Def of foreign exchange market – Delving into the realm of foreign exchange markets, we embark on a journey to decipher their intricate workings and pivotal role in facilitating global trade. These dynamic marketplaces serve as the lifeblood of international commerce, enabling the seamless exchange of currencies and bridging economic boundaries.

Within these markets, a diverse cast of participants converge, from central banks and multinational corporations to individual investors, each seeking to navigate the ever-shifting currency landscape. Their transactions, ranging from spot trades to forward contracts, fuel the constant flow of capital that underpins global economic activity.

Definition of Foreign Exchange Market: Def Of Foreign Exchange Market

The foreign exchange market (Forex or FX) is a global marketplace where currencies are traded. It is the largest financial market in the world, with a daily trading volume of over $5 trillion. The Forex market plays a vital role in global trade and finance, as it allows businesses and individuals to exchange currencies for international transactions.

Participants in the Foreign Exchange Market

The Forex market is a decentralized market, meaning there is no central exchange where all trades take place. Instead, trades are executed through a network of banks, brokers, and other financial institutions. The main participants in the Forex market include:

- Commercial banks

- Investment banks

- Forex brokers

- Hedge funds

- Corporations

- Individual investors

Types of Foreign Exchange Transactions

There are many different types of foreign exchange transactions, but the most common are:

- Spot transactions: These are transactions that are settled immediately, typically within two business days.

- Forward transactions: These are transactions that are settled at a future date, typically 30, 60, or 90 days in the future.

- Swap transactions: These are transactions that involve the exchange of two currencies at two different dates.

