In the realm of international finance, the foreign exchange swap market definition stands out as a pivotal concept. A foreign exchange swap is an agreement between two parties to exchange one currency for another at a specified rate on a future date. This intricate market plays a crucial role in facilitating global trade, hedging against currency fluctuations, and managing risk.

As we delve into the complexities of this market, we will explore the various types of foreign exchange swaps, the key players involved, and the factors that influence their dynamics. We will also shed light on the risk management strategies employed and the regulatory framework that governs this dynamic marketplace.

Foreign Exchange Swap Market Definition

:max_bytes(150000):strip_icc()/CurrencySwapBasics-effa071aba184066b9683bf80750c254.png)

The foreign exchange swap market is a global marketplace where participants can exchange one currency for another at a predetermined rate and date. It facilitates international trade, investment, and other financial transactions by providing a mechanism to manage currency risk and enhance liquidity.

Get the entire information you require about foreign exchange market supply shifters on this page.

Role of Foreign Exchange Swaps in International Finance, Foreign exchange swap market definition

Foreign exchange swaps play a crucial role in international finance by:

- Hedging currency risk: Swaps allow businesses and investors to lock in future exchange rates, mitigating the impact of currency fluctuations on their financial positions.

- Enhancing liquidity: Swaps create a secondary market for currencies, increasing liquidity and making it easier to obtain desired currencies.

- Facilitating investment: Swaps enable investors to diversify their portfolios across different currencies, accessing global investment opportunities.

- Supporting international trade: Swaps facilitate the settlement of international transactions by converting currencies at agreed-upon rates.

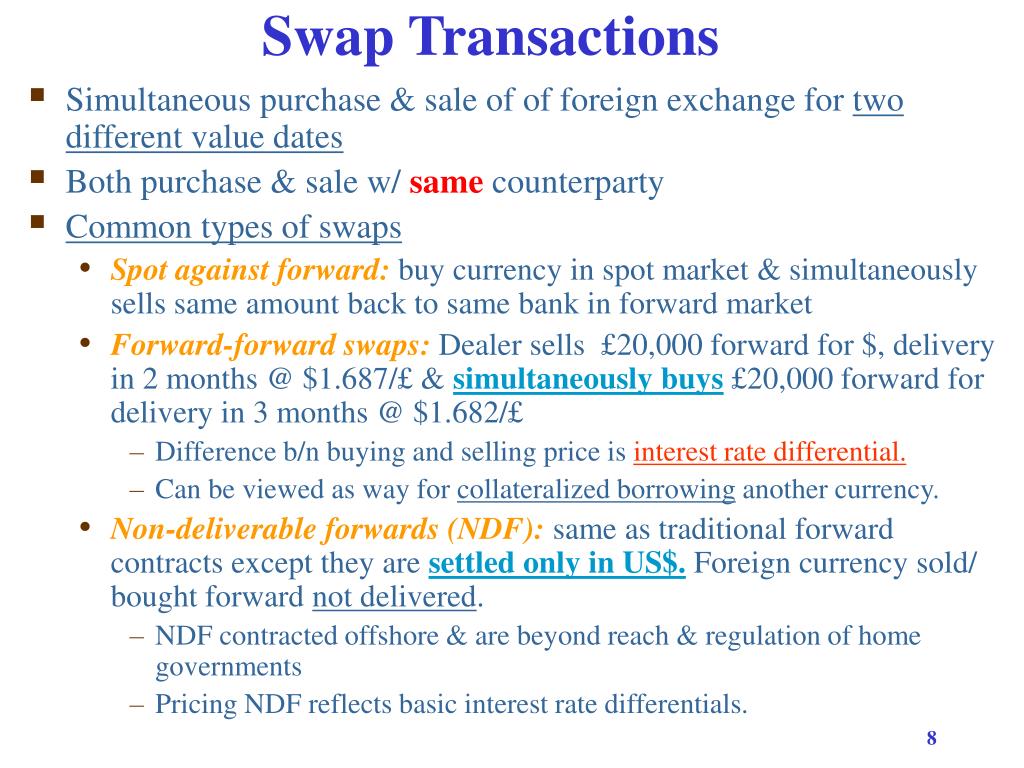

Common Foreign Exchange Swap Transactions

Common types of foreign exchange swaps include:

- Currency swaps: Exchange of one currency for another at a specified rate and date, with both currencies being exchanged back at the end of the swap period.

