The foreign exchange market definition – The foreign exchange market, also known as forex, is a vast global marketplace where currencies are traded. It plays a crucial role in the global financial system, facilitating international trade, investment, and tourism.

In this comprehensive guide, we will delve into the intricacies of the foreign exchange market, exploring its participants, structure, trading instruments, analysis techniques, and risk management strategies.

Definition and Overview

The foreign exchange market (forex) is a global marketplace where currencies are traded. It is the largest and most liquid financial market in the world, with a daily trading volume of over $5 trillion.

The forex market is a decentralized market, meaning that there is no central exchange where all trades are executed. Instead, trades are conducted over-the-counter (OTC) between banks, financial institutions, and individual traders.

The participants in the forex market can be broadly classified into three groups:

– Commercial participants: These are businesses that engage in international trade and need to exchange currencies to settle their transactions.

– Financial institutions: These are banks, investment banks, and hedge funds that trade currencies for their own account or on behalf of their clients.

– Individual traders: These are individuals who trade currencies for their own account, often using leverage to increase their potential profits.

The forex market plays a vital role in the global financial system. It provides a mechanism for businesses to exchange currencies and settle their international transactions. It also allows financial institutions to hedge their currency risk and to speculate on currency movements.

Currency Pairs and Exchange Rates

:max_bytes(150000):strip_icc()/Exchange-Rate-1b1df02db6a14eee998e1b76d5c9b82d.jpg)

In the foreign exchange market, currencies are traded in pairs, with the value of one currency quoted against the value of another. These pairs are known as currency pairs, and they form the basis for all foreign exchange transactions.

Discover the crucial elements that make foreign exchange market currency of the top choice.

Currency pairs are formed by combining two different currencies. The first currency in the pair is called the base currency, and the second currency is called the quote currency. For example, the currency pair EUR/USD represents the value of the euro (EUR) against the US dollar (USD).

You also can investigate more thoroughly about foreign exchange risk to enhance your awareness in the field of foreign exchange risk.

Factors Influencing Exchange Rates

The exchange rate between two currencies is determined by a variety of factors, including:

- Economic conditions: The economic conditions of the countries that issue the currencies can have a significant impact on their exchange rates. Countries with strong economies tend to have stronger currencies, while countries with weak economies tend to have weaker currencies.

- Interest rates: Interest rates are another important factor that can influence exchange rates. Countries with higher interest rates tend to attract more foreign investment, which can lead to an appreciation of their currencies.

- Political stability: Political stability is also a key factor that can affect exchange rates. Countries with stable political environments tend to have stronger currencies, while countries with unstable political environments tend to have weaker currencies.

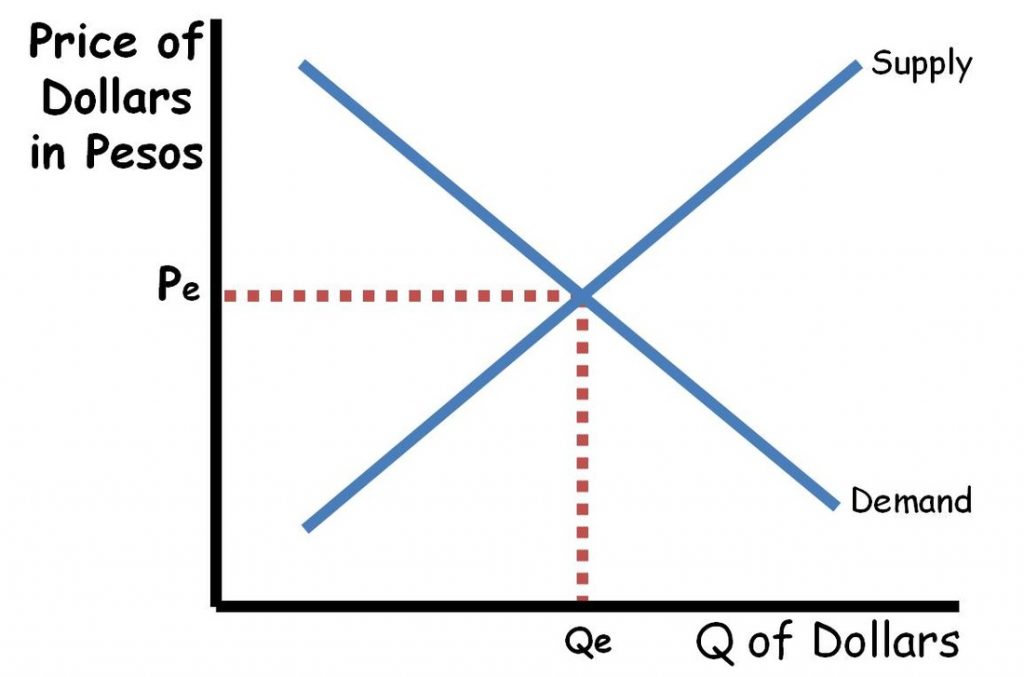

- Supply and demand: The supply and demand for a particular currency can also affect its exchange rate. If there is a high demand for a currency, its value will tend to increase. Conversely, if there is a low demand for a currency, its value will tend to decrease.

