Define the following foreign exchange market – Embark on a comprehensive exploration of the foreign exchange market, where currencies dance in a dynamic interplay. As we delve into its intricate workings, we’ll uncover the forces that shape currency values, the participants who drive its activity, and the risks and opportunities that await.

In this definitive guide, we’ll navigate the complexities of this global marketplace, empowering you with a deep understanding of how currencies are traded, valued, and regulated.

Define the Foreign Exchange Market

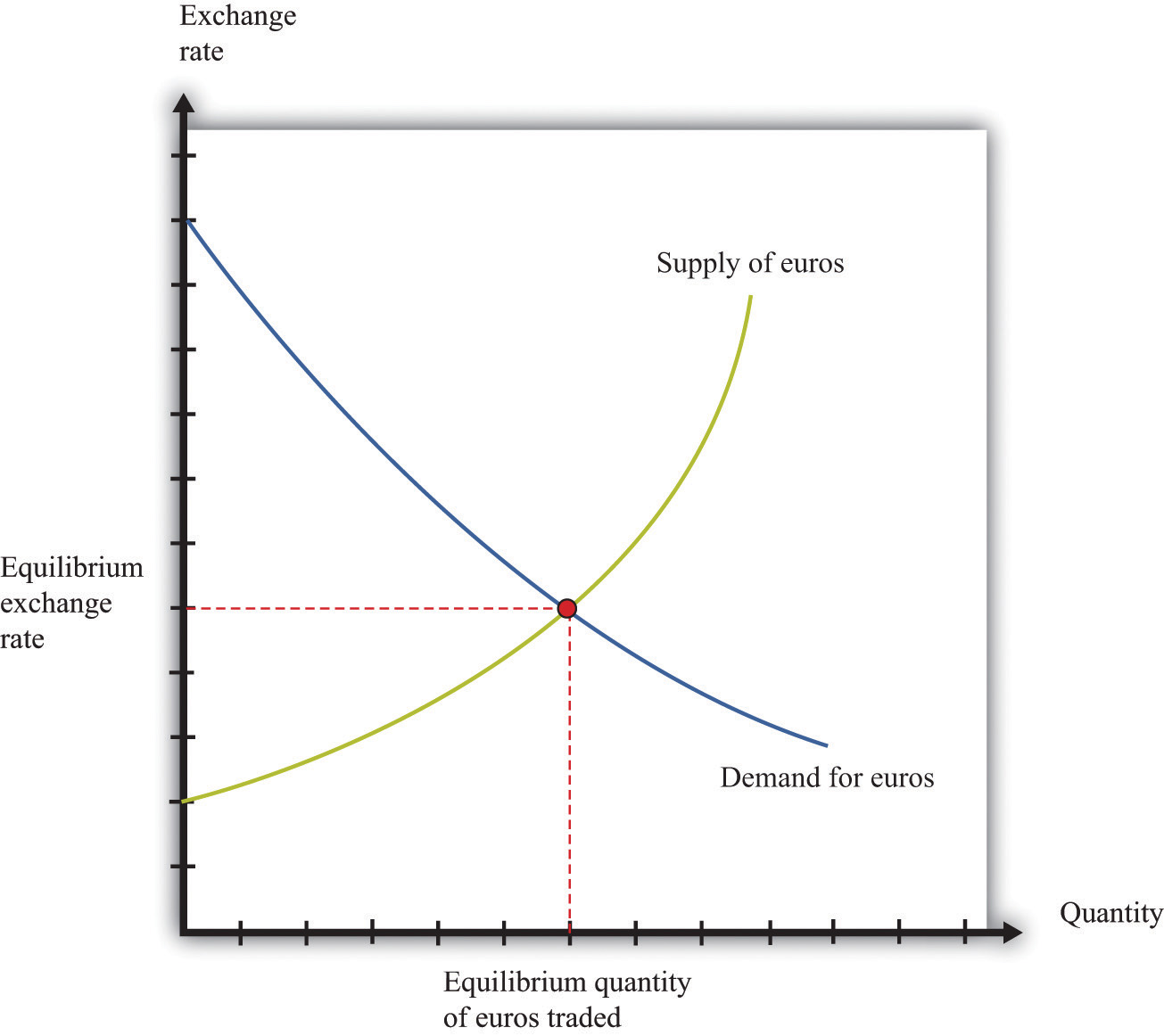

The foreign exchange market, also known as the forex market or currency market, is a global decentralized market where currencies are traded. It is the largest and most liquid financial market in the world, with an estimated daily trading volume of over $5 trillion.

