- Precise Market Analysis: Synchronized time zones allow traders to analyze market data accurately, as the data is displayed in the correct time frame.

- Consistency in Trading Strategies: Traders can develop and execute trading strategies based on specific time zones, ensuring consistency in their approach.

Challenges of Synchronized Time Zones

However, there are also some challenges associated with using synchronized time zones:

- Platform Compatibility: Not all trading platforms support time zone synchronization, which can limit the trader’s choice of platforms.

- Server Time Accuracy: The accuracy of time zone synchronization depends on the accuracy of the server’s time zone, which may not always be reliable.

- Manual Synchronization Errors: Manual time zone synchronization can be prone to errors, which can result in incorrect trade execution or market analysis.

Overall, time zone synchronization is an important aspect of forex trading platforms. By understanding the methods, benefits, and challenges of time zone synchronization, traders can ensure accurate trade execution and market analysis.

Time Zone Considerations for Automated Trading: Forex Time Zone

Automated trading systems rely on precise time synchronization to execute trades efficiently. However, time zone differences can introduce challenges for these systems, as markets open and close at different times across the globe.

To address these challenges, automated trading algorithms must be equipped with strategies for handling time zone conversions. These strategies ensure that trades are executed at the correct time, regardless of the time zone in which the trading platform is located.

Optimizing Automated Trading Systems for Different Time Zones

- Time Zone Conversion Functions: Implement functions within the trading algorithm to convert timestamps from one time zone to another, ensuring accurate trade execution.

- Market Open and Close Times: Store the open and close times for each market in a centralized database or configuration file, allowing the algorithm to adjust execution times accordingly.

- Dynamic Time Zone Adjustments: Incorporate logic to automatically adjust trading times based on daylight saving time changes or other time zone modifications.

- Historical Data Time Zone Conversion: When analyzing historical data, ensure that timestamps are converted to the appropriate time zone to maintain data integrity.

- Testing and Validation: Thoroughly test and validate the automated trading system across different time zones to ensure accurate execution and minimize errors.

Final Review

In conclusion, forex time zone is a multifaceted concept that requires careful consideration for successful trading. By leveraging time zone conversion tools, traders can adapt their strategies to different market hours and time zones. Moreover, understanding the impact of time zones on trading decisions and risk management empowers traders to make informed choices and maximize their trading potential.