Delve into the captivating world of forex supply and demand, where market forces collide to shape currency prices. Understanding these fundamental concepts empowers traders to identify lucrative opportunities and navigate the ever-shifting forex landscape with confidence.

Supply and demand, the driving forces behind price movements, play a pivotal role in the forex market. Economic data, political events, and market sentiment are just a few of the factors that influence the supply and demand of currencies, creating a dynamic and ever-evolving trading environment.

Forex Supply and Demand Fundamentals

In the foreign exchange market, supply and demand play a crucial role in determining currency prices. Supply refers to the amount of a currency that is available for sale, while demand refers to the amount that people are willing to buy.

Discover how foreign exchange market case study has transformed methods in RELATED FIELD.

Various factors can influence supply and demand in the forex market. Economic data, such as GDP growth rates, inflation, and unemployment figures, can provide insights into the health of an economy and affect the demand for its currency. Political events, such as elections or changes in government policy, can also impact currency prices by altering market sentiment.

Learn about more about the process of definisi foreign exchange market adalah in the field.

The interaction between supply and demand can have a significant impact on currency prices. When supply exceeds demand, the value of the currency tends to fall. Conversely, when demand exceeds supply, the currency’s value tends to rise.

Factors Influencing Supply and Demand

Several factors can influence supply and demand in the forex market, including:

- Economic Data: Economic indicators such as GDP growth rates, inflation, and unemployment figures can provide insights into the health of an economy and affect the demand for its currency.

- Political Events: Political events, such as elections or changes in government policy, can also impact currency prices by altering market sentiment.

- Market Sentiment: Market sentiment refers to the overall attitude of market participants towards a particular currency or asset. Positive sentiment can lead to increased demand, while negative sentiment can lead to increased supply.

Examples of Supply and Demand in Forex

Here are some examples of how supply and demand can affect currency prices:

- Increased Demand for USD: If the US economy is performing well, investors may increase their demand for the US dollar (USD) as a safe haven currency. This increased demand can lead to an appreciation of the USD against other currencies.

- Reduced Supply of EUR: If the European Central Bank (ECB) announces a reduction in its bond-buying program, it can reduce the supply of euros (EUR) in the market. This reduced supply can lead to an appreciation of the EUR against other currencies.