You also can investigate more thoroughly about meaning of a foreign exchange market to enhance your awareness in the field of meaning of a foreign exchange market.

Role and Significance of the Foreign Exchange Market

The foreign exchange market plays a crucial role in facilitating international trade and investment. It allows businesses and individuals to exchange currencies so that they can buy and sell goods and services from other countries. The market also provides a way for investors to hedge against currency fluctuations and to speculate on the value of currencies.

Participants in the Foreign Exchange Market: Define The Following Foreign Exchange Market

The foreign exchange market is a global marketplace where currencies are traded. A diverse range of participants, each with distinct roles and responsibilities, contribute to its functioning.

Banks

Banks play a crucial role as intermediaries in the foreign exchange market. They facilitate currency exchange transactions between customers, including businesses, individuals, and governments. Banks provide liquidity to the market by buying and selling currencies, ensuring a smooth flow of transactions.

Corporations

Corporations engage in foreign exchange transactions to facilitate international trade and investments. They buy and sell currencies to settle payments, manage currency risks, and hedge against fluctuations in exchange rates.

Institutional Investors, Define the following foreign exchange market

Institutional investors, such as hedge funds, pension funds, and mutual funds, participate in the foreign exchange market for investment purposes. They speculate on currency movements, seeking to generate profits from fluctuations in exchange rates.

Individual Traders

Individual traders, also known as retail traders, participate in the foreign exchange market to speculate on currency movements. They trade currencies through online platforms, hoping to profit from short-term price fluctuations.

Central Banks

Central banks, responsible for managing a country’s monetary policy, intervene in the foreign exchange market to influence exchange rates. They buy and sell currencies to maintain economic stability, control inflation, and support their respective currencies.

Get the entire information you require about foreign exchange market data on this page.

Types of Foreign Exchange Transactions

Foreign exchange transactions encompass a diverse range of activities that facilitate the exchange of currencies between parties across international borders. These transactions can be broadly categorized into three main types: spot transactions, forward contracts, and currency swaps.

Spot Transactions

Spot transactions involve the immediate exchange of currencies at the prevailing market rate. They are typically settled within two business days and are often used for urgent or short-term currency needs. For example, a company that needs to make a payment to a foreign supplier may engage in a spot transaction to convert its domestic currency into the supplier’s currency.

Forward Contracts

Forward contracts are agreements to exchange currencies at a predetermined rate on a future date. They are used to hedge against currency fluctuations and lock in exchange rates for future transactions. For instance, an importer who anticipates receiving a large payment in a foreign currency in six months may enter into a forward contract to sell that currency at a favorable rate, ensuring they receive a fixed amount in their domestic currency.

Currency Swaps

Currency swaps involve the simultaneous exchange of principal amounts in different currencies and the subsequent exchange of interest payments over a specified period. They are often used for long-term currency hedging and managing interest rate risk. For example, a company that has borrowed in a foreign currency may engage in a currency swap to reduce its exposure to exchange rate fluctuations and potentially obtain a more favorable interest rate.

Factors Affecting Foreign Exchange Rates

The foreign exchange market is constantly in flux, with currency values fluctuating based on a variety of factors. These factors can be broadly categorized into three main groups: economic conditions, political events, and market sentiment.

Economic Conditions

The economic health of a country is a major determinant of its currency’s value. A strong economy, characterized by high GDP growth, low inflation, and a stable financial system, tends to attract foreign investment and boost the demand for its currency, leading to currency appreciation.

Conversely, a weak economy, characterized by low GDP growth, high inflation, and a fragile financial system, tends to deter foreign investment and reduce the demand for its currency, leading to currency depreciation.

Political Events

Political events can also have a significant impact on foreign exchange rates. For example, a change in government, a major political crisis, or a change in foreign policy can all lead to uncertainty and risk aversion, which can cause investors to sell off a country’s currency and seek safer havens.

Political instability, such as wars, coups, or revolutions, can also damage a country’s economy and lead to currency depreciation.

Market Sentiment

Market sentiment, or the collective opinion of market participants, can also influence foreign exchange rates. If investors are optimistic about the future of a country’s economy, they are more likely to buy its currency, which can lead to currency appreciation.

