What is foreign exchange market equilibrium? It’s the elusive point where supply and demand for currencies align, creating a stable exchange rate. Understanding this equilibrium is crucial for businesses, investors, and governments navigating the complexities of international trade and finance.

Delving deeper, we’ll explore the key factors that determine equilibrium exchange rates and examine the vital role of central banks in managing these markets. Moreover, we’ll uncover the impact of foreign exchange market equilibrium on economic growth and delve into strategies for managing this delicate balance.

Definition of Foreign Exchange Market Equilibrium

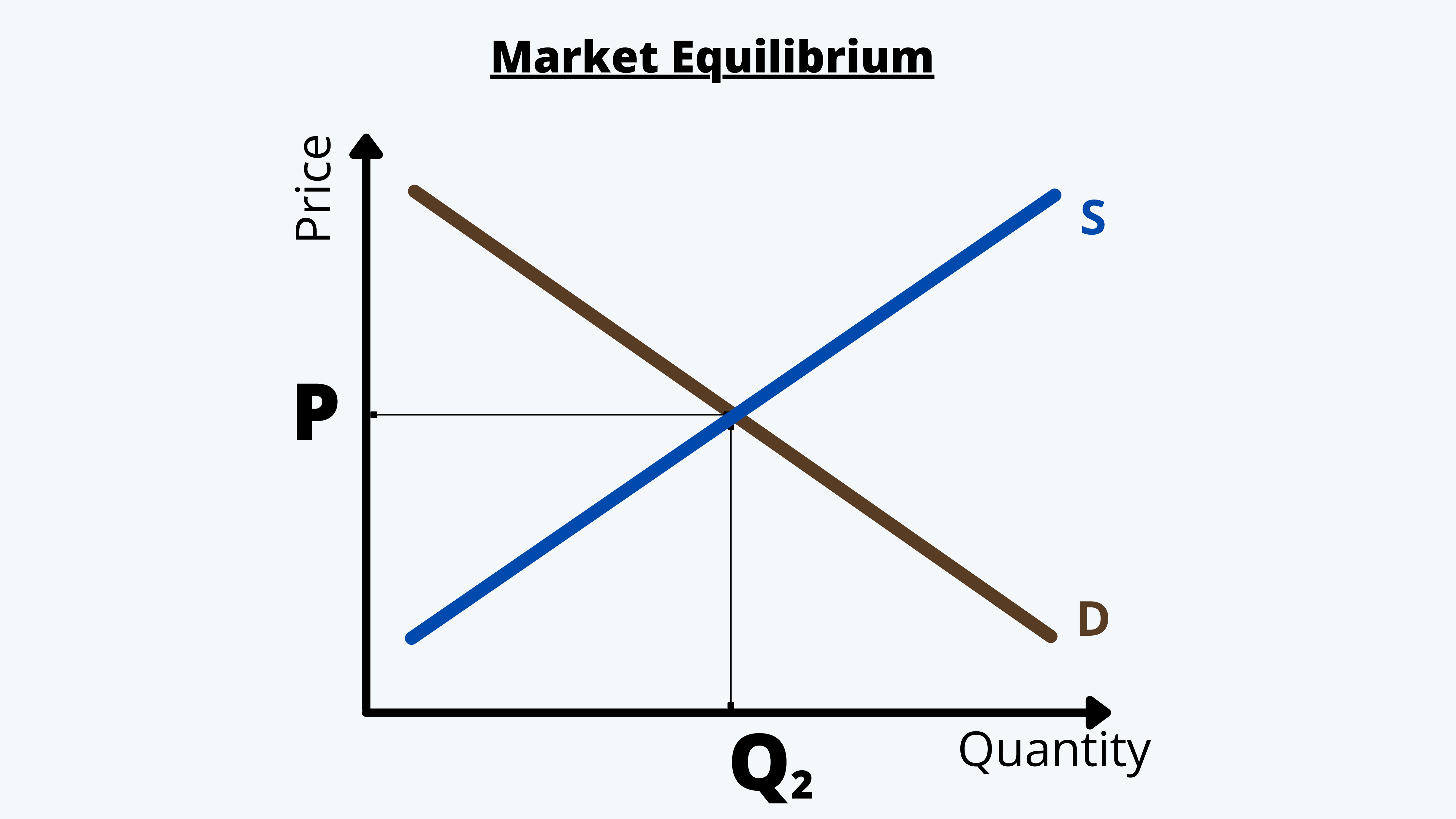

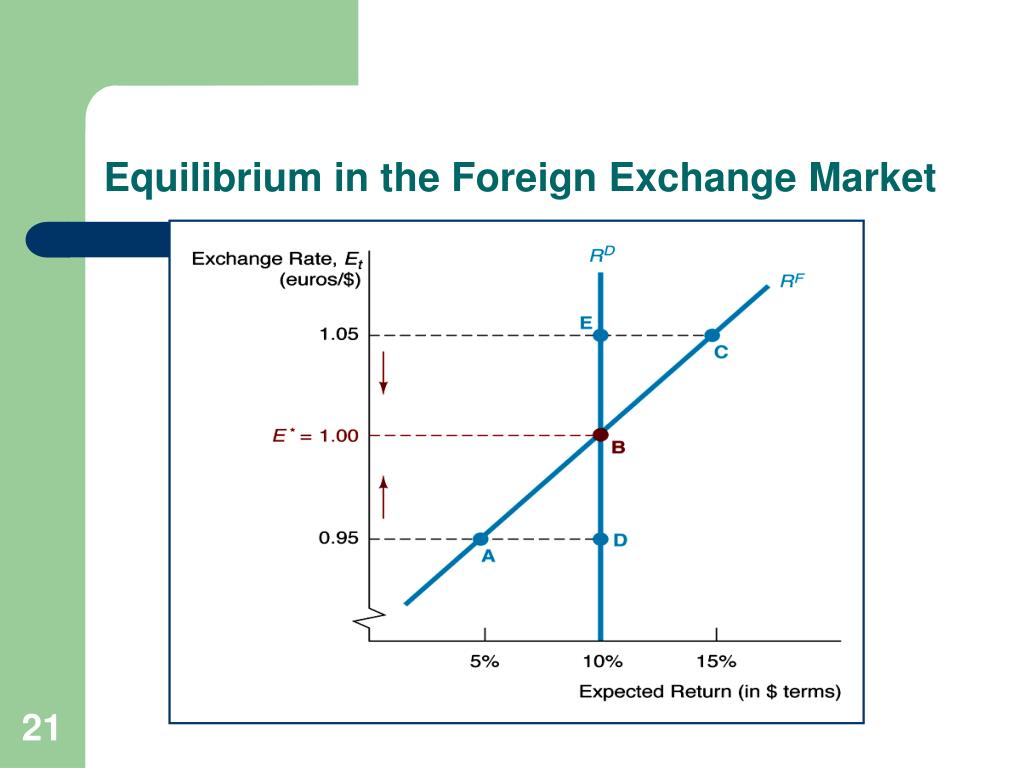

In the foreign exchange market, equilibrium is a state where the supply and demand for a currency are equal. At this point, the exchange rate is stable and there is no tendency for it to change.

The factors that determine equilibrium exchange rates include:

- Economic fundamentals: These include factors such as GDP, inflation, interest rates, and fiscal policy. Stronger economic fundamentals tend to lead to a stronger currency.

- Political stability: Political instability can lead to a weaker currency as investors become less willing to hold assets in that country.

- Central bank intervention: Central banks can intervene in the foreign exchange market to buy or sell their currency in order to influence the exchange rate.

Determinants of Foreign Exchange Market Equilibrium

Equilibrium exchange rates in the foreign exchange market are determined by a complex interplay of economic and political factors. These factors can be broadly classified into two categories: fundamental factors and market sentiment.

Finish your research with information from bis the foreign exchange market.

Fundamental factors include economic indicators such as GDP growth, inflation, interest rates, and balance of payments. Political factors include government policies, such as fiscal and monetary policies, as well as geopolitical events.

Browse the implementation of foreign exchange market of today in real-world situations to understand its applications.