- Interest rate swaps: Exchange of interest payments in different currencies, typically used to manage interest rate risk.

- Cross-currency swaps: Combination of a currency swap and an interest rate swap, involving the exchange of both currencies and interest payments.

Types of Foreign Exchange Swaps

Foreign exchange swaps are financial contracts that involve the exchange of two currencies for a specified period, with an agreement to reverse the transaction at a predetermined future date. There are several types of foreign exchange swaps, each with unique characteristics and uses.

The primary types of foreign exchange swaps include:

- Vanilla Swap: A basic swap involving the exchange of principal amounts and interest payments in different currencies.

- Cross-Currency Swap: A swap where the principal and interest payments are exchanged in different currencies, with different interest rates.

- Currency Swap: A swap where the principal and interest payments are exchanged in the same currency, but at different interest rates.

- Forward Swap: A swap where the exchange of principal and interest payments is agreed upon at a future date, but the transaction is executed immediately.

- Non-Deliverable Forward (NDF) Swap: A swap where the underlying currency is not freely convertible, and the settlement is made in a deliverable currency.

Summary of Key Features

The following table summarizes the key features of different types of foreign exchange swaps:

| Type | Principal Exchange | Interest Payment | Settlement |

|---|---|---|---|

| Vanilla Swap | Yes | Yes | Deliverable |

| Cross-Currency Swap | Yes | Yes | Deliverable |

| Currency Swap | Yes | Yes | Deliverable |

| Forward Swap | Yes | Yes | Deliverable |

| NDF Swap | No | Yes | Non-Deliverable |

Market Participants in Foreign Exchange Swaps

The foreign exchange swap market involves a diverse range of participants, each playing a distinct role in facilitating the exchange of currencies and mitigating currency risk.

Finish your research with information from foreign exchange market noun.

Banks

- Commercial banks are the primary participants in the foreign exchange swap market, acting as intermediaries between clients and other market participants.

- They provide liquidity to the market, offer competitive rates, and manage the risk associated with currency fluctuations.

Corporations

- Corporations use foreign exchange swaps to manage their foreign currency exposure, which arises from international trade, investments, and operations.

- By entering into swaps, they can lock in exchange rates and reduce the impact of currency fluctuations on their financial performance.

Hedge Funds

- Hedge funds engage in foreign exchange swaps for speculative purposes, seeking to profit from currency movements.

- They often use complex trading strategies and leverage to maximize their returns.

Central Banks

- Central banks participate in the foreign exchange swap market to manage their currency reserves and influence exchange rates.

- They may intervene in the market to stabilize exchange rates, control inflation, or support economic growth.

Other Participants

- Institutional investors, such as pension funds and insurance companies, use foreign exchange swaps to diversify their portfolios and manage currency risk.

- Government entities may also engage in swaps to fund foreign currency obligations or manage sovereign debt.

The diverse participation in the foreign exchange swap market ensures a robust and efficient market, facilitating the exchange of currencies and enabling market participants to manage currency risk.

Factors Influencing Foreign Exchange Swaps

Foreign exchange swaps are influenced by various economic and financial factors that affect the demand and supply of these transactions. Changes in these factors can significantly impact the market conditions, the pricing of swaps, and the overall dynamics of the market.

You also can understand valuable knowledge by exploring meaning and scope of foreign exchange market.

The key factors influencing foreign exchange swaps include:

Interest Rate Differentials

- Interest rate differentials between different currencies play a crucial role in determining the demand and supply of foreign exchange swaps. When there is a significant difference in interest rates between two currencies, it creates opportunities for arbitrage and speculation.