Major Currency Pairs and Their Typical Price Ranges

Some of the most commonly traded currency pairs include:

- EUR/USD (euro/US dollar): This is the most traded currency pair in the world, and it typically ranges between 1.05 and 1.25.

- USD/JPY (US dollar/Japanese yen): This is the second most traded currency pair in the world, and it typically ranges between 100 and 120.

- GBP/USD (British pound/US dollar): This is the third most traded currency pair in the world, and it typically ranges between 1.20 and 1.40.

- USD/CHF (US dollar/Swiss franc): This is the fourth most traded currency pair in the world, and it typically ranges between 0.90 and 1.10.

- AUD/USD (Australian dollar/US dollar): This is the fifth most traded currency pair in the world, and it typically ranges between 0.60 and 0.80.

Forex Market Structure and Trading

The forex market is a decentralized global market where currencies are traded. It involves a diverse range of participants, including banks, brokers, and retail traders, who engage in various types of trading instruments and transactions.

Types of Forex Market Participants

– Banks: Major banks are the largest participants in the forex market, acting as market makers and providing liquidity to other participants.

– Brokers: Forex brokers facilitate trades between market participants, providing access to the market and executing orders on their behalf.

– Retail Traders: Individual traders who participate in the forex market for speculative purposes or hedging.

Types of Forex Trading Instruments

– Spot Market: Involves the immediate exchange of currencies at the current market price.

– Forward Market: Contracts to exchange currencies at a predetermined price and future date.

– Options: Contracts that give the buyer the right, but not the obligation, to buy or sell a currency at a specified price and time.

Mechanics of Forex Trading

– Order Types: Traders place orders to buy or sell currencies, specifying the desired price, quantity, and order type (e.g., market order, limit order).

– Execution: Orders are executed when a matching counterparty is found, resulting in a currency exchange at the agreed-upon price.

Forex Market Analysis

Forex market analysis involves studying the market to identify trading opportunities and make informed decisions. There are two main types of forex market analysis: technical analysis and fundamental analysis.

Technical Analysis, The foreign exchange market definition

Technical analysis focuses on analyzing historical price data to identify patterns and trends that can help predict future price movements. It uses a variety of indicators and tools, such as:

- Moving averages: Calculate the average price of a currency pair over a specified period to identify trends and support/resistance levels.

- Trendlines: Lines drawn on a price chart to connect highs or lows, indicating the overall direction of the market.

- Candlesticks: Visual representations of price action over a specific period, showing the open, high, low, and close prices.

Fundamental Analysis

Fundamental analysis examines economic and political factors that can affect the value of a currency pair. These factors include:

- Interest rates: Changes in interest rates can influence the demand for a currency and its value.

- Economic growth: Strong economic growth can boost the value of a currency, while weak growth can lead to a decline.

- Political stability: Political uncertainty and instability can negatively impact a currency’s value.

By combining technical and fundamental analysis, traders can gain a comprehensive understanding of the forex market and make more informed trading decisions.

Get the entire information you require about foreign exchange market ap macro on this page.

Interpreting Forex Market Data

To interpret forex market data, traders look for patterns and trends that indicate potential trading opportunities. For example, a rising moving average may indicate an uptrend, while a downward trendline may suggest a downtrend. Traders also look for divergences between price action and technical indicators, which can signal a potential reversal in trend.

Risk Management and Trading Strategies

Risk management is paramount in forex trading, as it helps traders minimize losses and protect their capital.

Traders can employ various risk management strategies, such as stop-loss orders, which automatically close positions when the market moves against them. Position sizing, another key strategy, involves adjusting the size of trades based on account balance and risk tolerance.

Forex Trading Strategies

Forex trading strategies vary depending on the trader’s risk appetite and time horizon. Scalping involves taking quick, small profits by exploiting short-term price movements. Day trading focuses on capturing intraday price fluctuations, while swing trading aims for larger profits over longer time frames.

Concluding Remarks: The Foreign Exchange Market Definition

The foreign exchange market is a dynamic and ever-evolving landscape. Understanding its complexities is essential for businesses, investors, and anyone interested in the global financial system. By embracing the knowledge and strategies Artikeld in this guide, you can navigate the forex market with confidence and potentially reap its benefits.