Economic Factors

- GDP Growth: Higher GDP growth in a country typically leads to an appreciation of its currency as demand for its goods and services increases.

- Inflation: Higher inflation in a country can lead to a depreciation of its currency as investors seek to protect their capital from inflation.

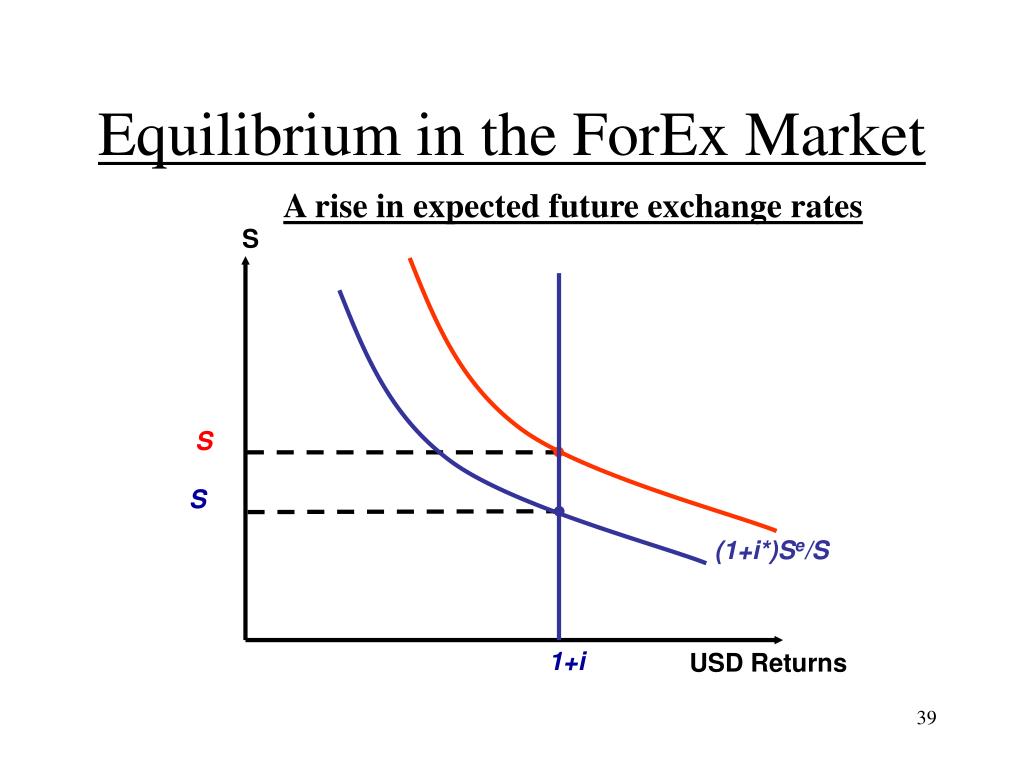

- Interest Rates: Higher interest rates in a country can attract foreign investment, leading to an appreciation of its currency.

- Balance of Payments: A country with a positive balance of payments (i.e., exports exceed imports) typically has a stronger currency.

Political Factors

- Government Policies: Government policies, such as fiscal and monetary policies, can influence the value of a currency.

- Geopolitical Events: Geopolitical events, such as wars, political instability, or natural disasters, can lead to currency fluctuations.

Role of Central Banks in Foreign Exchange Market Equilibrium: What Is Foreign Exchange Market Equilibrium

Central banks play a crucial role in managing foreign exchange markets to maintain stability and ensure orderly functioning. They intervene in the market to influence exchange rates, primarily through buying and selling foreign currencies.

Central Bank Interventions

Central banks intervene in foreign exchange markets through various measures:

- Open Market Operations: Buying or selling foreign currencies in the open market to influence the exchange rate.

- Foreign Exchange Swaps: Short-term agreements with other central banks to exchange currencies, affecting supply and demand.

- Interest Rate Adjustments: Changing interest rates to make a currency more or less attractive, influencing capital flows.

- Capital Controls: Implementing regulations to restrict or control the flow of capital into or out of the country, impacting exchange rates.