- For example, if the interest rate in the United States is higher than in the Eurozone, investors may borrow in euros at a lower rate and swap the proceeds into US dollars to earn the higher US interest rate. This creates demand for euro-denominated swaps and increases the supply of US dollar-denominated swaps.

Currency Exchange Rates

- Changes in currency exchange rates can also influence the demand and supply of foreign exchange swaps. When a currency is expected to appreciate against another currency, there is increased demand for swaps that allow investors to lock in the current exchange rate.

- For example, if the US dollar is expected to strengthen against the euro, investors may enter into a euro-dollar swap to protect themselves against potential losses from a euro depreciation.

Economic Conditions

- Economic conditions in different countries can also affect the demand and supply of foreign exchange swaps. Strong economic growth in a particular country can lead to increased demand for its currency, making swaps denominated in that currency more attractive.

- For example, if the Chinese economy is growing rapidly, there may be increased demand for renminbi-denominated swaps as investors seek exposure to the Chinese market.

Political and Regulatory Factors

- Political and regulatory factors can also influence the foreign exchange swap market. Changes in government policies, such as interest rate controls or capital controls, can affect the demand and supply of swaps.

- For example, if a government imposes capital controls that restrict the flow of foreign currency, it can reduce the demand for foreign exchange swaps.

Risk Management in Foreign Exchange Swaps

Foreign exchange swaps, while beneficial, involve inherent risks that market participants must manage effectively. These risks include currency risk, interest rate risk, and counterparty risk.

Risk Management Strategies

To mitigate these risks, market participants employ various strategies:

- Hedging: Using financial instruments, such as forwards or options, to offset the risk of adverse currency movements.

- Diversification: Spreading investments across different currencies to reduce exposure to a single currency’s fluctuations.

- Risk Limits: Setting limits on the amount of risk that can be taken on by traders or portfolio managers.

- Stress Testing: Simulating extreme market conditions to assess the resilience of swap portfolios.

- Counterparty Due Diligence: Evaluating the financial health and reputation of counterparties to minimize the risk of default.

Risk Management Techniques

The table below Artikels specific risk management techniques used in foreign exchange swaps:

| Risk Type | Risk Management Technique |

|---|---|

| Currency Risk | Forward Contracts, Currency Options, Cross-Currency Swaps |

| Interest Rate Risk | Interest Rate Swaps, Basis Swaps, Yield Curve Strategies |

| Counterparty Risk | Credit Default Swaps, Collateralization, Netting Agreements |

Regulation of Foreign Exchange Swaps

The foreign exchange swap market is subject to regulatory oversight to ensure its stability and integrity. This oversight is carried out by regulatory bodies, such as central banks and financial regulators, which implement and enforce regulations governing the market.

Role of Regulatory Bodies

- Establish rules and guidelines for the operation of the foreign exchange swap market, including requirements for market participants, trading practices, and risk management.

- Monitor and supervise the market to ensure compliance with regulations and identify potential risks.

- Investigate and enforce violations of regulations, imposing penalties and sanctions on non-compliant market participants.

- Collaborate with other regulatory bodies internationally to promote harmonized regulation and address cross-border issues.

Impact of Regulation

- Enhances market transparency and accountability, promoting confidence among market participants.

- Mitigates systemic risks by establishing prudential requirements and risk management frameworks.

- Protects investors and market participants from fraudulent or unethical practices.

- Contributes to the overall stability and integrity of the financial system, as foreign exchange swaps are an integral part of international finance.

Final Thoughts: Foreign Exchange Swap Market Definition

In conclusion, the foreign exchange swap market definition encompasses a multifaceted and ever-evolving landscape. Its significance in international finance cannot be overstated, as it provides a vital mechanism for managing currency risk, facilitating global trade, and fostering economic growth. Understanding the intricacies of this market is essential for navigating the complexities of the global financial system.