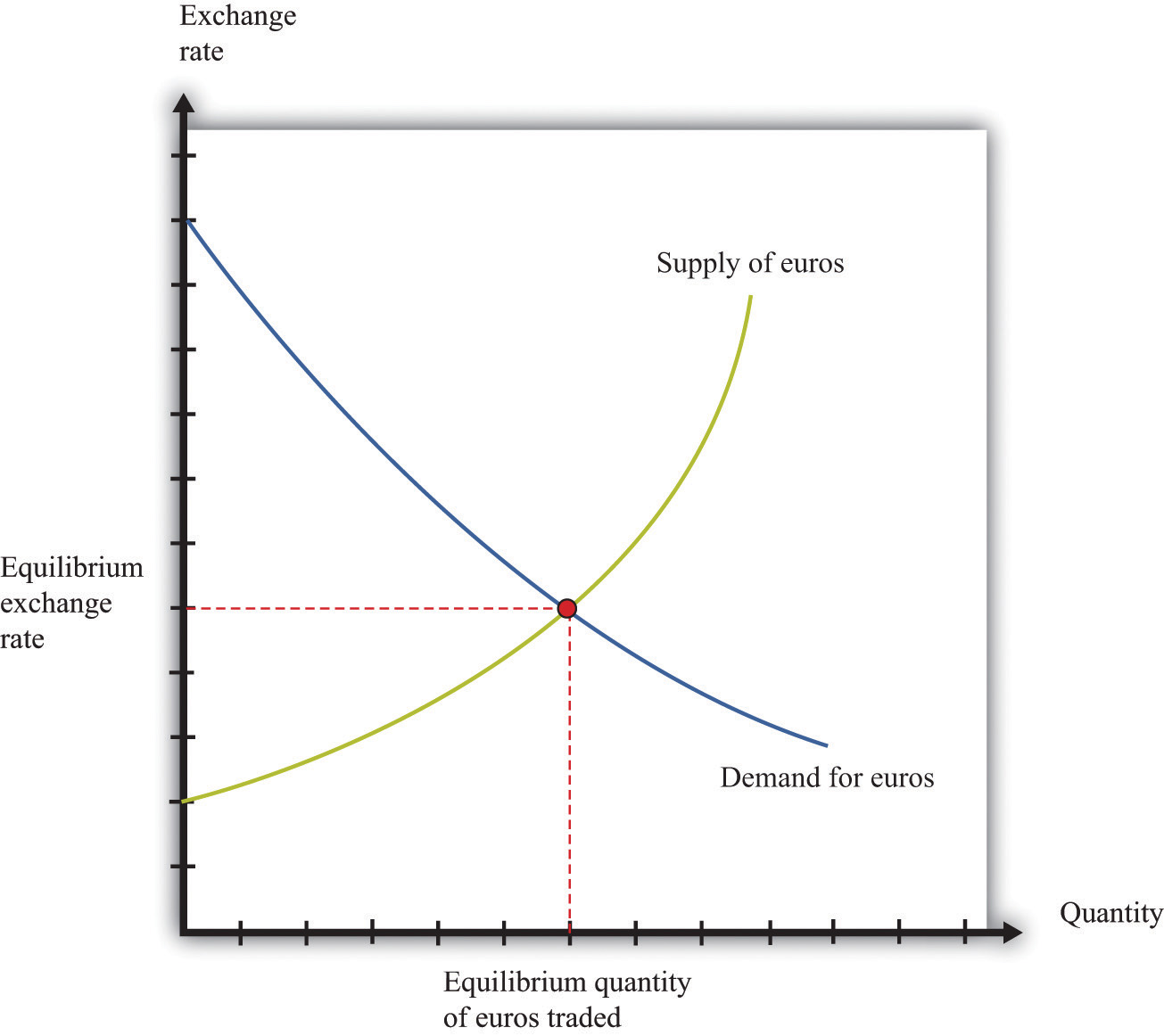

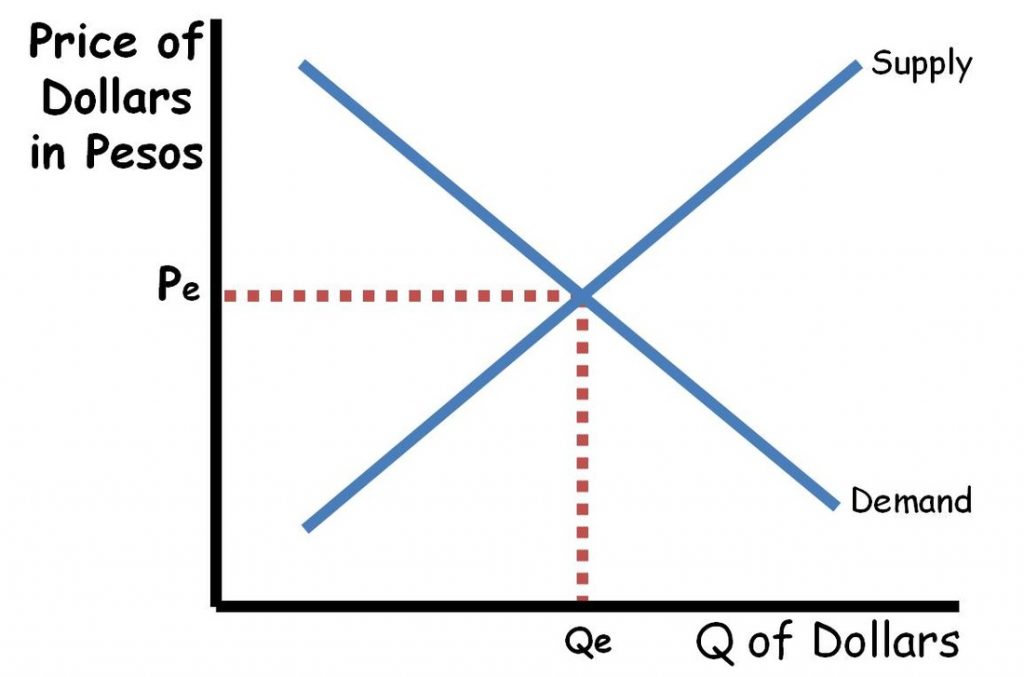

Factors Influencing Foreign Exchange Rates

The value of currencies in the foreign exchange market is determined by a complex interplay of economic, political, and social factors. These factors can influence the supply and demand for a particular currency, leading to fluctuations in its exchange rate against other currencies.

Economic Factors

Economic factors that impact foreign exchange rates include:

- Interest rates: Higher interest rates make a currency more attractive to investors, increasing demand and strengthening its value.

- Inflation: High inflation erodes the purchasing power of a currency, reducing its value relative to other currencies.

- Economic growth: Strong economic growth can lead to increased demand for a currency, as investors seek to invest in growing economies.

- Trade balance: A country with a trade surplus (exports exceeding imports) typically sees its currency appreciate, while a trade deficit (imports exceeding exports) can lead to depreciation.

Political and Social Factors

Political and social factors that influence foreign exchange rates include:

- Political stability: Political instability and uncertainty can lead to a loss of confidence in a currency, causing its value to decline.

- Government policies: Government policies, such as monetary and fiscal policies, can impact the economic outlook and, consequently, the exchange rate.

- Social unrest: Social unrest and protests can create economic uncertainty and reduce foreign investment, leading to currency depreciation.

Role of Central Banks, Def of foreign exchange market

Central banks play a significant role in managing foreign exchange rates. They can use various tools, such as:

- Interest rate adjustments: Raising interest rates can strengthen a currency, while lowering rates can weaken it.

- Currency intervention: Central banks can buy or sell their own currency in the foreign exchange market to influence its value.

