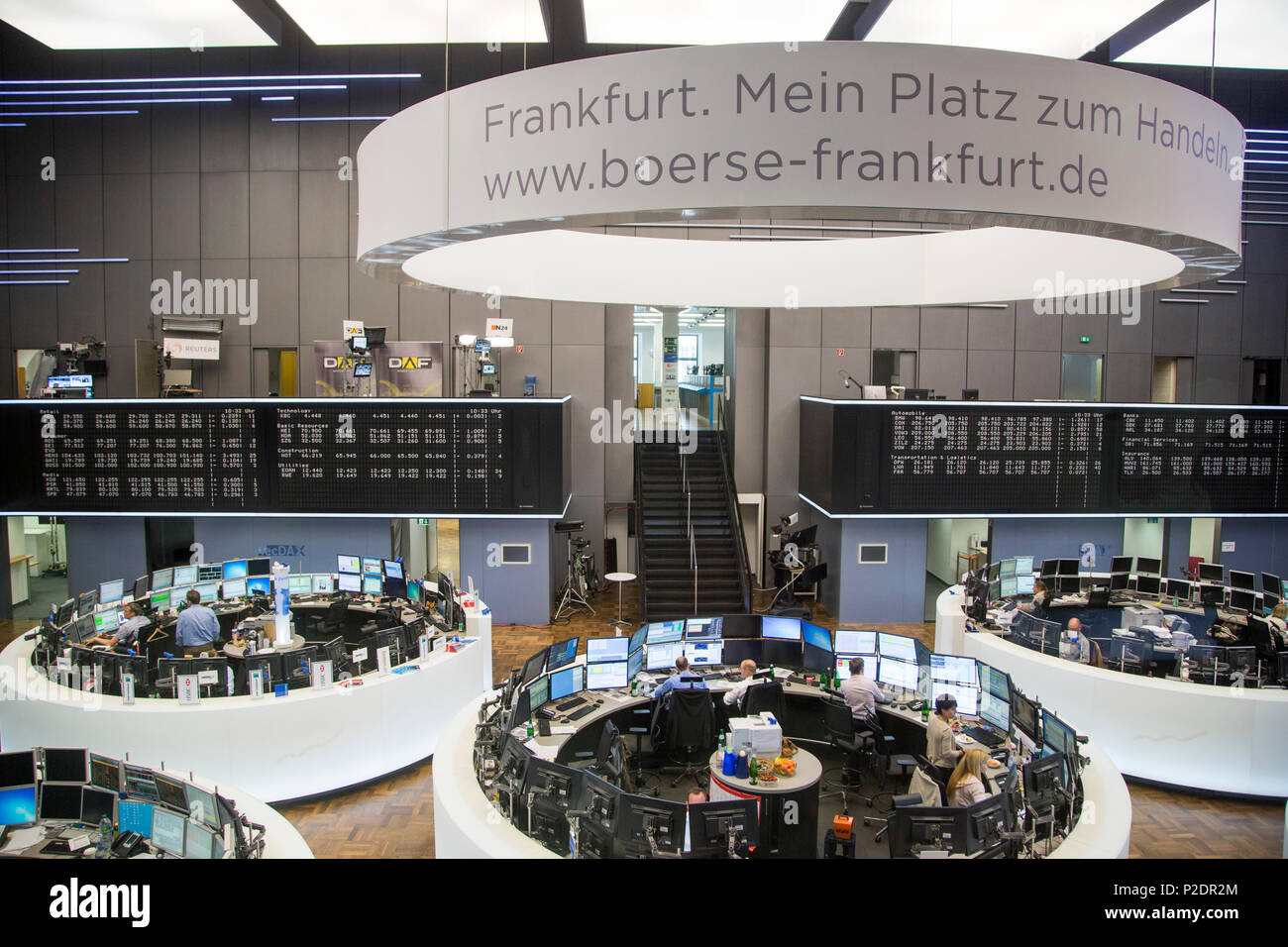

Germany stock exchange – The German Stock Exchange, also known as Deutsche Börse, stands as a towering titan in the financial landscape, shaping the economic destiny of Germany and beyond. With its rich history dating back to the 16th century, the exchange has played a pivotal role in fueling the growth of German industry and commerce.

Today, the German Stock Exchange stands as a bustling hub of trading activity, connecting investors from around the globe with a diverse range of financial instruments. It boasts a robust regulatory framework, ensuring transparency and investor protection while fostering innovation and technological advancements.

History of the German Stock Exchange: Germany Stock Exchange

The German Stock Exchange, known as Deutsche Börse AG, traces its origins to the 16th century. It has played a significant role in the development of the German economy and is one of the largest stock exchanges in the world.