Conversely, if investors are pessimistic about the future of a country’s economy, they are more likely to sell its currency, which can lead to currency depreciation.

Foreign Exchange Market Regulation

The foreign exchange market operates within a regulatory framework designed to ensure market stability, protect participants, and prevent financial instability.

Central banks play a crucial role in overseeing the foreign exchange market. They implement monetary policies that influence currency values, manage foreign exchange reserves, and intervene in the market to stabilize exchange rates when necessary.

Other regulatory bodies, such as the Bank for International Settlements (BIS), the International Monetary Fund (IMF), and national financial regulators, also contribute to the regulation of the foreign exchange market. They establish guidelines, monitor market activities, and enforce compliance with regulations.

To ensure market stability, regulatory measures include:

- Capital controls: Restrictions on the movement of capital across borders.

- Reserve requirements: Banks are required to hold a certain percentage of their deposits in foreign exchange reserves.

- Margin requirements: Traders are required to maintain a minimum level of capital to cover potential losses.

- Surveillance and monitoring: Regulatory bodies monitor market activities to identify and address potential risks.

These measures aim to prevent excessive speculation, maintain orderly market conditions, and protect participants from financial losses.

Technology in the Foreign Exchange Market

Advancements in technology have revolutionized the foreign exchange market, transforming the way currencies are traded. Electronic trading platforms, algorithmic trading, and mobile applications have significantly enhanced market efficiency and accessibility.

Electronic Trading Platforms

Electronic trading platforms have replaced traditional over-the-counter (OTC) trading methods. These platforms provide a centralized marketplace where buyers and sellers can connect and execute trades electronically. They offer real-time pricing, increased transparency, and faster execution speeds, reducing the time and costs associated with foreign exchange transactions.

Algorithmic Trading

Algorithmic trading involves using computer programs to automate trading decisions based on pre-defined parameters. These algorithms analyze market data and execute trades in milliseconds, allowing traders to take advantage of market inefficiencies and opportunities that may be missed by human traders. Algorithmic trading has increased market liquidity and reduced transaction costs.

Mobile Applications

Mobile applications have made foreign exchange trading accessible to retail investors and individuals. These apps provide real-time currency quotes, trading tools, and the ability to execute trades from anywhere with an internet connection. The convenience and ease of use of mobile applications have expanded the reach of the foreign exchange market and democratized access to currency trading.

Expand your understanding about foreign exchange money market job description with the sources we offer.

Impact on Market Efficiency and Accessibility

Technology has significantly improved the efficiency and accessibility of the foreign exchange market. Electronic trading platforms have reduced transaction costs and increased market liquidity. Algorithmic trading has enhanced execution speeds and allowed traders to capture market opportunities. Mobile applications have made foreign exchange trading more accessible to retail investors and individuals. As a result, the foreign exchange market has become more competitive and transparent, benefiting both traders and the global economy.

Risks and Opportunities in the Foreign Exchange Market

The foreign exchange market presents both risks and opportunities for participants. Understanding these factors is crucial for successful navigation of this dynamic market.

One of the primary risks is currency risk, which refers to the potential loss or gain resulting from fluctuations in exchange rates. This risk can significantly impact investors and businesses engaged in international trade or investments.

Strategies for Managing Risk and Maximizing Opportunities

To mitigate currency risk, various strategies can be employed:

- Hedging: Using financial instruments such as forward contracts or options to lock in exchange rates.

- Diversification: Investing in assets denominated in different currencies to reduce the impact of fluctuations in any single currency.

- Monitoring Market Conditions: Regularly tracking economic data and political events that may affect exchange rates.

- Using Currency Forecasts: Analyzing market trends and forecasts to anticipate potential currency movements.

Additionally, the foreign exchange market offers opportunities for profit through currency trading and speculation. However, these activities involve significant risk and require specialized knowledge and expertise.

Ending Remarks

As we conclude our journey through the foreign exchange market, we’ve gained a profound appreciation for its global reach and multifaceted nature. From the interplay of economic forces to the impact of technological advancements, the market remains a vibrant and ever-evolving landscape.

Whether you’re a seasoned investor, a curious observer, or an aspiring currency trader, this guide has equipped you with the knowledge and insights to navigate the complexities of the foreign exchange market with confidence.