By intervening, central banks can influence the equilibrium exchange rate, which is the rate at which the demand for a currency equals its supply. By buying or selling currencies, they can shift the supply and demand curves, leading to a change in the equilibrium rate.

Impact of Foreign Exchange Market Equilibrium on Economic Growth

Foreign exchange market equilibrium plays a significant role in economic growth by influencing the stability and competitiveness of a country’s economy.

Exchange rate fluctuations can have profound impacts on economic performance:

Impact on Exports

- Currency Appreciation: A stronger currency makes exports more expensive in foreign markets, potentially reducing demand and slowing economic growth.

- Currency Depreciation: A weaker currency makes exports cheaper, increasing demand and boosting economic growth.

Impact on Imports

- Currency Appreciation: A stronger currency makes imports cheaper, reducing costs for businesses and consumers.

- Currency Depreciation: A weaker currency makes imports more expensive, increasing costs and potentially leading to inflation.

Impact on Investment

- Currency Stability: Stable exchange rates encourage foreign direct investment (FDI), as investors perceive less risk.

- Currency Volatility: Volatile exchange rates deter FDI, as investors are wary of potential losses.

Impact on Tourism

- Currency Appreciation: A stronger currency makes travel to a country more expensive, potentially reducing tourism revenue.

li>Currency Depreciation: A weaker currency makes travel cheaper, boosting tourism and supporting economic growth.

Therefore, maintaining foreign exchange market equilibrium is crucial for economic stability and growth, as it influences trade, investment, and other key economic indicators.

Browse the implementation of foreign currency exchange market size in real-world situations to understand its applications.

Managing Foreign Exchange Market Equilibrium

Managing foreign exchange market equilibrium involves implementing strategies to maintain a stable and orderly market while facilitating international trade and investment. Different approaches have their advantages and disadvantages, which policymakers must carefully consider when making decisions.

Exchange Rate Management

- Fixed Exchange Rates: Pegging the domestic currency to a foreign currency or a basket of currencies to maintain a stable exchange rate.

- Managed Float: Allowing the exchange rate to fluctuate within a predetermined band, with central bank intervention to prevent extreme movements.

- Free Float: Allowing the exchange rate to be determined solely by market forces, without central bank intervention.

Monetary Policy

- Interest Rate Adjustments: Changing interest rates to influence capital flows and stabilize the exchange rate.

- Quantitative Easing: Increasing the money supply to weaken the domestic currency and stimulate exports.

- Quantitative Tightening: Reducing the money supply to strengthen the domestic currency and curb inflation.

Capital Controls

- Foreign Exchange Controls: Restricting the purchase and sale of foreign currencies to prevent speculative activity.

- Capital Outflow Restrictions: Limiting the amount of capital that can be invested abroad to maintain domestic liquidity.

- Capital Inflow Taxes: Imposing taxes on foreign investments to discourage capital inflows and prevent currency appreciation.

Pros and Cons, What is foreign exchange market equilibrium

| Approach | Pros | Cons |

|---|---|---|

| Fixed Exchange Rates | Stability, reduced exchange rate risk | Loss of monetary policy independence, potential for currency crises |

| Managed Float | Flexibility, balance of stability and independence | Potential for speculative attacks, less effective in volatile markets |

| Free Float | Monetary policy independence, automatic adjustment | Exchange rate volatility, potential for currency overvaluation/undervaluation |

| Interest Rate Adjustments | Influences capital flows, effective in stable markets | Time lag in effects, potential for inflation/recession |

| Quantitative Easing/Tightening | Direct impact on exchange rate, flexibility | Potential for inflation/deflation, asset bubbles |

| Capital Controls | Short-term stabilization, prevents speculative attacks | Distorts market signals, discourages foreign investment |

Epilogue

In conclusion, foreign exchange market equilibrium is a dynamic concept that affects global economic activity. Understanding its determinants and management strategies empowers decision-makers to navigate currency fluctuations and mitigate risks. By striking this equilibrium, we foster stability and facilitate international trade, ultimately contributing to global economic prosperity.