The history of the German Stock Exchange can be divided into several key periods:

Origins and Establishment

The origins of the German Stock Exchange can be traced back to the 16th century, when merchants in Augsburg and Frankfurt began trading in commodities and securities. In 1553, the Frankfurt Stock Exchange was established, making it one of the oldest stock exchanges in the world.

Growth and Development

In the 19th century, the German Stock Exchange experienced a period of rapid growth and development. The establishment of the German Empire in 1871 led to a surge in economic activity and the growth of the stock market. By the end of the 19th century, the German Stock Exchange was one of the largest and most important in the world.

20th Century

The 20th century was a turbulent period for the German Stock Exchange. The First World War and the subsequent economic crisis led to a decline in the stock market. The Nazi regime also had a negative impact on the stock exchange, as it imposed strict controls on the economy.

Post-World War II

After World War II, the German Stock Exchange was rebuilt and began to grow again. The establishment of the Federal Republic of Germany in 1949 led to a period of economic growth and prosperity. The German Stock Exchange played a major role in this growth, providing a platform for companies to raise capital.

Present Day

Today, the German Stock Exchange is one of the largest and most important stock exchanges in the world. It is home to a wide range of companies, from small businesses to large multinationals. The German Stock Exchange is also a major center for trading in derivatives and other financial instruments.

Expand your understanding about capital market foreign exchange risks with the sources we offer.

Structure and Organization of the German Stock Exchange

The German Stock Exchange, operated by Deutsche Börse Group, is a highly structured and organized marketplace for trading financial instruments. It comprises various segments and markets, each catering to specific asset classes and investor needs.

Discover how foreign exchange market efficiency meaning has transformed methods in RELATED FIELD.

Market Segments

- Cash Market: This segment facilitates the trading of stocks, bonds, and other securities during regular trading hours.

- Derivatives Market: This market deals in futures, options, and other derivative instruments, allowing investors to hedge risks or speculate on price movements.

- Exchange-Traded Funds (ETF) Market: This segment offers a wide range of ETFs, which track the performance of underlying assets or indices.

- Bond Market: The bond market provides a platform for trading government and corporate bonds, offering investors fixed-income opportunities.

- Real Estate Market: This segment caters to the trading of real estate-related securities, such as real estate investment trusts (REITs).

Role of Deutsche Börse Group, Germany stock exchange

Deutsche Börse Group, the parent company of the German Stock Exchange, plays a crucial role in operating and regulating the exchange. Its responsibilities include:

- Providing a secure and transparent trading platform

- Setting and enforcing listing requirements for companies

- Supervising market activities to ensure compliance and fair trading practices

- Promoting financial literacy and educating investors

Listing Requirements

Companies seeking to list on the German Stock Exchange must meet certain listing requirements, including:

- Financial Requirements: Companies must have a minimum size and profitability, as well as a track record of financial stability.

- Corporate Governance: Companies must demonstrate strong corporate governance practices, including transparency, accountability, and shareholder protection.

- Disclosure Requirements: Companies must provide regular and accurate financial and operational information to the public.

- Prospectus: Companies must publish a detailed prospectus outlining their business, financial condition, and listing plans.

The listing process involves a thorough review by Deutsche Börse Group to ensure that companies meet all applicable requirements and are suitable for public trading.

You also can investigate more thoroughly about foreign exchange market transactions to enhance your awareness in the field of foreign exchange market transactions.

Key Indices and Market Capitalization

The German Stock Exchange, also known as the Deutsche Börse, is home to a number of key stock indices that reflect the performance of the German economy. The most well-known of these is the DAX, which tracks the 40 largest and most liquid companies listed on the exchange. Other major indices include the MDAX, which tracks the next 60 largest companies, and the TecDAX, which tracks the 30 largest technology companies.

The German Stock Exchange has a long and storied history, dating back to the 16th century. Over the years, it has grown to become one of the largest and most important stock exchanges in the world. In terms of market capitalization, the German Stock Exchange is currently ranked fourth in the world, behind only the New York Stock Exchange, the Nasdaq, and the Shanghai Stock Exchange.

The German Stock Exchange has outperformed many other major stock exchanges in recent years. For example, over the past five years, the DAX has returned an average of 8% per year, compared to just 5% for the S&P 500. This outperformance is due in part to the strength of the German economy, which has been growing steadily in recent years.

Trading Activity and Market Trends

The German Stock Exchange (Deutsche Börse) is one of the largest and most liquid stock exchanges in the world. It plays a significant role in the German and European financial markets.

The trading volume on the German Stock Exchange is consistently high, with an average daily turnover of over €100 billion. The exchange is particularly known for its liquidity, which means that investors can easily buy and sell shares without significantly affecting the price.