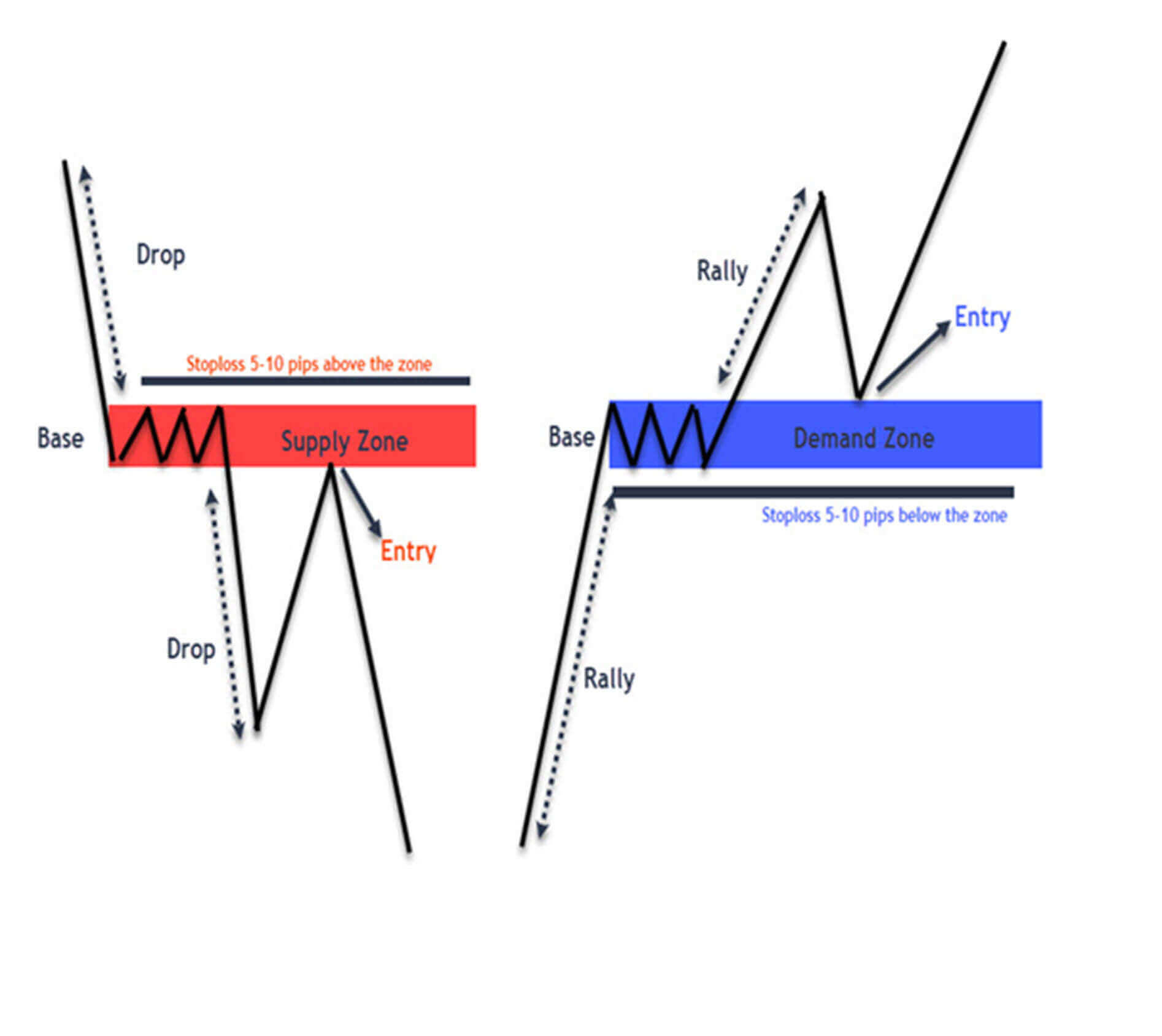

Identifying Supply and Demand Zones

Identifying supply and demand zones is crucial in supply and demand analysis. These zones represent areas on the price chart where there is an imbalance between supply and demand, creating potential opportunities for trading.

Techniques for Identifying Supply and Demand Zones

- Horizontal Lines: Draw horizontal lines at significant price levels where the price has repeatedly bounced or reversed. These levels often indicate areas of support or resistance, where supply or demand is likely to be concentrated.

- Trendlines: Trendlines connect a series of higher highs or lower lows. They indicate the direction of the trend and can be used to identify potential areas of reversal, where the trend may change direction due to a shift in supply or demand.

- Volume Analysis: High volume at a particular price level can indicate increased buying or selling pressure, suggesting a potential supply or demand zone.

- Order Flow Analysis: Order flow data can provide insights into the intentions of market participants. Large buy or sell orders at specific price levels can signal the presence of supply or demand.

Importance of Support and Resistance Levels

Support and resistance levels are critical in supply and demand analysis. Support is a price level where demand is strong enough to prevent the price from falling further. Resistance is a price level where supply is strong enough to prevent the price from rising further.

When the price approaches a support or resistance level, traders may anticipate a reversal or a breakout. Identifying these levels can help traders make informed decisions about potential trading opportunities.

Learn about more about the process of forex exchange adalah in the field.

Examples of Using Supply and Demand Zones, Forex supply and demand

- Identifying Potential Trading Opportunities: By identifying supply and demand zones, traders can look for opportunities to buy at support levels or sell at resistance levels.

- Confirming Trend Changes: A break of a significant supply or demand zone can indicate a change in the trend. Traders can use this information to adjust their trading strategies accordingly.

- Managing Risk: Supply and demand zones can help traders place stop-loss orders and take-profit orders at strategic levels, reducing their risk exposure.

Trading with Supply and Demand

Supply and demand analysis can provide valuable insights into the potential direction of price movements. By understanding the forces of supply and demand, traders can develop effective trading strategies that aim to capitalize on market imbalances.

Developing a Trading Strategy

To develop a trading strategy based on supply and demand analysis, traders should consider the following steps:

- Identify supply and demand zones: Use technical analysis tools, such as support and resistance levels, to identify areas where supply and demand are likely to converge.

- Determine the trend: Assess the overall trend of the market to determine the direction of potential price movements.

- Set entry and exit points: Place entry orders near supply or demand zones, depending on the anticipated price direction. Set stop-loss orders to manage risk and take-profit orders to lock in profits.

- Manage risk: Implement proper risk management techniques, such as position sizing and stop-loss orders, to mitigate potential losses.

Types of Orders

Various types of orders can be used to trade supply and demand zones:

- Market orders: Execute trades immediately at the current market price.

- Limit orders: Specify the desired price at which a trade should be executed.

- Stop orders: Trigger trades when the price reaches a predetermined level.

- Stop-limit orders: Combine stop and limit orders to execute trades at a specific price or better.

Examples of Successful Trades

Successful supply and demand trades involve identifying key price levels and executing trades accordingly:

- Identifying a support zone: A trader identifies a support zone at a previous low. They place a buy order near the support level, anticipating a bounce in price.

- Trading a resistance breakout: A trader identifies a resistance zone at a previous high. They place a sell order above the resistance level, expecting the price to break through and continue downward.

Advanced Supply and Demand Concepts

Market Structure and Supply and Demand

Market structure refers to the overall trend and momentum of a financial market. It can be classified into three main types: uptrend, downtrend, and ranging market.

Understanding market structure is crucial for supply and demand analysis as it provides context for identifying potential supply and demand zones. In an uptrend, traders look for areas where the price has retraced to a previous support level, indicating potential demand. Conversely, in a downtrend, traders look for areas where the price has rallied to a previous resistance level, indicating potential supply.

Final Wrap-Up

Mastering supply and demand analysis unlocks a wealth of trading strategies and techniques. By identifying supply and demand zones, traders can pinpoint potential trading opportunities and develop informed trading plans. Whether you’re a seasoned professional or just starting your forex journey, understanding supply and demand is essential for navigating the complexities of the market and achieving consistent profitability.