- Capital controls: Capital controls are measures implemented by central banks to limit the flow of foreign currency into or out of a country.

Foreign Exchange Market Structure

The foreign exchange market operates through a network of different market structures, each catering to specific needs and timeframes. These structures include spot markets and forward markets, which facilitate the trading of currencies for immediate or future delivery.

Spot Market

The spot market is the primary market for immediate currency exchange. Transactions in the spot market are settled within two business days of the trade date. It is where the current exchange rates are determined, and traders can buy and sell currencies for immediate delivery.

Obtain recommendations related to the foreign exchange market converts the currency of one country into that of another country that can assist you today.

Forward Market

The forward market is a derivatives market where contracts are traded for the future delivery of currencies. Forward contracts allow traders to lock in an exchange rate for a future date, hedging against potential fluctuations in currency values. Forward contracts are typically settled on a specific date in the future, which can range from one month to several years.

Foreign Exchange Trading and Settlement

Foreign exchange trading involves the buying and selling of currencies between two parties. The process typically involves the following steps:

- A trader places an order to buy or sell a currency at a specific exchange rate.

- The order is matched with an opposite order from another trader.

- The trade is executed, and the currencies are exchanged at the agreed-upon rate.

- The settlement of the trade occurs on the settlement date, which is typically two business days after the trade date.

Major Foreign Exchange Trading Centers

Foreign exchange trading is concentrated in a few major financial centers around the world. These centers include:

- London

- New York

- Tokyo

- Singapore

- Hong Kong

These centers provide a global network for foreign exchange trading, facilitating the exchange of currencies around the clock.

Foreign Exchange Market Instruments

The foreign exchange market utilizes a range of instruments to facilitate currency exchange and manage risk. These instruments vary in their characteristics and purposes, catering to different needs and strategies in the global financial system.

Spot Contracts

Spot contracts represent the most straightforward form of foreign exchange transaction. They involve the immediate exchange of currencies at the prevailing market rate. These contracts are typically settled within two business days and are used for immediate currency needs, such as international payments or trade settlements.

Browse the multiple elements of currency conversion of foreign exchange market to gain a more broad understanding.

Forward Contracts

Forward contracts are agreements to exchange currencies at a predetermined rate on a future date. They allow businesses and investors to lock in exchange rates in advance, hedging against potential fluctuations in currency values. Forward contracts are commonly used for managing foreign exchange risk associated with long-term transactions or investments.

In this topic, you find that is the foreign exchange market closed today is very useful.

Options

Options provide the right, but not the obligation, to buy or sell a currency at a specific price within a specified period. They are used to speculate on currency movements or to protect against potential losses. Call options give the holder the right to buy a currency, while put options give the right to sell a currency.

Foreign Exchange Market Risks

The foreign exchange market is inherently risky due to the constant fluctuations in currency values. Understanding and managing these risks is crucial for successful foreign exchange trading.

The risks associated with foreign exchange trading can be categorized into three main types:

Currency Risk

- Arises from changes in the exchange rates between currencies.

- Traders may experience losses if the value of their home currency appreciates against the foreign currency they are trading.

Interest Rate Risk

- Occurs when there are changes in interest rates, which can affect the value of currency pairs.

- Traders may lose money if interest rates in the country of their home currency increase relative to the foreign currency.

Liquidity Risk

- Refers to the difficulty or inability to buy or sell a currency pair at a desired price.

- Liquidity risk is higher in less-traded currency pairs and during periods of market volatility.

Methods to Manage and Mitigate Risks

- Hedging: Using financial instruments like forwards, futures, and options to offset the risk of adverse currency movements.

- Diversification: Investing in a portfolio of different currencies to reduce the impact of fluctuations in any single currency.

- Position Sizing: Trading with a risk-adjusted position size to limit potential losses.

- Stop-Loss Orders: Placing orders to automatically sell a currency pair if it reaches a predetermined price, limiting losses.

Strategies for Minimizing Risk Exposure

- Research and Analysis: Thoroughly understanding the factors influencing currency movements.

- Risk Management Plan: Establishing a clear plan for managing risks, including risk tolerance and hedging strategies.

- Monitor Market Conditions: Continuously monitoring economic and political news and events that may impact currency values.

- Use Market Orders: Executing trades at the prevailing market price to minimize slippage and liquidity risk.

Summary

In conclusion, foreign exchange markets stand as complex and ever-evolving ecosystems, shaping the global financial landscape. Their intricacies extend beyond mere currency conversions, influencing trade, investment, and economic growth on a worldwide scale. Understanding the dynamics of these markets empowers businesses and individuals alike to navigate the complexities of international commerce and harness the opportunities it presents.