Key Sectors and Industries

The German Stock Exchange represents a wide range of sectors and industries. The largest sector by market capitalization is the financial sector, which includes banks, insurance companies, and asset managers. Other major sectors include industrials, technology, and healthcare.

Recent Market Trends

In recent years, the German Stock Exchange has experienced a number of market trends. One of the most significant trends has been the rise of exchange-traded funds (ETFs). ETFs are baskets of securities that trade on the stock exchange like individual stocks. ETFs have become increasingly popular with investors because they offer a diversified and cost-effective way to invest in a particular sector or industry.

Another recent market trend has been the increasing importance of sustainable investing. Investors are increasingly looking to invest in companies that are committed to environmental, social, and governance (ESG) principles. The German Stock Exchange has responded to this trend by launching a number of ESG-focused indices and products.

Regulation and Compliance

The German Stock Exchange operates within a robust regulatory framework designed to protect investors and ensure market integrity. This framework is overseen by the German Federal Financial Supervisory Authority (BaFin), which plays a crucial role in enforcing regulations and monitoring market activities.

Role of BaFin

BaFin is responsible for supervising all financial markets in Germany, including the stock exchange. Its primary objectives include:

- Ensuring the orderly functioning of the market

- Preventing market abuse and insider trading

- Protecting investors from fraud and misconduct

- Enforcing compliance with regulatory requirements

Compliance Requirements for Listed Companies

Companies listed on the German Stock Exchange are subject to stringent compliance requirements, including:

- Disclosure of financial information and company performance

- Adherence to accounting standards and auditing requirements

- Compliance with insider trading regulations

- Corporate governance best practices

- Regular reporting of financial results and material events

Internationalization and Global Reach

The German Stock Exchange has a strong international presence and has formed strategic partnerships with stock exchanges worldwide. It is a member of the Federation of European Securities Exchanges (FESE) and the World Federation of Exchanges (WFE), which facilitates collaboration and cooperation with other major exchanges.

The German Stock Exchange plays a crucial role in attracting foreign investment. It offers a transparent and regulated trading environment, which makes it attractive for international investors. The exchange also provides access to a wide range of investment products, including stocks, bonds, and derivatives.

In a globalized financial market, the German Stock Exchange faces both challenges and opportunities. One challenge is the increasing competition from other exchanges, particularly from emerging markets. Another challenge is the need to adapt to changing regulatory requirements. However, the German Stock Exchange is well-positioned to meet these challenges and continue to be a major player in the global financial market.

Partnerships and Collaborations

The German Stock Exchange has formed partnerships with a number of stock exchanges around the world, including the New York Stock Exchange, the London Stock Exchange, and the Tokyo Stock Exchange. These partnerships allow the German Stock Exchange to offer its products and services to a wider range of investors and to access new markets.

Role in Attracting Foreign Investment

The German Stock Exchange is a major destination for foreign investment. In 2021, foreign investors accounted for over 40% of trading volume on the exchange. The exchange’s transparency, regulation, and access to a wide range of investment products make it attractive to international investors.

Challenges and Opportunities

The German Stock Exchange faces a number of challenges in the globalized financial market. One challenge is the increasing competition from other exchanges, particularly from emerging markets. Another challenge is the need to adapt to changing regulatory requirements. However, the German Stock Exchange is well-positioned to meet these challenges and continue to be a major player in the global financial market.

Technological Advancements and Innovation

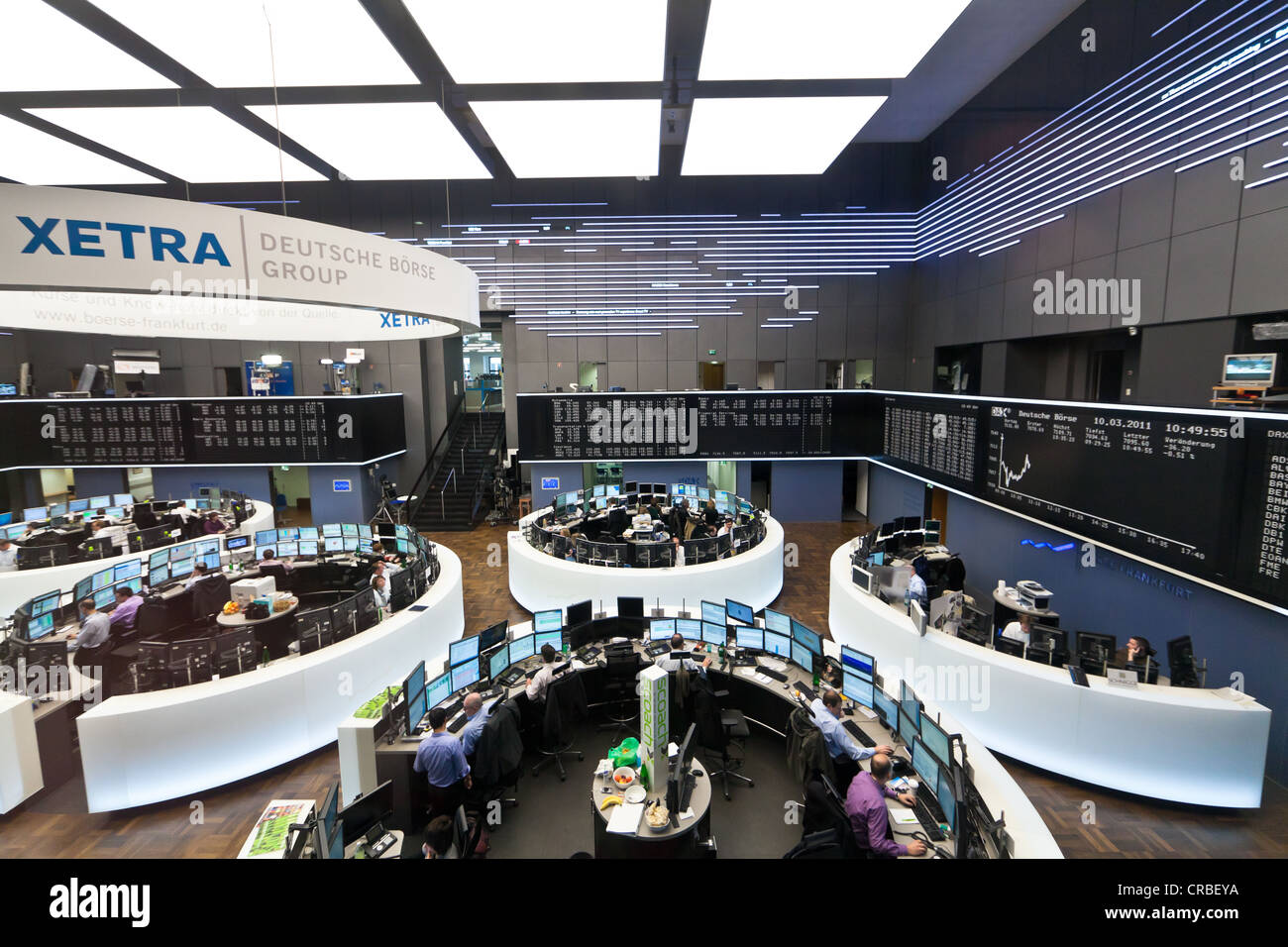

The German Stock Exchange has consistently invested in technological advancements to enhance its infrastructure and trading capabilities. It operates a state-of-the-art trading platform called Xetra, which is renowned for its speed, efficiency, and reliability.

Fintech and digitalization have significantly impacted the exchange. The adoption of blockchain technology, artificial intelligence (AI), and machine learning has streamlined operations, reduced costs, and improved transparency. These technologies have enabled the development of innovative products and services, such as digital asset trading and automated trading algorithms.

Role in Promoting Innovation

The German Stock Exchange actively supports innovation in the financial sector. It provides a platform for startups and fintech companies to showcase their technologies and connect with investors. The exchange also collaborates with research institutions and universities to foster knowledge sharing and the development of new solutions.

Sustainability and Corporate Social Responsibility

The German Stock Exchange has prioritized sustainability and corporate social responsibility (CSR) by implementing various initiatives and programs. It recognizes the significance of sustainable investing and aims to foster responsible business practices among listed companies.

ESG Reporting and Disclosure

The German Stock Exchange mandates ESG reporting for companies listed on its Prime Standard segment. This requirement ensures transparency and enables investors to assess companies’ environmental, social, and governance (ESG) performance. The exchange also provides guidance and support to companies in their ESG reporting efforts.

Sustainability Index

The German Stock Exchange launched the DAX ESG Index, which tracks the performance of the 40 most sustainable companies listed on the DAX index. This index provides investors with a benchmark for sustainable investments and encourages companies to adopt sustainable practices to improve their index inclusion.

Impact of ESG Factors

Studies have shown a positive correlation between ESG performance and company performance. Companies with strong ESG practices tend to attract more investors, have lower risk profiles, and experience better financial performance in the long run. The German Stock Exchange’s emphasis on ESG factors has contributed to the growing awareness and adoption of sustainable investing practices in Germany.

Conclusion

As the German Stock Exchange continues to navigate the ever-evolving global financial landscape, its legacy of excellence and innovation will undoubtedly continue to drive economic growth and prosperity for generations to come.